The U.S. Air Force has a motto: "Second to None". It's a shame that the U.S. economy can't make the same claim. After already over-taking Japan has the world's 2nd largest economy, the Chinese economy has just passed the U.S.’s to become the largest economy in the world.

Market Watch recently reported: "For the first time since Ulysses S. Grant was president, America is not the leading economic power on the planet ... The International Monetary Fund recently released the latest numbers for the world economy. And when you measure national economic output in “real” terms of goods and services, China will this year produce $17.6 trillion — compared with $17.4 trillion for the U.S.A."

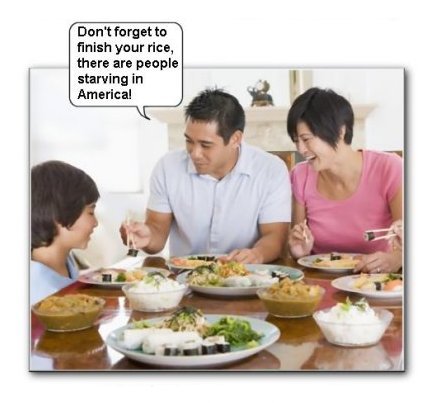

We used to laugh, smug with our "American exceptionalism" whenever we saw cheap goods with the stamp "Made in Japan" or "Made in China". American workers had always thought of themselves and their country superior in every way. We belonged to labor unions, had job security, and healthcare. Our parents used to tell us to eat all our vegetables because people were starving in China.

We had the "American Dream" and we defeated fascism and communism wherever and whenever challenged. We sent a man to the moon, and outspent the U.S.S.R. in military spending to break up the Soviet Union. We were so high and mighty and full of ourselves as we were buying up all those cheap goods, stereos, VCRs and TVs.

That was before American corporations began expanding their operations exponentially overseas after the Vietnam War for cheaper labor to increase their CEO's paychecks. The reason they gave was because of "global competitiveness". There is no such thing as "corporate patriotism". About that time was also when Wal-Mart began expanding their super-stores into our neighborhoods, putting small business that were selling American-made goods (with higher prices) out of business forever (with cheaper prices).

Manufacturing had drastically declined in America for cheaper labor elsewhere. In the last twelve years alone 64,000 factories have fled our shores, costing the U.S. millions jobs. So now, besides the healthcare industry, maybe government jobs and those in the service industry might be the only jobs left jobs that can't be outsourced to a foreign country. (A study shows that 1/3 of all U.S. jobs are still prone to offshoring/outsourcing).

A bartender or a maid working for a hotel that caters to foreign and domestic visitors aren't going to lose their jobs to a chain of hotels and casinos moving to China. Hospitals aren't going away either. And we will always need firefighters, police, and soldiers. The U.S. Post Office was once a safe and good-paying employer (but maybe not for long); and the high-tech industry now risks their trade secrets to espionage on foreign soil.

We can no longer depend on manufacturing any longer, and it won't get any better — it can only escalate. Rep. Betty Sutton once said: "Thanks to the globalization of the economy, big corporations and corrupt governments can make stuff in countries where it is legal to pay slave labor wages and then ship their products into the United States for free."

Even American college graduates might only earn $20,000 a year now. In China engineers or new graduates in computer science might only earn 10,000 RMB a month. That is about $1,588.84 — or approximately $19,068 a year ($366.69 a week or $9.17 an hour with a 40-hour work week) — which is slightly more than what a McDonalds worker earns here in the United States. It was these low-paying McJobs at McDonalds that had provided the Krocs with many of their McMansions.

An assembly line worker at Foxconn in China might earn $1 an hour, but in the long term Foxconn is considering moving to Vietnam in order to lower labor costs more, by replacing employees with robots at an automated facility in Taiwan. Only upper management positions in American companies in China might earn a compatible salary by U.S. standards. (Read my post: Where the Jobs Are...and where they continue to go.)

And it's also cheaper to live in China than it is in the United States. The cost of living in China is dramatically lower than that in the U.S., Australia, and Western Europe. In China a nice two bedroom, one bath apartment with wooden floors and marble counters in the kitchen will run around 4,500 RMB a month (about $715 USD). Chinese utilities are shockingly low, thanks to their government subsidies. In the aforementioned apartment, one could expect to pay an additional 300 RMB in utilities per month (less than $50).

And as far as small businesses in the U.S. is concerned, it's a lack of demand, not regulations that's hurting them. Millions of Americans with no jobs, or earning low pay, have less discretionary spending than they used to, especially as the cost of living continually goes higher. Forty years ago dad paid the bills, now 2 paychecks barely cover the costs for a family of four.

And it's not necessarily taxes either. The corporate tax rate in China is 25% (20% for small businesses), but for the past 25 years the average "effective" tax rate paid by American corporations for U.S. revenues has averaged only 18%. They are already paying less in taxes, so even ZERO taxes couldn't keep jobs in America, unless of course, we were not only willing to work for less than Chinese workers, but live with a much lower standard of living. (Read my post Record Profits + Record Bonuses = Zero Jobs)

And with energy and food prices constantly going up in the U.S., how will earning less be survivable for American workers to make American businesses more "competitive"? How can taxing corporations less (or more) ever affect the job outcome?

The cost of payroll is a business's biggest expense, whether it be for R&D, an engineer's pay, the cost for the building of a new factory, or for the menial labor jobs on an assembly line. The cost of labor will always trump whatever the corporate tax rate is — the rate could be set at either 90% or 0%, it wouldn't matter — not if a company had the option of cheaper labor somewhere else. This has always been the case.

Many American CEOs and banking executives earned more than their company paid in taxes. And American CEOs are paid much more than in any other country. Today, American CEOs make 263 times the average compensation for American workers, up from the 30 to 1 ratio in the 1970s. In 2010 alone, CEO pay went up 27 percent while average worker pay went up just 2 percent. The Institute for Policy Studies showed a high for 2010 at 325 to 1. In previous years the ratio on two occasions has exceeded 475 to 1 — to be specific, 516 to 1 in 1999 and 525 to 1 in 2000.

According to a report on executive pay put together by the independent research firm R. G. Associates, there were currently 32 companies that actually spent more on compensation for their top executives in 2010 than they paid in corporate income taxes:

"Total executive pay increased by 13.9 percent in 2010 among the 483 companies where data was available for the analysis. The total pay for those companies’ 2,591 named executives, before taxes, was $14.3 billion. Warming to his subject, Mr. Ciesielski also determined that 158 companies paid more in cash compensation to their top guys and gals last year than they paid in audit fees to their accounting firms. Thirty-two companies paid their top executives more in 2010 than they paid in cash income taxes." (Also read: Pay Disparity Ratio)

And the CEO's stock-options are taxed at only 23.8% for capital gains, while the middle-class is taxed at a higher rate. (See my posts How the 1% bilks the 99% and Low Wages Kills Jobs, Not High Taxes).

In 2011 there was a bill introduced in the House for closing the loopholes that allows wealthy money managers to pay the lower capital gains rate on their income (called “carried interest”) and no longer allowed multinational corporations to claim tax credits on earnings that they keep overseas. But the big business lobby, led by the Chamber of Commerce and the Business Roundtable, had its sights set on the Senate in the hopes of preventing the changes.

And the new Republican Congress might want to take a gander at what’s garnering interest on their own websites, as the proposal receiving the most “interest” (and the second highest number of overall votes) in the job creation section is to “Stop the outsourcing of jobs from America to other countries that do not pay taxes into the U.S. — and stop the tax breaks that are given to these companies that are outsourcing.”

Congress has yet to approve a bill that closes corporate tax loopholes that allows corporations to claim domestic tax credits on profits that they never bring back to the U.S. Republicans not only obstructed that bill, but also put forth an alternative that cut Medicaid and infrastructure funding, while leaving the tax loopholes intact.

At the same time, corporate tax revenue has plunged to historic lows. During the 1960s, for instance, the United States consistently raised nearly 4 percent of GDP in corporate revenue. During the 1970s, the total was still above 2.5 percent of GDP. But the U.S. now raises less than 1.5 percent of GDP from the corporate income tax.

This isn’t really surprising when you consider that several of the largest U.S. corporations simply paid no taxes at all. General Electric, for instance, made more than $5 billion in 2011, but had a tax rate of negative 64 percent, meaning it received billions in tax benefits. During that time Boeing hadn’t paid any federal income tax in the previous three years, while it's CEO Jim McNerny made $19 million that year. (See my post about the defense industry).

At the moment, a slew of multinational corporations are already paying exceedingly low taxes, and lobbying for more. With corporate taxes already historically low, and corporations flush with $2.2 trillion in cash, and paying tens of millions to their CEOs, there’s little reason to grant these huge companies (the "job creators") yet another giant tax giveaway. And there is little reason for them to pay their employees a "living wage" either, not if they're living and working in the U.S.

If we argue that this excessive and gross income disparity is unjust, we're called "socialists". If we argue that the U.S. Chamber of Commerce shouldn't be encouraging and helping companies to outsource jobs with trade agreements, we're called "anti-business". If we argue that companies shouldn't receive tax benefits for outsourcing domestic manufacturing and demand "fair trade" instead of "free trade", we're called "anti-capitalists".

How can American workers ever again compete for middle-class wages in America, whether we have an advanced college degree or not, if jobs keep hemorrhaging overseas for cheaper wages? Are we to just surrender to the fact the middle-class will eventually and completely disappear in America?

Is America just supposed to accept it's long and steady decline and go gentle into that good night — especially now since China is #1? Or should Americans rage against the dying of the light? And if not, and if Congress will never see the harm they've already caused us, then maybe it's time we wave a white flag and scream, "I surrender!"

Comments

Thx MNCs for giving away our economy!

Hey, thanks multinational corporations in cohoots with corrupt politicians! We just love giving away our economy and wealth to other nations so they can surpass us. Wow, export the jobs and import 3rd world poverty, awesome.

Sprinkle that with white people guilt to justify destroying America's economic future and middle class.

Wow, this is one economically history day and it's a very dark day indeed.

Must Be Good News for Stock Market

DOW just hit another all-time record high again today.

http://www.google.com/finance?cid=983582

the endurance of a feeble

the endurance of a feeble people can only be seen in every shop and house apt and housing unit. The true man lifts himself and his nation and can be seen going through life at his own idel to be recogned with when he speeks .{only truth ,meaning, joy, and respect.} if warrented the entire scam of life is complete with possers worthlessness and rediculousness but the endurance of a nation who say's send us your poor huddled and yearning to breath free has endured enough the pillage is over and the crap an american family has to endure at the hands of pathetic and apthetic men families and friends is over.

China number one?

Statistics in China are nowhere close to reality (see Stevenson-Yang). The economy they have is rife with corruption, and stifled by wooden central planning. They are to paraphrase John McCain, a five and dime store posing as a superpower.

This is, and should be, a wake-up call

Joseph E. Stiglitz: "This is, and should be, a wake-up call ... China enters 2015 in the top position, where it will likely remain for a very long time, if not forever. In doing so, it returns to the position it held through most of human history ... The most important thing America can do to maintain the value of its soft power is to address its own systemic deficiencies -- economic and political practices that are corrupt and skewed toward the rich and powerful."

http://www.vanityfair.com/business/2015/01/china-worlds-largest-economy

(* Our job creators have been telling us that outsourcing made the U.S. more "globally competitive", so why is China now #1?)

Putting the U.S. to Shame

Yum! Brands (e.g. KFC, Pizza Hut, etc.) continues to open new stores in China. Yum already has 6,400 restaurants in almost 1,000 Chinese cities, and plans to open another 700 new stores next year. China is "the best restaurant opportunity of the 21st century with a consuming class that is expected to double from 300 million to more than 600 million people by 2020," according to the company website. "We continue to invest behind the development of our emerging brands in China."

http://money.cnn.com/2014/12/09/investing/yum-kfc-china/

Facebook CEO Mark Zuckerberg last week was hosting a Chinese Communist Party official whose responsibility includes preventing Facebook from entering China. In the Western media, Lu is described as China’s “Internet czar,” implying that he is the gatekeeper who decides which Western Internet giants can do business in China. Because China now has the world’s largest population of Internet users (estimated at 640 million in 2014), no responsible CEO of an American technology company can afford to write off this huge market.

http://fortune.com/2014/12/10/mark-zuckerberg-rupert-murdoch-china/

China opens 32 high-speed rail routes in grand expansion. China has the world’s largest high-speed rail network, which keeps the growing population and economy connected. The world’s fastest passenger train is also in China - the Shanghai Maglev Train can reach speeds of over 430 kilometers (260 miles) per hour. Chinese trains will arrive in the US before any tracks, as one of the two biggest state-owned train makers, China CNR Corp, has sold 284 cars to Boston’s metro in a $537 million contract.

http://rt.com/business/212719-china-opens-high-speed-train/

And speaking of trains: Madrid mayor welcomes first cargo train from China after epic 8,111-mile rail trip inaugurates the longest rail link in the world.

http://www.theguardian.com/business/2014/dec/10/silk-railway-freight-tra...

Citigroup Runs Congress...

...and Killed the Dodd-Frank Bill

Washington Post: Elizabeth Warren, fellow liberals rail against bank provision in spending bill

http://www.washingtonpost.com/blogs/post-politics/wp/2014/12/10/elizabet...

Mother Jones: Citigroup Wrote the Wall Street Giveaway Congress Just Snuck Into a Must-Pass Spending Bill

http://www.motherjones.com/politics/2014/12/spending-bill-992-derivative...

New York Times: The spending bill that Citigroup helped draft

http://dealbook.nytimes.com/2014/12/09/wall-street-seeks-to-tuck-dodd-fr...