On The Economic Populist you might have noticed the middle column. We try to list other sites and blogs who have exceptional insight and writing on what is happening in the U.S. economy.

Sometimes though, one cannot say it better but miss those who did.

Must Read Post #1

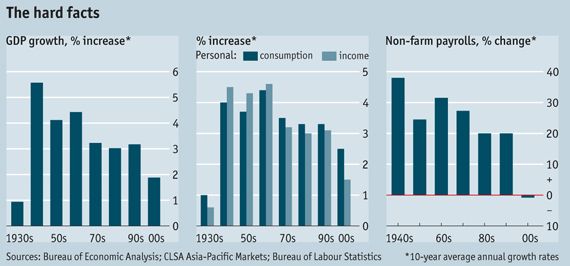

It's official, by any measure, including business cycles, the 2000's is the worst decade since the Great Depression. The Atlanta Fed analyzed a host of economic metrics, per business cycles (that's the worst point in a recession to another worst point in a recession, or trough to trough), and concluded this past decade was bad by any measure. If you're wondering what happened to your economic future, even though you've done everything right and work hard, check this one out. Lots of graphs to illustrate why you have so much education and accomplishment, yet are still broke.

Must Read Post #2

The Huffington Post has an overview on the reaction to the lame jobs bill. Senator Dorgan nailed something that drives me a little nuts, the minute one starts talking about the realities of labor economics, one gets this:

The minute you start talking about protecting American jobs in this town [Washington], "you are called some sort of xenophobic isolationist stooge who just can't see over the horizon."

We've seen over the horizon and it's a black cliff.

Must Read Post #3

This is an entire site The Floating Sheep. They are mapping out a host of unusual, never examined economic data, such as beer guts or the ratio of pizza to guns to strip clubs in the above.

Must Read Post #4

The CBO has a new estimate on TARP losses, now at $109 billion (That low? I don't believe it!)

CBO currently estimates that the cost to the government of the TARP’s transactions—including investments, grants, and loans—completed, outstanding, and anticipated will amount to $109 billion. Much of that estimated cost is associated with the assistance provided to American International Group (AIG)—at a cost of about $36 billion—and the automotive industry—at a cost of about $34 billion.

Must Read Post #5

Dean Baker does a nice call out on The Washington Post in a report that smaller banks are having a tougher time repaying TARP funds. Of course they are, they did not get the sweetheart deals that the Zombie Banks did.

Recent comments