I could not resist saying something about this Bloomberg article: Fed Said to Raise Standards for Banks' TARP Repayment. In May, the Fed released the results of the not too stressful 'stress tests'. The 'stress tests' concluded that JP Morgan Chase and American Express Co. didn't have to raise any additional capital. Apparently, the Fed has changed its mind.

JPMorgan Chase & Co. and American Express Co. were told they need to boost common equity, less than four weeks after being informed they had enough to withstand a deeper economic slump. Morgan Stanley was directed to raise more funds after already selling stock to cover its stress-test shortfall. One firm was told only yesterday, people with direct knowledge said.

But, wait a minute we were told that the 'stress tests' (Supervisory Capital Assessment Program - SCAP)were stringent and that should put to rest this issue of the health of financial conglomerates:

The SCAP was a deliberately stringent test. It was designed to account for the highly uncertain financial and economic conditions by identifying the extent to which a BHC is vulnerable today to a weaker than expected economy in the future. By ensuring that these large BHCs have a capital buffer now that is robust to a range of economic outcomes, this exercise counters the risk that uncertainty itself exerts contractionary pressures on the banking system and the

economy. In the event the economy weakens more than expected, the firms will have adequate capital; in the event the economy follows the expected path, or an even stronger path, the firms will still be viewed as stronger today for having higher levels of capital in an uncertain world.

The Fed's precondition of requiring more common equity from JP Morgan Chase and American Express (and more capital from Morgan Stanley) is an acknowledgment that the 'stress tests' were a joke. What are they worried about?

“The Fed doesn’t want to be criticized for allowing people to repay this and then having the banks say we just don’t have the capital to make loans now,” said Lawrence Kaplan, a former attorney at the Office of Thrift Supervision who now works at law firm Paul, Hastings, Janofsky & Walker LLP in Washington. “It’s an exercise to make sure that no one is going to get criticized for allowing these redemptions.”

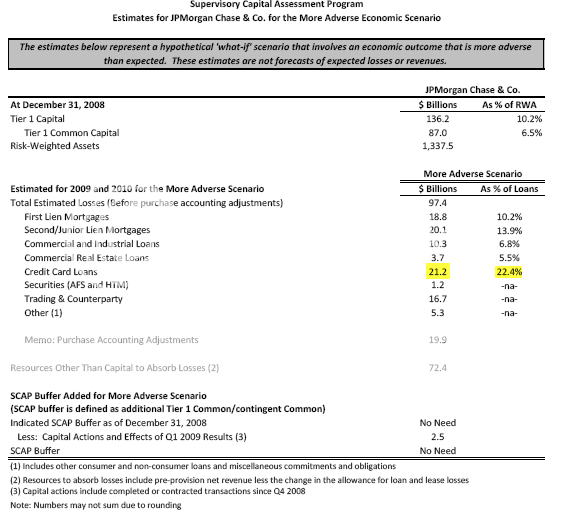

Sure, that may be part of it. But could it also be an indication that certain types of loans are about to get worse? Now, keep in mind that we are finding out about these additional capital requirements of financial conglomerates that either have applied for repayment or bragged about paying-off TARP. The Fed could be still concerned about credit card loans and financial conglomerates exposure to credit card loans. Check out American Express and JP Morgan 'stress test' results (click to enlarge):

American Express - Stress Test Results

JP Morgan Chase - Stress Test Results

There is a big issue here besides the exposure of credit card loans. That is the credibility of the Fed, Treasury and the entire TARP/bailout process. Was this just window dressing masking a much bigger problem of certain zombie-financial conglomerates?

We could be reliving the "lost decade" of Japan and that is what I am worried about.

very good question

I saw this and didn't have any answers as to the real reasons.

There is a house financial services committee hearing tomorrow on Freddie/Fannie and all I see is these Zombie banks trying to further rape their existing customers via credit card interest rates, etc.

Is the Fed worried about this:

that banks profits from accounting gimmicks are masking loan losses (can you say Zombie):

We may be reliving the "Lost Decade".

RebelCapitalist.com - Financial Information for the Rest of Us.