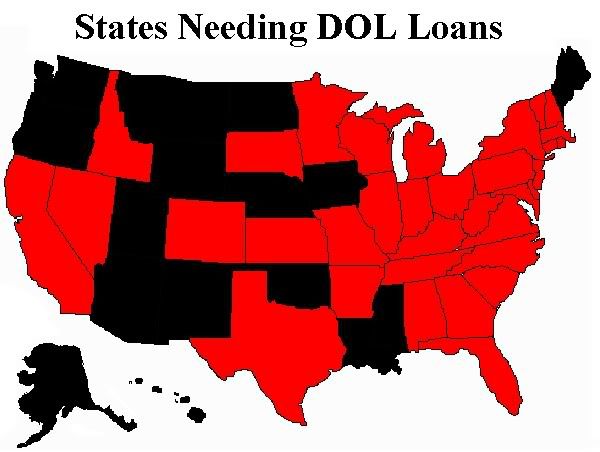

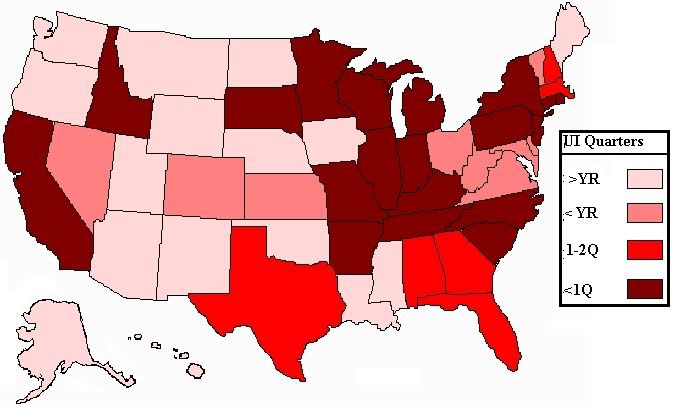

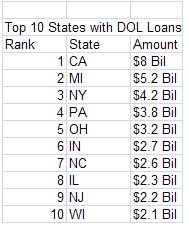

That's the amount of money currently lent by Federal Department of Labor (DOL) to a group of 15 states whose unemployment insurance (UI) trust funds have run dry. And it's about to get a whole hell of a lot worse. By the end of the year that number will likely have have grown to 35 states. Total DOL emergency loans to states at that time? Nearly $50 billion dollars. The situation will be far worse for some states than others. The states appearing in red on the map below are those that will need DOL loans to keep unemployment benefits rolling.

Just to put this into perspective, let's lay the numbers on out. A short note of caution. UI is collected only on a percentage of income (like how income hits a Social Security cap, so most of the revenue comes in the 1st and 2nd quarter. This means that you really need to lay the numbers out over the course of an entire year to get rid of the distortion from this. I have. However, this also means that UI trust funds look much better now than they will at year's end, because they are bloated with a disproportionate part of the year's UI revenue intake. Calculated over the year, the numbers look far worse.

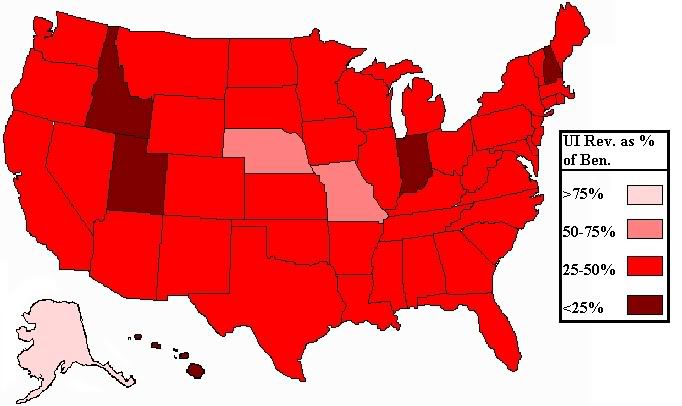

For example, one easy way to judge the health of the system is to calculate the what percentage of yearly expenditures is covered by yearly revenue. If more money is being collected than spent, the number will be larger than 100%. This means that money is going into the UI trust fund for use later. If it's less than that, it means that the payment of current UI benefits requires that money be taken out of the UI trust fund to cover these payments. Looking at it this way, we get the following map.

Ok, Indiana's really screwed here, but so is Hawaii apparently. Yet at the end of the year, Hawaii's in the black.

How does that work?

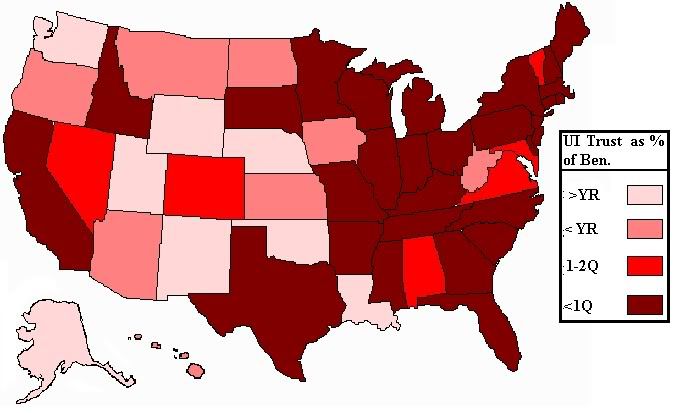

UI trust fund. Hawaii is drawing down on their UI trust. I jacked up the following map a little, but I think that idea is still clear. Hawaii can pay current UI benefits out of their trust for under a year. So even if unemployment revenues stopped, they'd be able to pay out benefits for almost a year off of what they currently have in the bank.

The real test is how long they can last using both current revenues and drawing down on their trust fund. And that's the map that follows.

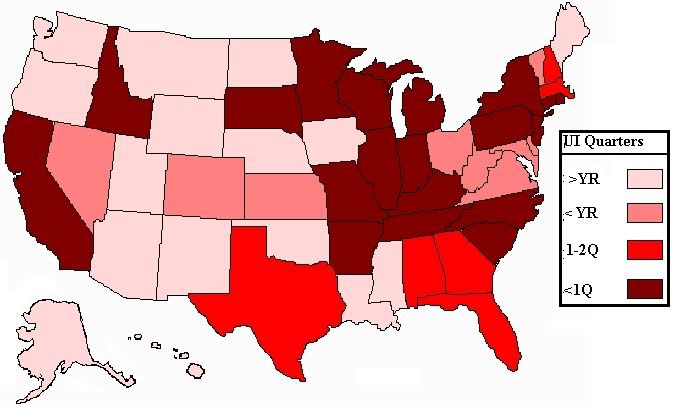

This is the number of quarters that the state can go without needing a loan from the DOL.

As you can see, the Great Lakes region down on to the Carolinas, and up into New York is pretty screwed. Many of these states (And California already have loans out from the DOL. By the end of the year it will be even worse.

For Indiana, that would take nearly 5 years worth of incoming revenue without any money spent in UI benefits in order to pay off. For Wisconsin, Ohio, Michigan, North Carolina that number is nearly 3 years. And for California and New York, it is almost 2.

The question that everyone in these state should be asking is wheter, given the current system, these loans will ever be paid off. When the DOL loaned money to the states for unemployment in the 1970s and early 1980s, it took several of the states until the middle of the 80s to pay them off. This time around, it looks an awful lot like it could be the better part of a decade, or far longer.

Comments

Crossposted at

Big Orange.

Oregon

Surely it's only a matter of time for Oregon. They have one of the highest unemployment rates in the country and then on top of it, it's a state controlled by the illegal alien lobby. Sorry but they continually do nothing to purge their social services rolls of illegals,, very similar to California. I think this is a big fat problem that isn't being recognized, the drain on state resources that illegal immigration causes.

I'm very surprised to not see it on this list.

Great work manfrommiddle. Did you know your email address bounces?

Oregon's

got a $1.6 bil balance in their trust fund right now, collects about $772 mil annually, and is burning through $1.7 bil year over year in UI benis. So they are good for just under two years of this before they hit a wall. Remember that OR has had a pretty good economy up until lately.

On my email. Ya. I had to change it. Lycos closed my account, I'm using gmail now. Does the database automatically update when I change the email I use for contacts in my profile?

Unemployment:

None of the current numbers in the unemployment reports are even close to accurate. If you knew the actual number of people without jobs, the ones that have run out of benifits, underemployed,and those that are no longer being counted like the homeless, you would see a rate of perhaps 20-25 % VERY SCARRY.