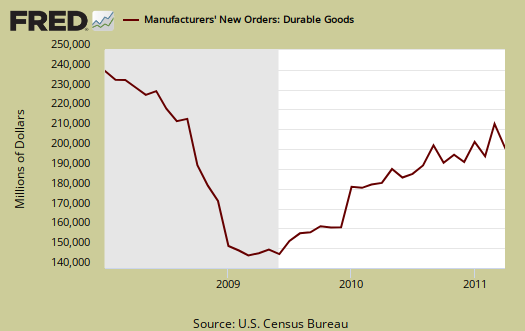

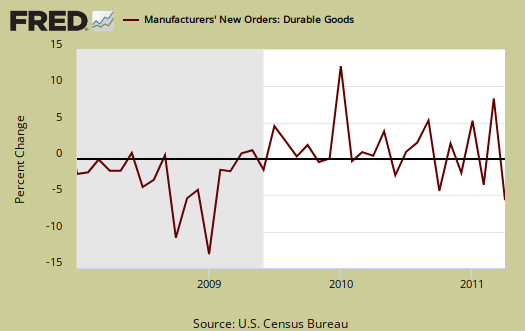

New Orders in Durable Goods decreased -3.6% for April 2011, after last month's +4.4% increase, which was significantly revised. New orders dropped $7.1 billion to $189.9 billion in a month. That's not good news and the biggest drop since October 2010.

Core capital goods new orders decreased -2.6%, after increasing 5.4% last month. Core capital goods is an investment gauge for the bet the private sector is placing on America's future economic growth.

For all transportation equipment, new orders plunged -9.5%. While nondefense aircraft plunged -30%, motor vehicles, which is not nearly as volatile as aircraft, decreased -4.5%. Even when factoring out transportion, durable goods new orders declined -1.5%. We cannot blame air-o-planes this time.

New orders have declined three of the last three months. New orders in machinery, down -3.4%; computers, down -4.4%; communications equipment, down -3.4%; electrical, appliances, down -4.9%. We have across the board declines and generally, a dismal report.

Once again, we have bad news for core capital goods, the stuff to make more stuff. Realize businesses and nations just don't go out and buy a billion dollar air-o-plane every day. Machinery is a large part of core capital goods.

Core capital goods are a leading indicator of future economic growth. It's all of the stuff used to make other stuff, kind of an future investment in the business meter. Core capital goods excludes defense and all aircraft. Shipments in core capital goods decreased -1.7%. Note, core capital goods has not recovered to 2007 levels.

To put the monthly percentage change in perspective, below is the graph of core capital goods, monthly percentage change going back to 2000. In January 2009, core capital goods new orders dropped -9.9% and also declined by -9.4% in December 2008.

Inventories, which also contributes to GDP, were up +0.9% in April 2011 after increasing 1.7% last month. Core Capital Goods inventories increased +1.1%. Inventories are at record levels.

This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 1.7 percent March increase.

Unfilled orders increased +0.2%. Machinery had a record on unfilled orders.

Machinery, up fifteen consecutive months, had the largest increase, $2.2 billion or 2.2 percent to $103.6 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 2.1 percent March increase.

Shipments, which contributes to the investment component of GDP, is down -1.0% in April. In core capital goods, shipments decreased -1/7%, which is not good news as an approximation and indicator on Q2 2011 GDP growth.

Producer's Durable Equipment (PDE) is part of the GDP investment metric, the I in GDP or nonresidential fixed investment. It is not all, but part of the total investment categories for GDP, usually contributing about 50% to the total investment metric (except recently where inventories have been the dominant factor).

Producer's Durable Equipment (PDE) is about 75%, or 3/4th of the durable goods core capital goods shipments, used as an approximation.

While some will blame the Japan earthquake disaster for distrupting the supply chain, others will blame the seasons, if one compare new orders for just April.

What is a durable good? It's stuff manufactured that's supposed to last at least 3 years. Yeah, right, laptops and cell phones.

Recent comments