Michael Collins

For at least ten years the large US banks have been selling a product – the residential home mortgage – with a fatal legal flaw that renders it uncollateralized. Numerian

Apocalypse When? Round Up of Massachusetts Supreme Court Decision on ForeclosureGate, US Bank N.A. v Ibanez - Around 1995, the big bank lenders established their own rules for handling the various steps of issuing a mortgage. They knew well the contract laws of the states in which they operated. But they had bigger plans. They wanted to bundle up thousands of mortgages and sell them as Mortgage Backed Securities (MBS). To do that, they needed an electronic system (MERS) that could bundle mortgages and sell them repeatedly to investors here and overseas. Never mind that state law required specific documentation at every step, including documentation to prove a specific owner of the property. When banks resold the MBS product, as it were, they were interested in churn and more money, not tagging a specific mortgage with the latest MBS owner.

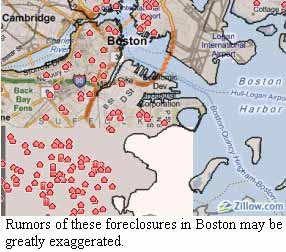

Oops! The big banks screwed up big time. Bankruptcy courts at the state and federal level are used to adherence to contract law and court rulings. Most people in foreclosure struggle to pay for representation if they go to court. Many settle out of court. But the Show Me the Note movement, in and out of court, has a powerful ally - the Ibanez decision.

Recent comments