Are those our only choices? And if so, what's it going to be? Cutting defense spending or cutting Social Security? Because with a GOP-dominated Congress, it won't mean increasing revenues by raising taxes on those who are most able to afford a slight increase.

Even though the rich live longer than the rest of us, the Washington Post columnist Robert Samuelson (like most Republicans) says we should raise eligibility ages for Social Security beneficiaries to reflect longer life expectancies, perhaps to 69 or 70. In other words, they want most of us "working stiffs" to work until the day we drop dead (most probably, while we're still at work). That's a very painless plan to implement — especially if you're a member of Congress. According to Fact Check:

Members of Congress are eligible for a pension at the age of 62 if they have completed at least five years of service. Members are eligible for a pension at age 50 if they have completed 20 years of service, or at any age after completing 25 years of service. The amount of the pension depends on years of service and the average of the highest three years of salary. By law, the starting amount of a Member’s retirement annuity may not exceed 80% of his or her final salary.

These people, who want to raise our retirement age and cut our benefits, also get Social Security — but then again, they don't pay this tax on 100% of their earnings — not like the bottom 97.7% of all other wage earners — because with a salary of $174,000 a year and a cap on Social Security taxes at $118,500 — members of Congress only pay this tax on 61.1% of their government taxpayer-paid salaries. Shouldn't they lead by example?

But even still, more than half the members of the House and Senate are already millionaires according to analysis of financial disclosure reports (and so therefore, they don't need any government pensions at all). As a different Washington Post article had noted:

"Upward redistribution of income in the United States has meant that income has shifted away from the workers whose full earnings are taxed and toward high-income workers whose additional dollars are exempt ... Many of the richest Americans count on capital gains for most of their income, but capital gains are exempt from the payroll tax ... The [Social Security] tax cap is adjusted each year in step with average wage growth year to year. Overall, some 17 percent of the nation’s wages escaped the tax, up from 10 percent in 1983 ... If the payroll tax covered the same 90 percent of earnings that it did in 1983, the program’s coffers would be $1.1 trillion larger and a significant chunk of its shortfall would disappear. " Also read: Should Billionaires be Taxed for Social Security?

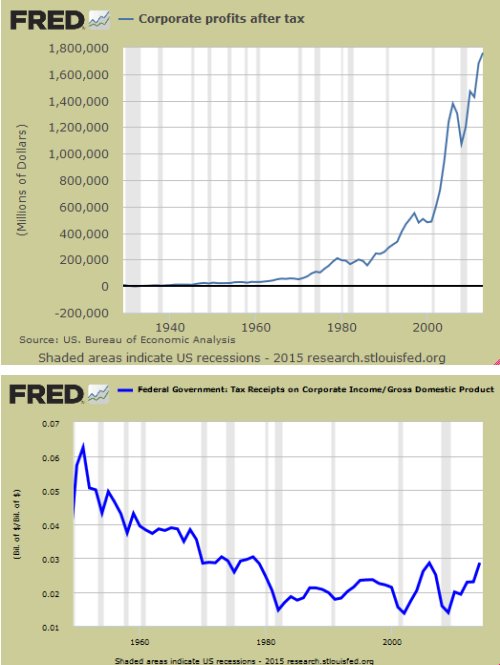

Robert Samuelson (at the Washington Post) is advocating for the Republican proposal to save money by cutting Social Security and Medicare budgets, claiming that the GOP's budget saves $2 trillion over the next decade: "Since 1965, federal taxes have averaged 17.4 percent of GDP. Even at 18 percent of GDP — near the current level — taxes fall about 2 percentage points short of average spending." Hmmmmmmm. I wonder why that is (see the charts below).

The Republicans are always saying the U.S. has the highest corporate tax rate in the world; but what they never tell us is, we also have one of the lowest "effective" corporate tax rates in the world (meaning, what corporations actually pay after all the tax loopholes and corporate subsidies are factored in).

Corporate income tax revenues, as a share of profits and as a percent of GDP, are both way down — even though corporate profits are at record highs. But the Republicans want to lower the corporate tax rate — to generate more capital gains and bigger estates — while at the same time, wants to completely eliminate the capital gains tax and the estate tax.

The Republicans in Congress want to starve the government of revenues to force cuts in government spending on Social Security and Medicare — forcing us to make a choice between letting old people live or defending old people against foreign invaders — because they refuse to raise taxes on the very wealthy (because members of Congress would have to put more skin in the game too).

Then Robert Samuelson links to the Democrat's budget and says: "The Democratic proposal from the House committee involves almost no discipline. Over the next decade, it runs nearly $6 trillion in deficits. It does nothing to curb spending on the elderly. It ignores balancing the budget and simply declares itself 'fiscally responsible,' a self-serving and meaningless verdict."

But that's not true at all. Here is what the Democrats' budget says:

"The tax code treats income from wealth more favorably than income from work by giving preferential tax rates on unearned financial gains and allowing billions of dollars of stock profits and other capital gains to pass tax-free to heirs of multi-million-dollar fortunes. The Congressional Budget Office (CBO) has determined that 17 percent of the benefits of these major “tax expenditures” go to households in the top one percent – a benefit of over $150 billion a year. Implementing tax reform that rewards work while reducing the benefit of these tax breaks would help rebalance the tax code so that it stops favoring wealth over work."

There's plenty more: "Closing unproductive special interest tax loopholes – The tax code is rife with special interest loopholes that help the wealthiest and the well-connected. This resolution supports efforts to close special interest tax loopholes".

And there's also this: "The tax code subsidizes companies that are moving jobs overseas, and allows U.S. companies to 'invert' and pretend that they are based in other countries purely to reduce their taxes. It also allows corporations to reap substantial tax benefits by shifting capital and intellectual property overseas for tax purposes or to shelter their profits from U.S. taxation in foreign tax havens. The President and Democrats in Congress have made many proposals that would stop subsidizing companies that shift jobs, capital, or profit overseas, and put a stop to inversions, and this budget accommodates these efforts."

Personally, I prefer the Progressive Caucus (CPC) who has a plan called "The People's Budget", which goes much farther on the subject of Social Security:

The Congressional Progressive Caucus does not include changes to Social Security in the People’s Budget, but endorses Social Security improvements separate from the federal budget process. We support increasing Social Security’s modest benefits, separate and apart from budget discussions. Social Security is a solution to a looming retirement income crisis, the disappearing middle-class and growing income inequality. It is the most secure, universal, fair and efficient insurance against the loss of wages in the event of disability, death, or old age; but its vitally important benefits are modest by virtually any measure.

The CPC also endorses expanding Social Security’s benefits and employing a more accurate measure of inflation as called for by the Strengthening Social Security Act. These benefits, as well as improvements to Social Security’s projected deficit that is modest in size and still two decades away, can be funded by gradually phasing out the cap on Social Security contributions. All working Americans and their employers would pay contributions at the same rate on all their earnings, just as they have been doing for Medicare since 1994.

Additionally, the CPC calls for the reallocation of funds from the Social Security Old Age and Survivors Insurance Trust Fund to the Disability Insurance Trust Fund in order to continue to pay full Disability Insurance benefits. By addressing long-term solvency for the entire Social Security Trust Fund and benefit adequacy, this plan will increases Social Security’s revenue by a net amount (i.e., once all benefits have been paid) of $1.2 trillion over the next ten years and by $4.7 trillion over the next seventy- five years.

The Progressive Caucus also advocates for better cost-of-living raises using CPI-E to calculate COLAs for federal retirement programs, besides just for Social Security. Affected programs include civil service retirement, military retirement, Supplemental Security Income, veteran’s pensions and compensations. "CPI-E is the most sensible and accurate measure of the real costs that seniors face in retirement as the current under-pricing of costs amount to cutting benefits for those on fixed incomes."

According to the Center for Economic and Policy Research (CEPR), Robert Samuelson at the Washington Post is wrong on all counts:

In discussing the Republicans' proposals to save money by cutting spending, he says that their budget saves $2 trillion over the next decade by repealing Obamacare. This is not quite right. The Republican proposal repeals the spending in the program, but leaves most of the revenue that paid for the spending in place ... In making the case for cutting Social Security and Medicare he suggests raising the retirement age to 69 or 70 over 15 years. By comparison, in 1983 the normal retirement age was raised from 65 to 67 over a 40 year period, so Samuelson is proposing a very abrupt increase in the retirement age. More accurately, this should be thought of as a cut in benefits of almost 20 percent over a 15 year period. In addition, Samuelson also wants to raise the age of Medicare eligibility to 69 or 70, implying large increases in health care costs for people between age 65 and 70.

The median retiree will have virtually no income other than Social Security in retirement. The average Social Security benefit is a bit less than $1,300 a month, yet somehow Samuelson views these cuts as being progressive. He does also want to cut benefits for "wealthier" retirees. In order to get any notable savings it would be necessary to have a cutoff for benefit cuts at around $40,000 of non-Social Security income. This gives a whole new definition to the term "wealthier." To better see how drastic this change would be, compare it to when the retirement age was raised from 65 to 67 over a 40-year period in 1983. The increase from age 66 to 67 is being phased in over the years 2016-2022, so Samuelson's rise would overlap with this rise. Samuelson also wants to raise the Medicare eligibility age to 69 or 70, increasing health care costs to those ages 65 to 70 during those crucial years.

Barbara J. Easterling, President of the Alliance for Retired Americans says, "Cutting Social Security and Medicare would be disastrous for our seniors. It would be forcing many of them into bankruptcy. This is not the answer to saving money.”

Near the end of his post, Robert Samuelson says, "Republicans need to admit that without tax increases, big and probably dangerous cuts in defense [my link] are inevitable. Democrats need to concede that all spending for the elderly is not sacrosanct because this shrinks other important government programs."

But what's more sacrosanct than surviving in old age when someone is too sick or too old to work any longer? A new aircraft carrier isn't going to save their asses. Eliminating the cap for Social Security and taxing capital gains as regular wages seems to be, not only the most fair thing to do (so that everyone pays the same percentage of their earnings to Social Security), but it's also a fiscally adequate solution to fixing all the problems we have for funding this program for working Americans.

Comments

Fake study says raise retirement age

To save Social Security, they want to raise the retirement age so that fewer people live long enough to get Social Security.

Source:

http://www.eurekalert.org/pub_releases/2015-04/uoia-rra040215.php

They start off by saying "The age to receive full Social Security benefits should be closer to 70."

Then they say: "Only 74.4 percent of 25 year olds who had less than a high school education survived to age 65, while 92.1 percent of their peers with a college degree or its equivalent years of education would do so ... However, the retirement age for Social Security is the same for everyone."

And they conclude: "People in population groups with lower life expectancies [i.e. lower incomes e.g. those with less than a high school education] would continue to pay into Social Security the same as anyone else, while becoming even less likely than they already are to live to see retirement -- and those who do reach retirement [i.e. higher incomes e.g. those with a college education] would draw benefits for even fewer years."

If only people with higher incomes live long enough to get Social Security, then because of their higher incomes, they will draw much larger Social Security checks --- so they will need more people at the bottom of the income scale to keep working longer.

So as the title of the article states, how does "raising the retirement age widen benefit disparities for the disadvantaged"?

Actually, just Google "Forbes rich live longer".

They always prefer to cut benefits (and/or raise the age) rather than eliminate the cap for Social Security taxes or tax capital gains for Social Security taxes.

Republican Recycle Bin

Those "sponsored" corporate spin "think tanks" should be banned. Misinformation machine at it again.

There should be some concern

There should be some concern given to the effect of longer life expectancy to us people who started working on having a nest egg based on the time we started doing it. The retirement income, if any, is creeping up, but the taxes go up according to the higher income. Maybe a tax reduction based on ages would be very appropriate.

Hillary Clinton won't Expand/Save Social Security

But a "populist Democrat" would. Legislation to increase Social Security benefits and boosting payroll taxes to cover the cost, now has 58 co-sponsors in the House. In the Senate, Elizabeth Warren won 42 Democratic votes (with just two Democrats voting no) for a nonbinding resolution calling for a “sustainable expansion of benefits.” A spokesman declined to comment on Hillary Clinton’s current position on this issue. (Silence speaks a million words.) Hillary is not known as a "progressive" Democrat (like FDR or Elizabeth Warren), but as a "New" pro-corporate "centrist" Democrat. In an op-ed in The Wall Street Journal in 2013, the "centrist" Democratic think tank "Third Way" called plans to increase benefits “reckless” and “irresponsible”. (So now we know what Hillary might privately think.)

http://www.wsj.com/articles/democrats-rethink-social-security-strategy-1...

How Elizabeth Warren Made Expanding Social Security Cool: "Warren just turned Social Security expansion—once a progressive pipe dream—into a tough-to-ignore 2016 issue."

http://www.motherjones.com/politics/2015/04/can-elizabeth-warren-expand-...

* The link to that poll in the above article doesn't work, but other polls at their website can be found here:

http://www.socialsecurityworks.org/new-polling-shows-support-expanding-s...

A solution for the social security dilemma: "There are basically three options to address the problem: increase taxes; reduce benefits; or obtain higher rates of return by privatizing the system ... Some argue for gradually increasing the existing tax rate on both the employee and employer by two percent over a period of twenty years and reducing the annual cost of living (COLA) on the basis that senior spending needs are less than folks in the current workforce. Others suggest increasing the retirement age to 70 and reducing the monthly payments. Another option is to privatize the system by moving from the current 'defined benefit' model to a system where new beneficiaries and those over, for example, age 50 are moved to a system of private accounts ... However, I suggest a more simple approach -- eliminate the taxable maximum ("TAXMAX"). Specifically, instead of taxing only the first $118,500 (plus annual increases based on COLA), individuals would pay on full salary. Thus an individual earning, for example, $750,000 would pay the rate on the full salary rather than just to $118,500. There would be no increase on others."

http://www.nj.com/opinion/index.ssf/2015/04/a_solution_for_the_social_se...

STUDY: Taxing the Poor Less creates Jobs

The Wall Street Journal cites a NBER study showing tax breaks for the bottom 90% spurs job growth, and tax cuts for the top 10% has little effect.

http://blogs.wsj.com/economics/2015/04/20/tax-cuts-boost-jobs-just-not-w...

http://www.nber.org/papers/w21035

At first, I found this odd --- not about the tax cuts, but that the Wall Street Journal would cite this study.

And then I got to thinking — even tax cuts for the bottom 90% could force cuts to government spending ("starving the beast") because so many people have transitioned into lower-paying jobs; not to mention, the stagnation of wages across the board for the last several decades (even as profits have grown exponentially compared to productivity).

So even taxing the poor less would give the GOP the overall desired effect that they hope for — less tax revenues. Rather than tax the rich more, they want to tax the poor less.

Brilliant! Imagine all those desperate people voting for Republicans to get a tax break in their paychecks — but at the expense of everything else that they will lose, that they once could one day have relied upon (like Social Security, perhaps?)

And the jobs the NBER study says tax breaks will create --- more low-paying part-time jobs?