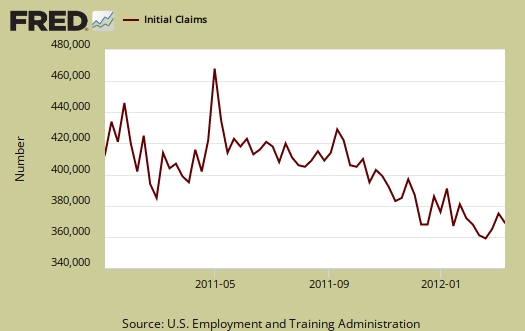

Initial weekly unemployment claims for the week ending on March 10th, 2012 were 351,000. The DOL reports this as a decrease of 14,000 from last week. The previous week was revised, from 362,000 to 365,000, an increase of 3,000. This is the lowest number of people filing for unemployment reported in four years, March 2008.

Today's report is another solid down tick in initial unemployment claims. The DOL does adjust weekly initial unemployment claims for seasonal increases and decreases, but since the report is issued weekly, there is a lot of variance even with seasonal adjustments.

Every week initial unemployment claims are also revised and the above graphs shows this report is noisy. One simply cannot compare the reported numbers on a week to week basis due to the lag in States reporting claims data and revisions, plus the fact this is a 1 week time window, versus a monthly one. One needs to at minimum look at the 4-week moving average, which is also below the magic 400,000 number which shows jobs creation. The 4 week moving average is now 355,750, the same as last week's 4 week average, which was revised from 355,000.

Below is the 4 week moving average, set to a logarithmic scale to remove even more statistical noise, for the last year. We have a clear downward trend, which is good news. The initial unemployment report is indicating moderate to modest job growth.

The magic number to show job creation is at minimum, below 400,000 initial unemployment claims, per week. Most Economists will quote 375,000 as the magic number to indicate job growth. Houston, we have a pattern, it seems finally, finally, weekly claims approaching that 375,000 level, as a trend, yet UI claims have not returned to pre-recession levels.

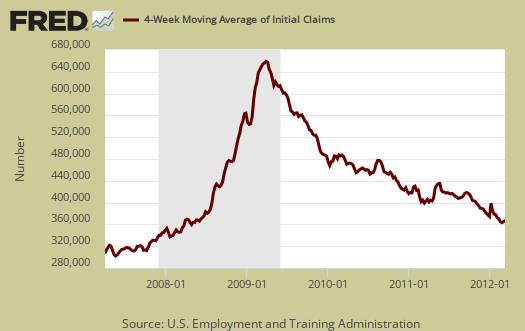

Below is the mathematical log of initial weekly unemployment claims, so one can get a better sense of the rise and fall of the numbers. A log helps remove some statistical noise, it's kind of an averaging. As we can see we have a step rise during the height of the recession, but then a leveling where every week initial unemployment insurance claims hover around 400,000, refusing to really drop for over two years, a never ending labor malaise for most of the time after the recession ended in July 2009. What we need to see here is a steep decline over time, which we seem to be finally seeing.

Below is the 4 week moving average, set to a log scale, from April 1st, 2007. Here we can see we still are not at pre-recession initial weekly unemployment claims levels. Clearly UI numbers have greatly improved from the above trend graph. Of course everyone in America should have been fired at least once by now.

Weekly initial unemployment claims are statistically noisy, the numbers are always revised, there is large variance because it's a weekly data report instead of monthly, and only through a long term pattern can one say anything about the unemployment situation. This report is great news, and what we want to see is a strong trend, dropping down to pre-recession levels, where the labor market still wasn't so great.

Continuing unemployment claims dropped but bear in mind people can plain being running out of benefits.

The advance number for seasonally adjusted insured unemployment during the week ending Mach 3, was 3,343,000, a decrease of 81,000 from the preceding week's revised level of 3,424,000. The 4-week moving average was 3,394,250, a decrease of 25,250 from the preceding week's revised average of 3,419,500.

In the week ending February 25th, not seasonally adjusted, the raw number was 7,424,040 official people obtaining some sort of unemployment insurance benefit. Officially, there are 12.8 million unemployed and if one takes all of the people who want a job, including those stuck in part-time because they can't get anything else, the number is over 28 million. Even at the February's job growth rate, it will take close to a decade to recover America's jobs.

Encouraging

Let this trend continue. Thursday mornings have been encouraging this year. We need a little break on gas prices and we could have liftoff.

Even the Repugs will be happy because they only care about social issues. Screw the economy its not in the bible. Not one primary candidate has the guts to put forth an honest economic plan. One that doesn't lead to being Greece anyway. They only offer us plans that would triple unemployment while providing taxcuts to their corporate owners. They can save their breathe and PAC money.

because Wall Street wants their speculation

I will probably put up much more on gas prices, looking at supply/demand vs. speculation. I did one already.

The trend is clearly down but I'd like to see initial claims drop to 2007 levels...at least!