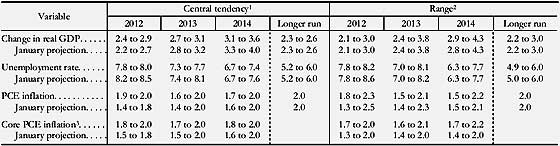

The Federal Open Market Committee, or FOMC has lowered their GDP growth projections for 2013 and 2014.

At the same time the FOMC also lowered their unemployment rate projections. How less economic growth will happen yet the unemployment rate falls implies none too good news for America's long term unemployed. In other words, lower labor participation rates and people giving up and no longer counted is probably how the unemployment rate will drop.

The committee blew off outrageous gas prices as temporary and are sticking with their core inflation annual rate of 2.0% using the personal consumption expenditures price index.

The increase in oil and gasoline prices earlier this year is expected to affect inflation only temporarily, and the Committee anticipates that subsequently inflation will run at or below the rate that it judges most consistent with its dual mandate.

Of course the Federal Funds Rate is still the same.

The Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

Traders and markets are scurrying, desperate to find any hint of more quantitative easing. Traders are literally hanging on every word, hunting for even a hint of QE3, which they did not get from the FOMC statement.

Federal Reserve Chair Ben Bernanke also gave a long press conference. He claims to be on board to end Too Big To Fail, or systemically risky large financial institutions whose collapse can bring down the entire financial system and the economy along with it.

When talking about the uber low labor participation rates and the jobs market in the above press conference Bernanke mentioned the possibility of more stimulative policies. Traders went nuts, taking that as an open door for more quantitative easing. Scary huh, seems traders are gonna want the labor market situation to remain poor.

Bottom line, there just appears to be no more quantitative easing and beyond concerns about European sovereign debt, it appears the #1 problem America has is the piss poor jobs market in the United States. Bernanke talked about problematic seasonal adjustments and high job growth earlier in the year possibly being caused by the over zealous firing that went on in 2008 and 2009.

Another area Bernanke hinted could put major brakes on the economy is our lovely Congress. Seems there are not just tax rate increases coming, but a lot of spending cuts. Yes folks, austerity does curtail economic growth, as witnessed by Greece and Ireland.

There were a lot of good questions asked during the above press conference and it's worth watching, especially in terms of what, or lack thereof, is happening to reform the financial sector.

Recent comments