President Obama gave a speech on winding down Freddie Mac and Fannie Mae, the GSEs often blamed for the housing crisis and a darling of conservative ire. Government sponsored enterprises, or GSEs buy up mortgages from private lenders and the theory is to loosen up funds to stir additional lending. Right now, GSEs have guaranteed 87% of all mortgages. Yet, the President's speech was spattered with lies, spin and blame. Here are some lowlights.

Did you know homeowners were reckless with no mention of the derivatives, those mortgage backed securities now being bought up by the Federal Reserve, that fueled the housing bubble?

Over time, responsibility too often gave way to recklessness – on the part of lenders who sold loans to people who couldn’t afford them, and buyers who knew they couldn’t afford them.

We’ve made it harder for reckless buyers to buy homes they can’t afford

Foreclosure statistics are amazingly tricky with little accuracy. Completed foreclosures estimates range from 4.5 million from January 2008 to over 20 million, counting the years of the start of the housing bubble collapse, 2006 and 2007. Right now there are 3.1 million foreclosed homes listed in police auction sites and a new book claims over 10 million families have been displaced. Regardless, blaming homeowners when jobs are low paying, non-existent, temporary and cannot pay for the rent of a cardboard box is unbelievably callous and just plain wrong. People lost their homes primarily because they lost their income and ability to earn, not because they were reckless. People were hoodwinked, lied to, given the runaround and sold a bill of goods, all the while getting their property and livelihoods sucked out right from under them.

Obama also seems to be killing the American dream of owning property entirely.

Step five: we should make sure families that don’t want to buy a home, or can’t yet afford to buy one, have a decent place to rent. In the run-up to the crisis, banks and the government too often made everyone feel like they had to own a home, even if they weren’t ready. That’s a mistake we shouldn’t repeat. Instead, let’s invest in affordable rental housing. And let’s bring together cities and states to address local barriers that drive up rent for working families

This is actually huge, the land owning class has always been more powerful and making it easier for landlords to collect rents instead of Americans being able to invest in property, their own home, is another unraveling of the promise of FDR's New Deal. Owning property is one of the great social levelers and land ownership through history has been to the ruling classes.

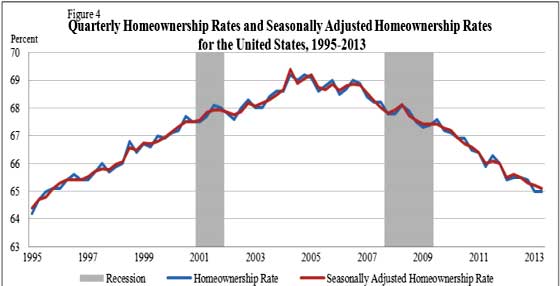

The latest Census data shows homeownership rates are down to 1995 levels, 65%. Clearly this is not the American dream. Additionally these figures imply Wall Street investors, not families are buying up the homes as of late, pushing prices higher.

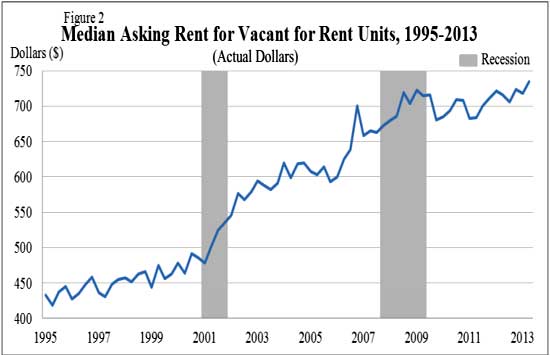

Meanwhile rents just continue to increase and with wages at $10/hr, one cannot afford by themselves even $735 a month. The median wages are so low, clearly fewer and fewer Americans can afford rent, never mind owning a home.

Yet Obama seems to promote drinking the Kool-Aid and puts the blame on the people and the GSEs, with the intent to close up shop on Fannie Mae and Freddie Mac.

That begins with winding down the companies known as Fannie Mae and Freddie Mac. For too long, these companies were allowed to make big profits buying mortgages, knowing that if their bets went bad, taxpayers would be left holding the bag. It was “heads we win, tails you lose.” And it was wrong.

This makes little sense. Currently the GSEs have record profits and Fannie Mae has paid 90% of their bail out back. Subprime fines are still coming, along with civil lawsuits over mortgage backed securities. Wall Street was the cause yet banks were enabled to become even bigger.

One of the worst things yet, Obama tries to claim immigration helps the housing market. This is a notorious false claim put out by lobbyists representing various business interests. If anyone isn't aware, the United States already has the highest legal immigration levels in the world, so obviously if immigration would balloon the housing market due to just increased demand, none of the crisis would have ever happened. Corporate lobbyists are actually after foreign guest workers. These visas are temporary, not permanent and thus people on them probably won't be signing up for 30 year mortgages. Legalization for those here illegally is projected to lower wages, not raise them. The reality is few can afford a home on even $20/hr wages, never mind $10/hr. most low skilled jobs pay, so it is highly doubtful legalizing so many unskilled workers would enable them to purchase and hang onto these now overpriced again homes. Additionally, returning to housing bubble price levels is not a good idea, not with this much income inequality, career uncertainty and repressed wages in America. This immigration lie is so extreme it is akin to the Bush administration weapons of mass destruction lie to justify invading Iraq. If anything, there is more evidence illegal immigration enabled the housing bubble from cheap labor in construction to some here unauthorized obtaining subprime loans. This has nothing to do with the government. All of this was motivated by fast greed and private unscrupulous lenders packaging up these obscene, ripoff, subprime, liar loans into derivatives, which eventually collapsed the financial system.

This all leads back to the banks of course. They were the ones buying up toxic debt in bulk and repackaging it as derivatives and they were the ones were were all for enabling liar loans and signing people onto mortgages they could not possibly afford. Additionally why were people signing up for houses they could not afford? Because housing prices were simply too damn high for the income and wage levels of most Americans.

Obama is clearly promoting privatization, which will let the banks have even more control over the housing market. It will also push up mortgage rates, forcing even less to be able to afford a home. Hedge funds have been lobbying for privatization of the GSEs and it looks like, once again, Wall Street has won.

Private capital should take a bigger role in the mortgage market.

We reproduce a comment left on this site that summed up the outrage over agenda to privatize Fannie Mae and Freddie Mac:

One of the things FDR did for us was the National Housing Act, giving us Fannie Mae, which allowed millions of people to get out from under the thumb of property owners, to have their own place, which eventually provided a foundation for the "middle class" to build wealth, something that had not been possible for the average working family until the vehicle of a house appeared. For 70 years that was a cornerstone of preparing for the time when one could not earn income any longer. Even with that, a third of all people retired with less than $10,000 in the bank, but for a hundred million people or more that one thing gave them a way to secure a chunk of money, a roof over their head, a tie to a community, and a chance not to live in poverty.

To call for the end of that is a slap in the face to the memory of the people who fought and worked so hard to bring us out of the Depression caused by the greedy bankers and capitalists, and soils the memory of FDR. If might also destroy a chance at a future without poverty for a large number of people. This would leave the middle class at the mercy of private money, the same private money that destroyed the savings and retirements for millions of Americans in the past few years. Mentioned in the speech was the 30 year mortgage, something that the creation of Fannie Mae brought us, because private money thought it too risky. Given the price of housing, and the lack of decent jobs being created, this very nearly guarantees that a hundred million people will never, ever have the tangible financial benefits that home ownership brings, and instead will cede that benefit to the Mi$$ RobMe capitalists, to to the thieving finance companies, to those who will own wealth, while the rest of us will become their gardeners and maintenance people, beholden to some landlord

Why not reform Fannie Mae and let them continue to work for the people, instead of selling us out to the banks? Fannie and Freddie didn't start this. Private capital brought us this mess, and that's a fact, Jack.

Fundamentally pushing housing prices higher is simply enabling even more wealth inequality. It pushes the lower classes out of the housing market and is almost a wealth transfer to the rich. Why would the government want to enable even more wealth inequality is the question of the decade, yet that seems to be the current agenda.

Comments

Well who expects him to blame donors? Future = temp camps

Fannie and Freddie to blame, along with Wall Street, everyone that created, packaged and sold derivatives, MBS, etc. that admitted they couldn't quantify value or risk, the govt. pensions and agencies and private buyers and sellers of these items of no value that risked everyone else's money, etc., etc. But hey, why blame them, if the donors are from this or that group, then donations buy silence or action. Anyway, I think we're set for another trillion dollar derivative collapse - bring it on because it's inevitable.

Regarding buying a house, who can or would want to? Come on, if the temp agency or Bezos or Gates or some politician wants you to work in burger franchise 3,000 miles (or 24,999 miles) to the east or west or north or south within 24 hours, best be on your way. Family? That's antiquated. Community? Antiquated. Little league? Knowing your neighbors? A vegetable patch? Wife or husband? Kids? Schools? Education worth investing in? Forget it. I don't even know how to answer where I'll be in 5 months, let alone the ridiculous, "Where do you see yourself in five years" question HR non-thinkers love. 5 years? Most likely poorer and even more locked out of any change.

If you want to work in the new USA and aren't reading a teleprompter like a politician or talking TV head, then better be able to move immediately for a minimum wage job. Otherwise, someone will label you lazy and unfit to live in the US. Doesn't it seem like we're going back a few centuries? Hmmm, so glad Glass-Steagall was revoked and NAFTA and CAFTA, etc. all came into play. It's all so much better now, right? Now, if only the Clintons or Bushes or Obamas or Gates or Dimons had to live under these conditions. But hey, why would they, Versailles has different rules. Time to eat my cake.

notice the hedge funds

I think the clue is how hedge funds are lobbying for Fannie Mae, Freddie Mac to be liquidated. Has their been anything passed that wasn't fueled by Wall street or corporate lobbyist demands?

I find lobbyists so odious, at the height of the financial crisis and they caused it, the hill was swarmed by banking lobbyists. That's astounding for at that time banks were operating on taxpayer money, so we paid for them to go lobby and screw over the American people once again.

Hedge funds? My piss gets better returns (and without the fees)

It's true. Just kidding, there's no way piss could beat the sh*t coming out of Greenwich and NYC these days. Or could it? Waste material for thought. Let me consult phone hacker-in-chief's/child murder investigation hamperer's newspaper and Forbes for the latest hedge fund returns (including their fees) - oh my, they all suck.

Regarding hedge funds, I love them because they think we're all morons that ain't got that readin', 'riting, 'rithmatic down. Excuse me, kind Sir, why should I pay you 20% of any profits and 2% of assets under management to some pudgy, lazy, douche kicking it in the Hamptons and Greenwich when I can beat that crap (even without fees) in a Vanguard index fund? Because hedge fund managers couldn't afford coke and whores without my cash? Well, good enough then, forgive my rudeness while I go broke. Oh, pensions force me to invest in that bullsh*t because my pension fund managers are also on the take? Yippee! And the DOJ and SEC and State AGs also suck it? Awesome! F IT ALL!

Lobbyists? The only question anyone with a clue needs to ask is how can someone or some group that espouses "no government" or "limited government" pour millions into the government and politicians to get the government to do (or not do) what they want. "But everyone does it, if we didn't, we'd suffer." Have you ever heard such whining? STFU, it's tragic. Wow, bold stand, real courageous, Gandhi would be proud of such heroism (probably not). Hypocrisy, idiocy, double standards, etc., etc. And I'm a product of public education - therein lies the problem. Damn you Jefferson and Paine and everyone else I read about, I needed lessons from Murdoch and Bloomberg and private corporate academies.

But I think the biggest question and issue of the day is this: when are Dimon and Corzine being released from USP Florence? Because I think the millions of people they ripped off need to have a voice. Wait, what? They never went in? They are living like the .1% still? Hmmm, I wonder, does crime really pay? And hard work and honesty and the American Dream are lies? Wow, who could have known?

They mean to have your money. All of it.

We lived through exactcly what Obama is proposing once, when the thieving banks had control, and they destroyed the economy and brought tragedy to tens of millions of people. The only place you could buy a home was from them, and then only under onerous terms of 1/2 down and the balance within 5 years. FDR created what became Fannie Mae, and for the next 40 years or so that institution became the bank of the people. By providing one of the major vehicles of middle-class savings when the banks walked away from us, it helped the middle-class of this country escape poverty and create wealth that is never possible when one can't own property. It brought them self-respect, and took them out from under the boot heel of the landlord

Around 2000 the largest banks saw their chance again, and, betraying the trust we had given them began to wring that profit from the lives of tens of millions of American families, leaving a wake of tragedy that we are still living with today, that may yet bring this great country a financial ruin that few are prepared to deal with.

And now Obama wants to hand them the keys to the kingdom. Again.

In 1548 Étienne De La Boétie wrote a document entitled "The Discourse on Voluntary Servitude" in which he observed that, because there were so many people, the tyrant only had the power the people gave up. Contrary to those who use what Congressman Allen West calls their "Weapons of Mass Distraction", the government is not the embodiment of the tyrant today. They are just water carriers for the real tyrants, the largest banks and the greediest and grasping of corporations. They have no wealth you didn't give them, and they have no power except that which you will not vote to keep.

But they will have your home, your future, and your servitude if Obama, instead of reforming and returning Fannie Mae to the reason it was created, shackles us and returns us to the bankers.

The tyrants will only have power if we give it to them.

Thank you for the article, and your work, Robert. It's important.

Proletariat here we come

Thanks for pointing out the speech. God,I will never forget those claiming Obama was this savior and me talking about "Triumph of the Will" propaganda techniques to no avail.

Kissing the Ass of the Banking Class

Last week Richmond, California initiated a plan to use eminent domain to purchase mortgages of residents who owe more than their homes are worth and refinance homeowners into new loans with lower principal and interest.

On Wednesday the FHFA issued a statement warning that it would consider legal challenges to any local or state action that sanctions the use of eminent domain to restructure loan contracts that affect FHFA's regulated entities.

http://www.huffingtonpost.com/peter-dreier/fhfas-ed-demarco-kissing-_b_3...

why not?

This is one part of Obama's proposal that makes a hell of a lot of sense. Of course it eats into the profits of the banks, refusing refinance because the home is underwater. Tisk, tisk, protect those bank profits at all costs, even though the banks ruined millions of people's lives by foreclosure and then sold the properties for pennies on the dollar (which they can use for additional reimbursements, fees and tax purposes).

The rule is the banks will always get carte blanche and the America people the shaft.

Then "Bye, and don't let the bank vault door hit you in the ass"

Their little threat reminds me of Cleavon Little when he held himself hostage in Blazing Saddles. And When he was successful his parting line was "--and they are so dumb!"

And if the FHFA and their silliness has any sway here, perhaps they (the town) are.

Instead the FHFA needs to bugger off, the homes will be taken and resold. Prices will decrease, private money will see the value, and the homeowners will be free of the Ponzi scheme our country is continuing to fund to the tune of $85 billion a month, to keep the assets of the wealthy inflated, on the backs of hungry kids, bridges that are breaking, and a trillion dollars in students loans that will wind up being paid to the thieving bankers by taxpayers. In yet another bailout.

$1 million average home price Silicon Valley

We have the executive class and even on six figure salaries people barely making rent in Silicon valley. Now you know why they demand so many foreign guest workers. They are the ones unaware they will be having to live 4 to an apartment to survive economically in the region.

Is that pathetic? Salaries that most of America think are the American dream not covering rent, never mind the idea of owning a home is long gone in that area.

disgusting!

anybody who follows this blog knows something is extremely amiss with the US economy. Again for ppl who do not know, i am an employed engineer living in connecticut, not an economist and therefore speak on behalf of the "populist" side of this blogs tittle.

basically, the way i see US economic history is this:

Founding of the country TO 1940 = plutocracy

1940 - 1980 = democratic middle class

1980 TO present = return to plutocracy

I am aware this is a gross simplification, but nonetheless i believe the overall picture is correct.

thank you

total foreclosures

a fair approximation of how many foreclosures have taken place over the recent crisis years can be made with the data from the LPS (Lender Processing Services) Mortgage Monitor; this one is for June: http://www.lpsvcs.com/LPSCorporateInformation/CommunicationCenter/DataRe...

i've captured the loan count data from page 28 of the pdf; monthly foreclosure starts are here: http://rjsigmund.files.wordpress.com/2013/08/junelpsloancountdata2.jpg

those represent the first legal action; not all are completed (ie, maybe the father in law steps in & pays it off)....but if you added the monthly totals (you'd have to extrapolate the early crisis years) and subtracted the current foreclosure inventory, you'd have something close to the total...

a rough approximation: 250 K foreclosure starts a month for 4 years = 12 milllion; another 200K a month for a year is another 2.4 million...so we have something on the order of 14.4 million foreclosure starts, minus the 1.5 million who are still in the process (notice the national average number of days that a foreclosed property has remained in the foreclosure process is now up to 860 days as of this report) leaves 12.9 million who had foreclosures started and exited the process either through a forclosure sale or by paying the overdue mortgage off...

rjs

terminology

just to clarify, a "foreclosure sale" is a euphemism for a home seizure; it's an auction where nothing is actually sold, the title is simply transferred to the bank's REO inventory..

rjs

completed foreclosures

Aren't the same thing as starts. Also Corelogic doesn't monitor all homes, it's a subset.

So we can extrapolate but this should be a hard number available and I couldn't find it.

Thanks Ritholtz for the read rec.

Thx to Barry Ritholtz over at the Big Picture for a recommended read. This story just flew by most of the financial press, but Ritholtz generally speaking has been on the ball (and why he is so widely read and followed!)

Also, Naked Capitalism has one gem of a call out read here on the Obama administration lying on the actual cases of mortgage fraud, as in inflating the numbers but up to 10x!

One more thing. The banks

One more thing. The banks with their teams of statisticians and data scientists who couldn't predict the collapse of the housing maket got rewarded, but the poor little with his with his calculator who also failed to predict it gets maligned. SMH.

Fannie Mae, Freddie Mac Billions in Losses

A new report is claiming the GSEs are not adopting a new accounting system which would show billions in losses. I haven't investigated on the truth of this, story here.

They claim the GSEs aren't writing off their losses on non-performing loans, yet obviously the GSEs are also under attack politically and the hedge funds want in on this action, as this article is about.