The Federal Reserve's consumer credit report for July 2013 shows a 4.4% annualized monthly increase in consumer credit, driven by auto loans. Once again student loans increased, while credit card debt declined. Revolving credit declined by -2.6%, and non-revolving credit jumped another 7.4%. June showed consumer credit increasing by a 5.1% annualized rate. In June, revolving credit increased by 9.5% while revolving credit declined by -5.2%.

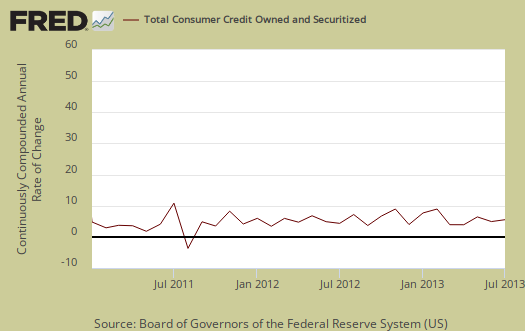

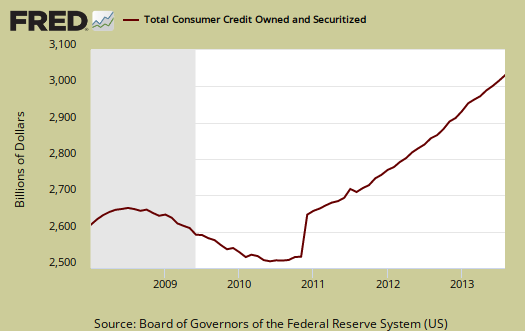

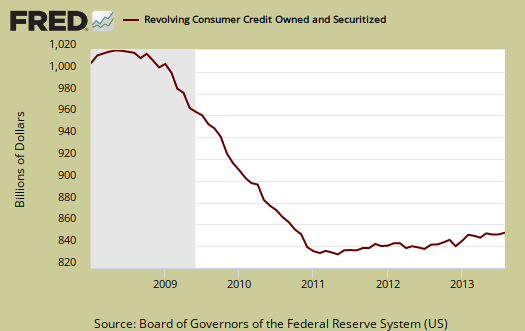

Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages, home equity loans and other loans associated with real estate are not included in this report. Overall consumer credit increased $10.4 billion dollars to $2,852.1 billion, seasonally adjusted. Revolving credit declined to $849.8 billion while non-revolving just popped past $2 trillion, a $12,2 billion increase from last month. The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. Consumer credit contractions correlate to recessions. The consumer credit report does not include charge offs and delinquencies. Graphed below is total consumer credit.

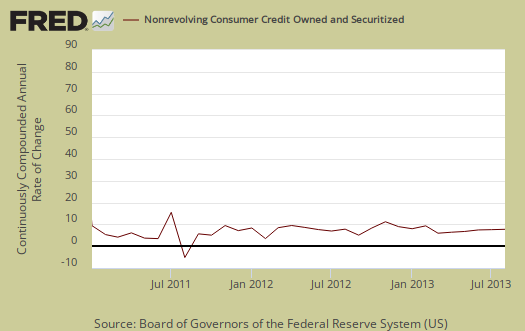

Below is non-revolving credit, seasonally adjusted, annualized percentage change. Non-revolving credit increased $11.1 billion, not seasonally adjusted and has increased every month since August 2011. Subtracting student loans from this figure we get a $8.6 billion increase in non-revolving loan debt. For June, minus student loans, non-revolving debt increased by $8.4 billion.

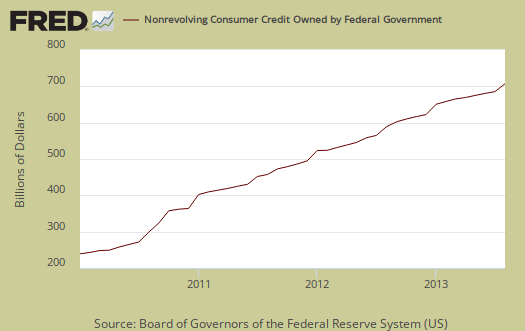

Federal government non-revolving consumer credit includes loans originated by the Department of Education under the Federal Direct Loan Program, as well as Federal Family Education Program loans that the government purchased from depository institutions and finance companies. In other words, Federal government non-resolving credit is student loans. This month student loans increased another $2.5 billion to $571.9 billion, not seasonally adjusted. The federal government started making 100% of guaranteed student loans in July 2010. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs. Below is the not seasonally adjusted ballooning non-revolving credit held by the Federal Government, i.e. student loans.

Revolving credit, which is mainly credit cards, has decreased, the second month in a row. Since the great deleveraging of the Great Recession, revolving credit has been fairly flat line Charge offs are not included in this report. Since most of America doesn't have enough money to make ends meet, when charge it! declines this implies there will be less consumer spending. Clearly there is a limit as to how much debt is offered to people with little to begin with and Wall Street relies on people using their credit cards at high interest rates to pay for basic living expenses.

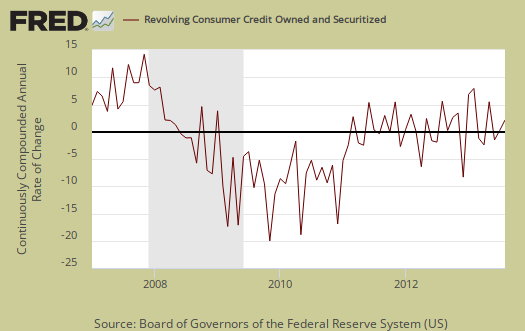

Graphed below is the monthly revolving consumer credit annualized percentage change.

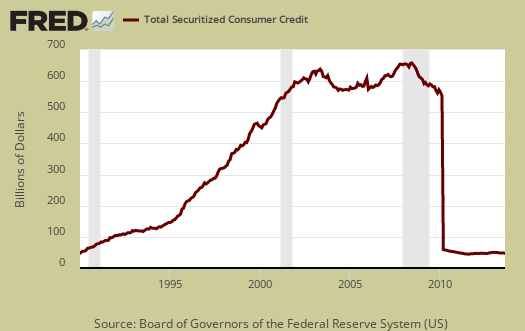

Now below is the pools of securitized assets, which is $31.0 billion. The Fed describes this category as:

Outstanding balances of pools upon which securities have been issued; these balances are no longer carried on the balance sheets of the loan originators. The shift of consumer credit from pools of securitized assets to other categories is largely due to financial institutions' implementation of the FAS 166/167 accounting rules.

They are off-balance-sheet securitized assets originated by all major holders and like much in Federal Reserve reports, not explained well.

Below is commercial banks revolving credit.

Below is revolving credit by finance companies.

Those 2010 "cliffs" on pools of assets and commercial banks graphs were the off the corporate books derivatives. They were brought back onto the liabilities book, via FSAB accounting rules changes in 2010.

Those in the press like to characterize debt as an increase in consumer spending and thus good for the economy. We somehow doubt crushing student loan debt has a stimulative effect to consumer spending or the economy. Every month we see student loan debt just piling up and this month is no exception. The better news is people are clearly buying cars again, which is reflected in the increase in auto loans as well as other economic reports showing the auto industry is blooming.

Recent comments