The NAR reports existing home sales dropped 2.2% in May. That's in spite of a tax credit.

a seasonally adjusted annual rate of 5.66 million units in May, down 2.2 percent from an upwardly revised surge of 5.79 million units in April. May closings are 19.2 percent above the 4.75 million-unit level in May 2009; April sales were revised to show an 8.0 percent monthly gain.

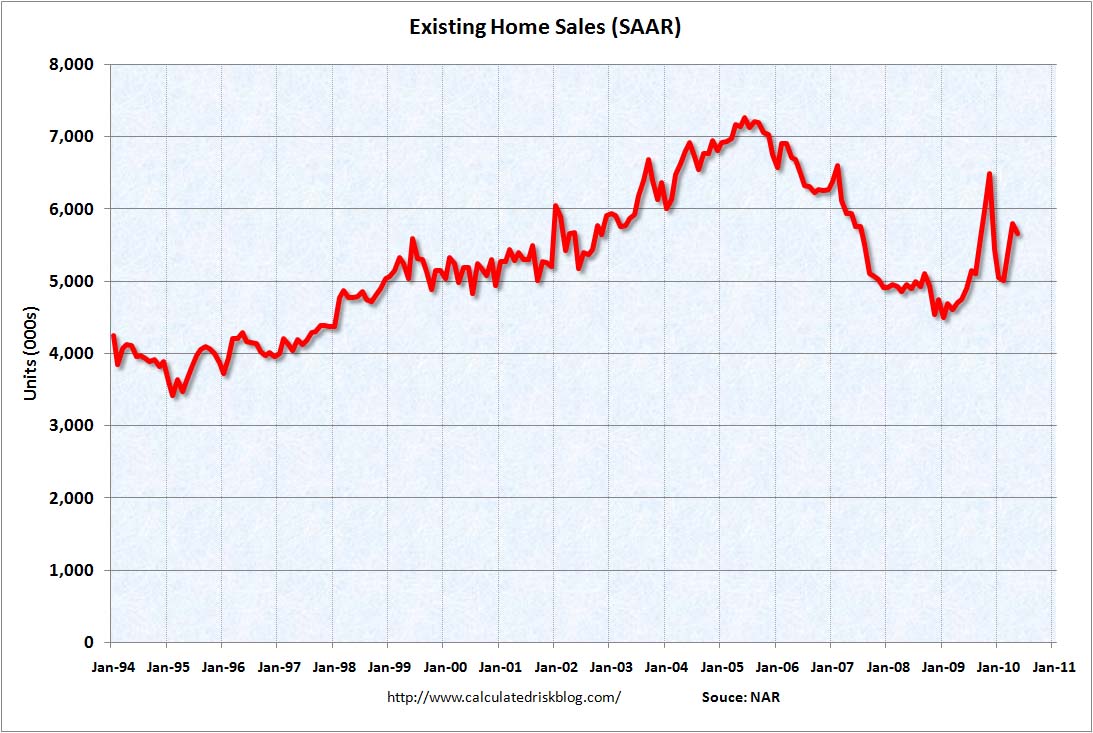

Graph courtesy of Calculated Risk

For June, the NAR reports 180,000 home closings will have the tax credit. June 30 is the closing date cut off for the $8,000 tax credit.

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage fell to 4.89 percent in May from 5.10 percent in April; the rate was 4.86 percent in May 2009.

The national median existing-home price2 for all housing types was $179,600 in May, up 2.7 percent from May 2009. Distressed homes slipped to 31 percent of sales last month, compared with 33 percent in April; it was also 33 percent in May 2009.

The NAR tries to put a happy face on this report, but a dip, even with the tax credit in effect is not good for the residential real estate market.

Inventories are at 8.3 months of supply, which is high. The median single home price is $179,400, up 2.7% from one year ago. Calculated Risk shows the year over year inventory increased.

Congress is considering extending the housing tax credit.

Recent comments