Banks are busy putting the screws to the middle class once again, this time in the form of reduced credit. The Wall Street Journal reports Residential Loans, refinance of mortgages and home equity loans are being subject to absurd credit requirements.

Are the banks going to investigate if you chewed gum and if so, deny you a loan for it next?

Recently, Mr. Berg arranged a refinancing for a borrower with a very high credit score and lots of home equity and debt payments totaling just 19% of pretax income. But Mr. Berg said the lender was worried about a credit report showing a $14 missed payment to a credit-card company in 2001. The lender insisted on proof the money had been paid, which Mr. Berg said was impossible to get.

"Who cares?" he said. "It's nine years ago, and it's $14." He appeased the lender by having the borrower write a $14 check, though no one knew where to send it.

Pete Ogilvie, a mortgage broker in Santa Cruz, Calif., hasn't found a bank that will refinance a $250,000 loan on a $1 million property for a borrower with more than $200,000 a year in income and a high credit score. Banks balked because the borrower, a technology executive, was out of work for nearly a year starting in 2008.

Wells Fargo now ends free checking to collect yet another fee on our meager earnings. Previously we noted Wells Fargo is moving into payday loans.

From last Thursday's Federal Reserve consumer credit report for May 2010:

Consumer credit decreased at an annual rate of 4.5% in May 2010. Revolving credit decreased at an annual rate of 10.5%, and nonrevolving credit decreased at an annual rate of 1.5%.

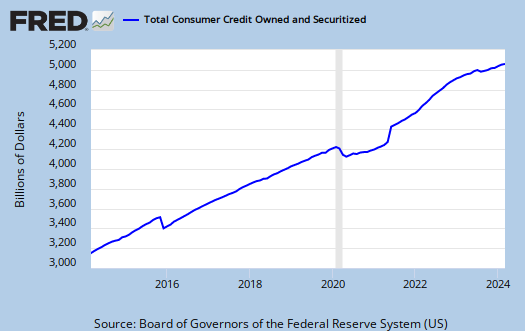

Below is total consumer credit for a decade. Realize non-institutional civilian population (the group most likely to obtain credit), during the decade has increased 11%, from 212.5 million to 237.7 million. While credit card late payments fell, to 3.9%, this metric fails to take into account the never ending declining consumer credit even available to be late on.

Below is the St. Louis Fed graph for total revolving credit for the past 5 years.

And non-revolving credit:

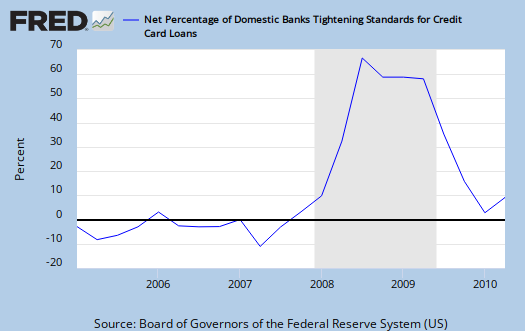

From April 2010 data, below is a graph on lenders tightening credit standards on consumer loans. Notice the uptick in April 2010.

Meanwhile Arizona takes a bold step and makes loan shark rates illegal. As a result payday lenders are fleeing Arizona.

Another take on this

This article puts the consumer credit numbers into perspective.

We have entered the post-credit world.

credit scores, tis true, they are falling

If you got no income, you cannot borrow. HuffPo (why is it when you go to the corporate website these so called press releases that have damning information are never posted and how do we get better access to them?) has an article showing the drop in credit scores:

But, on the other hand, there are plenty of reports of people who perfectly solid income streams getting denied credit over absurdities.

I'd like to see the percentage of denials when people are trying to refinance debt, mortgages to reduce their debt. I'll bet dollars to donuts that's where the credit crunch is, but I don't have the stats vs. percentage of people who are so broke, there is no way they can pay back their debt.