Several studies have been done since the Great Recession, and we've learned that many of the CEOs who devastated our economy weren't only greedy, but nearly 40% of them bombed at their jobs—and that 10% were psychopaths. Some studies have also revealed that the wealthier they were, the more likely they were to be more narcissistic and more unethical. So unless they were lucky enough to be born into wealth, many of these "job creators" were using nefarious means to accumulate their vast wealth—contrary to the popular myths that they accomplished this with just hard work and/ or a great idea.

Another psychological disorder which is related to greed is hoarding, which is also on the rise.

Hoarding is when a person accumulates a massive amount of valued objects for which that person has no practical use. The most damaging form of hoarding is the hoarding of money. Yet this is routinely done by those who can, and desire to do so; and it's celebrated in publications such as Forbes Magazine and the Wall Street Journal. The richest among us have far more money that they could possibly ever need, or even use, but to them it is a game in which the richest one is the "winner"—and as Paul Krugman recently noted, the rest of us are "losers".

Since the financial crisis, the wealthy have become the nation's top cash hoarders, filling up deposit accounts and money markets at a rapid clip (and in offshore banks accounts, such as in the Cook Islands and Ireland). One study found that ultra-wealthy investors are now keeping a bigger cash cushion out of the market—with 56% of millionaires who have a “substantial” amount of cash on hand, but only 16% of them plan to invest in the next few months—and 40% don't intend to invest for another two years. Critics argue that this cash may be better invested or pumped into the economy; but the markets seem to be doing just fine without those added funds.

But can making and hoarding too much money become an addiction, such as alcoholism; or induce someone to engage in obsessive-compulsive behavior similar to gambling? It's been said that wealth doesn't change people, but only enhances their character. But either way, if a mentally unstable person can become rich, or if excessive wealth can cause an addictive or obsessive-compulsive behavior, then maybe more taxation can be their only cure—or at the every least, help to control their manic behavior or obsessive impulses (by reducing the dose of their drug of choice --- cash.)

Maybe it's not their fault if multi-billionaires can't stop making and hoarding money, not even if they tried. It's only natural human behavior than someone would want more. We don't have built-in biological governors to tell us to stop. Eating and sleeping might be the only two exemptions, or when we reach our physical limitations when working or having sex. Even then, we sometimes over-extend ourselves. Satisfying our biological urges and needs is natural human behavior. But exceeding those desires can be harmful, not just to ourselves, but to others. If we are weak and lack will-power, or engage in obsessive behavior, or succumb to anti-social and/or criminal behavior, or surrender to other temptations, our actions often harm others.

"Government" is one of society's ways of governing human behavior, to keep some from harming others. We make rules and laws, such as "you can't kill" and " you can't steal" — then we met out punishments to those who break those rules. Without self-imposed rules, humans would have chaos and anarchy. In a democracy, we make laws based on the consensus of the majority. Some have argued that "rules" deprives us of our "freedoms" — the freedom to do as we please, no matter what the consequences are to others.

Governments collect taxes to benefit a society as a whole, and taxation has been a means of collecting revenues for centuries. Although, some politicians have argued that this "redistribution of the wealth" is somehow evil. But civilized societies have always used taxation for building and maintaining roads and bridges (infrastructure), building and maintaining an army (defense) and addressing the well-being of the populace (hospitals, food, water). The purposes and means for collecting taxes vary, but in a democracy, the majority decides what they need, how much to collect, and how to collect tax revenues. Some countries use a "progressive" tax system, where the rich pays a higher tax rate; but in the U.S., over the past 40 years, it's become only mildly progressive.

It's only natural human behavior than someone would want more. It's only natural human behavior than someone would not want to pay taxes. It's only natural human behavior than someone would want to earn more and keep more of what they earn. But at what point does our behavior become obsessive and/or excessive? What is the purpose for hoarding (rather than just saving for a rainy day)? Is it possible that someone can earn too much in income, and then pay too little in taxes — especially if it means that many more will earn too less and have too little in which to sustain themselves in a society that we built for ourselves collectively?

How many generations of one family can live in optimum luxury (without ever producing one more dollar of income) with $100 million — or even $1 billion — sitting idle in a typical checking account, without even earning interest to compensate for inflation? How many houses and cars can they buy?

Nick Hanauer in a speech at TED University: "Somebody like me makes hundreds or thousands as times much as the median American, but I don't buy hundreds or thousands of times as much stuff. My family owns three cars, not 3,000. I buy a few pairs of pants and shirts a year like most American men. Occasionally we go out to eat with friends."

From Mark Thoma, a macroeconomist at the University of Oregon:

"Most of the income gains during the recovery have gone to a group of people that tends to have a high saving rate. Instead of spending the money mostly on consumption goods like working class households do, much of it is saved instead ... The savings [trillions] piles up as retained earnings in corporations and excess reserves at banks. Had the economic gains gone to the working class and been spent on goods and services instead of sitting idle in corporate and bank coffers, the economy would have recovered faster."

We know when someone can have too little (now there are almost 50 million people in America who are poor), so at what point does someone have "enough", "more than enough" or "too much"? If someone has enough to sustain themselves in the highest capacity possible for the remainder of their natural life, and then also has enough to sustain their children in the highest capacity possible for the remainder of their natural lives—as well as their children's children—would that be enough for one person?

- 50% of all wage earners in the U.S. takes home less than $28,000 a year—the medium wage (a great many of these people are single moms).

- The most expensive home in America costs almost $200,000,000 (Recently sold by John Rudey, the CEO of U.S.Timberlands Services.)

- One American man has a net worth of $78,000,000,000 (Like a game of Monopoly, Bill Gates recently recaptured the title of world's richest person from the Mexican investor Carlos Slim)

- The 6 heirs of Walmart have over $100,000,000,000 in net worth and each earn over $1 million every single day of the year with stock dividends. The Walmart heirs rake in $41,000 an hour, but pay their employees an average of $9 an hour.

- America's 20 richest people have over ½ trillion dollars—just 20 individual human beings!

Is there anything at all obscene with this? When will the very few have too much if the vast majority will have too little?

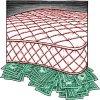

$1 billion is seen in the image below in $100-bills on pallets of $100 million each. There is 10 tons of cash sitting idle on those pallets collecting dust. Now multiply this by 78 for Bill Gates.

In 1961 IRS records indicate that the nation’s top 400 wealthiest Americans had incomes that averaged just over $2 million a year. These taxpayers, after exploiting every tax loophole they could find, paid 42.4 percent of their total incomes in federal tax.

Now fast forward to 2007, the last year before the Great Recession hit, and the IRS reports that our top 400 averaged $345 million in income. These contemporary rich, after exploiting every loophole they could find, paid only 16.6 percent of their total incomes in federal income tax.

After inflation, the top 400 in 2007 grabbed 25 times more in gross income than their top 400 counterparts in 1961 — and 36 times more income after taxes. In actual dollars (after taxes and after inflation) our top 400 in 2007 had $112 billion more than the top 400 of 1961.

A good chunk of this top 400 hailed from the hedge fund world. In 2007, according to the financial industry trade journal Alpha, 50 hedge fund managers made at least $210 million each, well above the $138.8 million minimum needed over the course of the year to reach top 400 status.

Our hedge fund and private equity kingpins are once again pulling down pre-recession-level jackpots, and last year, for the first time ever, the nation's top 10 corporate CEOs each realized over $100 million in compensation.

AFL-CIO President Richard Trumka unveiled the 2013 Executive PayWatch, revealing that U.S. CEOs of the largest companies made 354 times the average rank-and-file worker per year.

Where are today’s super rich putting all this loot? When they're not hoarding it, a good bit of it is cascading into politics. The Washington Post reported last week that in 2012 the billionaire Koch brothers and their allies stuffed at least $407 million in politically active nonprofits (and didn't even have to disclose their donors.) These rich people want to influence, corrupt and poison our democracy by getting politicians elected who won't tax them.

$1 trillion is seen in the image below in $100-bills on pallets of $100 million each. $1 trillion would cover a football field full of these pallets stacked two-high. Now multiply this by 2. This is America's 400 wealthiest job creators—and 6 of those are the Walmart heirs. And this doesn't even include what they have hidden away in offshore bank accounts—untaxed by our government to repair our infrastructure.

Is this too much or what? Billionaires can't stop making and hoarding money, not even if they tried. They don't need more, they just want more. It's like a game to them, and they are racing to become the world's first trillionaire. It's only natural human behavior than someone would want more. We don't have built-in biological governors to tell us to stop. So governments must make them stop, or at least slow them down a little, because all this wealth is not trickling down to the masses, but is only being sucked up from the bottom and hoarded at the top.

Never before have so few made so much at the expense of so many. You can call it "greed" or whatever you like, but "too much" is too much. It might be time to raise the tax rates, don't you think? Before the rich own all our government leaders, stop taxing at all, and our civilization falls into irreversible decay—and the entire nation will end up just like Detroit. Or worse, in total chaos and anarchy—and only then would the Tea Party radicals and anti-government libertarians finally be satisfied.

But why isn't the top 0.01 percent ever satisfied? Whenever we ask them to pay a little more in taxes, or ask them to pay us a "living wage", they look at us as though we were crazy—as if we were asking them to burn their money, even though they have no other use for their excess cash. It's almost as though they cling to their money like a security blanket, afraid to let go. Besides just narcissism and ethics, do they also have issues with anxiety as well? Let's ask the forensic psychologist Dr. Stephen Diamond:

"Avarice can describe various greedy behaviors such as betrayal or treason for personal gain, hoarding of material things, theft, robbery, and fraudulent schemes such as Bernie Madoff's, designed to dishonestly manipulate others for personal profit...Greed is about never being satisfied with what one has, always wanting and expecting more. It is an insatiable hunger...Addiction is a form of greed. Addicts always want more of what gets them high, gives them pleasure, enables escape from anxiety."

And from the clinical psychologist, Dr. Tian Dayton:

"The person who uses money to mood-alter can have their relationship with money spin out of control; by being overly focused on accumulating it, spending it, hoarding it or using it to control people, places and things... Just as with a drug or alcohol, tolerance increases and they may find themselves needing to devote increasingly larger amounts of time to these activities... Just as is the case with any addict, their preoccupation with money becomes their primary preoccupation and money becomes their primary relationship."

The U.S. has 400 billionaires on the Forbes Fortune list, but over 75 million Americans (50% of all wage earners) take home less than $28,000 a year (while we also had 23% unemployed). So what is the top 0.01 percent's "End Game"? When the U.S. has 5,000 billionaires, but 50% of all wage earners take home less than $1,000 a year with 75% unemployed? When will the economic devastation of the American people finally end? Or is their grand plan to completely eliminate human labor altogether by using robots with artificial intelligence, thereby putting all of us out of work?

New York Times: The Second Machine Age - "Our generation will have more power to improve (or destroy) the world than any before, relying on fewer people and more technology. But it also means that we need to rethink deeply our social contracts, because labor is so important to a person's identity and dignity and to societal stability. They suggest that we consider lowering taxes on human labor to make it cheaper relative to digital labor, that we reinvent education so more people can race with machines, not against them, that we do much more to foster the entrepreneurship that invents new industries and jobs, and even consider guaranteeing every American a basic income. We’ve got a lot of rethinking to do, they argue, because we’re not only in a recession-induced employment slump. We’re in a technological hurricane reshaping the workplace — and it just keeps doubling."

Mad Money's Jim Cramer recently said in an interview on MSNBC that "the best way for corporations to make money is to fire people." (And he wasn't joking.)

We have a minimum wage that hasn't been raised in 5 years or kept up with inflation. Recently seventy-five leading economists sent a letter to Congress telling them to raise the minimum wage, saying the Miller-Harkin plan would increase the wages of close to 17 million low-wage workers, bringing the minimum-wage value back to that of the late 1960s.

And we should raise the minimum wage, and we should also start considering a basic income; but maybe we should also consider a maximum wage as well. And we can accomplish this with taxation—and the best way to accomplish this is by taxing the top 0.01 percent on their capital gains income according to the current marginal income tax rates on regular wages; and also by taxing capital gains 100% for Social Security taxes (just like 95% of all regular wage earners currently pay).

Bruce Bartlett at the New York Times wrote a very interesting article about the history of the capital gains tax. It seems that ever since the Civil War, investors have filed lawsuits and constitutional challenges, arguing that capital gains were not ordinary income. But this should be changed, because obviously we can't seem to make these "job creators" pay us a living wage; nor can we keep them from offshoring our jobs overseas either—because of their addiction to cash hoarding.

But if we could convince Congress to tax them (and themselves) a little more progressively, just think of all the mentally unstable ultra-wealthy multi-billionaires we can cure with a little bit more taxation, by limiting their addiction to the hoarding of excessive money. And maybe this would also help cure them of their other vices: wrath, greed, sloth, pride, lust, envy, and gluttony. But unfortunately for us, too many members of our Congress also suffer from these same afflictions.

* The video below shows that wealth inequality in America is very real, but a study revealed that 9 out of 10 Americans were shocked to learn just by how much.

Comments

interesting take

Reminds me of when Skyler White said to Walter White in front of their money mountain in the storage locker, Please tell me...how much is enough? How big does this pile have to be?

It becomes a power exercise instead of wealth accumulation. Business Insider is a huge proponent of wealth worship. It is disgusting for 99.999% of America will never see such wealth and admiration is just perpetuating the problem. All hail the king.

AMERICANS ARE AFRAID to

AMERICANS ARE AFRAID to comment; Even to Question Swiss Bank Hoarders....Mentally Conditioned so.

Sage Knowledge: Knowing you have enough.

This was published in The New Yorker in May of 2005, from a poem written by Kurt Vonnegut about Joseph Heller, the author of the book, Catch-22:

Joseph Heller, an important and funny writer now dead, and I were at a party given by a billionaire on Shelter Island.

I said, "Joe, how does it make you feel to know that our host only yesterday may have made more money than your novel 'Catch-22' has earned in its entire history?"

And Joe said, "I've got something he can never have."

And I said, "What on earth could that be, Joe?"

And Joe said, "The knowledge that I've got enough."

http://www.linkedin.com/today/post/article/20131127174451-15893932-kurt-...

Possible future scenario

There will be a breaking point when the money paid to advertise the campaigns of treacherous politicians won't work. The political pendualum is at or near its fascist apex, and I suspect will swing back until all these corrupt top hoarders (afterall, it is crony capitalism that allowed for such accumulation in the frst place) are hanging from lampposts.

Not a wish, just an observation.

today i learned this

To back up the premise of this piece is a nice essay by Sam Polk for the NYT called "For the Love of Money". Pretty much verifies Bud's point.

On another topic, off topic BTW, i just have to say how amusing I find it the Walmart calls their wage slaves "associates" as if they were partners in a law firm.

Perhaps it is more sad than amusing

All of the euphemisms

All of the euphemisms employed by corporations are sad/amusing. Target's "guests" (customers). A retail store's "associates" (and this seems to be nearly universal). Obligatory meetings dubbed "team building". I often have wondered, silently, how many of my peers in these situations (for I've worked in retail) knew what the term "doublespeak" meant, or where it was first referenced.

The World's Top 1% now has $110 Trillion

The world's 85 richest people now have the combined wealth of 3.5 billion of the world's poorest people.

The wealth of the richest 1% in the world is $110 trillion and is 65 times the total wealth of the bottom 50% of the world's population. (1,426 individuals have a combined net worth of $5.4 trillion.)

As U.S. tech jobs were going to India over the last 10 years, the number of billionaires in that country increased from less than 6 to 61--- and this elite minority had its wealth skyrocket from 1.8 percent in 2003 to 26 percent in 2008.

http://www.nbcnews.com/business/worlds-85-richest-have-same-wealth-3-5-b...

Bill Gates

You're thinking too much inside the box, and only considering what people need. The truth is people don't need anywhere close to even 28,000 a year to live happily, they just want more to live a more comfortable life. However Bill Gates does need 78 billion dollars to live the lifestyle he wants, and in fact he probably doesn't have enough. The issue is his wants are much bigger than ours, eradicating polio, malaria, HIV, etc. is extremely expensive. Also where does the majority get the right to take what's his? If he had less money because the government took it to rebuild our roads or bridges, you could make a very compelling argument that children died of treatable diseases because the majority in the US cared about smoother roads and shorter commutes. We should let the people who earn the money choose how to allocate as much of it as possible.

really?

you are going to stand by and support this comment "The truth is people don't need anywhere close to even 28,000 a year to live happily," ???

If not anywhere close, then what? 10,000? is that the right number? Are you talking within the borders of the continental US or Thailand or Bolivia? Because if it's in the US you MIGHT be able to keep from dying from exposure on $28,000 a year in some parts of the country. Happy? highly unlikely.

In all honesty you just laid out a huge crapper. It's been your way for over 34 years at least in the US and what do we have to show for it? A rapidly declining middle class, stagnant wages, declining social mobility, declining life spans and on and on it goes ... I don't think we will agree I'll just leave it at that

no, glad you caught it

This is a (probably paid) "social media branding" troll and I let one through the anonymous moderation queue to give a solid example of one.

Kind of amazing isn't it? Someone sitting in the 3rd world somewhere writing comments for probably a penny or maybe 3, to promote billionaires.

It's true, you can find these jobs online, where they pay people in 3rd world countries pennies to write comments on sites and so on.

Wage Rate Suppression

Immigration reform (sic) will only exacerbate the problem by enabling the wealthy to hoard even more dollars as they pay workers less and less for their effort.

For the Love of Money

By SAM POLKJAN - January 2014

"In my last year on Wall Street my bonus was $3.6 million — and I was angry because it wasn’t big enough. I was 30 years old, had no children to raise, no debts to pay, no philanthropic goal in mind. I wanted more money for exactly the same reason an alcoholic needs another drink: I was addicted."

http://www.nytimes.com/2014/01/19/opinion/sunday/for-the-love-of-money.h...

MONEY, is it really the root of evil?

Let's face, money is power. And power can make us all crazy. All my life I lived within my means. I had a decent job and tried to do the right thing. When I retired, I sold my real estate positions and resettled in a tax friendly green state. My pension is adequate and I really want for nothing. I find this enough. Most people I run with agree with me on this point. I never met one of those super rich people outlined above. You talk about progressively taxing them, maybe you're right. Remember, money is power. I think changing their mind set would improve their "hoarding" tendencies. If Congress makes the laws and their corupt, how then can their laws help? Our President does his best as well as every president before, to make policies (laws) on his own if Congress doesn't co-operate quik enough. That scares me. We need a strong leader with a plan to harness the power out there and turn it around for the good of us all. And the only way a powerful wealthy man wil respond positively to that kind of leadership is if a fair and decent logical plan is laid out for them. No one and I mean NO ONE, knowingly likes to throw good money away. It is wasteful in their eyes and mine as well

America is a Republic,not a Democracy

America is a Republic, not a Democracy. Read, understand and know the difference.