You all know, of course, that a last minute deal was struck on Wednesday to end the government shutdown and raise the debt ceiling, but not before late Tuesday House shenanigans prompted a sell-off of short term US Treasuries by banks and mutual funds, causing T-bill yields to triple, temporarily resulting in an inverted yield curve. The deal itself didn't solve or resolve any of the issues that brought us to the brink of default, either, as it just set three new dates at which the basic elements of this recent crisis are to be replayed again in the near future. First, to end the government shutdown, this 35 page bill includes a continuing resolution to fund the government agencies at their current level until January 15th, a date chosen because it coincides with the initiation of the 2nd round of the across the board spending cuts known as the sequester. Then, to avert a default which would have ostensibly been caused by the debt limit, it grants the Treasury the unrestricted power to borrow as needed until Feb 7th, and since that already includes unwinding the emergency measures it took, and paying back the other Federal accounts it had used funds from, it would presumably give the Treasury the opportunity to use similar tricks to again extend the limit beyond that date. And lastly, the bill establishes a bipartisan House-Senate committee changed with coming up with a long-term deficit reduction budget by December 13th, with an eye to replacing the across the board sequester with something less brain-dead...

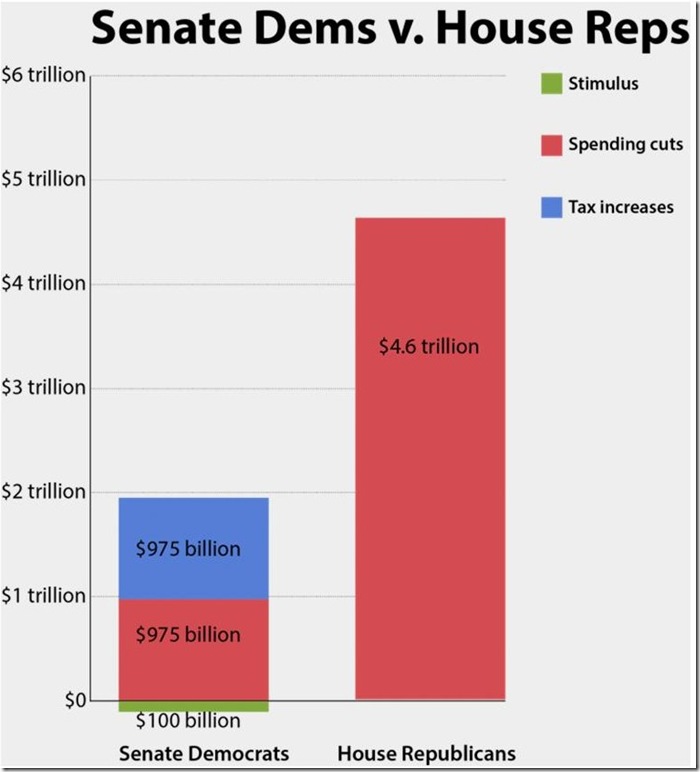

Now, of course, such a legislated budget plan should have been in place long ago. If we had a functioning Congress, it would have taken the president's budget request (usually due the first week of February but late again this year) and passed it out of the budget committees of both houses with their amendments by April 1, after which both houses should have passed a budget resolution for the next fiscal year by April 15th, ultimately producing a binding budget resolution, after reconciling differences in a conference committee between the two houses. But this year, like each of the past three, that budget responsibility was again shirked, leaving us with government by "continuing resolution" which has resulted in as many as seven such short term funding bills in one year. So now this newly formed House-Senate conference committee will attempt to come up with a budget that will set a new long term template to replaced the 10 years of mandated sequestered spending cuts that kicked in when a similar committee failed to produce a compromise in November of 2011. Leading the negotiations for the House Republicans will be Paul Ryan, who will start negotiations with his much panned "Ryan plan", which of course rolls back Obamacare, changes medicare to a voucher program, so seniors would buy their health care plan on the private market, converts Medicaid and the food stamp program into block grants to the states, and also includes other cuts to non-defense spending.. Presenting the Democrat team's plan is Senator Patty Murray, whose proposed long term budget includes $100 billion in infrastructure spending offset by what is nearly $1 trillion in new tax revenues resulting from the elimination of a batch of tax deductions, and nearly $1 trillion in spending cuts including $275 billion to heath programs and $240 billion to defense. The graphic to the right above, which came from the Washington Post, shows the differences between the two plans in trillions of dollars of budget cuts over 10 years. The schematic bar for the Democrat budget is on the left and it includes $975 billion in increased taxes, $975 billion in spending cuts, slightly offset by the $100 billion in infrastructure spending.. The schematic for the Republican Ryan plan is on the right and it shows $4.6 trillion dollars in spending cuts spread out over 10 years. The conference committee has less than two months to merge those two plans into one, such that both bars would have to become one and the same, however they compromised. And if they don't come up with such a compromise, then we're again stuck with the default, the second round of across the board sequestered spending cuts that were specified by the Budget Control Act of 2011.

There have been several attempts to quantify the economic damage done by this government shutdown debacle. Standard & Poor’s has estimated that the 16 days of shutdown cost the economy $24 billion dollars in lost output, or approximately $1.5 billion a day; that would apparently include everything from delayed mortgages and idled ports to lost revenues at DC restaurants that serve government workers. They also figure it will ultimately shave 0.6% off 4th quarter GDP. Likewise, Goldman Sachs has revised its forecast for 4th quarter GDP from 2.5% to 2.0%, as did JP Morgan.. Bank of America sees the economic impact from the shutdown and the uncertain resolution continuing into 2014, cutting their growth estimates for the first quarter from 3.3% to 2.8%, while their forecast for the 4th quarter is also at a weak 2.0%. IHS Global Insights, who lowered their 4th quarter growth estimate from 2.2% to an annualized 1.6%, points out that since the debt ceiling issue could return again as soon as February, the yields on 1, 3, and 6-month T-bills will likely stay elevated, so in addition to the $114 million in higher interest costs added to the Federal deficit from this past week's T-bill auctions, we could face another $1.3 billion in elevated interest costs if this impact plays out in a manner similar to the 2011 debt ceiling fiasco. In addition, the shutdown precipitated the worst drop in the Gallup Economic Confidence Index since collapse seen during onset of the global financial crisis in September 2008.. And in another widely circulated report, the heavyweight economic research firm Macroeconomic Advisers estimated that a two week shutdown would trim 0.3% off 4th quarter GDP, while they were producing a report that determined that our crisis-driven government and the resulting fiscal policy uncertainty has knocked 1.0% off GDP for each of the past three years, and has increased the unemployment rate by 0.6%, resulting in a loss of 900,000 jobs. Then, as if that weren't bad enough, Paul Krugman looked at their report and pointed out that they omitted the effects of the payroll tax hike and unemployment benefit cuts associated with the fiscal cliff deal, and concluded that the contraction resulting from perverted fiscal policy has been closer to 1.25 percent of GDP at an annual rate.

Even though the shutdown began on Oct 1st and was over on the 17th, we've essentially missed three weeks of economic data, since no major government reports were released this week nor in the week beginning Sept 30th. Last week we mentioned a number of economics reports that had gone by the boards in the first two weeks of the shutdown, including September's jobs report, September's retail sales report and August trade data; this week we've also missed September's reports on industrial production and capacity utilization, consumer prices, and new housing starts. The BLS has published a revised schedule of when their delayed reports will be released; notably, the September jobs report will be released this coming Tuesday, the job openings & labor turnover report will be released Thursday, and the consumer price index will be released on Wednesday, October 30. The delay of the CPI data has also delayed computation of cost of living adjustments for Social Security and other pensions that use the same COLA, as the annual increase is based on the average of CPI-W over the months of July, August and September compared to the CPI-W for the same months from last year. In addition, a note from the Cleveland Fed, which uses the BLS CPI data to compute a median and trimmed median price index, reports that the furlough of BLS employees involving in collecting the prices used in computing the CPI has the potential to induce errors in the CPI for as long as seven months, and hence in other programs and data its input is used to adjust, such as Treasury inflation protected securities and the PCE deflator. To compute the CPI for any given month, BLS field reps normally spend the entire month visiting stores, car dealers, doctors’ offices and other outlets to collect the 83,000 prices which are used as a basis for that month's report, normally reported in the middle of the next month.. So while that means the crucial September CPI will be OK, computation of the October CPI will be missing more than a half month's worth of data. Moreover, while food prices are collected daily, some price points are only checked every other month and batches of home and apartments rents are only collected every six months...so for some of those prices that were missed during the October furlough of CPI data collectors, the reports will not reflect their inclusion until May...

Other data will be skewed as well; the furlough of employees from the bureau of labor statistics not only delayed the employment summary and JOLTS but has also postponed the full week of data collection that should have been undertaken for the October household and establishment surveys, which means that October's job data will not be easily comparable with September's or November's on a month to month basis. That's because the labor department conducted the surveys for September during the week of September 9th, and they'll conduct those surveys for November during the week of November 11th, while the employment data collection for October wont begin until Monday, the week of October 21st. As a result, the September report, when released, will report on changes over the 28 days between that survey and August's, the October report will include employment changes over the 42 days between the September surveys and the delayed October surveys, and the November jobs report, which will again be surveyed on schedule, will only reflect employment changes over 21 days. We would not be surprised to see similar problems such as this, or as we've seen with the CPI, in other data. For instance, the data on housing starts, as unreliable as they are already, are also collected by census field reps, who visit housing permit offices and conduct road canvasses to gather the small sample of housing activity used in that report, which will now be half the size it normally is in October...

(crossposted from MarketWatch 666)

Comments

both parties nuts

Their agendas are just insane, they should be worrying about jobs and wages and that too, would help enormously with the deficit.

Supposedly they have "throw more techies" at the Obamacare website. That's nice and meaningless if they do not get the right techies, who are Americans in so many words, minus the lobbyists and their useless companies obtaining large contracts.

the sequestered cuts

the "budget control act" they passed at the end of 2011 is the hole they're in...the meat axe approach to budgeting blindly cuts $110 billlion a year for ten years, so obviously it gets worse each year...they have to dig out of that before they can move on...

rjs

ha ha, they want to cut SS, Medicare

No mention of anything else, so which is worse, across the board of that attack on working America?