Déjà Vu. And they're still being ignored. Now the Senate just passed fast track for the TPP trade agreement. It seems the early warnings of yesterday weren't heeded — and again, history repeats itself.

In 1975, U.S. exports had exceeded foreign imports by $12.4 billion — but that would be the last trade surplus the United States would ever see again in the 20th century — and possibly, forever. And our leaders were warned 16 years ago that, unless something was done, it was only going to get worse. Then something was done — to make it much worse.

Today’s average hourly wage has about the same purchasing power as it did in 1979 — which was also the year when union participation peaked, before it began its long decline until today. 1979 was also when manufacturing in the U.S. had peaked — when we had over 19.6 million manufacturing jobs (21.6% of all jobs). Now only 12.3 million Americans work in manufacturing (about 9.9% of all jobs). So rather than having 7.3 million MORE good-paying union jobs in manufacturing since 1979, we now have 7.3 million LESS in 2015.

Also, at the end of 1997 (earliest available data) we had 406,567 manufacturing establishments of all sizes. In 2014 we only had 339,406 — that's a whopping 67,161 less manufacturers than we had in 1997. One reason might be because of U.S. monopsonies.

A "monopsony" is defined as a market similar to a "monopoly" except that a large buyer, not seller, controls a large proportion of the market and drives prices down. Sometimes referred to as the buyer's monopoly. Walmart is monopsony and a big reason why so many manufacturers in the U.S. have offshored for cheaper wages to meet Walmart's buying prices. As Charles Fishman, the business reporter who wrote The Wal-Mart Effect asks, "What is the high cost of these low prices?" Walmart's market power is such that many of its suppliers face a stark choice: take dictation from Walmart, or lose half or more of their business. To survive in the face of Walmart's pricing demands, makers of everything from bras to bicycles to blue jeans have had to lay off employees and close U.S. plants in favor of outsourcing products from overseas.

Walmart has been a major supporter of the Clintons since Bill's days as governor of Arkansas. In fact, Hillary was a member of Walmart's Board of Directors for the six years leading up to her husband's first presidential campaign in 1992. By 1993, tax returns showed the Clintons owned more than $100,000 worth of Walmart stock. And in 2008, the company made substantial contributions to Hillary's presidential campaign, all while Bill has maintained a close personal relationship with Walmart's then-CEO H. Lee Scott.

If one were so inclined, we might even attribute The Powell Memo (written in 1971 to the business lobbying group calling itself the "U.S. Chamber of Commerce") as a "call to arms" for American corporations that began this long trend in union-busting, State's "right to work" laws, factory closings, offshoring, stagnate (and declining) wages, bad trade agreements and our huge trade deficit.

The whole concept of American multinational corporations opening up "emerging markets" to sell their products to foreign consumers with the claim of wanting to be "globally competitive" is premised on the myth that American workers in the U.S. would also benefit. In theory, if American companies were manufacturing goods at home and selling their goods (or providing their services) to foreign markets, that would indeed benefit American workers. But that's not what's been happening over the past four decades of outsourcing/offshoring. And the latest reports of "reshoring" is just a myth — which unfortunately, is one fable that President Obama embraces.

Say, for example, if an American company builds a factory in Vietnam or China, or uses a foreign contractor to manufacture its goods (that may or may not be using robots) for sell in those markets, that would be one scenario. But when American companies manufacture their goods in foreign countries and then IMPORT their goods back to the U.S. to sell here in America, they displace American workers and drive up our trade deficit. (Note to Congress: If you're going to put American humans out of work, we'd rather use American-made robots built by American citizens for production in the U.S.)

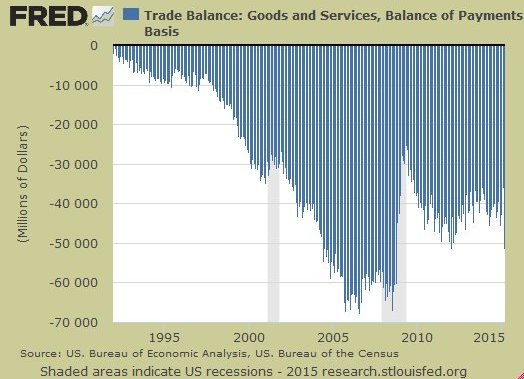

Following negotiations dating back to 1990, President George H. W. Bush signed the NAFTA trade agreement on December 17, 1992. After much heated debate, Congress passed NAFTA on November 17, 1993. Bill Clinton then signed it into law on December 8, 1993 — and it went into effect on January 1, 1994. (The following year, Bill Gates released Windows 95). Since 1975, and especially since NAFTA (as the chart below shows) the trade deficit has gotten much worse.

It appears that during recessions, when Americans had less to spend, imports went down, and the trade deficit receded.

After NAFTA had already been in effect for over six years, in the last year of his presidency Bill Clinton had also called on Congress to change the status of China’s trade relations with the U.S. to "Permanent Normal Trade Relations" (aka PNTR ). The legislation was first introduced on May 15, 2000 by Rep. William Reynolds Archer (R-Texas). It was passed in the House on May 24, 2000 and passed in the Senate on September 19, 2000 — and Bill Clinton signed it into law on Oct 10, 2000. Coincidentally (or not), that was also the very same year that the U.S. labor force participation rate hit its last historical all-time high — and it has been in decline ever since.

Just one year prior to Bill Clinton giving PNTR to China, an economist by the name of Robert E. Scott at the Economic Policy Institute had given testimony before a congressional committee on international economic policy and trade. (He had even used the term "income inequality" back then.)

Scott's testimony (warning) was given a little over fifteen years ago on July 22, 1999 — but his dire warnings, as well as those by many others at the time, has since gone completely ignored by our elected representatives — including our current President regarding the proposed TPP trade agreement. One only has to look at the chart below and ask: Why have our government leaders been leading our nation down this path of economic ruin and decline? Was it solely for the purpose of enriching a few executives at huge multinational corporations? What other reason can there possibly be?

Every picture tells a story ... some, very disheartening.

In an historical sense, it's very interesting (and also very sad) to read about the early warnings from 16 years ago when compared to the results we have today in 2015. While reading Robert Scott's testimony from 1999 (below), think of our current state of the affairs regarding jobs, wages, manufacturing, the debt and the trade deficit. His words were almost prophetic:

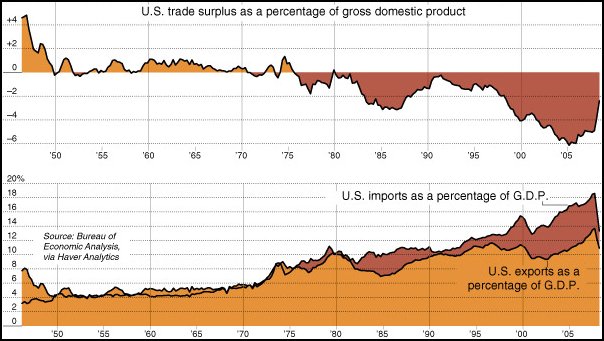

"In the 1950s and 1960s, the U.S. was the world’s leading export powerhouse. The Marshall plan helped provided the capital needed to rebuild Europe and Japan, and fueled a tremendous demand for U.S. exports. During this period, the U.S. ran a substantial trade surplus, of about one percent of Gross Domestic Product. The U.S. also benefited initially from strong export demand in a wide range of industries, from low-tech textiles and apparel to sophisticated aircraft and machine tools.

Since the 1970s the U.S. moved from a trade surplus to a deficit position, as Europe and Japan began to compete effectively with the U.S. in a range of industries. There are many ways in which trade has injured U.S. workers since then. First, deterioration in the trade balance (the difference between exports, which create jobs, and imports, which eliminate domestic employment) has reduced employment, especially in manufacturing and other industries producing traded goods.

The trade surplus of the 1960s was transformed into a deficit that reached 2.9% of GDP in 1998. This deficit will grow rapidly in the future as a result of the continuing global financial crisis. Although financial markets are beginning to recover throughout the world, the real economies of many developing countries and Japan remain mired in recessions. For example, reliable private sector reports show that unemployment in Sao Paulo, Brazil currently exceeds 20%.

The growth in the trade deficit over the past two decades has destroyed millions of high-wage, high skilled manufacturing jobs in the U.S., and pushed workers into other sectors where wages are lower, such as restaurants and health service industries. When I appeared before this committee last spring, I summarized EPI forecasts that the Asia Crisis would lead to the elimination of one million jobs in the U.S., with most of the losses concentrated in the manufacturing sectors of the economy. These job losses have begun to materialize, despite the continuing boom in the rest of the economy. The U.S. has lost nearly 500,000 manufacturing jobs since March of 1998, due to the impact of the rising trade deficit.

The IMF recently forecast that the U.S. current account deficit (the broadest measure of the trade balance) would reach nearly $300 billion in 1999, exceeding 3.5 percent of GDP for the first time in the post-war era. The U.S. can expect to lose another 400,000 to 500,000 manufacturing jobs as a result, even if the economy continues to expand at its current pace in 1999.

Trade deficits also have a direct impact on wages, especially for non-college educated workers, who make up three-quarters of the U.S. labor force. The average real wage for U.S. production workers peaked in 1978, declining more or less steadily through 1996. Real wages have begun to increase in the past 3 years. However, the small upturn increased real wages by only 4.5%, not nearly enough to offset a decline of more than 11% since the 1978, nor to return workers to the path of steadily rising wages they experienced from 1950 through 1973.

What is responsible for the decline in U.S. wages? Trade is certainly one of the most significant causes, because it hurts workers in several ways. First, the steady growth in our trade deficits over the past two decades has eliminated millions of U.S. manufacturing jobs. As we showed in another recent EPI report, trade eliminated 2.4 million jobs in the U.S between 1979 and 1994. Growing trade deficits eliminate good jobs and reduce average wages in the economy. Since then, many more jobs have been lost to NAFTA and other sources of our trade problems, including China, and recently, Europe.

The second way in which trade depresses wages is through the growth in imports from low wage countries. If the prices of these products fall, it puts downward pressure on prices in the U.S. Domestic firms are forced to cut wages or otherwise reduce their own labor costs in response. A third way in which globalization depresses wages is through foreign direct investment. When U.S. firms move plants to low wage countries, as they have done at an increasing rate in recent years, it has a chilling affect on the labor market. The mere threat of plant closure is often sufficient to extract wage cuts from workers. This tactic has also been used with increasing frequency in the 1990s and is effective even when plants don’t move.

Most economists now acknowledge that trade is responsible for 20 to 25 percent of the increase in income inequality which has occurred in the U.S. over the past two decades. However, existing research can only explain about half of the change in income inequality. Therefore, trade is responsible for about 40% of the explainable share of increased income inequality. The rest is due to forces such as declining unionization, and inflation-induced erosion in the value of the minimum wage.

There are many causes of the steady growth in U.S. trade deficits. These include non-tariff barriers to U.S. exports in a number of key foreign markets, and export-led growth strategies in many countries that target American markets because they are the largest and are more open than many others. Macroeconomic factors such as the over-valuation of the U.S. dollar and slow growth abroad have also played important roles in the 1990s, and especially in the past few years. Perhaps most important is a pattern of neglect of the American industrial structure by the federal government.

Important insights into the roles played by each of these factors can be gained by recognizing that the vast majority of the U.S. trade deficit is explained by extremely unbalanced trading relationships that exist with a few key countries, and in a limited number of critical industries. U.S. trade imbalances are concentrated in a few regions of the world.

The vast majority (about three fourths) of our trade deficit in manufactured goods is caused by imbalanced trade flows with Asia. The deficits with Asia are large and rapidly growing, despite very high rates of growth in the region until 1997. Europe and NAFTA were each responsible for about 13% of the deficit in 1998. The U.S. ran a small surplus with the other countries in the Western Hemisphere, and with the rest of the world, in this period . . .

The U.S. has a small but rapidly growing trade deficit with ASEAN, the Association of Southeast Asian Nations. The broader APEC group, which includes Japan, Canada, Mexico and 17 other countries along the Pacific Rim, was responsible for 87% of the overall U.S. deficit in manufactured goods in 1997. [ASEAN states — Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam.]

* Editor's Note: When wages went up in China, some companies moved production to other lower-wage places like Cambodia. Virgil Bierschwale at the website Keep America at Work relates this to a game of Musical Chairs, where American workers (and others) are left standing when the music stops.

The ten Big Emerging Markets (BEMs), made famous by former Commerce Undersecretary Jeffrey Garten, had some of the most rapidly growing trade deficits (21.9 percent per year), second only to ASEAN (22.5 percent). The ten BEM countries were responsible for about half of the U.S. trade deficit in 1998. [The Big Ten: Mexico, Brazil, Argentina, South Africa, Turkey, Poland, South Korea, Indonesia, China and India.]

Only ten countries were responsible for the entire U.S. trade deficit in 1998 — Japan, China and Germany had a combined deficit of $144 billion with the U.S. in 1998, nearly two-thirds of the total deficit in goods trade of $229 billion.

The U.S. trade deficit through May 1999 has increased by more than one-third over the same period last year. The deficit with the NAFTA countries has more than doubled over 1998, reflecting the impacts of the decline in the value of the Canadian dollar and the peso last year and the rapid growth of foreign investment in Maquiladora production facilities in Mexico. The U.S. deficit with Western Europe is also on pace to increase by nearly two-thirds in 1999, reflecting the continuing slowdown in that region, combined with EU trade barriers. Trade deficits have also increased with many countries in Asia, though not as rapidly as with NAFTA and Europe.

Some claim that the U.S. benefits from exporting “high-value added" goods such as aircraft and computers, while importing low-tech goods such as apparel, footwear and toys. The truth about U.S. trade patterns is more complicated. The industry with the largest U.S. trade deficit is crude oil and natural gas, which is not surprising since the U.S. now imports about half of its petroleum. However, the next largest deficit is in motor vehicles and parts, which are not low-technology industries by most measures. Motor vehicle trade is also responsible for more than half of the U.S. trade deficit with Japan, two-thirds of the deficit with Canada and essentially the entire bilateral deficit with Mexico.

Other high-technology and/or high-wage industries that also generated top trade deficits included Computers and office machines and parts, steel, blast furnace products, TVs, radios and other electronic equipment. Only three of the top eight trade deficit sectors are what economists traditionally consider to be low-technology products (apparel, leather products, toys and sporting goods). If the deficit in those eight industries could be eliminated, then the trade deficit could be converted into a surplus. [Editor's Note: Notice how computers and smartphones weren't even mentioned back then (e.g. Microsoft, Apple, etc.)]

The dependence of the U.S. on commodity exports and the steady erosion of output and employment in high-wage, high technologies industries are stark indicators of the failure of U.S. trade and industrial policies to nurture and sustain U.S. international competitiveness. Other countries have prospered at the expense of the U.S."

Yes --- other countries have prospered at the expense of American workers.

Shanghai, China - 1987 and 2013

Remember, Robert E. Scott's testimony was from 1999! And other than the dates and numbers he uses (and with a little tweaking), this testimony could have been given today if it were being used in a presentation opposing Obama's fast tracking the proposed TPP trade agreement.

But yet, even after being presented with overwhelming evidence to the contrary, President Obama still insists the TPP and TTIP trade agreements would be different than prior trade agreements. Right. And how did Albert Einstein define insanity? Did our President lose his marbles? Or did he just change his opinion about American workers since being a community organizer — and after first being elected POTUS in 2008? Since Obama can't run for a third term, we can suppose he can drop his more "populist" rhetoric and now show his true colors — a crony capitalist. And in sheer desperation, the White House has even gone so far as to falsely claim that polls show Democratic support for TPP.

Maybe we should change "taxation" to "trade" on the DC license plates.

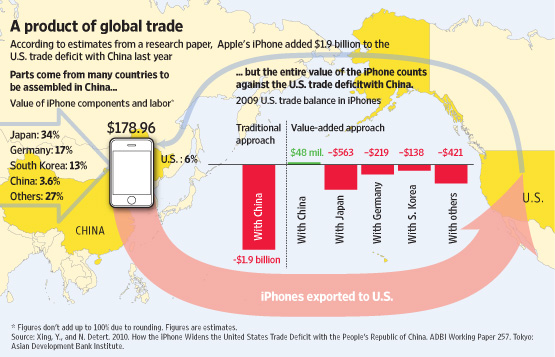

NAFTA was bad. PNTR with China was worse. And TPP would be the ultimate trade disaster (not to mention, TTIP with Europe). As it is now, it's very difficult to "Buy American" (Made in the U.S.A.) when so many of the things we rely upon these days are produced overseas — it requires a Herculean effort — even when using a "Buy American" iPhone app. Sometimes, even though the final stage of production or assembly (or value added*) could be attributed to U.S. workers in some cases, the majority of the items used in the overall production (including raw materials) could originate from somewhere else offshore.

One example is the tax dodger known as Apple.

* VOX (2011): "Could the iPhone be assembled in the US? It is not the competition but profit maximisation that drives the iPhone’ s assembly to China ... An interesting hypothetical scenario is one where Apple had all iPhones assembled in the US. Assuming that the wage of American workers is ten times as high as those of their Chinese counterparts, the total assembly cost would rise to $68 and total manufacturing cost would be pushed to approximately $240. Selling iPhones assembled by American workers at $500 per unit would still leave a 50% profit margin for Apple. In this hypothetical scenario, the iPhone could contribute to US exports and reduce the US trade deficit, not only with China, but also with the rest of world. More importantly, Apple would create jobs for US low-skilled workers ... Employing American workers to assemble iPhones may be an effective way to practice corporate social responsibility ... The value added created by Chinese workers accounts for only a small portion of a ready-to-use iPhone, so current trade statistics greatly inflate the value of China’s iPhone export to the US as well as the corresponding trade imbalance. Given this, the renminbi’s appreciation would have little impact on the global demand of the products simply assembled in China."

Since passing PNTR with China, there have been three attempts to repeal that legislation. Once was in 2005 when then-Representative Bernie Sanders of Vermont (now Senator Sanders, who is currently running for President in 2016) and sixty one co-sponsors introduced a legislation that would repeal PNTR with China. Sanders said on the floor of the House of Representatives, “Anyone who takes an objective look at our trade policy with China must conclude that is an absolute failure and needs to be fundamentally overhauled.” Bernie had noted how the U.S. trade deficit had increased and the number of American jobs being lost to our overseas "competitors". But who is America competing against? And for what? Are we trying to win a race to the bottom?

And unlike most of our current political candidates, Senator Sanders has always stood firm behind American workers. And it's not just trade policies, but also tax laws and a long list of other issues as well. Just as it was back in 1994 (NAFTA) and 2000 (PNTR with China), it's apparent that most of our elected officials in 2015 still don't represent the THE PEOPLE'S interest, but only those of the top 0.01%.

The day the music dies (when this "game" of Musical Chairs finally comes to an end), will someone please turn off the lights and lock all the doors after America becomes the next "emerging market"?

* Editor's Note: The full testimony given by Robert E. Scott before the congressional committee was edited (but not changed) for length for this post, but the complete text is here at the Economic Policy Institute with more details, graphs, policy recommendations and end notes. It was first posted at VIEWPOINTS on August 13, 1999 — then reposted on March 4, 2002 at the EPI.

Comments

We won't be fooled again!

@ Bloomberg (by Noah Smith) — Those who said we were wrong in 1999, are now admitting that they wrong then — but yet, are again saying we are wrong now. Haaaaaaaaaaaaaaaaaaa!!!!

"Warren and the anti-TPP movement are doing more harm than good ... The TPP is different. It’s mostly about trade with Japan and South Korea ... rich countries, with tons of capital and very high labor costs. The second reason TPP isn't like past trade deals is the intellectual property protection ... There is one type of activity that is very hard for U.S. companies to send offshore: innovation. Stronger international IP protection will help U.S. companies export more, which makes them hire more American workers, which increases the amount that those workers spend on the local economy. Yes, there are many problems with the U.S.’s intellectual property laws. But international harmonization of IP wouldn't exacerbate these problems ... So Elizabeth Warren and the populist Democrats have good intentions, but they’re attacking the wrong enemy. Globalization was a Pandora’s Box in 2000, when it was all about China. But we already opened Pandora’s Box. The monsters have already escaped, and the Democratic populists are 15 years too late. Now all they're doing is increasing the odds of scuttling a useful deal."

http://www.bloombergview.com/articles/2015-05-14/elizabeth-warren-s-trad...

Free Traitors

Here are the 13 Democrats who voted to advance fast track for Obama and the GOP:

1) Ron Wyden (D-OR) Also voted for the NAFTA and CAFTA.

2) Bill Nelson (D-FL) Also voted for the CAFTA .

3) Maria Cantwell (D-WA) Also voted for CAFTA.

4) Patty Murray (D-WA) Voted to double the number of H-1B visas.

5) Dianne Feinstein (D-CA)

6) Claire McCaskill (D-MO)

7) Heidi Heitkamp (D-ND)

8) Michael Bennet (D-CO)

9) Jeanne Shaheen (D-NH)

10) Tom Carper (D-DE)

11) Chris Coons (D-DE)

12) Tim Kaine (D-VA)

13) Mark Warner (D-VA)

Elizabeth Warren's report on TPP

"Broken Promises: Decades of Failure to Enforce Labor Standards in Free Trade Agreements"

(13 page report prepared by the Staff of Sen. Elizabeth Warren)

http://big.assets.huffingtonpost.com/WarrenReport.pdf

The Hill: "The Left presses Clinton to choose sides on Obama's trade pact"

http://thehill.com/homenews/campaign/242206-left-presses-clinton-to-choo...

(* We've already known for years how Senator Bernie Sanders feels.)

Senators move TPP to favor Boeing

On a vote of 62 to 38, the measure for fast-track authority received just enough Democratic support to keep it moving ... About 10 Democrats — who wavered over the legislation last week — issued a demand that congressional GOP leaders assure them that they would approve an extension of the federally backed Export-Import Bank that helps U.S. corporations sell their goods abroad. Many conservatives, particularly in the House, oppose renewing the charter of the bank because they consider it a form of corporate welfare that favors large, well-connected businesses, particularly Boeing [the job offshorer, the union buster and tax dodger] ... the lawmakers reached a deal on the Export-Import Bank that tipped the scales for Patty Murray (D) and Maria Cantwell (D), senators from Washington state, which relies on the thousands of jobs at Boeing plants that are tied to Export-Import Bank loans. Senior officials for Boeing — the largest recipient of Export-Import loans and a supporter of the trade deal — sat in a reception room just off the Senate floor during the cliffhanger. Also, the Washington state Democrats have a Republican ally, Sen. Lindsey O. Graham (S.C.), who is one of the few 2016 presidential contenders supporting the bank. All three senators represent states where Boeing is a major employer.

http://www.washingtonpost.com/politics/senate-votes-to-give-obama-fast-t...