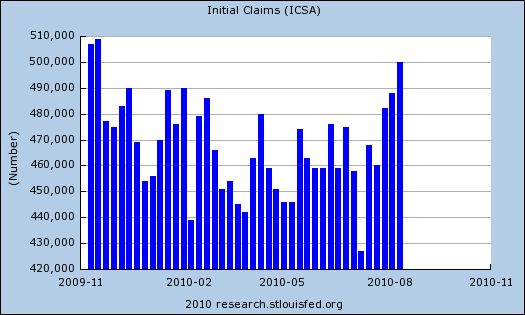

While initial weekly unemployment claims is a volatile number, subject to revisions, today's report is not good news. Initial weekly unemployment claims hit the magic number, 500,000. From the jobless claims report:

In the week ending Aug. 14, the advance figure for seasonally adjusted initial claims was 500,000, an increase of 12,000 from the previous week's revised figure of 488,000. The 4-week moving average was 482,500, an increase of 8,000 from the previous week's revised average of 474,500.

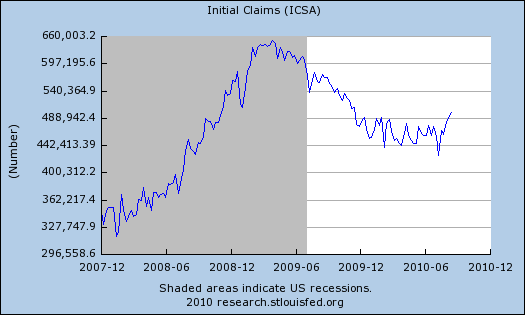

Below is the log of initial weekly unemployment claims, so one can get a better sense of the rise and fall of the numbers. A log helps remove some statistical noise. As we can see we have a step rise during the height of the recession, but then a leveling, not a similar decline and now this increase. This does not bode well for any sort of real recovery, which must include jobs.

Below is a graph of initial weekly unemployment claims since November 2009. As you can see, we're literally back to 10 months ago.

Recent comments