Challenger, Gray & Christmas tracks layoffs. In their May Report (attached), the tally of layoffs is 38,810. April announced layoffs were 38,326. 16,697 of the layoffs were in government and non-profit, which is an increase from last month.

New York had the most firings, with 18,960 layoffs in that state alone in May.

The number one reason for firing people is cost reduction. 15,998 of the 38,810 firings gave this reason.

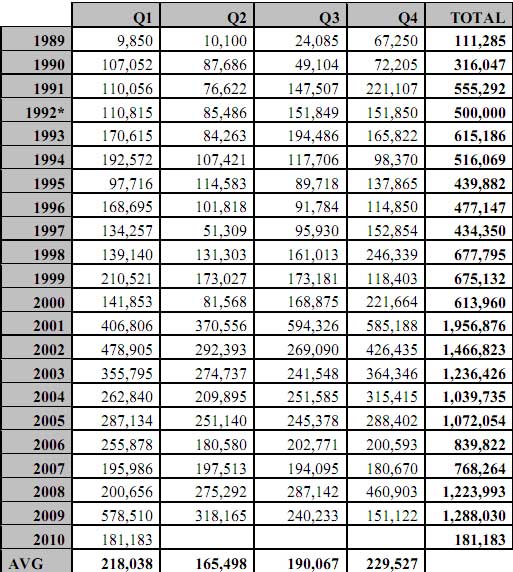

While Challenger & Gray compares this to last year and seems to say how great it all is, the reality is more corporations have been offshore outsourcing and labor arbitraging American workers for over a decade now. Below is the Challenger Quarterly Layoff tracker starting in 1989. One can see the pattern of treating workers as disposable commodities, starting to escalate as technology, such as cheap telecommunications, expanded and bad trade deals, like the China PNTR came into effect. Global labor arbitrage is a long term structural problem for the U.S. labor force.

Recent comments