"That's just the way it is."

That's more or less how Jeb Bush defended his tax plan to Fox News Sunday after he was slammed for giving lopsided tax breaks to the wealthy. He told Chris Wallace: “The simple fact is 1 percent of people pay 40 percent of all the taxes. So of course, tax cuts for everybody is going to generate more for people that are paying a lot more. I mean that’s just the way it is.”

More proof that Jeb Bush may care not so much for this country as he does for the very rich. Besides gutting government regulations, he also wants to cut taxes — the standard Republican mantra, (just like his brother George), so no surprises there. But why would Jeb lie about his tax plan on a Sunday when the Pope was still in town?

Watch the 3-minute YouTube clip below; and listen very carefully to the words he chooses and how he uses them — especially towards the end (You can watch the full interview at Fox News here.)

Normally a typical politician (when they don't accidentally tell the truth) will deny, deflect, discredit, exaggerate, embellish, obfuscate and lie. But Jeb Bush had accidentally told the truth. In Jeb Speak he had said: "Of course the rich will get richer ... that's just the way it is." (That's just the way it is, since the Earth and Heavens were first created.)

Jeb Bush didn't mention that the reason why 1 percent of the people who pay 40 percent of the taxes is because they are also raking in 40 percent of all the income too (when taxation is supposed to "progressive"). As a "percentage" of all their income, the poor actually pay more in taxes. So why didn't Jeb Bush also mention that? Maybe it's because, just like Mitt Romney, he's also afraid the poor will want more "free stuff".

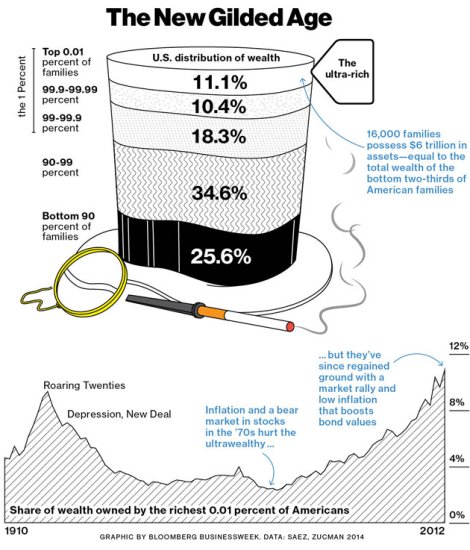

Jeb Bush also neglected to mention (BTW: all his omissions are the same as lies) that the very top 0.1 percent and the very top 0.01 percent (the top 1 percent of the top 1 percent) are the ones who actually rake in most of that income — and that they are the only ones that (progressive) Democrats want to raise taxes on (maybe by taxing capital gains income from investments the same way as regular wages are taxed for labor — and maybe by having the top 1 percent pay Social Security taxes on 100% of their income, the same way as 90% of all other wage earners currently do.)

Here's what Jeb didn't tell us about that one percent:

- Bloomberg: There’s Rich, Then There's the 0.01%

- The Economist: Forget the 1%

- The Atlantic: How You, I, and Everyone got the Top 1 Percent all Wrong

- CNBC: The other wealth gap—the 1% vs the 0.01%

- Bloomberg: The Richest Rich are in a Class by Themselves

- The Rise of the 0.01 Percent in America

According to Jeb Bush, the top 1 percent pays 40% of the tax, but they have also been extracting and hoarding most of the income — and have been, for the past 40 years.

Like all Republicans, besides cutting the capital gains tax rate for the top 0.01 percent, Jeb Bush also wants to lower the corporate tax rate (on businesses that generate most of the capital gains) — even though many major U.S. corporations (under the current tax law with write-offs and deductions) only pay about half the current statutory tax rate — and that doesn't include those that pay no tax at all. The "effective" tax rate that corporations pay, executives use as "selling points" in their annual reports to justify huge pay raises for themselves, figuring: "Since we don't have to pay the government, let's pay ourselves instead!"

So far US corporations have already stashed $3.8 trillion — and that's AFTER paying themselves and other shareholders. But wasn't more economic growth, higher profits and less taxes supposed to "trickle-down" and create more jobs and raise wages — instead of just producing huge and wasteful cash hoards? And that doesn't include all the cash hidden away in offshore tax havens — or other assets such as art, jewelry or real estate (also know as SWAG investments).

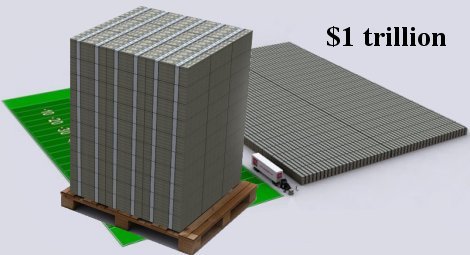

One hundred million dollars in $100 bills fits nicely onto a standard-sized pallet. The image below shows what $1 trillion in cash would look like with those pallets stacked two-high next to a football field. Now multiply that by 4 — and that is the current corporate cash hoard. U.S. corporations have not been spending on hiring people and raising worker's wages — so less taxes and/or lower tax rates proposed by Republicans will only grow this cash hoard much larger. And that's exactly what Jeb Bush wants to do.

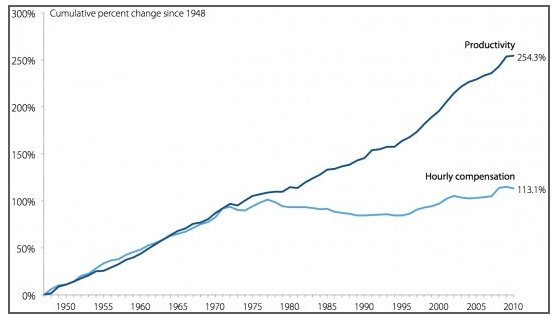

Many people are blaming the Great Recession for the current economy, where CEOs are raking in millions of dollars every year as stocks and profits soar, while everyone else is struggling. But the decline of the working-class has been going on for decades. Jeb Bush (and all the other Republicans, including many "moderate" Democrats) just want more of the same.

Yesterday Donald Trump also unveiled his tax plan. From CNN:

"One of the biggest beneficiaries appears to be families that draw the smallest paychecks. Individuals that make less than $25,000 (and $50,000 for married couples) would pay no income taxes under Trump's plan ... However, the proposal would also be a boon for the wealthiest Americans like Trump."

In a war of numbers on GDP with Jeb Bush, Trump also claims his plan will boost the economy by 6% — compared to Jeb's claim of 4%. In the real world, Q2 GDP was recently revised to 3.9%, but where were the wage increases? Just "growth" alone and tax cuts won't create jobs or raise wages. For a good examination of "growth and taxes", read this great post at Mark Thoma's blog: "The Growth Fairy".

Here's more from The Atlantic about Trump's tax plan:

"The top marginal income rate would drop to 25 percent from nearly 40 percent, middle-income earners would pay 10 or 20 percent, and anyone earning less than $25,000 a year ($50,000 for married couples) would pay no income tax at all. Trump would scrap the marriage penalty, the estate tax, and the alternative minimum tax. Businesses would pay no more than 15 percent of their income to the government."

Currently the "statutory" corporate tax rate is 35%, and Trumps wants it to be 15%. And Trump also wants a one-time repatriation of offshore corporate profits taxed at 10% — which we already know will only be redistributed to shareholders, rather than for reinvestment in the U.S. for domestic hiring and wage increases. (Read Robert Reich's Why we must end upward pre-distributions to the rich).

And Trump, just like all Republicans, wants to eliminate the tax on inheritances (a.k.a. The Death Tax, even though dead people don't pay taxes). A married couple can already leave the first $10 million tax-free to their children (so maybe Trump wants his entire $10 billion fortune to go to his daughter Ivanka tax-free.) From the IRS:

"Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return. A filing is required for estates with combined gross assets and prior taxable gifts exceeding $5,430,000 [per parent] in 2015."

Last night a pundit on Sean Hannity (Fox News) said "a lot of people" would be happy about a repeal of the estate tax; but 99.8 percent of all estates already owe no estate tax at all. It's mostly the multi-billionaires on the Forbes 400 list who would benefit from repealing this tax (e.g. Bill Gates, Warren Buffett, the Wal-Mart heirs, the Koch brothers, Donald Trump, etc.)

But even the estate tax is sometimes avoided with other loopholes — such as the step-up in basis at death for capital gains taxes and perpetual dynasty trust funds. If there is a loophole, an army of tax attorneys will find it. And if there isn't a loophole, the rich will lobby Congress for one.

Trump previously mentioned eliminating the "carried interest" loophole for hedge fund managers, but a New York Times article also says "Trump Plan is Tax Cut for the Rich, Even Hedge Fund Managers". And little if anything was specifically mentioned about the "capital gains tax" in Trump's plan.

But basically, all GOP tax plans are the same — they are just worded and sold differently. They are all about tax cuts to force cuts in government spending (a.k.a. Starving the Beast) — and working people, the poor, the unemployed, the disabled and the elderly are the "beasts" that the Republicans want to starve with their "feed the rich, starve the poor" economic policies.

The typical tax strategy that most politicians usually employ is to throw a few crumbs to the middle-class and poor to pacify them — to keep them from uprising and revolting against the plutocrats; but while also giving the biggest tax breaks to the most wealthy plutocrats (similar to other bait-and-switch or Three Card Monte schemes — it's all smoke and mirrors).

Bill Clinton, after praising both his wife and Bernie Sanders for laying out their own detailed and positive policy positions, recently told CNN that he thinks Donald Trump could win the GOP presidential nomination. So no matter what Republican wins their primary, they will cut taxes for the rich if they ever become President.

Hillary Clinton "talks" about raising taxes on the rich, but Bernie Sanders definitely would — but he could only do this if he also had a Congress packed with progressive Democrats. So even if Bernie Sanders became our next President, it's extremely unlikely that the rich would ever have to pay one penny MORE in tax than they already do today.

On the other hand, with the current Congress, if any Republican becomes President in 2016, they will most definitely cut taxes for the very rich (while also cutting government programs) — and then they'll promise everyone else that they will also get a bigger slice of the pie. But they've been telling us this fairy tale for the past 40 years.

Recently in a speech about racial injustice at the Edward M. Kennedy Institute, Senator Elizabeth Warren noted:

"Republicans’ trickle-down economic theory arrived. Just as this country was taking the first steps toward economic justice, the Republicans pushed a theory that meant helping the richest people and the most powerful corporations get richer and more powerful. I’ll just do one statistic on this: From 1980 to 2012, GDP continued to rise, but how much of the income growth went to the 90% of America—everyone outside the top 10%—black, white, Latino? None. Zero. Nothing. 100% of all the new income produced in this country over the past 30 years has gone to the top ten percent."

Comments

Jeb Bush: Dropping Oil-Export Ban

Fracking and "Drill, Baby, Drill!" — so that America can be "energy independent" — that's what we've been hearing for years.

Now, because of less global demand for oil (producing an oil glut), the price for gasoline at the pump has dropped — which is great for us, but yet, still " they" complain.

Jeb Bush is calling to remove the nation’s 40-year-old ban on oil exports, approving the Keystone XL pipeline and eliminating a raft of environmental regulations — saying his proposals would stimulate economic "growth".

All of the GOP candidates for president support the Keystone pipeline — and Ben Carson and Donald Trump would also support lifting the ban on crude-oil exports to foreign markets.

Jeb also wants to repeal limits on carbon emissions and environmental standards for fracking (The GOP also wants to cut or eliminate the EPA).

SOURCE: Wall Street Journal

http://www.wsj.com/articles/jeb-bushs-energy-plan-includes-dropping-oil-export-ban-1443499206

Scenario in 2026: Gasoline is up to $7 a gallon because oil (from Canada, Arctic drilling and fracking in the Dakotas) is now being exported to the highest bidder on the open global market.

While pumping some of the dirtiest oil on Earth to the Gulf of Mexico to be exported to China, the Keystone pipeline bursts in Nebraska, contaminating all of the fresh water in the Ogallala aquifer.

Worse yet, there is no EPA to clean up the mess — so the situation becomes permanent.

Now, until or unless the pipeline can be repaired, there's even less oil for domestic consumption — so the cost of gasoline goes up to $10 a gallon.

Meanwhile, owners of VWs are getting a lot less miles-to-the-gallon since their auto recalls.

Less regulation, less taxes, less government spending, and the export of America's natural resources for consumption in China was just what we needed. Only, it's too bad the Ogallala aquifer was ruined, or corporations may have wanted to bottle that water and export it for profit too.

The price of gas...

As a rough idea, the cost of gasoline can be estimated from the price of oil as follows:

Take the $/barrel for oil (Brent sweet crude)

Divide by 30

Add 50 cents to the answer.

That is the cost for a gallon of gasoline.

So with Oil at $45/bbl, gasoline should be $2/gallon.

Currently our prices are a bit high in the upper Midwest, but that is likely due to refinery issues in Indiana.

That is a rough empirical formula, but it is close enough for discussion purposes. I would like to see an accurate regression equation, as that one I worked out in my head one day while filling the tank of my '86 Dodge Power Wagon. (It gives you time to think)

So for gasoline to reach $7/gallon, the price of crude would need to be roughly $195/bbl. Since the likely effect of adding more supply to the world market would be to further lower prices, it seems unlikely that we will see $7.00 gas any time soon, unless we raise gasoline taxes significantly.

Not a great fan of exporting oil, but the only scenario for gasoline to get to $7/gallon in the next decade would be either dramatic increase in demand (global industrial growth) or significant curtailment of supply. Perhaps military issues interfering with oil supply from the Middle East, or legislative activities in the west making extraction of oil dramatically more expensive, or stopping it altogether.

One other possibility would be the Saudis run out of oil - most people I know in the oil industry were really surprised they could bring the price down as dramatically as they did, as there were doubts about their production capacity. Their goal in doing so was probably to discourage further development of US oil resources, so that they could maintain the leverage they have as the big producer, while they hope that the US environmentalists would be able to make curtailment of US development permanent.

I'm still hoping for a technological solution, though fuel cells don't seem to be it, and the so-called electrics are just coal burners.

Maybe someday we will have a Mr. Fusion in the center console, but even then "The DeLorean runs on gasoline."

oil imports stil high

i cover oil imports every week, Bud; we're still importing 40% of our needs and 6 weeks ago we saw the greatest excess of crude and products imports over exports in a year...the reason the oil industry wants to export crude, even though we're importing so much, is simple; international oil prices have been running between $5 and $10 a barrel more than US oil prices...so if they're able to sell their crude overseas (Canada and Mexico are exempt from the ban), US prices for oil will quickly jump to the international price, and we'll be paying 10% to 20% more for our oil products than we otherwise would if our market remained protected..

rjs

A certain sort of truth...

If you define "rich" as those whose income provides them with more than they need to meet their living expenses (including savings identified for specific lifestyle purchases like housing, health care, retirement, education), then it is true that the only people who accumulate wealth are those who are "rich".

The rest of us get by, we manage to limit our consumption to our available revenue stream. At the same time, our manner of living is defined by the money we can get.

Stated in another way, if a significant increase in revenue or net worth would not appreciably change how you live, then you qualify as rich. I realize that sort of definition is more challenging for statisticians, as it has a behavioral aspect to it. My brother who lives in a rooming house may qualify as rich, while an MLB player who blows his pay on everything fast may not.

However, it illuminates the idea that the rich get richer - if you have more income than you need to support your manner of living, your wealth tends to accumulate.

Obviously, if you have a LOT more, and you can afford to hire smart people to manage your money, and influence governments to favor you, then it grows faster.

That said, I don't think most people in the bottom 95% are thinking about getting rich. They are thinking about getting more income, so they can spend it on things they would like to include in their lifestyle.

I am not sure that taxes are the best way of restoring the balance of income, however. While taxes might help, using taxes in this way would bring to bear the efficiency of government in deciding who was deserving. And the rich people would, of course, hire smart people to help them get the most of the money back again pretty quickly.

The twin pillars of the disembowelment of the American economy have been

Lowering of trade barriers of all sorts, so goods can be made wherever labor is cheapest, and sold anywhere in the world. While this lowers the cost of goods, and sometimes the price, it lowers purchasing power for American workers. Most of the benefit goes to those wealthy enough to engage in multinational trade.

Importing workers from everywhere in the world, legally and illegally, to lower the cost of labor for those things which cannot reasonably be done a long way away, such as housing construction, health care, janitorial services, etc. This surplus drives down the cost of labor across the board, as it increases the supply substantially.

So while taxes may be a relatively quick fix, I would support a candidate who would deal with these problems at their root - which is by curtailing the supply of low cost labor. This will raise real income.

I'm not enough of an economist to understand the secondary effects and unintended consequences of such a change. I would expect the wealthy to fight to maintain their revenue stream. It does appear that The Donald sort of agrees with my perspective, and that gives me pause...

worst area for corruption

The tax code, especially the corporate tax code, is the worst place for corruption. The mega rich fund campaigns and are their pals, so no surprise they come up with a way to get even more money for themselves and suck the blood (there is no blood left) out of the middle class.

Trump's Tax Plan in a Nutshell

For individuals, Trump's plan would:

The only tax that goes up for the rich --> Trump's plan would tax " carried interest" at ordinary income tax rates ( instead of capital gains and dividends tax rates). This means that the tax rate that hedge fund managers and private equity investors like Mitt Romney have long enjoyed would be taxed as regular wages. But under Trump's plan, it would only be a slightly more:

For businesses that generate most of the capital gains --> Trump's plan reduces the tax on corporations and pass-through businesses from 35 percent to 15 percent, preserves the foreign tax credit, and provides a one-time repatriation tax of 10 percent on all foreign profits currently deferred.

The conservative Tax Foundation found that Trump's plan would boost the incomes of the top 1 percent of taxpayers by 21.8 percent, while those of the lowest-income Americans would rise by only 1.4 percent. The national debt, meanwhile, would jump by $12 trillion over the next decade.

http://www.huffingtonpost.com/entry/donald-trump-tax-plan_560ac15ce4b0af3706de0539

I thought 21.8 percent was a

I thought 21.8 percent was a bit much, but if you do the math, it is about right. It is just a bit less than the increase in pay you would get if you went from paying 39.6% federal tax to 25% federal tax.

That could pretty easily result in reduced federal tax revenues.

I would like to see the 12 trillion spelled out, to see if that is an additional 12T, or 12T including current deficit projections, but either way, that isn't a very good plan.

I suppose at this point, Donald is saying stupid stuff to appeal to the money side of the republican machine. On the other hand, he might actually think this is a good plan. More likely, it is a starting point (in his mind) for potential negotiations on changes to the tax code.

However, if he actually fixed the surplus labor/cheap imports problems, the income inequality problems would begin to right themselves.

I had a great idea for a proposed tax scheme, which would balance the budget by raising taxes on wealth and large incomes. But as I was about to explain it, I remembered a story, to wit:

LONG ago, the mice had a general council to consider what measures they could take to escape the depredations of their common enemy, the Cat.

Some said this, and some said that; but at last a young mouse got up and said he had a proposal to make, which he thought would meet the case.

“You will all agree,” said he, “that our chief danger consists in the sly and treacherous manner in which the enemy approaches us. Now, if we could receive some signal of her approach, we could easily escape from her.

I venture, therefore, to propose that a small bell be procured, and attached by a ribbon 'round the neck of the Cat. By this means we should always know when she was about, and could easily retire while she was in the neighborhood.”

This proposal met with general applause, until an old mouse got up and said: “That is all very well, but who is to bell the Cat?” The mice looked at one another and nobody spoke. Then the old mouse said:

“IT IS EASY TO PROPOSE IMPOSSIBLE REMEDIES.”

-Aesop

Carl Icahn on Tax Inversions

Multi-billionaire corporate raider Carl Icahn (who supports multi-billionaire real estate tycoon Donald Trump) told CNBC that he is putting $150 million into a Super PAC aimed at targeting inversions, the practice of companies moving their headquarters overseas to pay less in taxes.

http://www.reuters.com/article/2015/10/21/us-usa-election-icahn-idUSKCN0...