Are we...

In my last couple of blog entries I have suggested that data from past commodity driven recessions, as well as strongly supported evidence from the yield curve indicate that we may be near an inflation peak, and that as a result there might be a respite from this recession by the end of the year.

In a number of places on the econoblogosphere this position has been criticized, and in general the criticism comes down to two words: "Peak Oil!". I put that in caps and with an exclamation point because the argument is that "Peak Oil!" explains everything.

For purposes of this diary, let's assume that peak oil is a correct concept (and I happen to think it is) and furthermore that we are close in time to the point of peak oil (or at least on a long plateau of maximum oil production). Nevertheless, unless you are a believer in cosmic coincidence, it seems very unlikely that "Peak Oil!" explains most of what is happening with the world economy.

According to Bloomberg:

``The U.S. recession will be a footnote as far as the oil market is concerned,'' says Jeffrey Rubin, chief economist at CIBC World Markets Inc. in Toronto, who has correctly forecast higher oil prices since 2000. ``Supply isn't growing and demand is growing robustly in the developing world.''

Historically, a recession in the U.S. would lead to lower prices. Oil fell 26 percent to $19.84 a barrel in New York in 2001 when the economy contracted. The U.S. consumes 24 percent of the world's oil, down from 26 percent seven years ago.

Oil demand in both China and India will rise by 4.7 percent, according to the IEA. China, the world's second-biggest energy user, will consume 7.89 million barrels of oil a day this year. India will use 2.92 million barrels of oil a day in 2008, more than is pumped by OPEC member Venezuela.

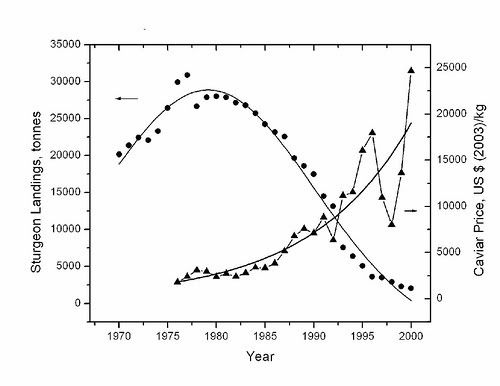

So there! "Peak Oil!" means that demand will continue to be constricted. Expect prices to continue skyward ad infinitum! Except, even in cases where it's pretty clear that the peak in production has long since been past and is unlikely to return in our lifetimes if ever, such as the caviar due to the sturgeon catch in the Caspian Sea, look what happens:

At some point, the knowledge of scarcity gives rise to speculation, and that speculation can cause extreme increases followed by collapses (followed by further increases) in price.

And I trust that people recall that even the greatest bull market in stocks in US history, from 1982-2000, was punctuated by the worst crash in history when in 1987 stocks lost more than 20% of their value on a single day!

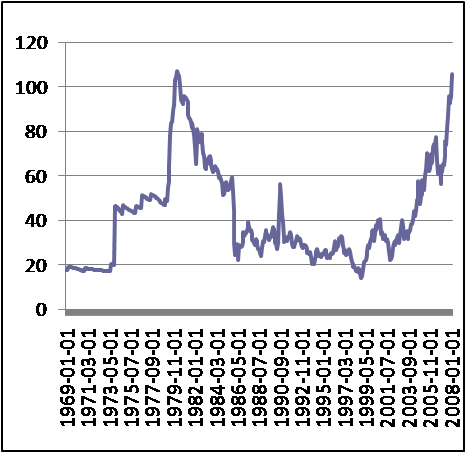

So, even if we have passed peak oil, that doesn't mean that the doubling of the price of a barrel of oil in the last year isn't at least in part due to speculation.

Furthermore, here is a graph of the inflation-adjusted price of oil since 1969, showing what is alleged to be a one-way parabolic price increase due to "Peak Oil!"

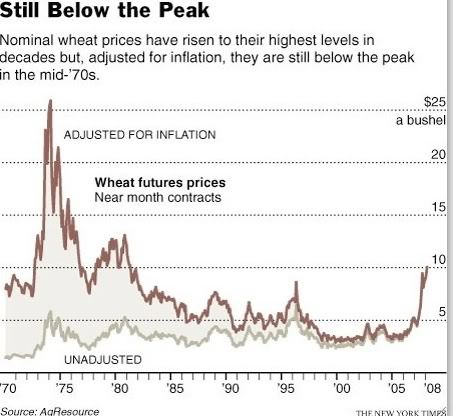

All well and good, but then are we also approaching "Peak Wheat!"?:

Ah, but the price of oil feeds through into food prices, we are told, explaining the parabolic rise in food prices too.

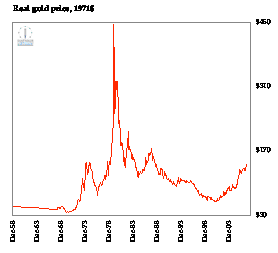

Well, then, are we also approaching "Peak Gold!"?:

I'm not aware of any special reason that oil prices should directly affect the price of mining or securing gold.

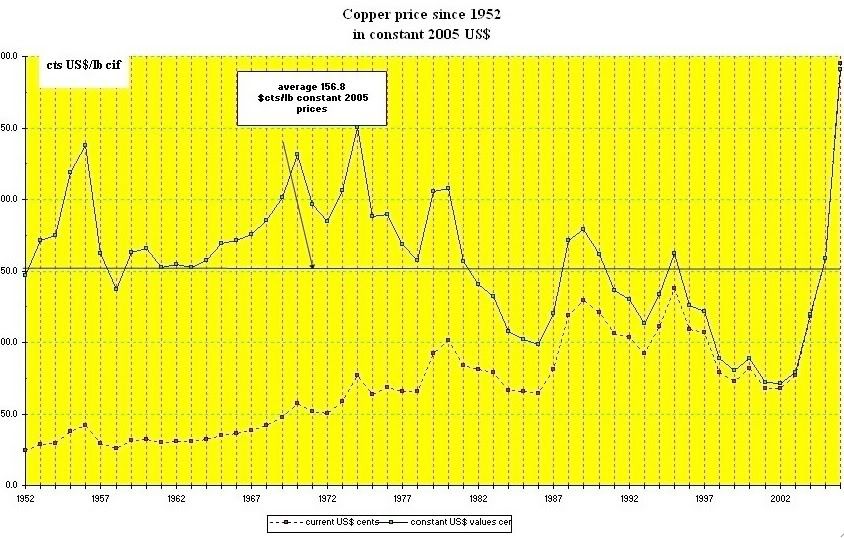

And if gold is special, because it is a historic store of value alternative to currencies, what then are we to make of "Peak Copper!"?:

Unless humankind has had the most unlucky year in history, hitting "Peak Everything!" in 2007, then something else is going on. That something else could be population growth and increasing use of resources, but like the graph of the price of caviar above, it could also be in full or at least in part due to financial speculation. And on this score, I am in agreement with Jim Hamilton of Econbrowser, that indeed part of the recent phenomenal rise in almost all commodities in unison, is due to speculation -- more precisely, the diversifying away from the US dollar into virtually any other potential store of value.

To be continued....

Comments

speculation

I don't recall who said it, but I heard 20% of the increases in oil were due to speculators in the hedge funds.

On the other hand, did you see the forum post I made about someone saying "economic Armageddon" as the US will experience hyperinflation?

Another question I have about all of this is the dollar and a possible decoupling from that I've read so much about.

On hyperinflation

I don't see hyperinflation anywhere on the horizon for the US.

I've actually done a fair amount of historical reading about hyperinflation, and you don't get there directly from a low inflation environment. There has to be a transition period of a sustained amount of time with double and triple digit inflation before hyperinflation sets in. In Latin America, that has often been a decade or more.

Interesting you should mention "decoupling" too. I hope to post on that issue shortly....

if you catch

the newsletter referred to in that front page cbsmarket watch story, I'd like to see it (predicting hyper inflation). No links to justify or explain why it was front page.

Dollar vs. commodities

In his book "Hot Commodities" Jim Rogers believes we're partway into a commodities bull market compounded by an ever shrinking dollar. Add to this artificial scarcity, self fulfilling prophecy, market speculation and global panic disorder and throw in some China phobia, and the next thing you know you've got a peak oil theory and a resource war with the pentagon in the back pocket of the oil companies. And it just so happens that the war is killing the dollar. And at least with the "peak oil theory" it's not the only game in town just the one that gets the most air time. The Russian Ukranian theory of Deep abiotic oil Genesis would be another one.

http://www.gasresources.net/Introduction.htm

Game Fan

Why don't you register (right hand column), here since you are commenting on most of the blog posts. It means the letters you have to type to make a comment go away and you wouldn't go into a comment approval queue. Welcome to EP!