Yes, the rich pay more in taxes (because they earn so much more) — but they don't usually pay more as a percentage of their incomes.

According to a new report from the Institute on Taxation and Economic Policy, in nearly every state, low- and middle-income families pay a bigger share of their income in state and local taxes than wealthy families. Patricia Cohen wrote in her very detailed and comprehensive article at the New York Times: "When it comes to the taxes closest to home, the less you earn, the harder you’re hit."

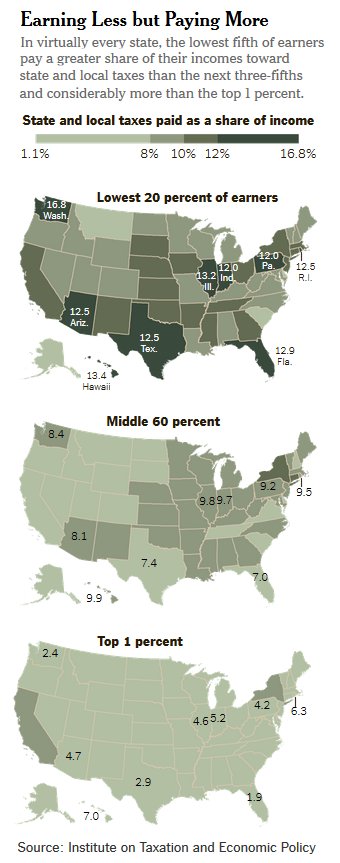

According to the study, in 2015 the poorest fifth of Americans will pay on average 10.9 percent of their income in state and local taxes, the middle fifth will pay 9.4 percent and the top 1 percent will average 5.4 percent.

In Bill Gate's great State of Washington, the tax system is the most regressive — where the bottom 20 percent of taxpayers pay 16.8 percent of their income in taxes, while the top 1 percent pay just 2.4 percent.

* Not to mention, when it comes to federal income tax, Bill Gate's capital gains are taxed at a lower rate than regular wages for people earning over $36,000 a year. Add to that, those wage earners also pay Social Security taxes on 100% of their earnings up to $118,500 (and 95% of all wage earners make less than this) — whereas, there is no Social Security taxes for billionaires, whose only income is usually from capital gains. And finally: billionaires pay cash for homes and other big-ticket items, so they don't have to pay annual interest on 30-year mortgages and 5-year auto loans.

A number of states, including Kansas, have made the situation worse in recent years by cutting income taxes, the only major state revenue source typically based on ability to pay. Income tax cuts thus tend to push more of the cost of paying for schools and other public services to the middle class and poor — exactly the opposite of what is needed.

Think Progress: "To pay for his failed experiment with trickle-down economics, Kansas Governor could raid the school budget."

The billionaire brothers Charles and David Koch recently presented a policy wish-list at a press conference:

1) A balanced budget (which of course would mean, cutting the safety net for working Americans — but not raising taxes on billionaires.)

2) Repealing the inheritance tax (they call it a "death tax", although, dead people don't pay taxes — "only the little people pay taxes.")

3) Allow the tax-free repatriation of trillions of dollars in U.S. profits earned overseas (made from offshoring U.S. jobs to foreign low-wage countries.)

Most American voters (from liberals to conservatives) want a fairer tax code, but neither the trolling Democrats nor the cruel Republicans will ever do anything to change it. Our tax code has been rigged for the very rich ever since the first Gilded Age.

Obama had the White House and the Democrats controlled both the House and the Senate for two years in 2009 and 2010, but they did NOTHING to reform the tax code or to shore up Social Security. Obamacare was two little, too late — when what we really needed was something similar to a "single-payer" healthcare system. A new study has put a price tag on how much more the United States pays in health care costs because it has chosen not to adopt a single-payer system: $375 billion annually.

But ever since the Occupy Wall Street movement, on many issues that the Progressives always advocated, the Moderate / Blue Dog / Third Way Democrats have only been “talking the talk, but not walking the walk.”

Now that the GOP controls both the House and Senate, many Democrats can now pretend they care about the American working-class, and then blame the GOP for all their short-comings. And of course, we still have those 29 Dems who just voted to gut Dodd-Frank — and then there were those 6 Dems who also voted against raising the minimum wage.

As usual, the rich will get richer as the poor get poorer. It seems nothing will ever change, no matter who is in charge.

Comments

Which Party Is Better for the Economy?

Which Party Is Better for the Economy? (by state)

Both, in terms of highest median household income and lowest levels of poverty, guess which states fair better -- Red States or Blue States? I think you already know the answer.

http://angrybearblog.com/2015/01/which-party-is-better-for-the-economy-b...

taxes

10% flat tax for everyone - no deductions (maybe $1500 exemption for person and dependents),

very regresssive, more give to the rich, take from the poor

A flat tax gives more to the rich and takes from the poor. The super rich came up with this absurdity to make sure the rich do not pay hardly any taxes and instead they are dumped onto the poor.

Correlation and Causation...

I went to the attached link, and it showed a loose correlation between economic well being and living in a state which typically (or in the last election cycle - not clear which) votes for one party or the other.

That is interesting, but it doesn't answer the question as to which is the cause, and which is the effect, or even if a causal relationship exists.

For example, if you plot the number of murders in a community vs the number of MD's in a community, you see a strong correlation. The more doctors, the more murders.

In that case, there is no actual cause and effect relationship. Murders happen where there are lots of people, and Doctors congregate where there are lots of people. Even on a per capita basis, the correlation remains, as murders are predominantly an urban phenomenon, and MDs tend to disproportionally congregate in urban areas also.

Teasing out cause and effect from the data in the linked article would be rather difficult.

One of the problems is that the Republican party seems to be the uneasy abode of the social conservatives. And for many, this is the main concern which determines their political affiliation. In that regard, they attract a lot of Christians, who are (according to 1 Corinthians 1:27-28) the foolish, weak, and base things of this world. The idea is not that they are stupid, necessarily, but that they are the losers, misfits, and wannabes.

So where you have these people, regardless of policy, if the Bible is true, you will have social conservatives and low incomes.

While the Republican leadership views this constituency with a mixture of loathing and contempt, they recognize their importance. If the social conservatives all stay home, all of the red states would turn blue.

So getting back to the tax burden on the poor, it seems intuitive that if you are poor, you will pay a larger proportion of your income on (name the category) food, housing, education, health care, as that is what it means to be poor. Your entire income is consumed in meeting your expenses. You have no wealth (surplus) and no means to acquire wealth. -I was raised poor, I know how it works...

I suppose there is some income proportion paid in state and local taxes which represents basic equality. What I mean by that is, if the poor and the rich both pay these taxes in exact proportion to the benefits they receive, so they get the same value for a dollar spent. If taxation were based on that principle, the rich will obviously pay a smaller proportion of their income in state and local taxes.

For example (chosen for its relative simplicity) the property tax largely pays for elementary and secondary education. The poor, as a class, if they have as many children per capita as the rich, typically pay a good deal less for this, as their real estate is less valuable, but the cost of educating their children is the same or perhaps greater. So while the percent of income the poor pay in real estate taxes is higher than that of the rich, the value they receive per dollar spent is significantly higher. (Here we are omitting the societal benefits of an educated populace, and how the rich benefit from well educated wage-slaves, etc.)

My question is, to what extent should the tax burden on one economic group subsidize the provision of service to another?

Should (as an example) the monies paid for personal security and property security (police) be based on the value of property secured, or on the cost of providing that service? In the one case, the rich should pay much more, but in the other, significantly less.

I think it would be helpful to articulate what the desired state is.

To what extent should the rich subsidize the poor, and in what areas, and why?