When I saw the alternative bailout bill from the so-called "progressive caucus" it struck me as just how intellectually bankrupt the progressive left is. Since when did suspending "fair value accounting standards to financial institutions" be anything other than Enron accounting?

All the great progressives in history rolled over in their graves the day this worthless legislation was proposed. You would never know that the progressive left was founded on Big Economic Ideas after reading this bill.

With this complete lack of direction from the political leadership as an example, I have to wonder if the average progressive is similarly ignorant of all the great ideas that have come before them. So I decided to present just a few Big Ideas from a proud history. None of these ideas are strictly socialist, but all of them have been tried before and worked.

This is nowhere near a full compilation of ideas. It's merely an attempt to get people to think outside the box.

The Single Tax on Land

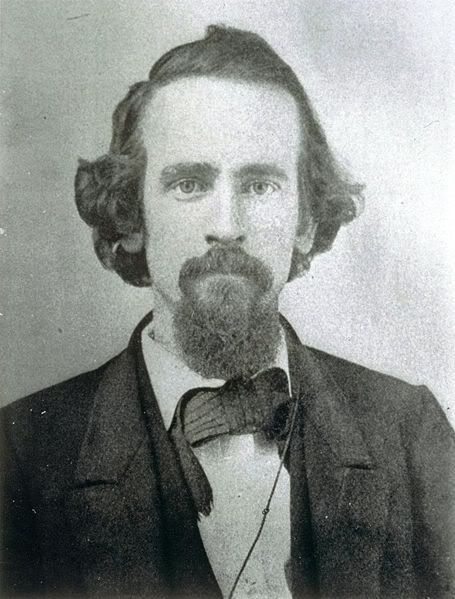

Let me introduce you to a 19th Century American economist that has been mostly forgotten - Henry George.

One day, while inquiring about the price of land in an area, it suddenly occurred to George that there was a connection between advancing poverty and advancing wealth. The philosophy of Georgism is simple:

everyone owns what they create, but that everything found in nature, most importantly land, belongs equally to all humanity.

While Georgists are largly right-wingers, the idea has found sympathizers in the environmentalist movement

There is a delusion resulting from the tendency to confound the accidental with the essential—a delusion which the law writers have done their best to extend, and political economists generally have acquiesced in, rather than endeavored to expose—that private property in land is necessary to the proper use of land, and that to make land common property would be to destroy civilization and revert to barbarism.This delusion may be likened to the idea which, according to Charles Lamb, so long prevailed among the Chinese after the savor of roast pork had been accidentally discovered by the burning down of Ho-ti’s hut—that to cook a pig it was necessary to set fire to a house.

This may sound radical and unworkable in today's world, but you would be wrong.

In Hong Kong, the most capitalist society in the world, all land is owned by the government, which gets 35% of its tax revenue from all rents. It is thus able to keep all other taxes low.

Henry George was a strong union supporter. He died in 1897 after running for mayor of New York on the United Labor Party ticket.

Corporations are NOT people

Monster corporations that seem to control all the levels of government and law, is a beast that didn't exist before the Industrial Revolution. At one time corporations had to get a charter to exist, and those charters generally expired after a period of time. These temporary creations were treated much different than today.

Corporate law at the time was focused on protection of the public interest, and not on the interests of corporate shareholders. Corporate charters were closely regulated by the states. Forming a corporation usually required an act of legislature. Investors generally had to be given an equal say in corporate governance, and corporations were required to comply with the purposes expressed in their charters.

What happened? The Supreme Court decided to give corporations the rights of an "artificial person".

Imagine a political system that wasn't owned by corporate lobbyists. Imagine corporations that had to answer to the community. That's the kind of world we can have again if corporations had to exist by charters that served the common good and then expired.

So why did this system end? Short-term thinking.

Eventually, state governments began to realize the greater corporate registration revenues available by providing more permissive corporate laws.

Think Different Banking

Bank runs, the boogyman of generations, don't have to happen. Nor does the enormous amounts of debt that permeate every sector of society. Both of these things are allowed to happen by our corrupt political leaders.

#1) In 1609 the Bank of Amsterdam (Amsterdamsche Wisselbank) opened. The Bank of Amsterdam was one of the largest and most successful international banks in the world for 150 years. It did most of the things that you would think of a normal bank doing today, with one large exception - the Bank of Amsterdam had 100% deposit reserves. There was no bank runs on the Bank of Amsterdam because there was never any danger of your money not being there.

However, that wasn't the reason why the Bank of Amsterdam kept 100% reserves.

The principal purpose of the Bank of Amsterdam, however, was not to

protect against the failure of private banks, but, instead, to discourage the

circulation of debased coins.

A debased currency is a related problem and totally applicable to our experience today. The fractional reserve banking system is a huge monetary inflation issue. Thus fractional reserve banking causes two systemic problems with our fragile financial system.

So if banks can still function and prosper without a fractional reserve system, why do we allow it? Hint: it has to do with the bankers making ungodly amounts of money.

#2) Albert Einstein is reported to have said, “The most powerful force in the universe is compound interest.”

Americans have accepted the idea that loans always come at interest. It's normal and natural, especially to banking. We never even question the usury interest rates we are being charged. In fact, I would be surprised if most people even understood how compound interest works.

One thing is for certain, the people who wrote the bible understood it.

"If you lend money to any of My people who are poor among you, you shall not be like a moneylender to him; you shall not charge him interest."

- Exodus 22:25

That is merely one of dozens of quotes against charging interest on loans. You might remember from your bible studies that the only time that Jesus ever got violent was against the moneychangers who were charging interest in the Temple. Jesus didn't live long after that, and the Christian religion didn't seem to take Jesus' example to heart.

But the Islamic religion did.

You might already be aware that according to sharia law, banks can't charge interest on loans. While no islamic bank is huge, they are all more stable than the current western banking system and the system has existed for over 1,300 years.

But instead of dwelling on Islamic banking, I would like to point you towards Sweden. Specifically, the Swedish JAK Medlemsbank (Members' Bank), which was founded during the depths of the Great Depression. It also doesn't charge interest on loans, and it is considered "the safest bank in Sweden."

So if banks can function without charging usury, and the bible repeatedly says it is wrong, why do we allow it? Hint: it has to do with the bankers making ungodly amounts of money.

#3) The U.S. Constitution says that Congress has the power to coin money (i.e. create money). It also says that no state can "coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts."

So why do we borrow paper money, at interest, from the Federal Reserve - a private cartel of banks? Why do we pay interest to create money that the American taxpayer is responsible for? Hint: it has to do with the bankers making ungodly amounts of money.

But before we go down the road of why have a central bank at all, let's look at a more modest alternative: why have a central bank that is controlled by private bankers?

The People's Bank of China is controlled by state-run banks. Thus if any money is paid to the central bank of China, at interest, it goes to the federal government's budget rather than to the pockets of greedy, private bankers.

The solutions to our current, chronic, economic problems are out there. What is keeping us from applying the cures is a lack of imagination, a stagnated political system dedicated to maintaining the economic status quo, a lack of leadership and courage at the top, and an economically ignorant populace.

These ideas I list here are just a tiny percentage of what is available and successfully tried. The question is how many more generations must we endure this corrupt and dysfunctional economic system before we try something more stable and fair?

Comments

you are focused on the wrong thing

There are real issues with mark to market but focusing on on that very small portion is simply the wrong thing.

The thing to focus in on is the RTC plan, which is the meat of the proposal.

Since most announcements of the bill were rushed, I don't even know if the entire plan is written up yet but focusing in on a couple of things where conservatives have a point...

that's a huge mistake that is going on right now.

I 100% completely disagree with you on the Bill because there are so many experts recommending precisely what they put together.

Those are the real Progressives, believe me and I know for a fact they have been talking extensively to economists on what would actually work and that's what they are recommending.

They are the real deal and I would never question their motives, not a one for I have watched some of their votes for a very long time....they are the few "good ones" we have left in Congress.

Then, one must realize they need to get conservatives on board to pass a bill and some of the conservative ideas are not that bad.

We are not going to agree on this

To put it simply, I think the proposal was pathetic. There is nothing daring and bold about this bill. Aren't we supposed to be in some sort of economic crisis? Then why is the progressive left giving lukewarm alternatives? How come conservatives never worry about getting liberals and progressives "on board", but liberals and progressives do? Hell, if you start out your negotiating by conceding nearly everything that isn't already mainstream then you aren't going to get anywhere but further to the right-wing.

As I said above, there is no bold and daring leadership in the progressive movement anymore. No one thinks outside the box anymore but conservatives, and I won't stand for it any longer.

No Bail Out Act Text

Now hold yer horses, let's read the bill draft

There you see the Net certificates program, which is the real meat of the bill.

Then DeFazio was immediately shot down on trying to have a very, very small fee increase on market transactions to fund this entire thing. Blasted down by a lobbyist, who of course Pelosi was fine with.

Then...of all people, Hillary Clinton as you know has many plans which are highly Progressive including a HOLC...

now McCain of all people just adopted her plan and now the left is blasting McCain!

But most economists seem to recommend something along the lines of a hybrid HOLC/RFC/RTC type of situation

and these guys are trying. The No Bail Out bill is endorsed by a series of economists, that's what they recommended.

I have tried to outline a series of proposals put forth by people who live in the real economic world on here...

So, I disagree, they acted very Progressive, bucked their own party leadership and their plan is simply not a bad one as you claim.

It's not...and they are talking about the uptick rule being reinstated and no one is talking about going back to

Enron accounting....that's not what they are recommending on the mark-to-market.

Naked shorts are supposed to be illegal anyway...so what is the issue with that?

I think you're just upset because we don't have a Progressive running for President. ;)

What exactly is "progressive" about this bill?

I don't think that raising the FDIC insurance to $250K is very progressive. It certainly has no effect on the middle class and poor.

As for defending "mark-to-model" accounting, I find that simply offensive. If an economist defends this and still calls himself "progressive" then I have to ask him what his definition of "progressive" is, because his definition isn't anything close to mine.

But the real problem I have with this bill, and the one thing that you don't seem to understand, is not that it isn't better than Paulson's plan, its that it lacks any progressive values.

Is it workable? Maybe, maybe not. Does it incorporate a larger vision of the world? Absolutely not. It does nothing to reform the current system. It functions on getting the current, dysfunctional status quo moving again while trying to limit the amount of pain.

That's it. Nothing more.

And that's all the current progressive movement ever comes up with. If we can't demand something more during a so-called crisis, why should we expect any difference when the crisis is over?

what are you talking about?

It's a matter of what will work and this is how they got rid of all of the oversupply of commercial real estate in the S&L crisis...

it's a matter of what will actually work the best and this has been proven to work as well as a modified HOLC...

so ....

as far as mark-to-market there is a serious timing issue and note, they are not saying to go back to Enron, they are talking about a review. Not the same thing.

Before you blast them, at least understand the issues on mark-to market and what they are trying to do...

they simply are not promoting accounting fraud here.

Honestly do you think opposing Paulson's bail out of his Goldman Sachs/Citigroup et al pals and keeping these institutions afloat is really the way to go and comparing this to that?

This is completely different from that and does not require $700 Billion of taxpayer money to implement.

I also don't believe this bill precludes anything about bailing out homeowners or anything else.

I mean come on, DeFazio? The guy who fights against the privatization of all public works constantly and just fought to get chair of the transportation committee to stop it, Mr. perfect voting record (on our side) on trade is magically out to screw the middle class? No way, they put this together based on analysis of what would actually work and not waste $700 Billion to Paulson's pals.

what are you talking about?

Defazio's a fine Congressman but that doesn't mean I have to get behind everything he stamps. I was really looking forward to the Progressive Caucus' alternative. And was completely underwhelmed.

The larger problem is the left is playing by the rules of a game that has been completely discredited. Instead of outlining a bold proposal that challenges fundamental capitalist assumptions, they offer a tepid package of accounting tricks and government reassurances proposed by a Reagan official.

I understand the pragmatic considerations here -- it would've been unwise to load up a bailout plan with every item on the left's wish list. But this is the progressive caucus we're talking about here, not Dodd and Pelosi. Any package should've addressed the current meltdown AND contained the seeds of fundmental change. This proposal seeks to prop up -- at a smaller cost than the Paulson plan to be sure -- a dying system.

Ironically, Paulson may now be to the left of the caucus, as he considers partial nationalization. If the caucus had proposed this, they'd look prescient right now.

Let's stop reacting to the GOP/WallStreet/Pentagon and start leading. Create an agenda and push it mercilessly.

I honestly don't think it's understood

Firstly, let's get over ourselves on conservative vs. liberal on where this RTC structure came from. Reality is it worked and more importantly didn't pull money from taxpayers to get it to work. It also allowed insolvency financial institutions to outright fail, which right now...they seem to be interested in saving certain ones.

Secondly, from the bill text:

So, they did not roll back any accounting methods here on fair marketing accounting. They are simply asking for a report on what the SEC did recently when the SEC, not Congress loosened mark-to-market. Not the same thing as signing up for Enron 2.

There are so many economists saying this solution will work, regardless of political flavorings and that's key here to prevent a cascade.

I'm fairly certain they did not intend this one bill to be the end of, it's simply an alternative to the financial system bail out. That does not preclude a HOLC, does not preclude a reinvestment of infrastructure...and considering DeFazio has proposed these things...it assuredly doesn't preclude that since he's been already pushing for massive infastructure agenda and is fighting the purchase of US public infrastructure by foreign interests and fighting the privatization of it...

So,I think people need to separate out 1 component, one bill versus what these Congress representatives have introduced into legislation, what they advocate for generally and you need to look to the committee chairs...

see how their other bills get buried and are killed off by Pelosi and committee chairs, never allowed to see the light of day or even get brought up for a vote in committee.

This one bill was due to the immediate demand for immediate action on one component and was presented as something to be immediately passed instead of handing over to Paulson $700 billion dollars to add to the ~$800 billion (or more depending on estimates) he already spent trying to help out his financial elite buddies.

On accounting, that is one nasty business and I can see the issue in dealing with sudden nasty market spikes being an issue as well as manipulation of a 3 year average...so let's see what some reports and hearings and the ind. accounting body, experts who are not corrupt and vested have to say. I am by no means an expert in accounting manipulations but my understanding of the reforms in 2002 is that they were half hearted, incomplete and there are still many problems.

I'd also point out

That economists in general, are tied to the status quo. The entire question of whether we should have a money supply based on fractional reserve banking, gets censored due to this.

-------------------------------------

Maximum jobs, not maximum profits.

well

I know this is the "Ron Paul" issue as well as many on the left....

but someone needs to write a sane analysis on fractional reserve banking because most of the arguments I find to be fairly way out there in reasoning as to why this is such a problem.

I mean the reason this is a mess is due to the increased leveraging, not the 10:1 ratio it's supposed to be.

Although the entire money as debt argument is interesting...I mean money is just an exchange medium, so I don't get the issue really, not in terms of a modern economy and keeping the system rolling, why they are so upset beyond the fact that the Fed is a private institution, not elected and so on.

what it comes down to for me

Is transparency. Same reason I'm for open meetings laws, blogging government employees, and open source voting machines.

The current leveraging system, even with a 10:1 ratio, is dependent upon people believing a lie, that loans are created out of the money available for deposits (a 1:1 ratio of loans to deposits). Even a 1:1 ratio is troubling- since that means that there are *NO* deposits on hand to pay out, they've all been given out as loans. A 10:1 loan to deposit ratio means that 90% of the money a bank has given out, it didn't own TO give out in the first place; if you or I tried that it would be called counterfeiting and get us 10-30 in federal prison.

The reason this fraud is a problem is the same reason we have a problem with H-1b visas: supply and demand. The more supply, the lower the price point for demand; but when you're talking about the money supply vs other goods, the more supply, the more money there is to exchange for the goods and the prices of those goods rise. Inflation. And when wages are held essentially steady (what job in the last 15 years has actually had COI inflation adjustment? None that I've held) in relation to that inflation, that means the middle class is poorer.

You can no more escape the fact that inflated money supplies cause inflation than we can escape the fact that more foreign labor means domestic labor is worth less than it used to be.

Finally, money as debt- if all of your money is part of this big credit bubble that just gets larger with every rescue of the economy- then what happens when the WORLD overleverages itself 10:1 with loans:PRODUCTION? Which is what has really happened here.

-------------------------------------

Maximum jobs, not maximum profits.

Kaptur

On her website has a lot of the details from other economists on why they put this bill together. Plus links to other legislation to accompany this bill.

Hey, she's quoting Greider, surely that will appease your wrath! ;)

Not exactly

The fact that there hasn't been a single comment on a single one of these ideas is rather depressing. When I made this diary I was hoping people would make comments like "that's an interesting idea. I've never heard of it before", or "I don't agree with that idea, but I like this one that you didn't mention even more."

Instead we get debate about something that is already in the past. It's feeling very similar to DKos.

cause

I'm trying to figure out what you are slamming these guys...

on the corporate personhood I'm positive DeFazio supports that and I have written about it on here...

I think that's a good idea..

Government owning the land? I just don't know...seems that has some downside and upsides and the US does own quite a bit of public lands already and i do think the public works, or infrastructure and so on should be expanded.

But we also have a highly dysfunctional government right now that needs to be made efficient, streamlined...it's been so damn corrupted I worry bout any agency effectively manage anything.

I think maybe the issue (I'm trying to boil it down) is this one bill does not preclude other bills, another pieces to the puzzle...

When they introduced this bill is was a 1st step in a series of pieces of legislation, not the end, this was just the beginning...

so nationalization of the banks is another one I mentioned and that's also been bubbling around because Sweden came out of their financial crisis the fastest by doing that..

but now we have "G7" meeting say "oh we won't do anything in the US that might hurt another country" and this is a "global coordinated effort" which I find frightening as to what that really means.

Paul just say he's going to give cash to banks for stock...

that's the equity stakes but honestly I'm not so sure how great that is...and as far as I know it's not nationalizing the banks...better than just handing them money for bad assets though.

Hell no this isn't DK, I'm just trying to get to the meat of the argument on why you are blasting that bill cause I just don't see the problem and when they introduced it they said it was the 1st step.

Nothing Progressive About Insuring Deposts, Maybe only necessry.

I do not agree that guarantees of the

FDIC deposit are progressive. They may be necessary depending on the level of insurance. All such FDIC insurance has a huge cost. When TheReserve broke the buck, it was said they needed FDIC insuranc for money market funds!.

The whole idea of MM funds is a lack of insurance in exchange for higher risk. Every day the risk of model of capitalism is re-written in fave or lower risk, high social guarantees.

So the question now is why capitalism and in what form? If the US and Germany and Britain nationalize the banks, and Hugo Chavez nationalizes the Bank of Venezuala, the important difference between Bush/Bernamke/Poulson and Chavez is that only one of them speaks good Spanish.

Burton Leed

Sen. Bernie Sanders, building up coalition

Rebuild America:

Now how's that?

Sen. Bernie Sanders, building up coalition

The only things missing are viable mass transit and bossting the ailing US mfg sector - if you add that you have a winner

If you are serious about...

...long term restructuring of the economy. Read this:

http://www.theoildrum.com/node/3941

and get back to me.

There are more than one set of tools to deal with the current short term crisis, that is not to belittle it, and one thing is certain sure...

If BushCo and his enablers in the 'Democrat' Party say, 'This is what we need...this HAS to be done...' I will bet you ten to one whatever they are crying out for will not work and I will walk away a big winner.

Anything, anything whatsoever Paulson, Pelosi, Bush, McSame or Obama has to say on this must be discounted at the market rate....

...which is 100%

If you have not yet grasped the goals, techniques and frames of 'conservative' economists, the practitioners of 'Disaster Capitalism...' and the got damned 'Free Marketeers' you are beyond all help.

Get a sixpack of beer and watch the ALCS. That knock at the door?

That would be the Sheriff.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

On Track: Manufadcturing Depressed by Foreign Trade

On a level of Finance as pretended by those idiots who pretend lead the big economies, there is peace. Today through Sunday they will create a document designed to pacify markets,as they pretend to understand them.

It is not risky to presume that markets in the US will adjust to the level of third world nations, as their citizens have also been forced. Eventually when the US markets reach the level of the third world nations (where their oligicarchies have tended), markets may stabilize. Stabilization of US and 3rd World Markets is the point. Rationalization of US Wages, Housing Prices, US Currency, obliteration of US Sovereignty is equally the point(anyone disputing this should consider 'Partnership for Prosperuty of the Bush Administration in point).

None of these subjects are polite conversation during the presidential, or congressional debates. The dialog concerning both economic and social policy becomes increasingly shrill, and class-polarized, as this site has predicted.

Burton Leed