If you are out of work like me, and hoping that the Depression will end soon so you can get a job, you better develop a Plan B.

A recent analysis by a trio of economists with the Federal Reserve Bank of San Francisco predicted a jobless recovery on a nationwide basis, following a pattern that appeared after the recessions of the early 1990s and 2001.

Most economic predictions can be taken with a grain of salt. If you were as wrong on your job as often as economists are on their jobs, you would get fired very quickly.

On the other hand, it's common sense to look at recent historical trends and project patterns from them. Given that premise, let's look at what we can expect in terms of employment.

"We have had a lot of talk of “green shoots”, but once one looks deeper, most negative news one hears are facts, whereas most positive news appears to be subjective forecasts and expectations of policy makers."

- Axel Merck, 2009

Recent Recessions

The people who declare when recessions/depressions start and end are the National Bureau of Economic Research (NBER).

According to them the last two recessions in America lasted from July 1990 to March 1991, and from March 2001 to November 2001. Both recessions lasting eight months, relatively short by historical standards.

What was unusual about these recessions was the long lag from the end of the recession until unemployment began dropping.

The unemployment rate was 6.8% in March 1991. It crested at 7.8% in June of 1992, 15 months later. It didn't reach 6.8% again until October 1993.

The unemployment rate was 5.5% in November of 2001. It crested at 6.3% in June of 2003, 19 months later. It didn't reach 5.5% again until August 2004.

Using these numbers I'm going to try and extrapolate a few scenarios of what we are likely to see.

The Current Depression

monthly unemployment rate since beginning of Depression

First of all let's look at the most optimistic of scenarios.

Let's make the assumption that the Depression will bottom at the end of this month and that unemployment will take only 15 months to peak from there (like the early 90's recession).

The unemployment rate rose 14.7% after the recession ended in 1991, and almost the exact same amount after the 2001 recession. Given that the unemployment rate is currently at 9.4%, that would mean that unemployment would peak at 10.8% in September of 2010.

It wouldn't get back down to 9.4% until December of 2011.

Remember - this is the optimistic scenario. This is assuming that the guys who predicted a "soft landing" will suddenly start getting things right.

To put things into perspective, if everything goes right then 18 months from now the unemployment rate will be just as bad as it currently is.

weekly unemployment claims since beginning of Depression

If you are waiting for a return of the economy of 2006 you better have a backup plan.

Now let's look at the more realistic scenario.

“We have ‘failed bankers’ giving advice to ’failed regulators’ on how to deal with ‘failed assets’”.

-William Black, associate professor of Economics at the University of Missouri

Welcome To The Jungle

First of all, this isn't just another recession like the two previous ones.

We are already 17 months into this Depression, more than double the previous recessions, with no clear end in sight. That suggests a much longer curve for everything.

Without a clear idea of how deep this Depression will go, an accurate prediction is hard to make. A majority of economists predict the Depression to end some time between June and October of this year.

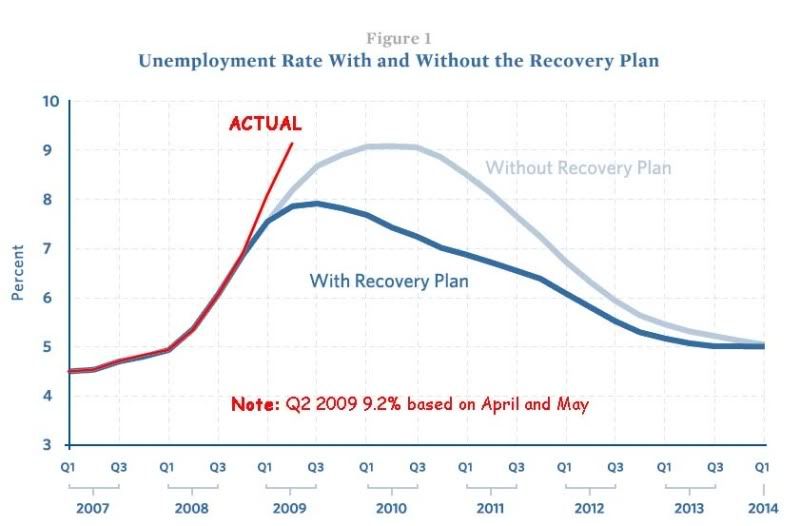

Of course these exact same guys predicted just seven months ago that the unemployment rate wouldn't exceed 7.5% and the Depression would have already ended months ago. They also predicted the economy to shrink by only 1.5% at the same time it was shrinking by about 6%.

Economists have consistently been far too optimistic, thus we can expect the reality to be worse.

"The last duty of a central banker is to tell the public the truth."

- former Federal Reserve Vice Chairman, Alan Blinder

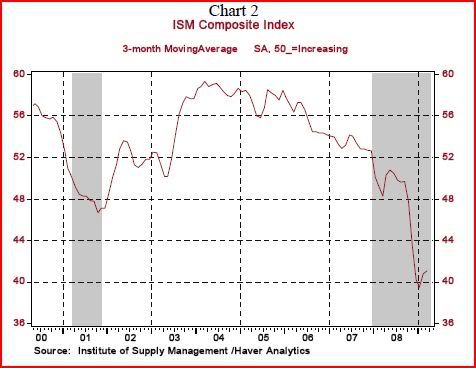

Does this look like a recovery to you?

Nouriel Roubini, one of the few economists that accurately predicted the Depression, says it will last at least another 6 months, but it might not end until the end of 2010.

Taking the more optimistic of Roubini's scenario's, this would make the current Depression the longest, uninterrupted economic downturn since the the one that lasted from August 1929 to March 1933.

For those of you who think Roubini is just a pessimist, consider that he predicted in January that the unemployment rate would peak at 9% in early 2010, a rate we exceeded nearly a year earlier.

He now predicts unemployment to peak at over 11% in 2010, but you have to wonder if he's underestimated it again.

If the jobless recovery experience of the past is correct, and Roubini's optimistic timeline of the Depression ending in December is also correct, then the unemployment rate won't peak until the summer of 2011.

This scenario, of course, doesn't take into account the fact that we are probably dealing with a much deeper economic curve than the examples being used.

Does this look like a recovery to you?

Looking Ahead

“The worst is over without a doubt.”

- James J. Davis, Secretary of Labor, June 1930

“The depression has ended.”

- Dr. Julius Klein, Assistant Secretary of Commerce, June 9, 1931

If you were waiting for me to tell you what is going to happen, I have bad news for you - like Obama, I don't have a working crystal ball (Although predicting 10% unemployment is like predicting the sun will rise in the east).

However, I can make a few observations.

1) All the predictions by the economists make one large assumption - that the economy won't see another shock.

The assumption that Latvia won't trigger a currency crisis in Europe. That Pakistan won't spiral into chaos. That a wave of bank failures won't trigger another shock to the economy. That massive layoffs from the GM and Chrysler bankruptcies won't collapse the rust belt economies. That governments won't make things worse. That the Chinese won't balk at funding our deficits. That California's budget problems won't collapse the state's economy. That something else won't surprise us all.

Remember that the Great Depression was only a recession until 1931, when unexpected bank collapses swept both Europe and America and turned an economic downturn into a panic. The longer and deeper the current Depression gets, the more likely an "accident" will happen.

2) Almost no one is predicting a more scary scenario.

Roubini's predictions really aren't much worse than the mainstream predictions anymore (now that reality has caught up with the mainstream). It seems somewhat strange to not see anyone predicting a more scary outcome when mathematical odds tell us that it is indeed possible for things to get much worse.

Notice that I haven't talked about a "worst-case scenario" because anything worse than what the economists are predicting is off-the-charts. The current situation has already exceeded the worst-case scenarios of the past predictions of most economists and we haven't hit the bottom yet.

3) Almost no one is taking into account the consequences.

Ambrose Evans-Pritchard pointed out that Europe has seen the rise of the extreme right-wing in recent elections because of the Depression.

America is looking at an unemployment rate north of 9% for the rest of the Obama Administration, if not a lot longer. That is going to create a political backlash, probably from both extremes, both here in America and around the world.

This will have totally unpredictable outcomes, and make all long-term forecasts useless.

Comments

jobless recovery

is just another word for shipping your job offshore.

Seriously, I put up a industrial production Instapopulist today and I noticed this massive dip which wasn't there when advanced high tech was removed and this is from the 2001 recession. Well, at that time tech multinationals were all offshore outsourcing jobs as fast as they could along with other sectors who had any in house I.T.

You're right there are certain jobs which are guaranteed no matter how wrong you are. I'd say the list includes:

1. Cable News Pundit

2. Any job at CNBC

3. CEO

4. Corporate Board member

5. Government regulator

6. Economist

7. Anyone working at The Economist

For once

you are more optimistic than I am, since I'm figuring 10.1% unemployment by July, even if that month marks the NBER end of the recession, rising to ~12% in 2010.

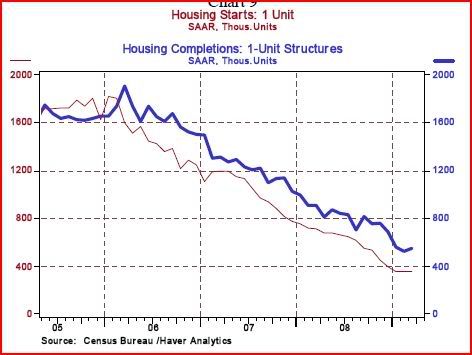

One caution about housing starts: in the aftermath of the 1920s housing bubble, starts didn't bottom until 1935, two years after the bottom of the recession. Whether we reach a bottom here or not probably depends on whether there is another "event" ratcheting down economic activity (as there was last September).

I wouldn't say that

I'm not optimistic at all. I just don't have any hard info, or even official numbers, to base a more realistic prediction on. I wish I had some hard data from the late 19th Century, because there is nothing from the post-WWII recessions to base the current Depression on.

To be honest I do expect an "accident" before the end of the year, probably coming from California or overseas. I think we are only months away from another economic shock, and I think the political fallout from all this is going to be scary indeed.

This all started out yesterday when I was thinking about my personal situation, and it became a more general academic exercise.

I think we're only 14 days from the next shock

And that's based on state government budgets (only 4 of which are still in the black) and the fact that 40 states hit their end of the fiscal year or biennium July 1.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Just remember the economy is turning

I read today that Obama said unemployent will hit ten percent but that the economy is turning.

Ha ha! The economy is always headed up down or sideways. Anyone can say that the economy is turning and eventually they will be correct. Hope and change. Does hope and change repay the $ trillions of wasted money?

Going back to my BBC to read about the best way to cook carrots. Something that is a bit more spot on.

This morning in FT

Martin Wolf wrote a piece about how he thought the Great Recession has tracked the early parts of the Great Depression. His conclusion is that the race to full recovery (if even possible in my mind) will be long, hard and UNCERTAIN.

Link

RebelCapitalist.com - Financial Information for the Rest of Us.

My fear is that we have not done enough.

Enough stimulus that is. I know deficit hawks are howling but the fact is that the government, with deficit spending, is the only player in the economy. Now, I am afraid it is politically too late to seek more.

But the spending has to be about priorities: infrastructure improvements, education, health care and environment - that is it. Good-bye subsidies, war spending. The tough calls and decisions have to be made.

Sadly, for someone who supported this President throughout the election cycle, his actions have not met the enormity of the problems.

RebelCapitalist.com - Financial Information for the Rest of Us.

Call me silly but the longest recession is the one that received

the most government intervention. In fact they gave it a name....The Great Depression.

http://www.reuters.com/article/newsOne/idUSTRE4B06ZD20081201?virtualBran...

There is an awful lot of data that suggests the FDR stimulus extended the recession. I've lived in earthquake country and those little rumblings are much needed to relieve pressure and there is little you can do. It seems that maybe the more government does to stop the small rumbles leads us to the big quake.

Sometimes just as in the physical world, the immediate economic medicine must be received to stop the long term illness.

Goes back in history a bit more.........

http://www.nber.org/cycles/cyclesmain.html

This was written in Feb. 2002....

"The Nippon government has tried to spend its way out of the problem, Keynesian-style, to no avail. Instead, total government debt in Japan has risen 140% of GDP, the highest in the OECD and an astounding 465% of government revenues.

The only answer appears to be to let the Japanese currency collapse so that Japan can revive by selling more goods abroad by lowering their prices. But if the yen falls sharply, Japan will cause competitive devaluations from currencies throughout Asia. That could lead to further deflation pressures in the US and a prolonged stagnant world economy. The land of cheap electronics and Godzilla movies is leading the world to the brink of disaster."

Like Japan we had the stimulus spending.

Then the second paragraph mentions devaluations. I ask, is the dollar getting stronger or weaker?

Government wastes so much freaking money. Take the Medicaid long term care. If an elderly person just needs a bit of help with activity daily living (ADL's), maybe they need help making meals or other little ADL's. Medicare will not pay anything for home health care. The cost to have an agency to stop by once a day, the cost may be $15,000 to $20,000. Instead Medicaid will pay to have that person put into a nursing home to the tune of $40,000, $50,000 or $75,000 a year. Plus the person must move out of their house. I currently know of a person that is in the above

problem. The nursing home will bill Medicaid $7100/month and nobody will bat an eyelash.

Errrrrrrrr!!!!!!!!! Just like Medicare they waste money like a drunken sailor. Who the hell is running that show? Finally I've read (after 40 years of abuse) Medicare will start looking into fraud. Oh dear....that will mean their administration rate will go up. I am sure they will roll it over into another program.

DO I seem jaded?

See NDD's article in Instapopulist

With a deflationary rate of -1.3% for the year AND about to hit Trapdoor Day for state governments; I'd say we're about 14 days away from a wage deflationary spiral.

And I don't really see any way out of it. We'd have to spend a good $20-$30 trillion in hyperinflationary Printing-press dollars directly supporting the 46 states that are in the red to avoid it.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Plan B for somebody with severence pay

1. Find some unused land along a transit corridor

2. Buy a riding lawnmower with rototiller attachment

3. Divide land into10x10 plots for yearly rent.

4. Rent to city folks for gardens.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.