Yet another month, yet another report on how our money was used to bail out foreign banks, while we go without retirement and jobs.

The Congressional Oversight Committee has released a new report, The Global Context and International Effects of the TARP.

Guess what?

It appears likely that America‟s financial rescue had a much greater impact internationally than other nations‟ programs had on the United States.

Gets better. Of course the U.S. didn't bother to ask other nations to help...

if the U.S. government had gathered more information about which countries‟ institutions would most benefit from some of its actions, it might have been able to ask those countries to share the pain of rescue. For example, banks in France and Germany were among the greatest beneficiaries of AIG‟s rescue, yet the U.S. government bore the entire $70 billion risk of the AIG capital injection program. The U.S. share of this single rescue exceeded the size of France‟s entire $35 billion capital injection program and was nearly half the size of Germany‟s $133 billion program.

And even better. Of course to this day the U.S. Treasury isn't collecting data on our taxpayer dollars flowing overseas.

Treasury gathered very little data on how TARP funds flowed overseas.

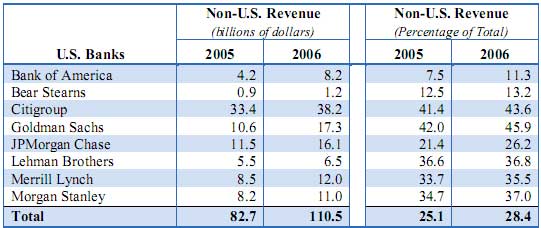

Our "U.S." banks, actually have significant revenues abroad, yet we, not an equal distribution from nations where they operate, are the ones who get to bail them out. Below is a table from the report, showing the large percentages of foreign revenues of U.S. bailed out banks.

Then, this is old news, but via AIG, we had a massive foreign bail out:

87 entities that benefited indirectly from government assistance provided to AIG. Each of these entities wrote credit default swap protection on AIG for Goldman. Of these 87 entities, 43 are foreign. When the government intervened to prevent AIG from failing, these foreign entities were not required to make payments on that protection, which they would have been obligated to do in the event of an AIG default.

Foreign hedge providers made up 43.4 percent of the total, by dollar amount, with European banks and other financial institutions being most heavily represented.

Finally, we have the percentages and amounts of various nations banking out the Banksters. Notice how the United States footed the largest bill.

Below is a video introduction and summary of the report by Elizabeth Warren.

Comments

TARP

I don't feel bad that the US had to shoulder most of the responsibility for helping out banks including international ones because the sub-prime mortgages and their derivatives began in the US and the risk was transferred to other countries. The US deregulated so that these derivatives could engulf the entire world. Before the US tells the rest of the world what to do to prevent crises, they should first take care of the crises that begin at home.