At this point, many people here are aware that a number of states have deep budget deficits that threaten to bring shutdowns as early as August. I think that throwing some numbers in really shows the depth of the problem as well.

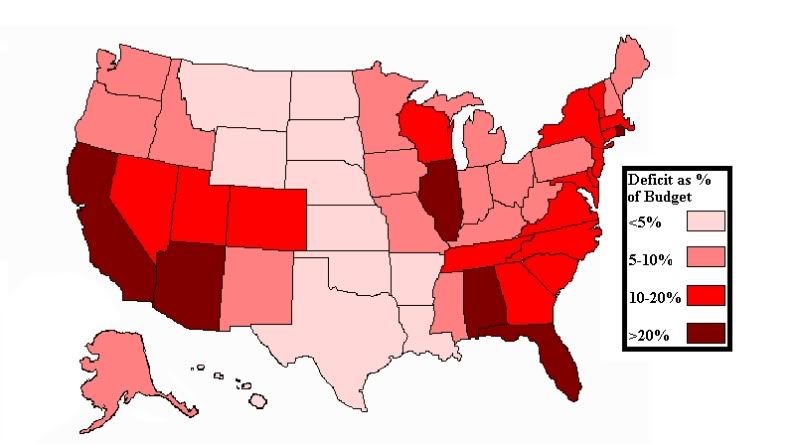

This map shows the gap between expected 2009 state revenues and the budget for the year in percentage terms. California has a real problem, as do several other states.

Back at the end of May, I noted the danger of a dead cat bounce. That is that we could have a situation in which things appeared to get better, only to grow suddenly worse. Of particular concern to me at that time was the fact that the only two sectors in which employment had increased since the start of the recession were government, education, and health. These sectors are all heavily dependent upon government spending, and more specifically on state government spending. Anything that caused a collapse in employment in these sectors would have an outsized effect because it would create uncertainty about future job prospects in sectors that had largely been left untouched.

The cat is about to bounce.

California is hurling towards going into default, forcing the state to stop payment on a number of debts.

California lawmakers were poised to miss their constitutional deadline on Monday for a state budget, bringing the state's government closer to running out of cash.

Democrats and Republicans in the legislature's budget conference committee worked through Monday afternoon on a variety of proposals addressing Gov. Arnold Schwarzenegger's plan to close a $24.3 billion budget shortfall, but they failed to find common ground on its most dramatic proposal: eliminating the state's welfare system.....

It will run out of cash within weeks if it does not balance its books, leaving it little option but to postpone a variety of payments, according to State Controller John Chiang, who estimated last week that California was "less than 50 days away from a meltdown of state government."

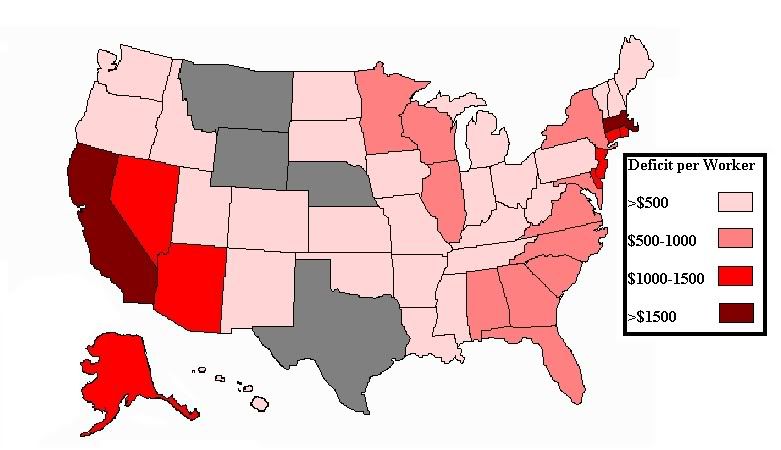

California has all but begged for a federal bailout of the estimated $35.9 billion deficit that it is set to accumulate through FY 2009. While California's deficit is the most impressive, a number of other states have large deficits looming over them. Below I've calculated the amount of deficit owed by each worker in all the states.

In California, the deficit comes to $1929.69 foreach person in the labor force. In Massachusetts, $1519.67. Rhode Island, $1420.73.

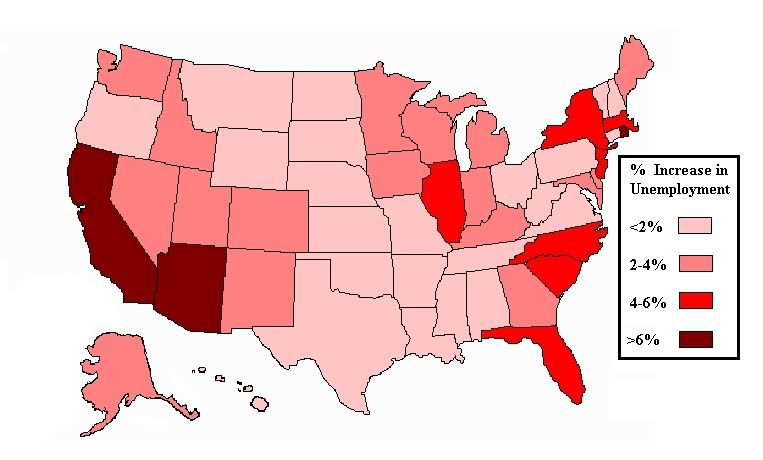

And this isn't the worst of it. It's likely that budget showdowns that result in government shutdowns that will force all but essential services to be suspended. That means a lot of people off of work. What I've done below is put together a map that shows the increase in unemployment is employment in the sectors where the government is important where to be cut a rate proportionate to the budget deficit. So in California, the deficit is 35.5%, and the map shows how much unemployment would increase if 35.5% of employment in those sectors was lost. In California, this would raise the state's unemployment rate by 8.3%.

This would make an already bad employment situation much, much worse. Nationally, unemployment would increase by 3.6%, taking it from from 9.1% to 12.7%. This would top the post war unemployment high of 10.8% set in December 1982 by nearly 2 full points, not including collateral damage in the private sector.

And it will cause collateral damage. If state workers lose their jobs, they stop spending money, sending many others out of work as well. So simply calculating the unemployment rate adding in those unemployed by cuts in state employment understates what would likely be the real rate.

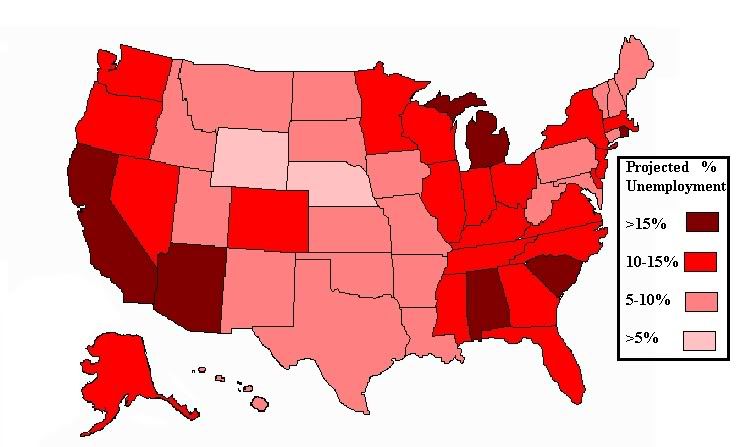

Nonetheless, it's pretty scary to look at the numbers. The unemployment created by employment cuts equal to the budget deficit would produce a 19.1% unemployment rate in California, 18.1% in Rhode Island, and 16% in Arizona.

This could set of a "reverse Okie" situation where large groups of people leave California to find work in places like Texas and the Plain states that have been less affected by the recession.

It's highly likely unless something is done to increase state revenues in that the dead cat is going to bounce. Whatever brief recovery might be possible due to the stimulus will likely be followed by an ever deeper recession. Ironically, one of the easiest actions that can be taken must occur at the federal level. State taxes are calculated using the taxable income from federal tax forms, which means that if people are able to shelter most of their income from taxation at the federal level, no amount of of state tax increases is going to lead to this income being taxed.

Ultimately, a huge part of the answer must come in the form of the federal government taking away the tax privileges that have allowed the wealthy to avoid effective taxation. Only then will states be able to confront the budget crisis without resorting to increased sales taxes and other regressive tax measures.

Comments

I

crossposted this a Big Orange.

The libertarians are out, ugh.

nice work middle

I think that comment claiming somehow workers would keep their jobs while services are suspended is wrong.

Also, the site has changed so we need to promote all posts now to the front page. So everyone has to use the promotion/demotion arrows on the bottom right of posts.

I should be shocked by the per person deficit but the Fed calculations make this look like chump change.

I noticed that he left

the moment I asked him (or I suppose her) to tell me how exactly budgets would be balanced absent tax increases or personnel cuts.

California's situation is scary

Speaking from someone who currently lives in California, I have to wonder if I need to make plans for going elsewhere.

And if California, the 8th largest economy in the world, goes down, how can they honestly expect the economy of the rest of America not to collapse with it?

2/3rd Rule

Interesting that two of three states with the 2/3rd rule are in the red: California and Rhode Island. They are dominated by a minority who prevent raising taxes.

But Wyoming and Nebraska

Seem to be doing the best in all the above charts- and they're not exactly know as big tax and spend states either.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

At least 60,000 job losses

Here's the first projections for job losses because of California's budget problems.

What this report doesn't say is how many private sector jobs will be lost because of all the public sector jobs getting cut?

as far as I know

middle calculated his own projections, so quite the validation I'd say for middle here. (not that it's thrilling to be right about impeding economic Armageddon!)