A number of on again, off again, stories that Russia was planning to meet with the members of the OPEC cartel to negotiate production cuts drove oil prices higher last week, but even now it's still not clear if there was any actual communication between any leaders of the countries to bring about such a meeting, or if the entire hullabaloo was just an old idea that gained a life of its own once news bureau foreign energy correspondents started asking questions of officials whose ambiguous responses fed the story as it built on itself. The proposal for an OPEC meeting with Russia had been called for by Venezuelan and Algerian officials and ignored on several occasions over the past year, but what seems to have started this week's spate of stories was a vague comment by Iraq's oil minister that "We have seen some flexibility from the brothers in Saudi and a change in tone from Russia,", that quickly turned into a plethora of articles to the effect that Russia would cooperate with OPEC in reducing oil supply in order to boost prices. Even though both Russian and OPEC officials initially denied the rumors, the articles about a planned meeting persisted, as the price of oil continued to rise in response each day. Then on Thursday, Tass reported that Russian Energy Minister Alexander Novak indicated he was ready to take part in an upcoming meeting of the OPEC and non-OPEC producers in February, and the price of Brent crude spiked to over $35 a barrel in Europe. But at the same time OPEC delegates denied there was any talk of a meeting with Russia, and Iran went a step further by insisting that they wouldn't consider a deal until their exports rose 1.5 million barrels per day above current levels (recall last week that Iran's new output is not expect to reach 600 thousand bpd until June). Furthermore, everyone knew the Saudis wouldn't cut their production to benefit Iran, since they broke off diplomatic relations with Iran after their embassy was burnt earlier this month, so by the end of the week serious talk of such a deal had pretty much vaporized.

At any rate, that entire sequence of Russia/OPEC news stories never seemed quite kosher to me as it was crossing my feeds this week. Here's why: it was already known by most players in the energy markets that oil shorts were at a all time high at the beginning of the week. "Oil shorts" are those who've entered into a futures contract to sell oil that they don't own; their hope is that the price would fall further, and they'd be able to buy oil at a lower price at some time in the future to meet their original contract, and hence make a profit. Since they're putting a very small percentage down when they enter into such contracts, small price moves against them mean the exchange will demand an additional payment to cover their paper, or should we say electronic, losses, and keep them in the black. If prices rise enough, many of those short sellers typically wouldn't have the funds available to cover their theoretical losses, and they are thus forced to closed out their contract by buying oil back at a now higher price, at a loss to them, which adds to the oil buying and thus drives the price for oil up even more, forcing even more shorts to sell. That's what's called a short squeeze, and what i saw happening this week with the price of oil had all the earmarks of it. With a story like that of a Russian OPEC cartel that drives a large price change was put out on the wires, and continued to be repeated and distributed even though it's been officially denied, it certainly seemed like someone was trying to manipulate the price. The Russian energy minister only chimed in later, when he saw the rumor was moving the price higher. With oil trading of WTI at NYMEX running above 1.2 million 1000 barrel oil contracts each day this week and trading of Brent contracts in London probably even higher, there was a lot of money to be made every day for every $1 per barrel price change. We would not be surprised to hear that Russian oil traders in Europe were among those who profited the most...

New Record High Supplies of Crude Oil and Gasoline

In news that is far less dubious and has more immediate relevance, this week's stats from the US Energy Information Administration showed that our supplies of crude oil and gasoline in storage have both risen to the highest levels on record, even as our oil imports remain well above last year's level. This week's report showed that our imports of crude oil fell by 170,000 barrels per day to average 7,609,000 barrels per day during the week ending January 22nd, down from the 7,779,000 barrels per day import pace of the prior week. While that was 2.5% more than our 7,422,000 barrel per day of imports during the week ending January 23rd a year ago, oil imports are notoriously volatile week to week as 2 million barrel VLCC tankers arrive and are offloaded irregularly, so the EIA's weekly Petroleum Status Report (62 pp pdf) reports imports as a 4 week moving average. That EIA report showed the 4 week average of our imports remained at the 7.8 million barrel per day level, which was 7.2% above the same four-week period last year.

Production of crude oil from US wells, meanwhile, slipped for the first time in 7 weeks, but still remained above the levels of this past fall. Our field production of crude oil fell from 9,235,000 barrels per day during the week ending January 15th to 9,221,000 barrels per day during the week ending January 22nd, which except for the past two weeks, was still at a level higher than any week since August. Our field production for January has averaged about 9,228,000 barrels per day to date, which is roughly 100,000 barrels per day more than our average production during September and October, and remains 3.8% above the 9,197,000 barrels per day that was being produced in the same 3 week period a year ago, despite a 70% drop in active oil drilling rigs from the peak of October 2014 since then.

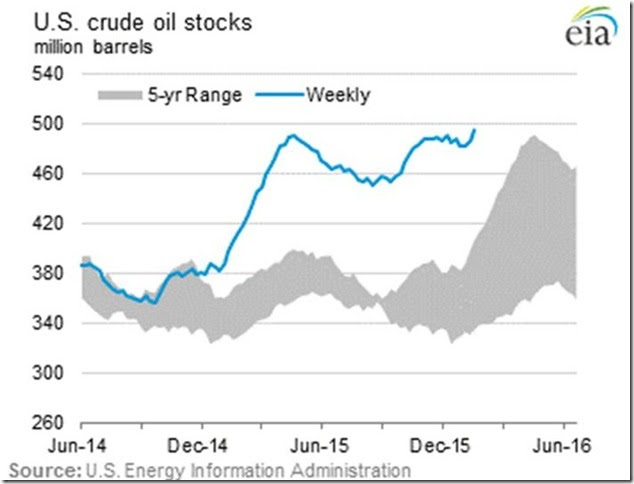

However, our refineries used 551,000 barrels per day less crude than they did last week, which meant there were 8,383,000 barrels more of surplus oil left unused at the end of the week; as a result, our stocks of crude oil in storage, not counting what's in the government's Strategic Petroleum Reserve, rose by that 8,383,000 barrels to end the week at 494,920,000 barrels, which was up 21.7% from the record inventory of 406,727,000 barrels in storage the same week a year ago, and the most oil we've ever had stored in the 80 years of EIA record keeping. We'll include a graphic of that here so you can all see what that looks like:

In the graph above, copied from “This Week in Petroleum” from the EIA, the blue line shows the recent track of US oil inventories over the period from June 2014 to January 22, 2016, while the grey shaded area represents the range of US oil inventories as reported weekly by the EIA over the prior 5 years for any given time of year, essentially showing us the normal range of US oil inventories as they fluctuate from season to season. We can see that crude oil inventories typically fall through the summer, when refineries are running flat out, just as they did this year, but we're now heading into the winter period when oil refineries cut back operations and oil inventories rise. Note that the large grey wedge on the right now includes the record oil inventories that were being set last year at this time (ie, it includes the image of the early 2015 inventories) which we are now exceeding by more 20% each week. Hence our oil inventories are now exceeding last year's records by an unheard of margin, just as the 2015 global temperature record exceeded the 2014 global temperature record by an unheard of margin.

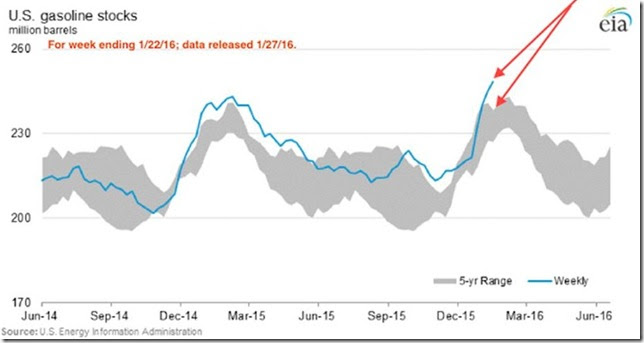

As noted, the amount crude used by our refineries fell by 551,000 barrels per day to an average of 15,639,000 barrels per day during the week ending January 22nd, as the US refinery utilization rate fell to 87.4%, down from 90.6% last week and down from a utilization rate as high as 94.5% at the end of November, as they're in a normal seasonal slowdown. Respective figures for a year ago were 15,256,000 barrels of oil refined and an 88.0% utilization rate. Hence, refinery production of gasoline fell a bit, from 9,453,000 barrels per day during week ending January 15th to 9,377,000 barrels per day during week ending January 22nd, which was still 200,000 barrels per day more gasoline than was produced the same week last year. At the same time, refinery production of distillate fuels (diesel fuel and heat oil) decreased by 100,000 barrels per day from the week ending the 15th to 4,452,000 barrels per day during the week ending January 22nd. For gasoline, that production was again more than we could use or export, and hence our end of the week gasoline in storage rose by 3,464,000 barrels to 248,461,000 barrels, which was the most gasoline we've had stored at the end of any week at any time of year in the 25 years of EIA weekly records, which once again merits posting a chart of our gasoline supplies:

The above graph was originally from this week’s weekly Petroleum Status Report (62 pp pdf), but the screen grab of it we're using here was taken from Reuters oil analyst Jack Kemp because the red arrows he included are instructionaL. Like the crude oil stocks graph above, the blue line on this graph shows the recent track of our gasoline inventories over the period from June 2014 to January 22, 2016, while the grey shaded area represents the range of our gasoline supplies as reported weekly by the EIA over the prior 5 years, showing us the normal range of gasoline inventories as they fluctuate from season to season. The red arrows point to the current week's inventories and the previous record gasoline supply for this week, which was set on January 23, 2015, again giving us a clear picture of how much we beat the old record by; last January 23rd’s gasoline inventory record was 238,335,000 barrels, so we’ve just beat that record by more than 10 million barrels. You can also see that we can expect gasoline inventories to increase seasonally at least until March, when refineries will begin winding down for maintenance and to switch over to produce summer blends of gasoline.

Inventories of other refined products are also above normal for this time of year. With the cold weather, our distillate fuel inventories fell for the 2nd week in a row, dropping by 4,057,000 barrels to 160,472,000 barrels, down 3.1% from the 5 year record high 165,554,000 barrels we had stored on January 8th, which came after a warm December when heat oil consumption was minimal. Hence we still have 20.9% more distillate fuels stored than the 132,687,000 barrels of distillates we had stored on January 23rd of last year, leaving current distillate fuel supplies still near the upper limit of the average range for this time of year. Quickly running through other major refinery products, supplies of kerosene-type jet fuel were at 41,828,000 barrels as of January 22nd, also near the upper limit of the average range for this time of year. Supplies of residual fuel oils, which are used to power ships and large boilers, were at 160,472,000 barrels, not a record but the highest since January 2011. And supplies of propane/propylene were at 83,695,000 barrels, down almost 15% since Christmas, but still well above the average range for this time of year.. The point is that not only do we have record supplies of crude oil and gasoline, but also have a glut of all the other products refined from crude, suggesting that US refineries will ultimately be force to slow down before they're buried in their own output.

Why Gasoline Demand is Down

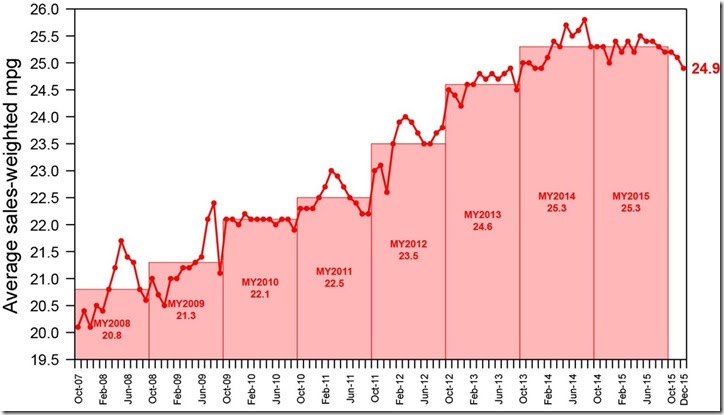

Over the past several weeks i've been puzzling over stats and charts that showed that our gasoline consumption has been down considerably since the fall, and that it has now even fallen to below the level of last year for the last 4 weeks. Those reports from the EIA did not seem to jive with reports from US automakers that 3 out of 4 new passenger vehicles they've been selling have been gas guzzlers built on a truck frame, and reports from the Department of Transportation which showed that vehicle miles driven in the US surged 4.3% to a new record in November. This week i realized that what i have been failing to take into account was the fact that the new SUVs and pickup trucks being bought today are essentially replacing vehicles that are 15 or 20 years old that were getting much poorer gas mileage, so i went looking for the stats on that. It seems that even the government refers to data compiled by the Transportation Research Institute at the University of Michigan, and i found a really neat graphic at their website which gives us an excellent picture of what is happening with fuel-economy in the US light vehicle fleet, which i'm including below...

The above graph shows the average gas mileage for all the cars sold each month since October 2007, divided into mileage years that begin on each October 1st. Wwe can see that the average gas mileage of cars sold in the US hit a peak at nearly 26 miles per gallon in July of 2014, a month after oil peaked at $107 a barrel and 3 months before the infamous OPEC meeting which crashed the price of oil, and it's been falling in an irregular fashion since, as Americans have been buying a greater percentage of SUVs and pickup trucks as passenger vehicles. We can see on the graph that as of December, new vehicles being purchased were still averaging 24.9 miles per gallon of gasoline, despite the fact that more than half of them were built on a truck frame. But the majority of cars that were being junked at the same time were likely sold well before the 2008 model year, and hence were getting less than 20 miles per gallon. So for the present, every new gas guzzler being bought is an improvement in gasoline consumption on the old cars heading for the junkyard, to the extent that we could eventually see a 20% reduction in gasoline consumption per mile driven as the entire fleet turns over. However, the current deterioration in average gas mileage for new vehicles is set to continue for some time, because current CAFE standards favor even heavier, larger pickups and are not due to be changed until the 2022 model year...

This Week's Rig Counts

Lower prices continued to drive more drillers to the sidelines during the week ending January 29th as the total number of active drilling rigs deployed in the US fell for the 6th week in a row. Baker Hughes reported that the total active rig count fell by 18 to 619, as the count of active oil rigs fell by 12 to 498 while the count of active gas rigs fell by 6 to 121...those totals were down from 1223 oil rigs, 319 gas rigs and 1 miscellaneous rig that were actively drilling as of the last weekend of January a year ago, and by that time the rig count had already fallen from the peaks in the prior October and November. Oil rigs had hit their fracking era high at 1609 working rigs on October 10, 2014, while the recent high for gas drilling rigs was the 356 rigs that were deployed on November 11th of that same year

One platform in the Gulf of Mexico was idled this week, after three were set up & started drilling there last week, which left the active Gulf rig count at 28, down from 47 in the Gulf and 49 offshore a year ago. 13 rigs that had been doing horizontal drilling were also shut down, cutting the horizontal rig count down to 487, which was down from 1168 in the same week a year ago. In addition, the count of active vertical drilling rigs was down by 3 from last week to 74, which was down from the 235 rigs that were drilling vertically on January 30th of 2015, and 2 directional rigs were also removed, leaving 58 active, down from the 140 directional rigs that were in use a year ago..

Of the major shale basins, the Permian of west Texas alone accounted for most of the drop, as a net of 17 rigs that had drilling there last week were stacked, leaving 182, which was down from 454 that were drilling in the Permian last January 31st. The Barnett shale of the Dallas area, the Granite Wash of the Oklahoma-Texas panhandle region, the Marcellus of the northern Appalachians and the Williston of North Dakota all saw a net of one rig removed. Those cuts left the Barnett with 3 rigs, down from 19 a year earlier, the Granite Wash with 13 rigs, down from last year's 40, the Marcellus with 34, down from 75 a year earlier, and the Williston with 44, down from 148 last year at this time. Meanwhile, 2 rigs were added in the DJ-Niobrara chalk of the Rockies front range, which brought the count of rigs drilling in that area up to 21, which was still down from 51 a year earlier, and a single rig was added in the Mississippian of southwest Kansas, where the 11 rigs active this week was down from 54 in the same week of 2015.

The Baker Hughes state count tables show that Texas still had 281 rigs still working, down 13 from last week and down from 695 in the same week last year. New Mexico, which also claims some of the Permian basin, was down 4 rigs to 26, which was down from 87 rigs on January 31st of 2015. Louisiana saw 3 rigs stacked this week, leaving 51, which was down from 108 a year earlier, while Kansas, North Dakota and Pennsylvania were each down 1 rig, leaving Kansas with 9 rigs, down from 22 a year earlier, North Dakota with 44 rigs, down from 143 a year earlier, and Pennsylvania with 22 rigs, down from the 54 rigs that were drilling in the Keystone state at the end of January last year. States adding rigs this week included Alaska, where they were up 2 to 13, which was also up from 10 rigs a year earlier, Colorado, where they also added 2 rigs, bringing their count back up to 22, which was still down from last year's 63, and Oklahoma, where the addition of 1 rig brought their count to 88, still down from 183 a year ago at this time.

NB: the above was excerpted from my weekly coverage at Focus on Fracking

Recent comments