America and China appear to be locked in a financial embrace turned toxic. If America is running perennial trade deficits and if American consumers are running dire savings deficits, then China appears to be wrestling with the opposite peril: a worsening inflationary spiral caused by a tsunami of incoming ever-cheaper dollars.

I won't pretend to be an expert on China's stock or bond market, but then again finding such discussion of financial conditions in China seems to be just about impossible. What I do know a little about is financial history, and what conditions in stock and even moreso bond markets can tell us about where an economy is going.

With that in mind, it is worthwhile to look at China's markets and ask ourselves, "If this was the US, where would the economy be heading?" The answer (while enviable compared to America's condition) ain't so pretty.

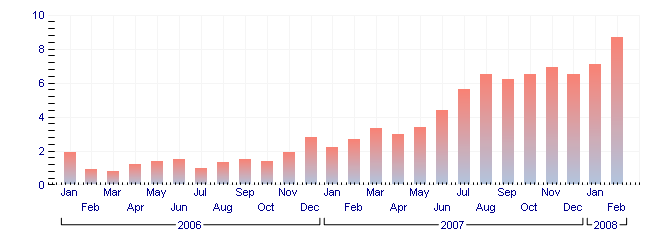

Inflation in the Chinese economy is rising, and rising at a faster clip as the dollar depreciates:

Until a year ago, inflation seemed well-contained at a rate of less than 4% a year. Recently inflation has exceeded 8% a year, bringing to mind the wage-price spirals of the US in the 1970s. And make no mistake, Chinese wages have been appreciating at a rapid clip as well, averaging $200 a month, doubling from just a few years ago (something that makes even poorer countries like Vietnam look appealing for global corporatists).

In the US, the normal way to rein in inflation was for the central bank to raise interest rates until the yield curve "inverts" that is, shorter term interest rates pay more than longer term interest rates. The result is a recession which acts to bring down inflation as consumers cut back their spending. No such prospect appears on the horizon in China. Why?

The reaction of the government in China to stresses in the economy appears to mirror that of authorities, especially the Alan Greenspan Fed in the US. Moral hazard be damned, big financial players must be bailed out! In China that peril is worsened by the fact that Chinese consumers, unlike Americans, are unable to vent themselves at the polls. At least in this country, American voters can vote out the GOP and vote in democrats if they are sufficiently unhappy with the economy. There is no such option avaiable to ordinary Chinese, and of course the highest priority of the Chinese Communist Party is to make sure there never is one! Thus a consumer recession is to be avoided at nearly all costs as explained here:

China's leaders are jittery about the political fallout from rising inflation

Rising inflation, just an economic nuisance a few months ago, could turn into a political problem for China’s leaders, whose legitimacy rests partly on delivering steady improvement in standards of living. Rising global energy prices and catastrophic snowstorms a month ago in China have caused food prices to shoot up.

Inflation in China hits particularly hard at urban residents on fixed incomes, such as retirees and factory workers, many of whom have seen a sudden erosion in their rising living standards.

In short, China faces a choice between an inflationary spiral that continues to erode workers' real incomes, or reining in exports, which will lead to more employment. Right now, it still appears to be plumping for more inflation:

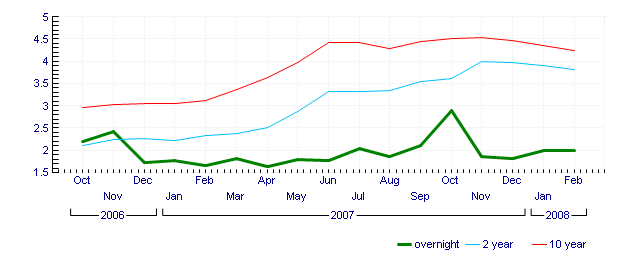

Here are 2 graphs. The first compares the overnight rate with 2 year and 10 year interest returns. In this graph, overnight rates in China are lower than US Federal funds rates!

The second graph shows the yield curve in Chinese bonds from 1-30 years. While this curve is flatter than the US curve, it is nonetheless a positively sloped curve.

So there appears no rush by Chinese authorities to inflict enough pain on their economy to cause raging inglation to subside. Keep in mind that ALL of the interest rates shown above are well below the inflation rate of 8%+, making these interest rates strongly stimulative.

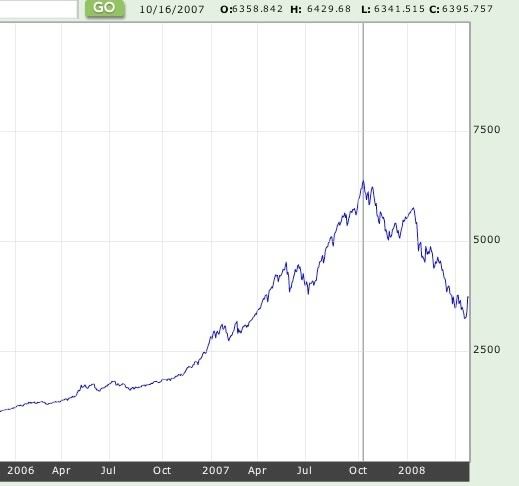

Out of control inflation will lead to asset bubbles, and there certainly was one in the Shanghai stock market, which quadrupled in value in the last couple of years, until it crashed 50% from its October 2007 high:

Last week the Chinese government directly intervened, cutting taxes on stock trades and possibly buying stocks directly. As a result, the Shanghai market gained more than 10% in just a couple of days at the end of last week! But the stock crash, like e.g. the Nasdaq crash from 5000 in 2000-2001, at very least presages a dramatic slowdown if not a recession in China as a result of this overheated inflation.

The worry that rising Chinese unemployment and unrest is to avoided at nearly all costs, explains a lot about the stories coming out of China in the last week or so. For example:

China resuming tax incentives for exporters

China may need to resume tax incentives for textiles exporters after the yuan's appreciation crimped profits and curbed production, an official with the top economic planning agency said.

``Many of those companies are on the verge of shutting down,'' Zhang Xiaoqiang, vice chairman of the National Development and Reform Commission, said at a trade conference in Beijing today. ``We should consider resuming some tax incentives to help them survive.''

....

The strengthening yuan and weaker demand in the U.S., Europe and Japan, China's largest trade partners, curbed export growth of toys, textiles, shoes and garments in the first quarter, Zhang said. China won't further cut rebates in sectors that create a lot of employment, he said.``Some exporters are idling half or even all of their production this year because they couldn't sign contracts while they are uncertain about how fast the yuan will rise,'' Zhang said. ``We should continue to support labor-intensive manufacturing to help boost jobs and farmers' income.''

Or how about encouraging buying stocks on margin:

China may limit new share sales and allow investors to borrow money to buy equities in an effort to boost the world's sixth worst-performing stock market, according to Citic Securities Co.

....

The CSI 300 rallied 16 percent last week after the government reduced the so-called stamp duty on stock transactions to encourage trading....Shares slumped after the CSI 300 rose almost sixfold in 2006 and 2007 and stocks traded at an average 52.8 times earnings. They also fell on concern government steps to curb inflation would hurt corporate profit and new equity sales would overwhelm demand. This year's decline wiped out $1.14 trillion in market value.

.... China clamped down on unauthorized margin trading in 1997 and 2001, when banks were found to have illegally channeled money into the stock market.

But the more China tries to protect its capital enterprises and employment, the more it must get concerned about inflation:

“The price of everything has just gone mad,” griped Zhou Qiongfang, a housekeeper, as she looked over slabs of raw pork at a wholesale market.

“At every meal, I eat less,” she added.

China is the world’s biggest pork producer.... Pig production is expected to fall 10 percent this year, even as pork prices have risen nearly 60 percent in the past year.

It isn’t just meat that’s soared in price. Vegetables, rice and cooking oil all have climbed in recent months, and manufacturers in other sectors are eager to pass along increased energy costs to consumers.

But Stephen Roach, Asia chairman at Morgan Stanley, insists the inflation threat is real.

But China’s inflation fears run deep – and extend beyond just energy. The big concern is soaring food prices,... In February, Chinese consumer prices leapt 8.7% over the same period last year, to their highest level in 12 years. Pork prices, hit by an epidemic of the deadly “blue-eared” virus, surged in some areas by as much as 65% - prompting waves of pig-jackings.

....

Many economists dismiss the fuss about global inflation as overdone. ... declares UBS economist John Anderson in a recent note to clients. “The evidence suggests the current spike in prices will be temporary, fading away by the second half of 2008.”Anderson contends that, unlike the 1990s, when inflationary pressures were broadly based, the current price spike is almost entirely limited to food items, which make up less than a third of urban household expenditure. When food is excluded, China’s core inflation rate drops to 1.6%.

....

But Stephen Roach [says] “I’ve seen this movie before,” he writes in this piece in the Wall Street Journal. “It takes me back to the early 1970s” when Fed chairman Aurthur Burns dismissed the significance of rising food and energy prices as external shocks, and focused instead on core inflation with disastrous consequences. Roach’s conclusion: “China cannot afford to ignore the lessons of America’s most painful policy blunder on the inflation front.”

In short, the mutually parasitic embrace between Chinese mercantilists and American corporatists appears to be reaching a breaking point -- for both parties.

Comments

China has one lever that the US does not have ...

... available to it, which is that since China has pursued a policy of a steeply discounted exchange rate, it can allow the exchange rate to rise against the US$.

What this sacrifices is some hypothetical competitiveness in the US markets, but since the US economy is heading into recession, and Chinese producers have driven domestic US competitors out of business in so many industries, there may well be very little lost by allowing the renminbi to rise against the US$.

Further, this does not require abandoning the policy of a steeply discounted exchange rate, but simply a shift in the focus from the US$ to the Euro and Yen (and other trading currencies, such as UK Pound, Australian Dollar, Swiss Franc, etc).

And the Chinese are already positioned to adopt this policy in an incremental way that poses the least risk of upsetting financial markets, since they switched from a US$ peg to the Singapore model of a hidden basket peg.

Allowing the renminbi to rise against the US$ would help moderate the cost-push side of Chinese inflation drivers, and could well be enough to keep inflation inside the kind of 5%-10% target that would make the most sense for the position that the Chinese find themselves in.

this seems to be their usual game plan

They keep things, such as tariffs, super high and promise to lower them, but only after they capture that entire market, get that industry to move to China and all goods in that market come from China (let's say auto parts as an example)....then they lower tariffs since nothing will be imported into their markets.

So, they can play the same rigged game with the exchange rate.

They are loaded, positively loaded with cash as well, US dollars, so I don't think it will hurt them much.

It's a shame Charles McMillion (he is blogging here) has gone on vacation until Sept. He really has studied China and could give some deep insight.

Intuitively for myself, I'm not worried about China and their stock markets, I'm much more worried about are massive trade deficit with China and I don't see them missing their target to dominate the world economically in 5 years.

This diary is best understood as Part 2 of

a series that began with "Peak Everything?!?"

I am trying to make sense of the commodities spike, and I found myself disagreeing with Prof. Krugman that "Peak Oil!" was the explanation (the subject of the first diary). In exploring the issue, I was surprised that in the face of rampant inflation, China's central bank still had negative real interest rates. So it seems 2 of the world's dynamos are making use of mirror-image easy money policies response to 2 opposite but interconnected crises.

There is at least one part part to the series, but I have to organize and edit the source material.

I read some stuff at

I read some stuff at www.chinaeconomicscan.com the other day that's interesting in the context of this article, I mean sure time has passed, but seeing the current state of things and recent developments... the china-US relationship is fascinating, very symbiotic in terms of trade and investment, yet very tense in light of the economic and political dialect...