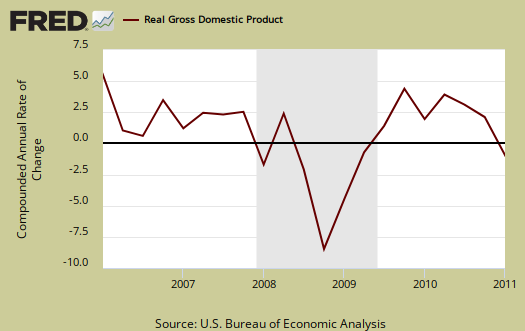

Q1 GDP 2011 came in at 1.8% for the second revision, same as the advance report. Here is the original BEA GDP report.

The decrease of Q1 GDP growth is once again, due to the never ending increasing trade deficit, a slow down in personal consumption and a drop in government spending.

As a reminder, GDP is made up of:

where:

Y=GDP, C=Consumption, I=Investment, G=Government Spending, (X-M)=Net Exports, X=Exports, M=Imports*.

Here are the Q1 2011 2nd revision report breakdown of GDP by percentage point contributions:

- C = +1.53

- I = +1.45

- G = –1.07

- X = +1.16

- M = –1.22

Here is the Q1 2011 advance report breakdown of GDP by percentage point contributions:

- C = +1.91

- I = +1.01

- G = –1.09

- X = +0.64

- M = –0.72

Below are the percentage point differences, or spread between the 2nd estimate and advance Q1 2011 GDP report components. We see a slowing further in personal consumption than the advance GDP indicated, an increase in imports and exports, and an increase in investment, which balanced out the loss in personal consumption.

- C = -0.38

- I = +0.44

- G = +0.02

- X = +0.52

- M = -0.50

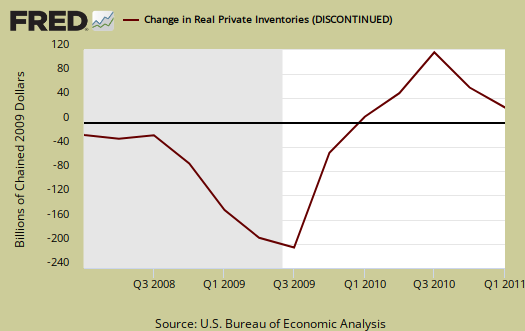

Changes in private inventories surged, was 1.19 of the Q1 GDP percentage contribution versus 0.93 percentage points in the advance report, a revision of +0.26. This means changes in private inventories was 66% of Q1 2011 GDP.

Below are real final sales of domestic product, or GDP - inventories change. This gives a better feel for real demand in the economy. This is the bad news of this GDP revision, it shows real demand was almost flat, a 0.6% increase, revised downward from an 0.8% increase in Q1 GDP advance report.

Below the the St. Louis FRED graph for C, or real personal consumption expenditures of the above GDP equation. As we can see from the above, while PCE, or C in the above equation, decelerated in Q1.

Below is the breakdown in C or real PCE annualized change. Notice when times are tough, durable goods (bright red) consumption drops. Notice the deceleration in durable goods this quarter and Durable goods personal consumption was +0.83, an upward 0.06 revision to the percentage points of GDP.

Below are net exports, or trade deficit, in real chained dollars, for Q1 2011. The two revisions balanced each other, but does not negate the fact imports dramatically increased from Q4 2010 to Q1 2011.

The below graph is real imports vs. exports. While exports increased, it is the trade deficit that matters. We can see imports are starting their acceleration once again.

Below are the percentage changes of Q1 2011 GDP components, revised, in comparison to the forth quarter of 2010:

- C = +2.2%

- I = +12.3%

- G = –5.1%

- X = +9.2%

- M = +7.5%

The BEA's comparisons in percentage change breakdown of 1st quarter GDP components are below. Changes to private inventories is a component of I.

C: Real personal consumption expenditures increased increased 2.2% in Q1, compared with an increase of 4.0% in Q1. Durable goods increased 8.9%, compared with an increase of 21.1%. Nondurable goods increased 1.1%, compared with an increase of 4.1%. Services increased 1.5%, compared with an increase of 1.5%.

I: Real nonresidential fixed investment increased increased 3.4% in the Q1, compared with an increase of 7.7% in Q4. Nonresidential structures decreased -16.8%, in contrast to a increase of 7.6%. Equipment and software increased 11.6%, compared with an increase of 7.7%. Real residential fixed investment decreased -3.3%, in contrast to a increase of 3.3%.

X & M: Real exports of goods and services increased 9.2% in Q1, compared with an increase of 8.6% in Q4. Real imports of goods and services increased 7.5%, in contrast to a decrease of -12.6% in Q4.

G: Real federal government consumption expenditures and gross investment decreased -7.9% in the first quarter, in contrast to a decrease of -0.3% in the forth. National defense decreased -11.7%, in contrast to a decrease of -2.2%. Nondefense increased 0.1%, compared with an increase of 3.7%. Real state and local government consumption expenditures and gross investment decreased -3.2%, in contrast to a decrease of 2.6%.

Motor Vehicles added 1.28, a downward revision of -0.12, percentage points to Q1 real GDP while computer final sales was halved in the 2nd GDP revision, to +0.06, from +0.12 percentage point changes. This is different from personal consumption, or C auto & parts. Motor vehicles are bought as investment, as fleets by the government and so forth and in Q1, they bought more.

Residential fixed investment subtracted -0.07, revised downward by 0.02, percentage points to Q1 GDP after adding a paltry 0.07 percentage points in Q4. Below is the raw totals on residential investment. If one could ever see the housing bubble and then it's collapse in terms of economic contributions, the below graph is it.

Private, or not from the government Nonresidential investment was revised, now a 3.4% change from last quarter and was a 0.33 percentage point contribution to Q1 GDP. Structures was a –0.48, revised upward +0.15, percent point contribution, or a –16.8% percentage change from Q4 to Q1 alone.

Here are the overview for the Q1 2011 advance GDP report overview.

* In Table 2, the BEA reports GDP contribution components with their equation sign. If durable goods for example, decreased over the quarter or year, it is reported as a negative number. Imports, from the GDP equation, are already a negative for that is not something produced domestically. A negative sign implies imports increased for the time period and a + sign means the change in imports decreased. Or, from the GDP equation: . Confusing but bottom line exports add to economic growth, imports subtract.

GDP is not enough to create jobs

Just in case, one needs about 2.5% GDP growth to create jobs, so this is god awful.