We already know many large multinationals pay no Federal taxes, but did you know many businesses don't pay State taxes either? Citizens for Tax Justice has issued a new report, Corporate Tax Dodging in the 50 States, 2008-2010. The report shows, instead of creating jobs and products, corporations seem to be in the business of tax dodge.

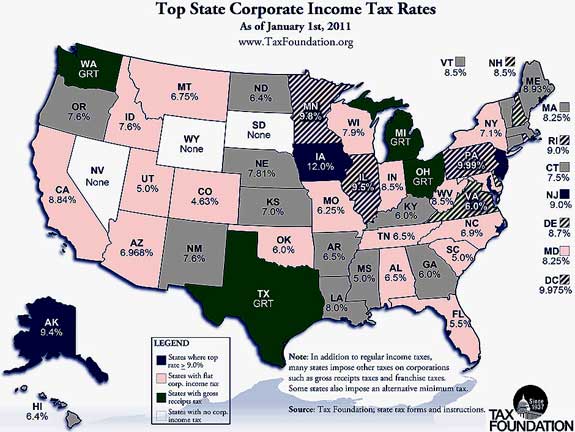

State Corporate Tax Map Created By The Tax Foundation

A comprehensive new study that profiles 265 consistently profitable Fortune 500 companies finds that 68 of them paid no state corporate income tax in at least one of the last three years and 20 of them averaged a tax rate of zero or less during the 2008-2010 period.

Pepsi is the worst offender, with a 3 year effective state tax rate of –13.2%. Yes, that means the States pay Pepsi, not the other way around. One must wonder how flavored sugar water could get so many tax breaks.

A huge surprise on who is paying taxes, JPMorgan Chase. Yes, I kid you not, a TBTF bank's 3 year effective state tax rate was 9.1%.

A federal contractor and outsourcer, Computer Sciences Corporation had the next biggest three year negative effective state tax rate, –9.5%. Yes, they operate a division in...drum roll please, Bangalore, although the good news is often DoD contracts require U.S. citizenship and a security clearance, a saving grace which preserves U.S. jobs...for now.

CTJ found corporations' taxes were once 0.5% of State Gross Product (the state equivalent of GDP) back in 1986. Now corporate taxes are only 0.28% of Gross State Product and the lowest contribution levels since World War II.

100 Percent Nowhere Income

The report goes through some tax avoidance tricks, incentives which corporations lobby state governments to avoid paying any taxes. In many cases, these same corporations get states to pay them. One such loophole is called the 100% nowhere tax. What corporations got is a tax on sales only in that state instead of business activity, property, payrolls in the state. All a corporation has to do to pay zero taxes is to have their production in that state and all actual sales, out of that state. Voilà, zero tax.

Corporations also shift profits around for tax purposes:

Profit shifting among states is enabled by a provision of most states’ corporate tax laws that treats every individual corporation in a multi-corporate group (that is, the parent and potentially dozens or even hundreds of subsidiaries)as a separate corporation for tax purposes. This practice —known as “separate-entity taxation”—enables a number of tax avoidance techniques.

There is one tax shelter, referred to as the toys -r- us, where corporations dump all of their trademarks, copyrights, patents, logos into a separate holding company that is then incorporated in a tax haven jurisdiction. Then, that newly incorporated holding company charges royalties to the other companies' holdings to use their own logos and trademarks, copyrights and patents. What happens here is a massive tax write off, as a business expense, for charging yourself fees for using your own intellectual property. Pretty slick huh? Now you know why corporations move various patents, copyrights and trademarks into special purpose vehicles, incorporated in the Caymans, Delaware and so on. Tax Loophole extraordinaire.

The report goes on to make recommendations for states to close loopholes, but then mentions a bill in Congress, the Business Activity Tax Simplification Act, which makes the situation even worse. We already know corporations get incentives, subsidies to create jobs, take that state and local tax break, and offshore outsource the jobs instead.

In 2004, Congress passed a qualified production activities income deduction, supposedly to assist in a WTO ruled illegal export subsidy. Thing is, corporations are using this tax break, without creating actual jobs in the states. Why? Because congress didn't tie this tax break to jobs, a pattern we've seen over and over again. If States want corporations to create jobs and give incentives for them, they must tie the tax break to actual State residents, U.S. citizens, for the jobs. Doh.

Bottom line, corporations clearly spend millions, with divisions of lbbyists, CPAs and tax attorneys, to manipulate tax codes. One of the study authors, Matthew Gardner said this on his findings:

Our report shows these 265 corporations raked in a combined $1.33 trillion in profits in the last three years, and far too many have managed to shelter half or more of their profits from state taxes. They’re so busy avoiding taxes, it’s no wonder they’re not creating any new jobs.

Comments

Not flavored sugar water.

Not flavored sugar water. Flavored high-fructose corn syrup water. The reason why it's not sugar water is import restrictions on sugar (which benefits Big Sugar) and subsidies to Big Corn.

Needless to say the fact that the rise in type II diabetes that goes along with the increase in the use of high fructose corn syrup is just a coincidence.

I stand corrected!

No kidding. We have obesity problems, diabetes problems and they put high fructose corn syrup in everything. This is an economics site and I don't know what "studies say", but I sure do know it drives me crazy to go to the grocery and not be able to buy salad dressing without it or bread, you name it. The stuff makes the product taste terrible too! How much high fructose corn syrup is in McDonalds and even KFC? Empty calorie nation at minimum.

Goes to show you what advertising, marketing and shelf space competition does to people. Kind of like our politics today, labeling "quality" via cable noise babbling heads, our fast food politicians, Primarily flavored beef fat, smothered in plastic cheese and coated with fake sugar. ;)