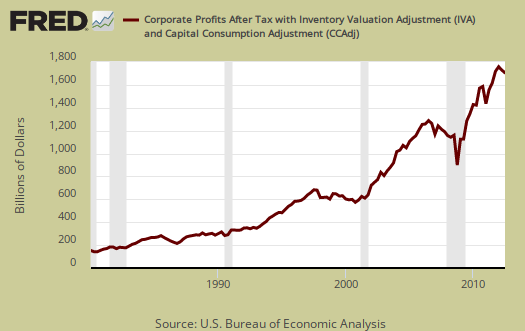

The BEA released corporate profits for Q3 2013 along with GDP and anyway you slice it, corporate profits are soaring to the stratosphere. Corporate profits after tax increased 2.8% from Q2 2013 to $1,871.7 billion. Corporate profits after tax are also up 5.8% from a year ago. Corporate profits as a percentage of GDP are at an all time high and after tax profit margins per unit are also soaring to the stratosphere.

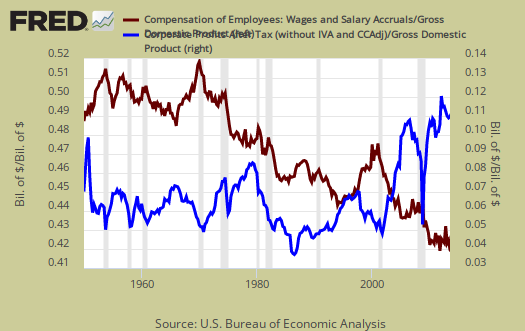

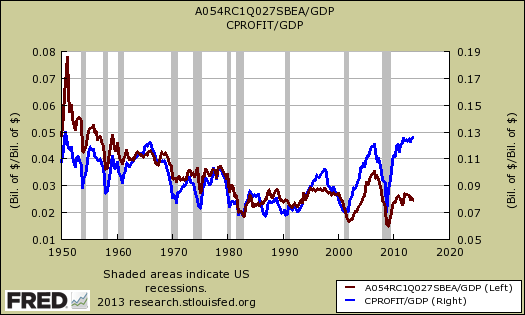

Corporate profits after tax just hit a record high as a percentage of GDP, 11.08%, while wages are at their lows as a percentage of nominal gross domestic product. Workers are clearly getting less and less of the American economic pie, while corporate profits continue to soar. To illustrate how bad this is, the below graph shows wages and salaries as a percentage of GDP in red, scale on the left, against corporate profits as a percentage of GDP, in blue, scale on the right. This is just terrible for America and American workers as wages get less and less of the economic pie while corporate profits continue to roar.

Corporate profits per unit also set a record. That's not due to increased prices and because this is profits per unit, it's not an incredible in sales volume. Nope, corporations are making out like bandits because they are squeezing workers, continuing their practice of labor arbitrage and also cashing in on very low interest rates.

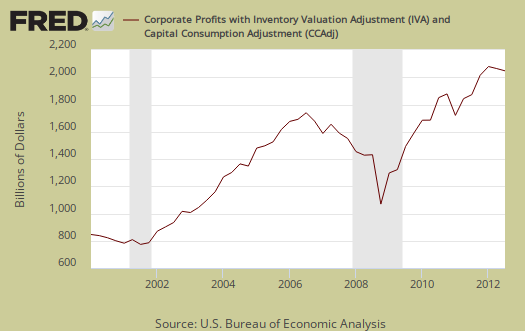

The BEA reports corporate profits in a variety of ways and it seems whatever one's focus and political predilections are implies which number they use. Below are some of the other ways of viewing corporate profits, but anyway ya slice it, corporations are simply getting more of the American pie while workers go without. By any measure corporate profits are hitting records in Q3.

Corporate profits with inventory valuation and capital consumption adjustments, after tax, increased 2.6% from last quarter to $1,712.2 billion and are up 8.8% from one year ago.

Corporate profits with inventory valuation and capital consumption adjustments, pre-tax, increased 1.8% from Q2 to $2,125.7 billion and have increased 5.6% from a year ago. These are profits from current production.

Net cash flow, with inventory evaluation adjustment soared 11.4% from Q2 to $2,287.8 billion. This is a 3.6% change from a year ago. These are the corporate funds available for investment according to the BEA.

Quarterly tax receipts for Q3 decreased -1.1 from Q1 to $413.4 billion and have decreased -5.8% from a year ago. Below is another ratio to GDP of corporate taxes paid (red, scale on left) and corporate profits after tax with adjustments (blue, scale on right). Using this method of measuring after tax corporate profits we have near record to GDP ratio of 12.59%. The interesting thing about the below graph is how taxes paid have decoupled from corporate profits after tax. Notice how the two lines, the taxes as a ratio of GDP and corporate profits after tax as a ratio of GDP follow each other in curve....except for recently.

Bottom line no matter which metric the BEA uses to report corporate profits they all are soaring. Obviously corporations and Wall Street are doing fine while workers and wages languish.

From the BEA's magic secret decoder ring guide to National Income and Product Accounts (large pdf), national income also uses inventory valuation and capital consumption adjustments. Their reasoning for inventory valuation is this:

Inventory valuation adjustment (IVA) is the difference between the cost of inventory withdrawals valued at acquisition cost and the cost of inventory withdrawals valued at replacement cost. The IVA is needed because inventories as reported by business are often charged to cost of sales (that is, withdrawn) at their acquisition (historical) cost rather than at their replacement cost (the concept underlying the NIPAs). As prices change, businesses that value inventory withdrawals at acquisition cost may realize profits or losses. Inventory profits, a capital-gains-like element in business income (corporate profits and nonfarm proprietors’ income), result from an increase in inventory prices, and inventory losses, a capital-loss-like element, result from a decrease in inventory prices.

The mysterious capital consumption adjustment, along with inventory valuations, derives current production income.

The private capital consumption adjustment (CCAdj) converts depreciation that is on a historical-cost (book value) basis—the capital consumption allowance (CCA)—to depreciation that is on a current-cost basis—consumption of fixed capital (CFC)—and is derived as the difference between private CCA and private CFC.

Since this is what the BEA uses for national accounts and makes much more sense from a business accounting perspective generally, seems the above before and after tax numbers are the right metrics to use when thinking about corporate profits from a national and macro-economic perspective.

If the above magic secret BEA decoder ring didn't make much sense, try this one:

Corporate profits with inventory valuation and capital consumption adjustments is the net current-production income of organizations treated as corporations in the NIPA's. These organizations consist of all entities required to file Federal corporate tax returns, including mutual financial institutions and cooperatives subject to Federal income tax; private noninsured pension funds; nonprofit institutions that primarily serve business; Federal Reserve banks; and federally sponsored credit agencies. With several differences, this income is measured as receipts less expenses as defined in Federal tax law. Among these differences: Receipts exclude capital gains and dividends received, expenses exclude depletion and capital losses and losses resulting from bad debts, inventory withdrawals are valued at replacement cost, and depreciation is on a consistent accounting basis and is valued at replacement cost using depreciation profiles based on empirical evidence on used-asset prices that generally suggest a geometric pattern of price declines. Because national income is defined as the income of U.S. residents, its profits component includes income earned abroad by U.S. corporations and excludes income earned in the United States by the rest of the world.

Recent comments