Treasury Secretary Tim Geithner proposed a new trade plan to the G-20 meeting. The idea is to limit national current account balances to a hard cap of 4% annual domestic GDP.

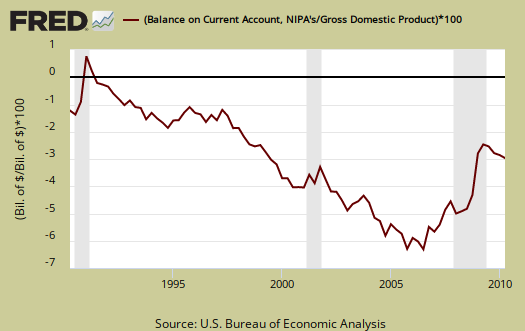

The below graph is the current account balance as a percentage of GDP:

Current Account Balance measures foreign trade. The United States is running a current account deficit of about 3.5% GDP projected for 2010. Before the great recession, the current account balance deficit ratio was above 5% of U.S. GDP. The Current account deficit for Q2 2010 was $123.3 billion. Only a global recession with it's corresponding trade implosion could reduce the trade deficit. Now that Asia has recovered economically, the great trade imbalance is comin' back with a roar. Q2 2010 current account deficit was 3.4% of GDP, the highest since 2008, and rising.

Of course the G-20 gave a big raspberry to Geithner. Germany claims this is planned economic thinking. Only Canada and France thought it wasn't a bad idea. Australia likes it. So, once again you have those fueling their economies with unfair trade practices hating Geithner's proposal and the one's being decimated by unfair trade, thinking it's not half bad. What a surprise. Where's Nash when you need him?

Of course the G-20 gave a big raspberry to Geithner. Germany claims this is planned economic thinking. Only Canada and France thought it wasn't a bad idea. Australia likes it. So, once again you have those fueling their economies with unfair trade practices hating Geithner's proposal and the one's being decimated by unfair trade, thinking it's not half bad. What a surprise. Where's Nash when you need him?

Geithner also called countries to stop manipulating their currencies:

US treasury secretary Timothy Geithner has told the G20 nations to stop manipulating their currencies to prevent "excessive volatility" and a global currency war.

We've picked on Timmy many times for being Wall Street's personal water boy. But now, it seems he's starting to move on trade and currency manipulation and increasingly not willing to carry water for China.

Good for him!

Good for him!

Someone read the latest U.S. GDP report, which shows the trade deficit ate our economy.

The International Business Times printed the letter Geithner wrote to the G-20.

The breakdown of the policy proposal is as follows:

- Account balance per country doesn't rise above a certain domestic percentage

- G-20 should outlaw currency manipulation

- IMF would be new global currency and balance of trade Cop

Did you know the United States was dead last in current account balances in 2007? See who was dead first? Yuppers, China.

Very interesting that Geithner wants an expanded role for the IMF. Lord knows they love their austerity, but come on, would the WTO or World Bank do any better? From past records, the USTR going up against the WTO, often results in a loss for the U.S. Looking elsewhere for an international fair trade cop, even the oh so NeoCon IMF, isn't a bad idea.

Where is this stuff coming from anywho? Some of it is coming from The Horizon Project, (some think tanks actually think and this is one!) and has been introduced as legislation by Senator Byron Dorgan in 2005. Now why a hard cap, a trade deficit as a ratio to GDP?

It's an alarm bell, a trigger for further actions. Setting a hard threshold would enable a series of additional actions to correct an imbalance of trade. When the trade balance goes that out of whack, odds are someone out there is practicing unfair trade. Additionally it means reduced overall economic growth for the deficit country and it means throwing millions of people out of work.

It's an alarm bell, a trigger for further actions. Setting a hard threshold would enable a series of additional actions to correct an imbalance of trade. When the trade balance goes that out of whack, odds are someone out there is practicing unfair trade. Additionally it means reduced overall economic growth for the deficit country and it means throwing millions of people out of work.

Geithner is proposing to set the bar and notice how he's moving authority away from the WTO.

Just like a fire detector a hard cap of 4% GDP throws alarm bells to find out the source of the problem, the trade imbalance and correct for it.

Don't let these other nations throw you with planned economy. There is no greater planned economy than China. Their plan? To become the globe's #1 economy of course.

Way to Go Geithner! Play to win!

Comments

Yes...

...I listened to his interview with, I believe it was the head of Sequoia Investment Fund, and dang if he didn't sound just like me on the issues I know about. Very strange to hear the guy go on explicating mostly progressive policy points when what is actually happening seemingly, seemingly, bears no relation to same.

He actually said that at the current time U.S. tax law makes it more profitable for a U.S. company to expand it's workforce overseas!

I'm soooo confused!

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Seems almost schizoid

Like he is being pressured to do something but in reality, refuses. Where is this interview? Link?

Also, can you help out with the facebook thing? I found facebook to be a "black hole" in terms of time sink but it's clearly the platform of choice, increasing for people, so gotta "hook it in".

It was on S-Span Internet...

...I listen to them on Sunday am. You get all the gasbag shows.

Facebook...heh...

I spend toooo much time there. I guess you could start a page for this bog. I am not an expert.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

EP is already on Facebook, please "like" us

http://www.facebook.com/pages/The-Economic-Populist/164442030250560

Please "like" us. I think we need to get 20 "likes" before I can create a direct link to start using the hooks into Facebook more.

I spend all of my time administrating, writing, dealing with EP, so any useful things facebook people would like, please let me know what they are.

It took me forever to figure out what I got on the page. I want EP to remain EP, including not reposting our content, (excerpts aok) on Facebook.

But I am looking at figuring out how to "hook in" more for I see a lot of people love and use Facebook every day.

But first we need 20 "likes" and then I believe I can work on some of those linking in features, such as you see on the major press and blogs so people can share, discuss on facebook and I might if I can get the security together, set up the ability to login to EP using other accounts already set up, such as Facebook.

Complaining about China's

Complaining about China's trade surplus is a simplistic and politically grandstanding way of shifting blame.

As Dr. Michael Hudson has noted a number of times, 'anti-dumping' laws won't bring back American jobs - because even a 30% or 40% import tax will only remove less than 1/4 of the actual labor cost disparity.

This labor cost is significantly due to housing prices, taxes, and health care.

Fix the FIRE economy first - by beheading the TBTF part.

If Geithner wants to outlaw

If Geithner wants to outlaw currency manipulation, the first stop would be his ol' buddy Ben Bernanke. Talk about the pot calling the kettle black. Currency manipulation and monetary policy that is heavily expansionary has been the bread and butter of the US strategy since Greenspan.

It's not China's planned economy that is besting the US. China continues to unleash the forces of capitalism and the free market while the US is moving towards ever more rigid wage, taxation, and regulatory regimes.

It is also the Keynesian policies of the US movers that demands consumer spending and squashing consumer savings to stimulate aggregate demand. You think that might play a part in perceived "savings glut" overseas and our lack of savings, which by definition effecs the current account deficit.

Also, if Bernanke would let the market set interest rates to their natural level and above 0, Americans would be motivated to save.

disagree the Fed wants China currency manipulation

All indicators from the Fed at least are do something and in part I believe their hands were forced on QE2 BECAUSE this administration, Treasury/Congress won't do something.

I'm not Ben's personal pal here but let's stick to the facts on policy announcements. Bernanke cannot confront China's currency manipulation, that's up to this administration and Congress, unfortunately. He's issued many a statement implying it's critical the U.S. do something right now about it.