The Supreme court ruled Obamacare's mandate to buy individual insurance is a tax. The Patient Protection and Affordable Care Act, a.k.a. PPACA, stands, but now Obamacare is classified as a tax.

The Supreme court ruled Obamacare's mandate to buy individual insurance is a tax. The Patient Protection and Affordable Care Act, a.k.a. PPACA, stands, but now Obamacare is classified as a tax.

CHIEF JUSTICE ROBERTS concluded in Part III–B that the individual mandate must be construed as imposing a tax on those who do not have health insurance, if such a construction is reasonable.

Let's see, health care is no longer a right, instead it's a tax. Great, talk about frying pan to fire, that's a public tax for private corporations, namely health insurance companies. PPACA was seen as a tax due to the penalties. There is no go directly to jail consequence if one does not buy health insurance, instead not buying health insurance is seen as a government civil penalty, which the court interpreted as a tax.

Neither the Affordable Care Act nor any other law attaches negative legal consequences to not buying health insurance, beyond requiring a payment to the IRS.

There are some things in this ruling that are most interesting, way beyond health care. It seems SCOTUS just usurped Congress and limited their power. The first way this happened is the ruling on how PPACA is invalid under the Commerce Act. This opinion seems to limit Congress by claiming they cannot force people to engage in commerce. Wow.

Construing the Commerce Clause to permit Congress to regulate individuals precisely because they are doing nothing would open a new and potentially vast domain to congressional authority. Congress already possesses expansive power to regulate what people do. Upholding the Affordable Care Act under the Commerce Clause would give Congress the same license to regulate what people do not do. The Framers knew the difference between doing something and doing nothing. They gave Congress the power to regulate commerce, not to compel it. Ignoring that distinction would undermine the principle that the Federal Government is a government of limited and enumerated powers. The individual mandate thus cannot be sustained under Congress’s power to “regulate Commerce.”

The second part of the SCOTUS opinion again seems to severally curtail Congressional power. The ruling denys the PPACA is necessary and proper, another Constitutional clause which has enabled Congress to declare war and enact the 1930's New Deal.

The individual mandate,by contrast, vests Congress with the extraordinary ability to create the necessary predicate to the exercise of an enumerated power and draw within its regulatory scope those who would otherwise be outside of it. Even if the individual mandate is “necessary” to the Affordable Care Act’s other reforms, such an expansion of federal power is not a “proper” means for making those reforms effective.

Wow again. While people are talking about Obamacare being upheld, it seems more that the Supreme court just significantly limited the powers of Congress. Of course the poor get screwed still, for SCOTUS struck down the PPACA provision to force states to expand Medicaid:

CHIEF JUSTICE ROBERTS, joined by JUSTICE BREYER and JUSTICE KAGAN, concluded in Part IV that the Medicaid expansion violates the Constitution by threatening States with the loss of their existing Medicaid funding if they decline to comply with the expansion.

Beyond enabling some States to continue to deny benefits to the poor on health insurance, this ruling again limits the power of the Federal government. The ruling seems to imply under the spending clause, Federal Government programs which the States then implement, those program conditions and terms are now voluntary for the States to oblige. We'll see how legal scholars interpret this part of the ruling, but it sure seems to be a severe limiting of Federal power, implying Congress cannot change terms and conditions while doling out billions to the States.

The Spending Clause grants Congress the power “to pay the Debts and provide for the . . . general Welfare of the United States.” Art. I, §8, cl. 1. Congress may use this power to establish cooperative state-federal Spending Clause programs. The legitimacy of Spending Clause legislation, however, depends on whether a State voluntarily and knowingly accepts the terms of such programs.

Here's the word of the day, dragooning. It means to threaten or coerce. That's how expansion of Medicaid was perceived by the court, the bill bullies States into expanding their Medicaid programs.

The threatened loss of over 10 percent of a State’s overall budget is economic dragooning that leaves the States with no real option but to acquiesce in the Medicaid expansion. The Government claims that the expansion is properly viewed as only a modification of the existing program, and that this modification is permissible because Congress reserved the “right to alter, amend, or repeal any provision” of Medicaid. §1304. But the expansion accomplishes a shift in kind, not merely degree. The original program was designed to cover medical services for particular categories of vulnerable individuals. Under the Affordable Care Act, Medicaid is trans-formed into a program to meet the health care needs of the entire nonelderly population with income below 133 percent of the poverty level. A State could hardly anticipate that Congress’s reservation of the right to “alter” or “amend” the Medicaid program included the power to transform it so dramatically. The Medicaid expansion thus violates the Constitution by threatening States with the loss of their existing Medicaid funding if they decline to comply with the expansion.

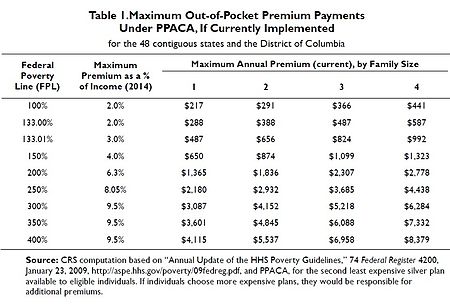

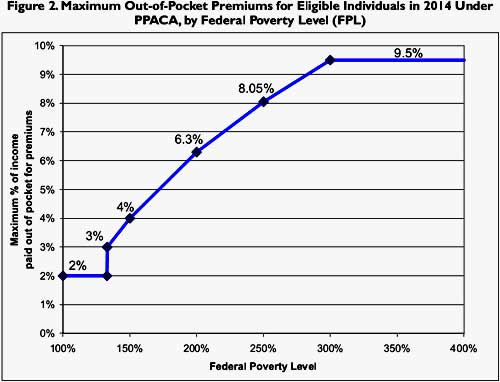

So, we have the poor with no money, now not getting expansion of coverage and instead face a tax. The best accurate PPACA explanation we've found is from the Congressional Research Service. This analysis was written in 2010 and attached to this post. Below is the out of pocket premium amounts people will pay, depending on where their income lies by the Federal Poverty level.

Look at this percentages of income, devoted to just health care insurance premiums. Bear in mind health insurance usually only covers 80% for the Gold standard, which are usually very expensive health insurance policies.

Federal Poverty Levels are adjusted every year, but frankly not by much. The Federal Poverty Levels are adjusted for inflation and not for regional cost differences. In other words, the levels are artificially low, you're basically living in a cardbox box to qualify officially for aid.

| 2012 Poverty Guidelines (Continental U.S.) | ||

|---|---|---|

| Persons in family/household | Poverty guideline | 300% of FPL |

| 1 | $11,170 | $33,510 |

| 2 | 15,130 | 45,390 |

| 3 | 19,090 | 57,270 |

| 4 | 23,050 | 69,150 |

| 5 | 27,010 | 81,030 |

| 6 | 30,970 | 92,910 |

| 7 | 34,930 | 104,790 |

| 8 | 38,890 | 116,670 |

|

For families/households with more than 8 persons, add $3,960 for each additional person for FPL. |

||

If we take the 2012 Federal Poverty level for an individual, and apply the 2014 health care individual insurance mandate, a person would have a gross income of $33,684 with $3200 per year being paid to just health insurance. That's $267 per month. Think about that, with rent, food, gas, car payment. Take a typical rent payment for a 1 bedroom, $800/month. That's $9600 in rent alone for a year. $34k is not a lot of money and now one has an additional very large mandatory expense, since health care costs were not addressed by PPACA, de facto. Also notice this is a major regressive tax on single people. The average family size is 2.59 in 2010. The median income for an individual in 2010 was $26,197 and over half of America is officially low income or poor. Generally single people get the economic shaft by our government and society, yet this one is pretty much stickin' it individuals, in part because individual health premiums don't give single people a break.

Bottom line, the individual health insurance mandate is an incredible racket. All hail corporate lobbyists and for profit, private health insurance companies. Now these private insurance companies are enabled to levy a tax on you called health insurance premiums or penalty, you pick. Exodus to Canada or the U.K. anyone?

| Attachment | Size |

|---|---|

| 446.85 KB |

Comments

this is not a "Republican" argument

We pointed to many times how much cheaper health care is in other nations and no, it is NOT because Americans are fat. It is because they do not have these for profit, private health care sector, making money off of the sick.

We're about more efficiency and reducing costs, universal U.S. citizen coverage.

not that I am thrilled with validation

But the reason this post starts out with the opinion is it has such bad ramifications and lo behold the constitutional lawyers, scholars are coming out and saying something similar.

Sorry folks, you have to get to the bottom of the post to see real costs.

I should have added something, last I saw, finding a health care policy for an individual that covered anything and didn't have a $10k deductible for less than $300 was not around.

So, on the health care situation these tea party, Republican people wanting to return to what is before have to be kidding. It's literally killing people.

The argument here is simply on systems, costs, merits.

Ginsburg

I pulled a CNN and did not read the entire opinion. Justice Ginsburg really pointing out what is implied in the above, these clauses Robert's claimed were "unconstitutional" are the very clauses which enabled social security, Medicare, Medicaid, so it seems the backdoor open to attack our existing social safety nets was laid.

From the Justice Ginsburg opinion:

Penalty for non-compliance with ACA minimal (for now)

For individuals the current 'tax' for not complying with the ACA is only about $760. It will be cheaper for some just to pay the penalty.

If an uninsured person has the choice of paying $760 vs $500/month with a $5000 deductable, the choice is obvious.

It's better to place the money in your own account then negotiate a cash price for services with the doctor.

This is a stealth tax on the poor that will be raised in the future. Since we currently have a market based system that has failed to restrain costs, I'm not sure how obligating people to participate in the same broken system will change things.

corporate monopolies, health services

I don't think one can negotiate with MDs. We have a corporate take over of health care services. I plan to detail this, but they are forcing patients to sign over to loan shark interest rates, plus turning over bills that aren't even late to bill collectors, ruining people's credit.

Pretty obscene with poor services, or fake billing and obviously a $10k bill @ 18% interest rates is an outright crime.

Some are pushing people into loan shark credit deals for medical services that are not even actually necessary, "sales" push.

The point of this entire exercise wasn't supposed to be about a tax and a penalty, it's supposed to be about getting everybody quality health care to stop the medical horror stories.

If you click on that link to the CRS analysis, there is a sliding and increasing scale on the penalties, which I agree, people will just pay that.

I think the Good news in associating this with a tax is for people to realize taxes are supposed to pay for public services, not go into some black hole somewhere and another point is this is why other nation's taxes are higher, those who have national, universal single payer health care systems.

In other words, those other countries shouldn't be looked at as "high taxes" but instead providing high quality health care at reasonable cost and that is what all of their citizens pay for, through taxes.

See link

The CRS link you cited appears to be broken. No need to post this, but I'd be grateful if you posted the report.

thanks

"see link" fixed, CRS report now attached

Thanks for letting me know. It should be there now, as the link and as an attachment. Must have gotten lost in an edit. It is so difficult to get accurate overviews on the PPACA, the politics are absolutely thick as ....well, the point of this post.

McCarran Ferguson - Federal Insurance Law since 1942

The idea that only the Commerce Clause governs insurance is pure fiction. McCarran Ferguson owns federal authority through a body called NAIC - the National Association of Insurance Commissioners. This body has authority to standardize any state rule or regulation regarding insurance. This is because insurance regulation, when disputes arise over standards, is a federal matter.

NAIC has never been shy about standardizing rules nation-wide so that there is consistency. The U.S. has always been a federal system, unlike our Confederacy, and unlike the EU, another Confedaracy.

So the Commerce Clause of Article I is secondary. The power of McCarran derives from Article I enumerated powers. That power has never been challenged in 70 years. SCOTUS is a political body, geared towards the most reactionary of agendas. The leak from Scalia proves this.

If the SCOTUS decision were thorough and well researched, there would be references to McCarran-Ferguson in some form.

In a convoluted way, SCOTUS validated a Affordable Care Act that few want, for reasons hardly any informed observers can accept.

Burton Leed

bad for people in high cost of living areas

Regarding how the mandate is regressive for lower/middle income singles, you said "typical rent payment for a 1 bedroom, $800/month"......It's even worse if you're making that 33k income living is Southern California where the average 1 bedroom apt is more like 1,400 a month. That person BARELY squeeks by as it is. Obamacare will take what little discretionary money that usually goes to car repairs, out of pocket health expenses (to walk in clinics for example) and other emergencies that come up. Guess they want to drive that person to debt and bankruptcy.