With Spain now getting a bail out all to pump up their insolvent banks, one might wonder how did we get here in the first place?

With Spain now getting a bail out all to pump up their insolvent banks, one might wonder how did we get here in the first place?

We actually are on the precipice, with a key critical Geek vote on whether or not they will default on their international bail out. Sitting on the edge of a cliff, a review of the European sovereign debt crisis and how we got here is at hand.

What the hell happened is complicated. Greece is not the same as Ireland, nor is Spain the same as Greece. Ireland's sovereign debt crisis was the direct result of their financial crisis. Greece, on the other hand, had long standing structural problems with their economy. Nor are their economies the same although treating them as such originally was part of the problem.

The St. Louis Federal Reserve Research Director Christopher Waller gave a presentation on the the European Debt Crisis. The entire May 8th, 2012 lecture is below. The focus is on debt to GDP ratios, the European Union and interest rates for sovereign bonds. We learn about the European Union's major financial structural problems versus how exactly the debt happened. There are plenty of specifics and this lecture is concise, accurate in it's scope. If you don't understand European Sovereign Debt fundamentals, watch this lecture in full and you will.

As we can see the real economic contagion threat to Europe are Spain and Italy, now coming right at us. The above lecture's fundamental question of why Germany and France did not simply buy up Greece's debt in the first place, for it was a way cheaper solution, goes unanswered. Yet, here we are on the true economic tsunami 2nd wave, Spain. The third wave is Italy and as in all tsunamis, it's usually the 3rd wave that's the killer.

We should point out the above lecture never mentions the sovereign debt solution to grow one's way out of massive deficits. Another flaw in their presentation is the lack or the characterization of the debt itself. Some debt is stupid and inept, the responsibility of that country. Other debt was caused by financial derivatives and points to financial reform as a key solution to reduce sovereign debt.

The massive unemployment rates and grinding to a halt of these economies isn't mentioned either. Literally Waller comments on how the Irish just grumbled and went back to work when austerity was enacted. Greece on the other hand is pretty much in revolt. Well, well, let's state the obvious. Ireland still has a few jobs to go to, Greece does not. May we suggest not worrying about political unrest and start worrying about collapsing economies under the weight of such heavy handed austerity demands.

The harmonized levels of unemployment in PIIGS, Portugal, Ireland, Italy, Greece and Spain, is astounding and shown in the below graph. Spain's unemployment rate is 22.1% (maroon), Greece is off the charts with a 21% unemployment rate (red), Portugal's unemployment rate is 15.0% (orange) and Ireland's unemployment rate is 14.7% (green). Italy's unemployment rate is 9.3%, not yet hit with bail outs and austerity.

One cannot have unemployment levels the same as pre-Nazi Germany and Italy and expect entire governments to be upheld. When the people are starving, surprise, all hell breaks loose, especially when that suffering is not necessary.

Now that Spain has gotten their own glorified TARP, the ball is starting to roll and assuredly here comes Italy. In another St. Louis Fed publication, Sovereign Debt: A Modern Greek Tragedy, there are cited some astounding statistics on Italian debt:

Italy has about €1.9 trillion of debt outstanding, of which 50 percent is held externally. Furthermore, Italy needs to roll over more than €300 billion euros of debt in 2012, an amount greater than the entire Greek debt! Complicating matters is the fact that Italy has had essentially zero economic growth over the past decade; thus, it has not been able to reduce its debt burden through income growth.

Did you know Greece and Ireland combined has less GDP than Pennsylvania? This is why these countries are the first tsunami wave. Their ripple effects are small in comparison to Spain and Italy. They are the first tsunami wave.

Greece’s GDP (measured in U.S. dollars) was about $300 billion in 2010, while Ireland’s was approximately $200 billion. Their combined GDP is less than the GDP of Pennsylvania.

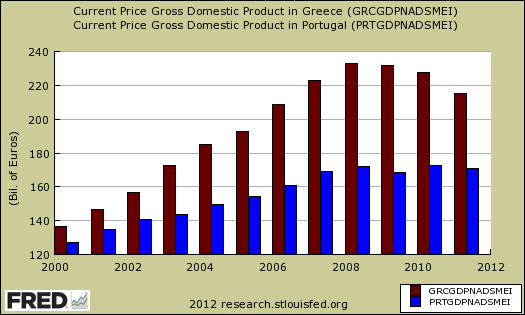

Below is a graph of Greece and Portugal's GDP. Beyond noticing both national GDPs are below €200 billion, see how Greece has literally imploded, shrank? That's austerity in action.

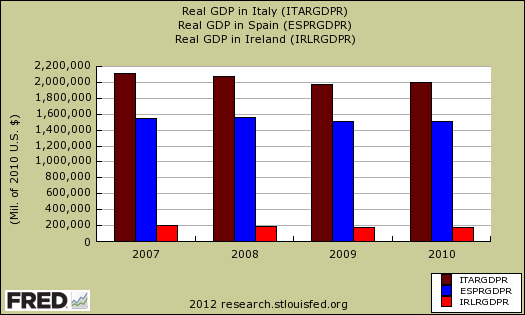

Now compare the above to the real GDP's of Ireland (bright red), Italy (maroon) and Spain (blue) below, we're talking billions vs. trillions in GDP. This is what's coming at us, economies of size, having sovereign debt crises. In the case of Spain, their trauma is once again spawned by a financial crisis and the Spanish government absorbing the debt of the banks. Notice how Italy's real GDP is larger than Spain's.

That said, Italy did not get sucked into a residential real estate bubble and corresponding bank implosion. Yet Italy's total debt is over is twice as large as Spain.

This is why Spain's glorified EuroTARP is such a big deal. Spain is truly the tip of the contagion iceberg and the real crisis may just be starting to unfold. Spain's recent bail out is like Europe's last stand against a contagion flood. Will the gates hold?

Comments

Spanish bond yield up 6.8% 06.12.12

That's not good folks. The barometer of weather for Spain is pointing to more bail out.

Austerity

CA is implementing austerity, even though nobody is saying it, measures now to balance the budget. Which got me to thinking about why austerity in Europe has such an effect on the GDP of the respective countries. What percent of the economies is government of the countries you mention? I can find GDP, but not the government budget. I would like to see how it compares to us(a).

Clayton

OECD probably is where to find it

When I can get to it, I'll go dig around. There should be a breakdown of each countries GDP components, similar to the U.S. see GDP here, where I can then calculate out the percentages. But I've got to do some data dumpster diving to find it. Not all government spending is bad and depending how the country is structured, i.e. mixed economies, government allowed to invest in state enterprises which generate revenues and such.

Just mentioning this because the political rancor wants to characterize governments as "bad". Not true from a macro economic view.

On CA, I hate to say this, but illegal immigration costs that state something like $11 billion a year. They ain't even acknowledging that statistic, but bottom line CA is the "U.S. Greece" as is IL.

But if I can't get to it, I'd start with the inane OECD databases.

How much fiat can be magically created and serve no purpose?

This trainwreck of a global economy just needs to crash already (or are we still in the crash, I don't know, there never was a recovery for 99.9% of us).

The Spanish bailout jacked up the markets for less than 24 hours, so now all the PR and printing $ in the world isn't fooling anyone. Try agaim, and again, and again, just proves how stupid and futile it all is while creating more debt burdens and austerity for the non-banksters and non-EU bureaucrats and politicians.

The sad thing is the article talks about European unemployment rates. Ours is just as bad (22%+), it's just that we don't have people lining up like we did in the '30s because of the advent of the Internet, cash cards, SNAP cards, etc. We also have a better propaganda machine brought to you by the BLS, MSM, the White House, and Congress (both parties don't want the full-blown crisis known because they would actually fear street violence after years of economic oppression). We are experiencing the same Euro and Eurozone economic nighmare ("we" meaning the non-banksters, the banksters are kicking it in the Hamptons, thank you), no amount of blue Atlantic can fix that.

Meanwhile, China is hoping its property bubble brought by Foxconn and other "American" companies doesn't pop too soon because those folks truly know revolution, angry mobs, and dunce caps (literally!).

those are harmonized unemployment rates

Those unemployment rates are the latest OECD data available and harmonized across EU member states. I believe Spain announced a 24.1% unemployment rate by country, March 2012.

I should have stated those rates are harmonized in order to compare against other countries as well as the U.S.

The U.S. compares to harmonized rates about 1% below what it would be if measured via the OECD methods.

These are "official" unemployment rates. See this post for our own alternative unemployment rate (calculated from the monthly BLS figures).

In other words, as bad off as we are, Spain is a disaster, basically everybody is out of a job, same as Greece. In other words, while we can make a case for a 20% unemployment rate in the U.S., making the same argument for Spain is going to be close to the upper bound of 50%.

Mexico is one of the worst for disparity between official unemployment rates and reality on the ground.

I believe the bail out buzz lasted less than 5 hours for the stock market critters.

Our data is limited by Congress is two ways, one they won't fund larger samplings and additional data points (we need immigration status of the labor force for one), and two they won't change the methods.

The BLS itself is just a bunch of statistical geek people. The data is limited, the error rate too large, it's not a planned "they are lying to us". Congress and this administration, including the Commerce Dept. and the DOL on the other hand....well....

but the statistics people are truly just doing their statistics groove thing for the most part.

Anybody waiting for the Chinese revolution better look at that country's sense of patriotism, loyalty as a general rule.

Right, if one assumes one needs annual 2% GDP growth just to maintain, calling this a "recovery" is insulting. Even more insulting is global labor arbitrage and acting like it's not a problem for American workers. Clearly it is, clearly the U.S. worker is being discarded like a disposable diaper by these MNCs.

Sorry but you totally miss the elephant in the living room

I can't watch the vids, but Robert Oak's comments are way off base (and I say that as someone who usually appreciate's Mr. Oak's posts).

The EU countries surrendered their monetary sovereignty. They surrendered the right to print their own currency. They surrendered the right set their own interest rates. They surrendered their right to have a currency that floats relative to their trading partners, to compensate for trade imbalances. They surrendered their right to determine their own budget.

The EU was DESIGNED TO FAIL.

There are 2 possible fixes. 1) form a fiscal union similar to the US or 2) exit the EU and let each country print its own fiat currency, have its own central bank, set its own interest rates, determine its own budget, and let its currency float to compensate for trade imbalances.

All this talk of deficits is very misleading. A monetarily sovereign country can pay any debt, a non-monetarily sovereign country cannot. That's the real issue.

ECB vs. member nation-states plus elephant herds

I don't think anything I said here contradicts that. In fact, I think the lecture talk I point to amplifies that problem of differing economies w/n the EU yet membership allowed, falsely, bond yields to converge. It also mentions the inability to "inflate one's way out of" sovereign debt by printing money.

I'm also pointing to a couple of solutions not mentioned in the lecture. You have to watch the lecture, to get the meat of this article.

That said, the ECB did inject €1 trillion in December 2011 and does control the money supply for Euros.

A fiscal union means even less sovereignty. That's tax, spend, budget policies dictated by the European Union instead of countries. Supposedly it's "on the table" with various countries saying there needs to be a contingency plan for failures before consideration at the moment.

That's another thing in the lecture mentioned, uh, where was the exit plan to kick out a bad actor nation from the European Union. There isn't one, which is another reason why Greece has been such a @$(* up.

Currency floats against each other, i.e. killing the Euro, considering Germany is the big fat exporter, I'll bet Germany won't go for that one worth a damn.

As far as actual sovereign debt goes, I'm just mentioning it as being out of control and due to bond yields, and unfortunately CDSes and such, tsunami waves. Sometimes those neocon/neoliberals use real facts and I use them facts too, but it sure doesn't mean solutions, such as draconian austerity is something I imply is good juju. I'm all for banning CDSes, yes sovereign CDSes Hedge Fund/GS apologists, hair cuts and defaults, nationalization, hit the reset button, direct job programs which will give the most bang for the buck in terms of economic growth and such.

Ya wanna talk about trade flows between EU member states, and one currency as being a problem, increasing imbalances, we're all ears on that score here too.

Well...I watched this all the

Well...I watched this all the way through and was troubled by two false statements by St. Louis Federal Reserve Research Director Christopher Waller:

1] CDS's are "simple" and are the "same as insurance". This is a false statement for the following reasons;

a) Insurance is a highly regulated business...much like banking, the need for offsetting collateral in insurance is a FUNDAMENTAL REQUIREMENT. Apparently, Walker is still unaware of the AIG bailout by the US Government, his ignorance of current events is breathtaking.

b) With a CDS you may insure that which do not own, or have an interest in...in fact, you may insure that which you wish to see fail. Anybody attempting this with insurance is a criminal suspect.

2] The under the monetary union "Germany's has not benefited from increased exports, because Greece may now default. The Euro made German products much, much cheaper than they would otherwise be, the same as China "pegging" [pun intended] their currency to the USD. Prior to the Euro, Germans sold Mercedes in Greece by using German banks to provide credit and direct German Government subsidies, now the cost of German mercantilism is spread across all EU members...which is a great deal...for Germany. Christopher Waller's ignorance of previous German exporting practice, whether affected or real is deeply troubling and indicative of either an ideological bent, or a lack of education. Is this guy aware that China pegs it's currency to the USD? Germany's EU advantage would be similar to China coercing India, Japan, Singapore, Taiwan and South Korea into chipping in when the China buys US treasuries.

While some of what Christopher Waller said was true, it was so couched in "Friedmanesque" ideology, that I would be very suspect of the man. I would not recommend listening to St. Louis Federal Reserve Research Director Christopher Waller, nor any solutions he may offer.

fair nuf

I agree with your criticisms of the lecture, but overall, he does accurately describe some of the mechanics of why things are imploding. It's the best lecture I have found, from an economics/technical view point.

I also saw what you mean, that deficit mentality, low inflation, cut spending, all "free" trade is "good", labor/workers are an afterthought as if they live on air and so on orthodoxy, but that said, the technicals are well explained and accurate.