Regardless of whether the economy as a whole begins to improve, the malaise of working and middle class America will not be relieved until wages increase, and employment rates return to a robust level.

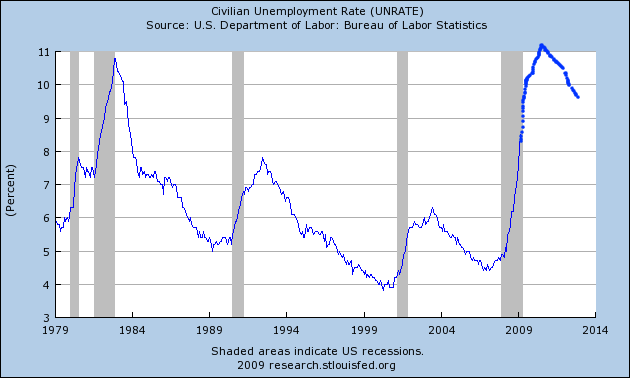

The news on that score is grim. Unemployment is a lagging indicator. Historically, it continued to rise right through to the end of recessions. The "jobless recoveries" from the 1990 and 2001 recessions were even worse: unemployment continued to rise for over a year after both recessions ended!

If that pattern is again true for any recovery from this recession, the forecast is grim indeed.

For purposes of this discussion, let's follow the optimistic scenario I laid out for 2009 in the conclusion of my discussion of "Economic Indicators during the Roaring Twenties and Great Depression"; viz., that the YoY inflation rate will bottom in about July 2009 and that will mark the end of the recession and the beginning point of any recovery. What will the rate of unemployment look like if the pattern of the last two "jobless recoveries" is followed again?

The 1990-91 recession ended in March 1991 with an unemployment rate of 6.8%. Unemployment continued to rise for 15 months to 7.8%. It took another 14 months for it to decline back to 6.8%.

The "jobless recovery" following 2001 was even worse. From the November 2001 rate of 5.5%, unemployment continued to rise for 19 months to 6.3%. It then took another 13 months for it to decline back to 5.5%.

The average for both recoveries is a 17 month increase of .9% (or a 15% percent increase in the rate) followed by 13.5 months decrease back to the starting number.

Applying these averages to our present scenario, in which unemployment has been rising at .4% a month for the last 4 months, we have 4 more months of rising rates to a 10.1% unemployment rate in July 2009 when the recession ends under the "optimistic scenario."

Even under the optimistic scenario, if unemployment follows the same pattern as in the last two recoveries, here is what its graph will look like for the next 3 years:

Unemployment rises to 11.3% by December 2010, and then takes until early 2012 just to decrease back to 10.1%.

Note this is U3 unemployment, so U6 unemployment will be correspondingly worse.

It is safe to say that there will be major social and political consequences from an unemployment rate over 10% for 2 1/2 or more years -- and that's the optimistic scenario.

Comments

Interesting statement re: stress tests and unemployment:

Link

So much for the stress test. But this raises an interesting scenario if unemployment goes higher than the optimistic scenario.

RebelCapitalist.com - Financial Information for the Rest of Us.

12.1% in Oregon

And rising, according to the morning paper.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

Oregon at the top now?

I know they are about 3rd last time I checked but the thing is, Oregon does not have a large manufacturing base and I believe a fairly varied economy so this is pretty astounding.

What is going on in Oregon to cause it to match Detroit in unemployment rates?

Nope, still officially 3rd

I believe the other two went up as well.

Well, one big thing lately was Joe's (GI Joe's, a local surplus store chain turned sporting goods store) got bought out by an investment company a year ago that ran them into the ground- they've now been turned over to a liquidator and laid off a bunch of staff statewide, with more layoffs coming in the next month or so.

Daimler Chrysler was also a big name in Portland for employment in the Freightliner plant, that's closed down now.

Intel's cutting back, they're a big name around these parts too.

Overseas competition, environmentalism, and Mexican Tariffs are cutting into the agricultural sector (though personally, I think that last is a good thing as we need to replenish the food bank shelves now that so many people are out of work).

Logging is down in the dumps again, with more land being designated wilderness.

Overall, it's just pretty bad here.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

Double digit unemployment is

Double digit unemployment is assured because there's simply too much debt still in the system. As Economist Steve Keen notes in his blog, "The sheer scale of private debt de-leveraging swamps the government’s pump priming, while there is so much debt relative to government created money that the latter will have to be increased by astronomical amounts–and given to those in debt, rather than to the banks–to counter the collapse in demand caused by private deleveraging."

offshore outsourcing, insourcing and illegal immigration

The topics that never get mentioned in unemployment statistics. After the dot con crash, the tech sector couldn't offshore outsource jobs fast enough. They also brought in foreign workers in H-1B and L-1 Visas and displaced U.S. workers. Literally age discrimination is institutionalized in these fields with many perfect capable, highly skilled people having their careers cut short because they were over the age of 35. Think about it. 35 years of age!

The Financial sector also wiped out massive amounts of U.S. employees by offshore outsourcing pretty much anything that wasn't nailed down, call center jobs, I.T. jobs, even analysis, trading jobs.

Then, in manufacturing, they shipped jobs off to China in record speed, wiping out entire towns.

Finally illegal immigration rounded it out. Instead of dealing with the influx of illegal labor repressing wages, avoiding taxes, workman's comp., cities used taxpayer dollars to create day labor centers so these illegal workers

were easier to hire. This is also a massive underground economy, cash under the table.

This is labor economics 101 and we even have spin trying to refute some highly validated axioms in this topic area...

Labor follows the law of supply and demand, that's reality.

To date, you cannot even get this properly analyzed. Corporations refuse to release the data on how many jobs were offshore outsourced and the DOL just plain ignores it.

Instead we have estimates from a few brave researchers and economists, doing battle with corporate lobbyists in faux pas debates.

The DOL literally counts foreign temporary guest workers in the U.S. unemployment statistics, skewing the numbers and to hide the displacement of U.S. workers.

Until the United States recognizes labor economics 101 and starts addressing the global labor arbitrage problems, I don't see how any recovery could be anything but jobless.

Seriously, this issue kills me because they won't even pull their heads out of the sand to obtain the raw data for proper analysis, never mind pass legislation.