There is another round of bad news for most Americans. A study shows the top 1% of America's rich captured 121% of the income gains for the two years after the 2007-2009 recession was declared over. U.C. Berkeley Economist Emmanuel Saez released his study Striking it Richer: The Evolution of Top Incomes in the United States early this month to much press. It truly is astounding. Gone is America's strong middle class where work was rewarded. Replaced is a growing elitist class, where the ticket to enter is $$366,623 a year. Saez's findings:

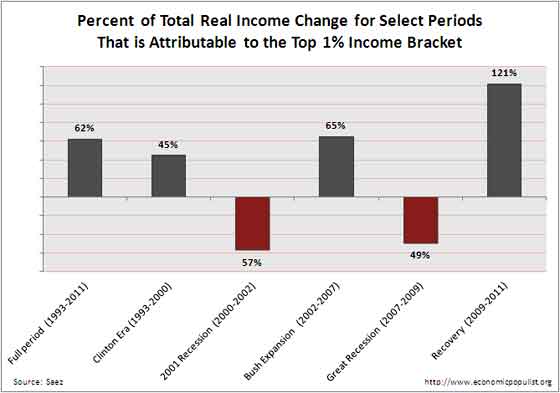

From 2009 to 2011, average real income per family grew modestly by 1.7% but the gains were very uneven. Top 1% incomes grew by 11.2% while bottom 99% incomes shrunk by 0.4%. Hence, the top 1% captured 121% of the income gains in the first two years of the recovery. From 2009 to 2010, top 1% grew fast and then stagnated from 2010 to 2011. Bottom 99% stagnated both from 2009 to 2010 and from 2010 to 2011. In 2012, top 1% income will likely surge, due to booming stock-prices, as well as re-timing of income to avoid the higher 2013 top tax rates. Bottom 99% will likely grow much more modestly than top 1% incomes from 2011 to 2012.

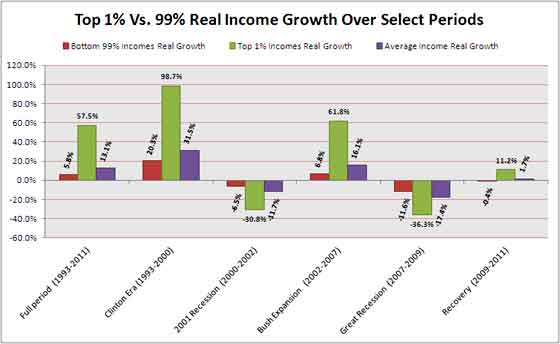

We took the liberty of creating some graphs from Saez's calculations. In the first graph below is the bottom 99% real income growth, the gains in real income by the top 1% and then the average real income growth for selected periods between 1993 tol 2011. We can compare this recession to the Clinton era as well as the recession of 2001. What this graph amplifies is the rich are getting richer while the rest of us are simply getting poorer or going nowhere with income. Saez uses a special research CPI to compute real income, the same series used in labor productivity. Real means adjusted for inflation.

We also see the income disparity was getting worse, even under a Democratic administration. In spite of the rhetoric, Clinton was quite good for the rich.   Obama is looking even better for the top 1%.

The next graph shows the haul the rich got as overall real income changed. The rich did take a hit in both recessions, but this is due to stock market declines and temporary. Most shocking is the last two years most people have seen their real income decline by -0.4% while the top 1% grabbed 121% of the income gains made in 2010 and 2011. In other words, the only ones who recovered from the recession are the rich.

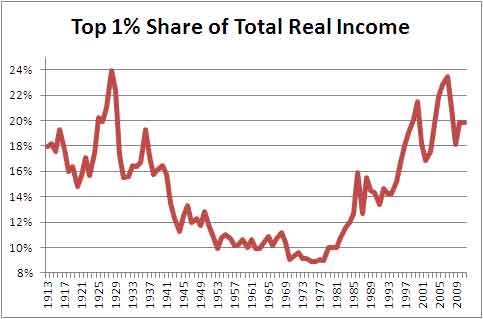

As the Saez paper amplifies, it is like most of America is going backwards in time, straight to the idle wealthy and robber barons of a bygone era. Instead of the idle rich living off of inheritance, we have hedge fund managers and overpaid CEOs becoming America's new elite upper crust class.

During the Great Recession, from 2007 to 2009, average real income per family declined dramatically by 17.4%, the largest two year drop since the Great Depression. Average real income for the top percentile fell even faster (36.3 percent decline), which lead to a decrease in the top percentile income share from 23.5 to 18.1 percent. Average real income for the bottom 99% also fell sharply by 11.6%, also by far the largest two year decline since the Great Depression. This drop of 11.6% more than erases the 6.8% income gain from 2002 to 2007 for the bottom 99%.

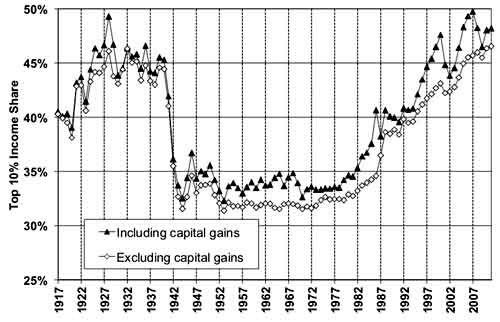

Beyond the rich making all of the income recovery post the financial crisis, the study also shows we have returned to 1917 in terms of income share going to the rich. Anyway you slice it, with capital gains made from the stock market or not, all of the economic justice of the past century has been wiped out.

Excluding realized capital gains, the top decile income share in 2011 is equal to 46.5%, the highest ever since 1917 when the series started.

Below is Saez's graph of the top 10% percent as a share of total real income in the United States. There are two lines, one with stock market gains and another without capital gains. As we can see, income inequality has turned back the clock an entire century.

We created the below graph from Saez's data showing the income share as a percentage of total real U.S. income of just the top 1% since 1913. Here too, we see income inequality rising as the top income bracket get more and more of total real annual income in the United States. The rich are are not just getting more than their fair share of the income pie, they are eating it, with barely a crumb left for the rest of us.

Saez lays blame for the increasing income inequality in the United States on the attack on so many New Deal and WWII policies, programs and laws made during the FDR administration. The never ending attack on labor, progressive tax policies, social security, wages and low cost education have taken their toll. We could throw into the mix global labor arbitrage, where corporations have an unlimited pool of workers so they consider Americans disposable. Saez seems to believe we could turn this around through government policy. Considering our Congress right at this moment is guaranteeing to harm the economy through sequestration, it does not look like there is much hope of getting real policies passed to return America to her former glory.

We need to decide as a society whether this increase in income inequality is efficient and acceptable and, if not, what mix of institutional and tax reforms should be developed to counter it.

We cannot decide. Large corporations and very rich people decided for us and it's not good news for economic justice in the United States.

Comments

Graph of performance vs. pay and CEO pay vs. median pay

Every pension and other fund the middle class pays into (where they still exist) should plot their performance vs. market index performance vs. managers' pay (based on AUM and profits). Then every single person in the fund should have a "yes" or "no" vote on whether the pension should continue allowing this pillage to go on. No closed-door meetings in Sacramento or Austin or Albany, the people who are losing money to poor performance and exorbitant fees decide, not the captured administrators and lobbyists. Worst case for the pension, people have the option of getting out completely because they can see the pension is losing money through outrageous fees and many people would feel better investing themselves vs. financing banksters' Swiss accounts. In addition, the pensions should force Goldman Sachs and other managers to show much their CEOs earn vs. the median salary of the public servants in the pension funds. Why should someone earning $40,000 in a tax-heavy state like NY help fund Blankfein's $32.5 million Hamptons estate while he appears at the White House and on TV complaining about "entitlements" and the need to basically let people rot?

This applies to basically every industry though. The CEO pay is so out-of-whack with actual performance. DOD can cut contracts or contract employees at the bottom rungs earn less and less and are never sure about their next job (sometimes years go by if anything) but the CEOs of these MNCs still collect massive paychecks that dwarf soldiers and civilian contract employees. Health CEOs making huge loot but insurance seems to cover less and less. And forget about those that don't have company-provided insurance (e.g., the unemployed and many other sectors) - they are screwed on monthlies and doomed if they get cancer or some other disease.

Pay for performance has never meant so little. Same with hiring people based on talent, skills, or education. Not true. Heads they win, tails we lose. Hiring, promotions, and pay all reveal the duplicity at all levels.

A request for a graph?

I can try to get to some statistics on the obscene rise in executive pay vs. pension performance vs. worker wages.

Meritocracy is clearly something for glossy HR brochures and pamphlets that are all about not getting sued and controlling the staff.

That's really the point of this article, to amplify America has grown a super elite class, of the uber-rich similar to the aristocracy or the elite American class of the late 1800's, early 20th Century.

It's a complete joke at this point, they have literally wiped out America as we knew it from even 30 years ago.

Nah, let the folks in Albany and Austin and Sacramento do it

These graphs should go out with the regular mailings regarding the pensions' holdings and performance they have to send. I'm sure when everything is laid out in nice pictures the pension administrators in cities and states across the country would receive quite a few questions like, "Why the Hell does this hedge fund manager underperform the market year-after-year and why does he make $2 billion/yr. when my wife just got fired through austerity that the same manager demanded on TV! And why is he making 40,000 X the median salary I make as a public servant?! He demands punishing the public but gets rich from the same public."

Good times for the administrators and lobbyists.

We are an economics site

I have been so busy with server problems and trying to finish the site, I haven't sat down to crank through raw data as this site is know for. That said, expecting pension fund managers to ask this question, you're going to collect a lot of cobwebs waiting for it.

It's a good question and one I will bookmark. We're perfectly capable of generating that kind of information from raw statistics, first principles. Why this site is popular.

People have written on this issue - and like you said, ignored

Public servants have written to both administrators and their respective AGs. They don't care. But you'll see, when some politician or wannabe governor or Senator decides to make it an issue, suddenly they will be seen as having tremendous insight and amazing intelligence as they tackle this "outrage." See, it's all in who says and does it. A politician or CEO does something, like taking a crap, it's pure genius. Common man or woman develops a cure for a disease, well, it's only because some CEO somewhere allowed him to breathe the same air as him. Forgive the cynicism, but damn, this country is just breeding it.

Only campaign fodder to be ignored in practice

The proof was in the pudding when Obama had a golden opportunity when first in office. They could have nationalized the banks and dramatically cut CEO pay. Instead it was simply used as campaign rhetoric as Geithner, esp. gave carte blanche to the banks and CEOs generally. Hedge fund managers were a major Obama campaign contributor.

Now, we cannot even get Congress to stop tanking the economy over their inane "budget cut" absurdities.

That never stopped us from ranting with numbers and we should not stop.