New Orders in Durable Goods dropped 3.3% for October 2010, but last month's 3.3% increase was revised up to 5%. New orders has declined 3 of the past 5 months. New orders in non-defense capital goods decreased -4.5%. Core capital goods new orders also fell -4.5%.

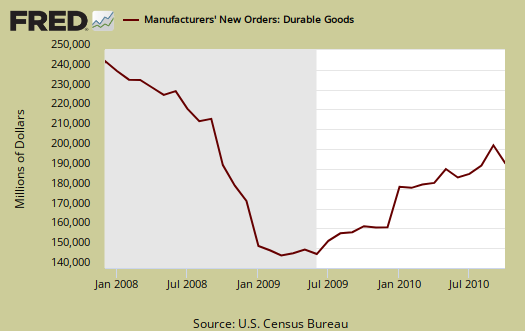

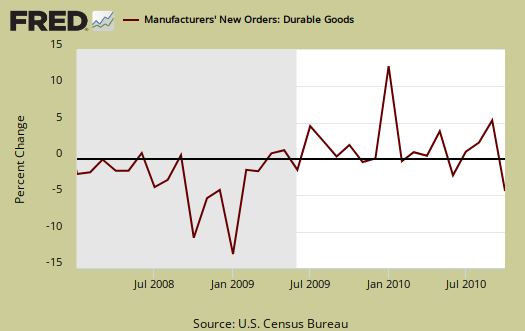

While major press declare this is the worst decline since January 2009 (and it is), let's take this decline in context. Below is the percentage change in durable goods since January 2008.

Compare to the above graph in terms of raw new orders. As one can see this isn't the end of the world yet. It's not good, no doubt, but the headlines are a little misleading for clearly new orders are not where they were in January 2009. Also, last month was revised to a blow out 5.0% increase in new orders. Only from lofty heights can one fall so low.

For a change, the report data is not really about volatile Aircraft & parts, so this time folks cannot just blame air-o-planes. Non-defense Aircraft, new orders were only down -4.4% while defense aircraft was down -25.1%. Transportation new orders alone decreased -5.2% in October.

Excluding transportation, new orders decreased 2.7 percent. Excluding defense, new orders decreased 2.1 percent.

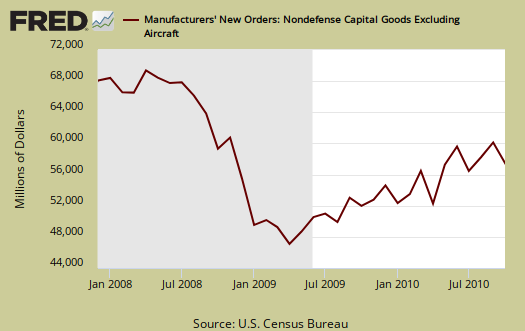

Core capital goods are a leading indicator of future economic growth. It's all of the stuff used to make other stuff, kind of an future investment in the business meter. Core capital goods excludes defense and all aircraft. New orders are down -4.5%. Shipments are down -1.5%. Two things to note, core capital goods has not recovered to 2007 levels but this month's dramatic decline is not good news. If you wish to have a economic sky is falling freak out, this is the number to use.

Inventories, which also contributes to GDP, were up +0.4% in October 2010 for manufactured durable goods with non-defense inventories up +0.4%, but excluding transportation, inventories increased +0.5%. Unfilled orders were up 0.7%.

Shipments, which contributes to the investment component of GDP, is down -0.9% in October. Machinery dropped -3.6%. Non-defense capital goods shipments decreased -0.6%. In core capital goods, shipments dropped -1.5%, not good as an approximation and indicator on Q4 2010 GDP growth.

There is a lot of confusion about precisely which shipment metric is a good approximation for the investment component of GDP. It is the total which gives a better feel. The reason? While core capital goods shipment is a good approximation for part of the investment GDP calculation, it sure isn't all.

Producer's Durable Equipment (PDE) is part of the GDP investment metric, the I in GDP or nonresidential fixed investment. It is not all, but part of the total investment categories for GDP, usually contributing about 50% to the total investment metric (except recently where inventories have been the dominant factor).

Producer's Durable Equipment (PDE) is about 75%, or 3/4th of the durable goods core capital goods shipments, used as an approximation. Therefore, we see some bad news here with a -1.5% decrease in core capital goods shipments, to guesstimate PDE, which is part of the GDP investment component. Yet 37.5% is not 100%. Airplanes and autos are also included in PDE.

September Durable Goods new orders was revised down up, to +5.0%, with core capital goods new orders for September being a 1.9% increase.

What is a durable good? It's stuff manufactured that's supposed to last at least 3 years. Yeah, right, laptops.

Recent comments