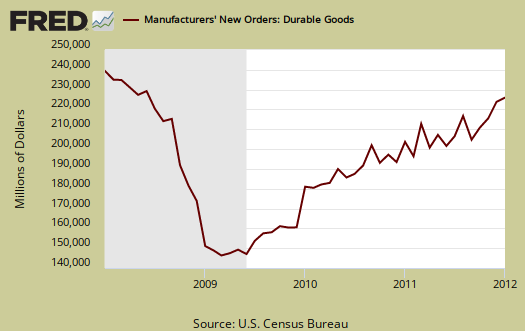

New Orders in Durable Goods, advance report, dropped -4.0% for January 2012. December durable goods new orders jumped by 3.2%, revised. While some will blame a business tax credit expiration, this report is across the board bad news.

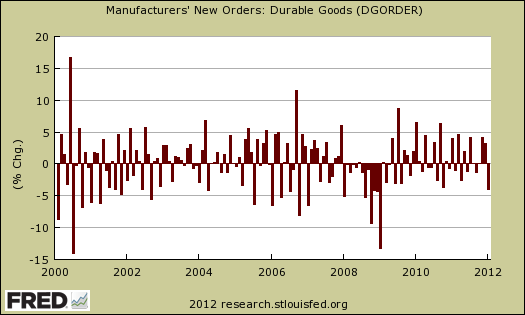

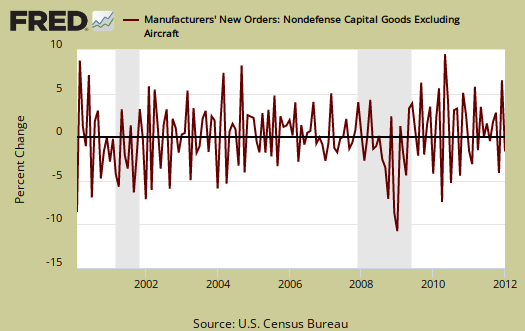

While headline blare this is the lowest monthly percent change in 3 years, January 2009 had a -13.2% month change in durable good new orders, we need to put the monthly percentage change in perspective. Below is a graph of the monthly durable goods new orders percentage change. As we can see, durable goods has a lot of volatility month after month. Durable goods must either decline by a huge amount or contract month after month to really indicate something bad is happening.

Manufacturing with unfilled orders included gives a new orders plunge, -5.8% from December to January. December manufacturing new orders, including unfilled, increased 4.1%.

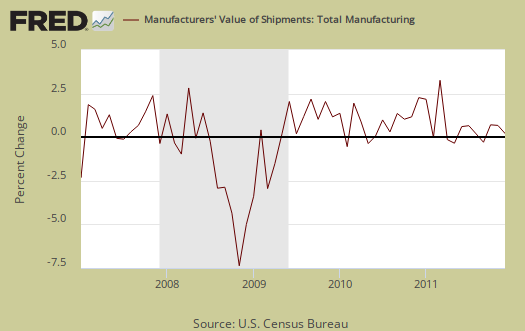

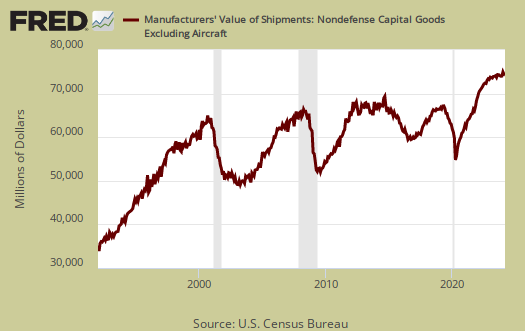

Shipments overall increased 0.4% from December. Below is the monthly percent change for all durable goods shipments.

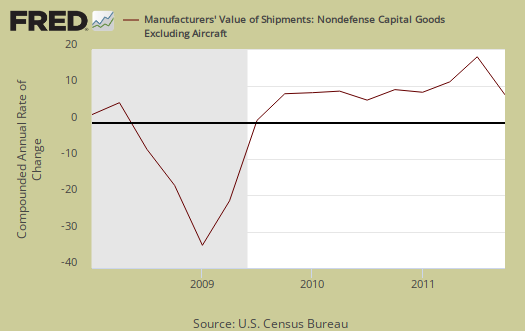

Core capital goods new orders dropped -4.5%, after increasing 3.4% in December. Machinery alone dropped -10.4% in January. Core capital goods is an investment gauge for the bet the private sector is placing on America's future economic growth.

For all transportation equipment, new orders declined -6.1%, but this includes volatile nondefense aircraft, which showed a -19.0% change in January. Motor vehicles new orders increased 0.9% and defense aircraft new orders declined -5.6%.

Core capital goods are a leading indicator of future economic growth. It's all of the stuff used to make other stuff, kind of an future investment in the business meter. Core capital goods excludes defense and all aircraft.

Shipments in core capital goods declined -3.1%. Machinery is a large part of core capital goods and machinery shipments dropped -5.7% for the month.

It's typical for aircraft to vary dramatically, after all who orders up a billion dollar air-o-plane every day? This report is often dramatically revised as well.

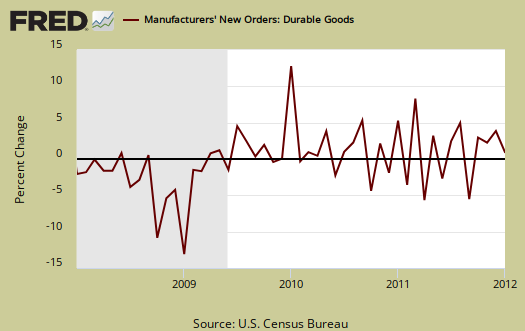

To put the monthly percentage change in perspective, below is the graph of core capital goods, monthly percentage change going back to 2000. Looks like noise right? In January 2009, core capital goods new orders dropped -9.9% and also declined by -9.4% in December 2008.

Inventories, which also contributes to GDP, are at an all time high and up +0.7% for January. Inventories have been at all time highs for months and have increased for 25 months in a row. Core Capital Goods inventories increased 1.3%.

Unfilled orders increased +0.5% with core capital goods unfilled orders also increasing by +0.5%.

Core shipments contributes to the investment component of GDP. The graph below is core capital goods shipments, quarterly annualized percent change. As we can see, the effective rate barely registered for Q4. Q1 2012 is getting off to a terrible start.

Producer's Durable Equipment (PDE) is part of the GDP investment metric, the I in GDP or nonresidential fixed investment. It is not all, but part of the total investment categories for GDP, usually contributing about 50% to the total investment metric (except recently where inventories have been the dominant factor).

Producer's Durable Equipment (PDE) is about 75%, or 3/4th of the durable goods core capital goods shipments, in real dollars, used as an approximation.

What is a durable good? It's stuff manufactured that's supposed to last at least 3 years. Yeah, right, electronics, laptops and cell phones and crappy printers, refrigerators that break in a matter of months. Regardless, that's the definition.

Here is last month's overview, not revised, although the graphs are. One might get a sense of how strongly the durable goods report is revised as more data comes into the Census bureau.

expiring 2011 business tax credits

This CPA has the list of expiring 2011 tax credits. I just don't have enough knowledge or statistical details to know how much the business 100% depreciation could have affected manufacturers new orders in December. I guess we'll see when this report is revised.