The transcript from this week’s, MiB: Ed Yardeni on the Roaring 20s, is below.

You can stream and download our full conversation, including any podcast extras, on Apple Podcasts, Spotify, YouTube, and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here.

~~~

This is Masters in business with Barry Ritholtz on Bloomberg Radio.

Barry Ritholtz: This week on the podcast, I have another extra special guest. Dr. Ed Yardeni is a really a legend on Wall Street. He is both an investment strategist and an economist, and I’m very comfortable saying he does that better than anybody else. He has had a number of major market calls and economic calls that have been notable, not just because they were right, but for the way he uses data to reach the right conclusion. He has consistently been bullish since the market bottomed in March oh nine. He has talked about where a recession is and isn’t coming. He’s more or less nailed what the Fed was going to do. Even though a lot of these calls have been outliers and very contrarian compared to the rest of the world of finance. Ed is a neighbor of mine, lives the next town over. I’ve known him for

a long time, and I’ve just marveled at how he thinks about markets and the economy and government and data. I subscribe to his daily notes and find them to be tremendously useful in contextualizing the fire hose of data, looking at what’s important and what’s not, and how much of this stuff is just noise. I found this conversation to be informational, educational, and fascinating, and I think you will also, with no further ado, my interview with Dr. Ed Yardeni.

Barry Ritholtz: Dr. Ed Denni. Welcome back to Bloomberg.

Ed Yardeni: Barry, it’s always a pleasure. Thank you for having me.

Barry Ritholtz: Well, well thank you for coming. It’s always good to see you. We’re neighbors. We probably, yes. Don’t get to see each other as much as we did pre pandemic.

Ed Yardeni: We have to catch up.

Barry Ritholtz: We still have some bad pandemic habits that we have to break. Let’s talk a little bit about your background. You have a fascinating academic background, a PhD in economics from Yale, and your thesis advisor is Nobel Laureate, James Tobin. Tell us about working with Tobin.

Ed Yardeni: Well, it was certainly an, an honor and to work with somebody who won the Nobel Prize for his contribution to economics. But sometimes it wasn’t that easy to understand his theories because they were mathematical and got complicated. But as a result of that, I turned to Janet Yellen. Janet Yellen had graduated from Yale in their PhD program six years before I attended. And she took meticulous notes, you know, she must’ve been one of those, you know, very focused students sitting in the front row of Tobin’s class six years before I got there. And she took meticulous notes, just great notes, and they were xeroxed. And I think most of us who studied under Tobin basically got through Yale, got our PhDs because of Janet Yellen’s notes.

Barry Ritholtz: That’s really interesting. The, the undergrad at Cornell and then a master’s degree also at Yale. What that seems like a lot of education. Was the plan to go into academia or was it always Wall Street?

Ed Yardeni: Well, I didn’t really know what I wanted to do when I was an undergraduate, so I took everything from a couple of courses of engineering, physics, math, political science and economics. And based on all that, I realized I wasn’t any good at math or, or at physics. So I had to go into something a little softer and easier. So I did go into a combination of politics and economics. And then for my master’s, I went to the international relations program at Yale, which combined economics and political science. And then as I ended that two year program, I realized I’d accumulated enough to basically do a PhD in four years there as well, on on top, you know, not an extra

four years, one more year to go.

And then I just had to write a PhD dissertation. And I’d seen too many of my fellow students who are kind of hanging around the graduate program, because they couldn’t quite finish their PhD dissertations. I decided I was gonna get out of there quick. And so I, I wrote a dissertation, empirical one that confirmed a lot of Tobin’s theories. He absolutely loved it. And let, let, let me move on from there.

Barry Ritholtz: So you graduate with a PhD in economics in 1976. We’re gonna talk about inflation later, but I have to ask a lot of your peers who graduated in the mid seventies, it seemed to really leave a mark on them, unlike most of them. You nailed inflation on the way up. You nailed it on the way down. So many of them seem to be scarred by their 1970s experience. Right. Why did that whole era of economists, and I’m including like big names like Lawrence Summers, right? Why did they get this so wrong?

Ed Yardeni: I think that they first start out with theories and then look for data to support it. And you know, I can’t really generalize about the economics profession, but I think there isn’t enough attention to just, you know, dealing with the facts, with the data and with historical events. I lived through a lot of those historical events and learned from them. But I observed that, you know, inflation was in fact brought down in a very conventional way in the late seventies, early eighties with very tight monetary policy. And then in the eighties, I observed that we were seeing Deindustrialization in America. But that was because of globalization, right?

Barry Ritholtz: Which was deflationary…

Ed Yardeni: Which was deflationary. And in fact, I think it was in the early eighties, I don’t know the, I think it was 82, 83, I predicted that we’re probably gonna see a period of disinflation. And part of that was also based on my view that as globalization prevailed, that’d be more global competition. And that would keep a lid on inflation.

Barry Ritholtz: And you also wrote a piece in 2023 about why conventional forecasting models were so wrong. Right? And a lot of people in particular, you mentioned Jamie Diamond had been expecting a recession, right? It seemed like almost every economist was expecting Yeah. A recession. And it never showed what again, what did you get right? What did they get wrong? Well,

Ed Yardeni: I think most economists very logically believe that if the Fed’s gonna go from zero on the Fed funds rate to five point a quarter percent, how could we not have a recession? My argument was that while the Fed certainly was tightening, they were also normalizing. I mean, right. And so you had to not only look at where interest rates had gotten to, but where they came from and they

came from zero. So the real abnormality was the ultra easy monetary policy that we had from the great financial crisis to the great virus crisis. And I felt that the economy was demonstrating that it could handle it, that it would be in fact relatively resilient. And of course, you have to get the consumer right. And along the way, I concluded that while Jamie Diamond and others were focusing on the consumer

running, running out of, so-called excess saving, the idea that was that, you know, consumers that accumulated two to $3 trillion for during the two months of shutdowns, and then for, while the helicopter money that was deposited in their accounts, I was pointing out increasingly that, well, wait a second, the baby boomers have $75 trillion in retirement assets. And you know what? They’re starting to retire.

Barry Ritholtz: : I love that chart. You actually showed that chart today.

Ed Yardeni: Yeah. Net wealth, it comes from the, the net Flow of Funds from report from the Federal Reserve. But when you look at the millennials and the Gen Xers, wasn’t everybody predicting the the boomers were gonna go broke. They wouldn’t have any money. Retire 75, almost $77 trillion.

Barry Ritholtz: That’s a lot of money.

Ed Yardeni: It’s an all time record high. The household sector in its entirety has over $150 trillion in, in net worth. And that’s assets minus liabilities. And it’s all sorts of different assets. It’s houses, it’s stocks, it’s pensions, it’s the whole, the whole thing. So that’s at a record high. And the baby boomers own half of that, roughly $75 trillion. And then the younger generations are kinda looking at mom and dad starting to retire, said, you know, I, I wish you a long and, and happy retirement, but don’t spend it all. And so I, I think the savings rate’s gonna remain extremely low because the baby boomers are not saving anymore. They’re right. They’re, they’re spending. And I think that the younger generation can actually look forward to some substantial as being substantial beneficiaries of inherited wealth.

Barry Ritholtz: Let’s roll back to the work that you did with James Tobin and one, I believe he won the Nobel Prize Yes. For his work on fiscal spending. So when you have the CARES Act one, which was 10% of GDP [Yeah, Huge]. And then the CARES Act two, and then the Cares Act three, shouldn’t that offset whatever the Fed’s gonna do? And by the way, 5% isn’t outrageously high. That’s kind of average.

Ed Yardeni: Yeah. Well, I think that’s a, that’s another good point, is that not only did the consumers turn out to be resilient and they remain resilient, they’re still spending, and LA labor market’s been really tight. The reason for that, of course, is the baby boomers are spending more on going out to restaurants, right? Traveling healthcare services. And so guess what employment is doing in on all those industries? All time record high. You, you don’t get a, a recession when construction and total payroll employment are at all time record highs. That’s the other reason why the economy has done well, is there’s been a tremendous amount of fiscal spending that has led to record spending on infrastructure. I mean, you can actually see it in the data. It’s not just there was an act and then nothing happened. There was a lot of spending. And then of course, onshoring, we receive a lot of tax benefits. So we’ve seen construction of factory facilities just exploding to the upside. And again, those are all construction jobs and they’re gonna need employees and and so on.

Barry Ritholtz: So, nice tailwind, we’ll come back to that a little later. Sure. Let’s stay with the early days of your career. ’cause I really find it kind of unique. You’re an economist at the New York Fed in 76 and 77, right? You’re fairly young and new. Then what were you working on when you were at the New York Fed?

Ed Yardeni: Well, just by happenstance, they put me on writing memos, updating data. It wasn’t real exciting stuff, but I focused on the savings and loan industry. I mean, you can’t think of anything like more boring and it’s like, and useless than analyzing the savings and loan industry in the, in the late seventies as

Barry Ritholtz: Right, right before it blew up.

Ed Yardeni: And then it blew up. And then I’m suddenly on Wall Street and I have a lot of knowledge of just what was going on in the s and l industry. So it, it really helped me to understand that crisis.

Barry Ritholtz: So here’s what I find so fascinating and unique about your career. You have been Chief Investment Strategist at places like Deutsche Bank and Prudential, but you are also Chief Economist at EF Hutton, Prudential Base, CJ Lawrence, which eventually gets bought by Deutsche Bank, right? Like that’s a rare pair of hats for one person to wear. Right. Tell us a little bit about how you managed to do both jobs.

Ed Yardeni: I did start out as an economist, I think, think I was at EF Hutton for about a year or two, and then the Chief Economist decided to move on. And so only a couple years into Wall Street career, I was chief economist of EF Hutton. So that was pretty exciting. But I learned a lot from the strategist I worked with. There was a fellow by the name of Greg Smith, who was a strategist at EF Hutton. Jim Moltz was a well regarded, I remember Jim Sure. cj, CJ Lawrence. And so I learned a lot from them. And an opening became available to be a strategist at CJ Lawrence, which by then had become part of Deutsche Bank Securities. And I jumped at it and I said, look, I think I can do both jobs. And it just to me, made sense to do both jobs. ’cause I don’t know how you can be, you know, a well-informed strategist without understanding the economy.

Barry Ritholtz: So when you were working for Lawrence as part of, and eventually become Chief Investment Strategy at Deutsche Bank, what was that like? Given the fact that they’re based in Germany, many, I don’t wanna say most, but many of their clients are European. How did that change how you looked at, at the world?

Ed Yardeni: Well, I, I didn’t really work for Deutsche Bank per se. I worked as the chief economist and strategist for Deutsche Bank Securities, which was still, to a large extent, based in the United States and had international clients. But we certainly had plenty in the us. So the transition from CJ, a Lawrence being independent to CJ a Lawrence evolving into Deutsche Bank securities, nothing really changed for me, quite honestly. What was very visible is Deutsche Bank spent a tremendous amount of, of money on expanding. And so they, they hired the Frank Tron group. Oh, sure. Yeah. And in the research investment banking department for the, a couple of years at the time, Quaran brought Amazon to to, to the marketplace. And I’m kicking myself, you know, I mean, there was like, I think 13 bucks before all the splits, but it was an exciting time. Sure.

Barry Ritholtz: Let me ask you about that exciting time your on Wall Street in the eighties and nineties, arguably the biggest bull market of our lifetime. We’ll see how far this one goes. Yeah. Where we are today. What was it like in that era when people were still stock pickers, active mutual funds, right. Were attracting the flows. Everybody thought they could beat the market. We didn’t quite have all the data yet. Te tell us what that era was like as a chief strategist on the street.

Ed Yardeni: Well, the, the, the eighties were certainly interesting and near the tail end, we had the, the crash in the stock market. The one day crash, I scrambled to kinda understand what was going on, concluded it was a portfolio insurance. And that the week before the House Ways and Means committee was starting to talk about taxing some of these transactions that were going on in m and a. And so a lot of the m and a stocks got hit quite hard. And my conclusion that it was largely a government, a reaction to possible government regulation. Huh. And that it probably would pass. And Rustin Kowski, who was the head of the House committee at the time, did in fact pass on it in December. Suddenly it was kind of evaporated. So I, I concluded within a couple of days that we were probably making it low in this bear market that only lasted really a few days. I mean, officially it was October to to December.

Barry Ritholtz: To be fair, I I wanna say by August of 87 S&P500 was up 40 something percent. Yeah. And we finished the year plus 1%. Yeah. So that’s quite a, quite a whack age that, that would constitute a bear in my book. Right.

Ed Yardeni: In the early nineties, I started to recognize the technology revolution that was going on. And I got very bullish.

Barry Ritholtz: You were early and vocal?

Ed Yardeni: I was early and vocal. And as a matter of fact, I walked into a Barnes and Noble store, I think in 1994, early 1995. And I, I’m pretty sure that I was the first one to have a website on the internet, obviously on Wall Street. I know no other economists had it. I, I didn’t know how I got away with it at Deutsche Bank. Why they would allow, you know, Dr. Ed Ya Denny’s economics network to be featured on, on the internet without any real, any real mention of who I worked for.

Barry Ritholtz: Well maybe that’s the German ownership didn’t understand US compliance roles [I suppose]. Who knows. You launch in January ’07, not that much earlier than the financial crisis. Tell us what led you to launching Yardeni Research?

Ed Yardeni: Well, I had been on Wall Street for many years. I was getting a little stale. The lawyers were starting to take over and there are more limits on, on what you could write about or who you could talk to, even in your own shop. You had to get approval to go down to the trading desk. It just wasn’t as exciting as it had been in the early two thousands. And suddenly out of the blue, I got a call from Jim Slager, who runs Oak Associates in Akron, Ohio. And Jim was looking for somebody to work with him as a strategist in Akron, Ohio. So I talked to him and it sounded like a great opportunity. He made me an offer I couldn’t refuse. So I, I accepted it and it was a three year deal and it worked out fine. But after two years, I kind of missed just doing what I had been doing on the street. Meanwhile, Jim had

allowed me to continue to, to write and to keep in touch with my, my client base. So I left in the end of 2006 and 2000 January 1st, 2007, we started, I started the Denni research as an independent research provider.

Barry Ritholtz: Did you move to Ohio or stay put?

Ed Yardeni: I actually commuted. They, they have a great airport there. Canton Akron Airport’s, a wonderful airport.

Barry Ritholtz: Farmingdale or LaGuardia to Akron?

Ed Yardeni: LaGuardia. And I leave on a Sunday and sometimes hang, hang around there until Wednesday or Thursday. But, so I just kind of commuted and that was okay with Jim and it, and it worked out fine. And of course I did some marketing with him. So I would kind of meet him at different parts of the country and we’d market together.

Barry Ritholtz: Let’s talk about your clients. I’m assuming they’re primarily institutional.

Ed Yardeni: Well, they have been primarily institutional. You know, since I’ve been on Wall Street, I, I guess, you know, I did work for some firms that also had a huge retail base with like Prudential. So I certainly had a lot of interaction with both institutional and retail. When I moved to CGL Lawrence is, is primarily institutional. It was all institutional really. And then when I went off on my own, it, I continued on with an institutional bent. The research was aimed at a fairly sophisticated professional investment community. But about two years ago, we realized that there’s a demand for what we do among individual investors. So we came up with something called gari quicktakes.com and that’s a daily and it’s shorter and it’s to the point, and it, it, it does what I I I I’ve always done, which is kind of combined strategy and economics.

Barry Ritholtz: I was gonna say, you, you also put a lot of information online. Yes. That’s there for free, right? I don’t mean like a chart here or there. Huge runs of data and charts and it’s updated like daily.

Ed Yardeni: Yeah. It’s automatically updated.

Barry Ritholtz:How do you manage to handle all this? That seems like a lot of work, right? That you’re essentially giving away.

Ed Yardeni: Well, several years ago, I, I didn’t see the point of doing all these charts manually over and over again. And, you know, when you run this chart, where is it? And so we came up with an in-house program. This was when I was still on Wall Street an in-house program that ran these charts automatically when the data was available from our data vendor and updated the charts and then put the charts in the proper place in the PDFs that focused on those particular topics. It worked great. I mean it was, I think it was in some ways a very crude artificial intelligence tool. Right. You know, I should mentioned AI at least once in our interview here. Right?

Barry Ritholtz: Oh, we have lots of AI to talk about a little later.

Ed Yardeni: Yeah. But, so anyways, this, this smart program figured out how to paying the, the vendors say anything new for me. And if there was, everything would be updated automatically. And we’re still doing that. And look,if nobody was looking at our charts, I would

still have the whole thing. ’cause that’s what I used to write. And so what I’m doing is basically sharing the puzzle pieces. And anybody who wants to see how I, how I put the puzzles together, has to subscribe to our research.

Barry Ritholtz: And, and just to put some flesh on those bones, you post on valuation, the global economy, the US economy, inflation credit, consumer spending, employee markets, pretty much anything that there’s a regular data stream, it updates automatically. That’s correct. Huh? It’s really, really intriguing. Yeah. Let’s talk about putting some of those puzzle pieces together. You talk about the mega Cap eight, the magnificent seven plus Netflix. How

Ed Yardeni: I like, I like movies as Barry, so I didn’t want to leave Netflix outta there.

Barry Ritholtz: Let me steer you away from the Nu Wonka movie because it’s terrible. Okay. But how important are these eight stocks to the overall market this year and last?

Ed Yardeni: Well, I mean, arithmetically, they’re very important. They’re about 28% of the market cap of the s and p 500. So they, they, they’re huge in terms of their impact. And some people look at that and say, well, that that’s not healthy. It’s, it’s a sign that this market is vulnerable and I’m empirical about it. It is, it is what it is. These are great companies that they’re here to stay. They’ve had a, a couple of sell offs that turn out to be great opportunities to get, get into those stocks. So I think we have to factor in that when you look at the valuation multiple, the s and p 500, maybe it’s not the historical average of 15 anymore. Maybe it’s something more like something, something north of that maybe it’s even closer to 20, which is where we are right now. And nobody seems to be particularly bothered by it. ’cause these are companies that in fact have earnings, have customers have a tremendous amount of cash flow and don’t seem to be that interest rate sensitive. They, they’ve got all the money in the world to expand and they’re always looking for new businesses.

Barry Ritholtz: Michael Mauboussin put out a piece a couple of years ago talking about the intangibles. That this market is not like the market of a hundred years ago.

Ed Yardeni: Right. Where you had giant factories, big foundries, right. Massive demands for labor, material and income. A lot of the wealth today, a lot of the assets of these companies today are intangibles. Their copyrights, their trademarks,

their algorithms, intellectual wealth, IP.

Ed Yardeni: Barry Ritholtz: All this intellectual property. Are we rationalizing a price of your market or is that a fair explanation?

Barry Ritholtz: I think it’s a fair explanation. I think it’s also important to realize that in the bull market we’ve had, in the upward trend in the stock market certainly reflects the fact that the country is getting wealthier and wealthier. I know this is a very controversial subject because once, once you start getting into income and wealth, people talk about it, income and wealth inequality. But I think a fair amount of that is related to demography. And as we said before, that record household net worth record, net worth for, for the baby boomers. And so there’s a lot of money out there that needs to be invested. We’re seeing that. And even in the government bond market, I mean, we all know that a lot of people have been pouring money into Nvidia, into, into to some of the other mega Cap eight, though it seems to be the rally within those eight is even starting to narrow a bit of late.

Ed Yardeni: Someone called it the fabulous four.

Barry Ritholtz: Yeah. But you know, that, that will be meaningful until it isn’t. You know, I mean, I dunno that you wanna bet against Elon Musk and Right. You know, what he’s doing with Tesla, but that’s been an underperformer.

Ed Yardeni: Yeah. That’s got cut in half over the past couple of years.

Barry Ritholtz: So, you know, people talk about the mega cap eight as proof that the market is narrowing and that’s negative. Yeah. But a quote of yours, the new bull market has actually been fairly broad all along. Discuss.

Ed Yardeni: Well again, we, we had started with the data and then come to the conclusion rather than the other way around. And so a lot of people have been looking at various measures of market breadth, like the ratio of s and p 500 equal weighted to s and p 500 market cap weighted. And it’s been going down so clearly the market’s getting narrower. But when you actually look at it, the a hundred plus industries that are in the s and p 500, what you see is that the sectors that have the mega cap eight in them have done extremely well because of, of the outperformance of eight, you know, the mega cap eight stocks. But then you also see that, well wait a second, there’s a lot of stocks that are up and, and industries that are up Oh, a measly 20%, which is kind of bull market territory. So I think it’s kind of a, a relative game. I mean, some stocks, particularly the mega CAP eight, have done remarkably well. And there’ve been lots of others that have done unremarkably well, but very decent returns.

Barry Ritholtz: So another quote of yours I found kind of fascinating. People keep talking about Nvidia, like it’s a bubble, but the Nvidia stock price is up about the same amount right. As Nvidia earnings. Right. How, how can that be a bubble?

Ed Yardeni: I don’t think it is a bubble. It just looks like a bubble on a chart. You know, anything that, you know,

Barry Ritholtz: Goes vertical like that.

Ed Yardeni: When everything goes vertical like that, look at, at, at some point Nvidia, because it’s getting so much press, so much buzz and it’s making so much money with such high profit margins is gonna attract a lot of capital into competitors. And it’s already doing that. You know, Nvidia could be put outta business like overnight if somebody suddenly came up with a quantum computer that that worked and, you know, operates, you know, lightning speed compared to half lightning speed of NVIDIA’s chips. But Nvidia keeps in innovating and that’s, that’s what’s so exciting about tech technology. Technology is always moving forward. It’s actually a source of deflation. ’cause technology prices decline and in addition to that, technology boosts productivity.

Barry Ritholtz: So we’ve seen this sort of single stock going vertical before. We’ve seen it with Intel. We’ve seen it with Cisco. Cisco, yeah. There’s always one company that, you know, is in the right space at the right company, captures lightning in a bottle and you know, all bets are off. But it sounds like we’re not that late stage for Nvidia here. Well,

Ed Yardeni: You know, a lot of, in the past couple of years, we’ve all been comparing the current decade, the 2020s to previous decades. I’ve seen similarities between the 2020s and the 1920s productivity, technology, excitement. It started out

Barry Ritholtz: That Newfangled car Yeah. Had come out.

Ed Yardeni: Yeah. It started out really depressing. And somehow or other, it just turned out to be the Roaring 2020. So there’s that analogy then, as we discussed earlier, there’s the 1970s and that there’s some analogies there. I mean, look, if if the Middle East insanities eventually, or some point actually caused the price of oil to spike up to a hundred and higher, it is gonna be the 1970s all over again. Right. But so far it hasn’t been. I don’t think it’s gonna be. But then there’s the 1990s and people have asked me if this is the 1990s, where are we in the 1990s? I say, well, probably more like December 5th, 1996. That’s when irrational exuberance, the irrational exuberance speech by Alan Greenspan. And you know, he, he, he did a hamlet on us. He says, how do we know if we’ve got irrational exuberance in, in the market? And the market actually sold off on that figuring, oh my God. He he’s thinking irrational exuberance. He just asked the question. And then the way he answered is that maybe we don’t, because inflation’s come down and, you know, we’re doing all the right things. So I think we’re more like in 1996 than in 1999, still early on. And again, if this is the roaring 2020s, the decade still has a ways to go.

Barry Ritholtz: Really interesting. Let’s talk about some of the things that other people seem to be getting wrong. Quote, you don’t get a recession when unemployment is at all time lows. Explain.

Ed Yardeni: Well, the, the pessimist would respond to that by saying, if you look at a chart of the unemployment rate, it’s always at a cyclical low of sometime at an all time low right before recessions. Which, which is absolutely true. So when you see it like this, this low, you, you do have to start to worry about the historical precedence. I think a lot of the people who’ve gotten it wrong so far, they may still get a recession. I’m not saying it’s impossible, but a a a lot of them might look at charts and said, look, the, the yield curve’s been inverted and every time it’s been inverted in the past, that’s led to a recession. Leading indicators have been declining. And every time that’s happened, that’s been a recession. But I think that what many of them got wrong is that the process by which we get to recessions is the key here to understanding why we haven’t had a recession.

Barry Ritholtz: The inverted yield curve in the past really did a good job of predicting a process that led to recession. So what was that process?

Ed Yardeni: The Fed would be tightening, raising interest rates. And then at some point along the way, the bond investors would start to say, you know what? I know I could get a higher yield than a two year than a 10 year. And, but you know, the 10 year is okay here because if the Fed keeps raising interest rates, I want them to keep raising interest rates. ’cause something will break and then I’ll be very happy owning a 10 year bond because those yields will, will come tumbling down. And so what the inverted yield curve does, it doesn’t cause recessions. And I wrote a little study of this in 2019, so I’ve been thinking about this for a while. And what the point of that piece was that what happens when you get an inverted yield curve is the bond market starts to anticipate a financial crisis. And lo and behold, something does break and then that becomes a credit crunch and that’s what causes a recession. So you need to see a crisis, a credit crunch, and a recession that that’s been sort of the usual way it, it happens and this time around the in ver yield curve. Got it. Absolutely right. Again, we had a financial crisis in March of last year that lasted all of two days before the Fed Fed came in and provided a tremendous amount of liquidity. And we never had a recession.

Barry Ritholtz: How often do we get an inverted yield curve starting with fed funds rates at zero? This seems to be almost a case of first impression.

Ed Yardeni: Yeah. Well, again, the, the pessimists, the, the crowd of, of naysayers had a very logical possession. And that is, how could you see rates go from zero to five and a quarter, five point a half percent without something breaking, without having a recession? And the answer is, yeah, they were right. We get something broke. But the Fed had so much experience during the great financial crisis, and again, during the great virus crisis playing whacka whack-a-mole in the credit markets, you know, some, there’d be a liquidity crisis and they, they’d whack it and create another liquidity facility overnight. And that’s what they did last year. Overnight. They, you know, on a weekend they came up with a liquidity facility that calmed everything down. So the crisis did not turn into a credit crunch and therefore did not turn into recession. High interest rates, I think we’ve, we’ve been learning here don’t inherently cause a, a recession.

Barry Ritholtz: Obviously they’ve, they cause a recession in the housing market.

Ed Yardeni: But I, I’ve been making the point for the past two years, well be very careful because of the housing market. It was single family housing that went to recession. Multifamily did quite well. And so I said, you know what, let’s talk about this as rolling recessions. And I’ve been doing this for a while. So in the mid-eighties, as I think I came up with the term rolling recessions back then when energy prices collapsed and everybody thought that the recession in Texas and Oklahoma was gonna go national and it didn’t.

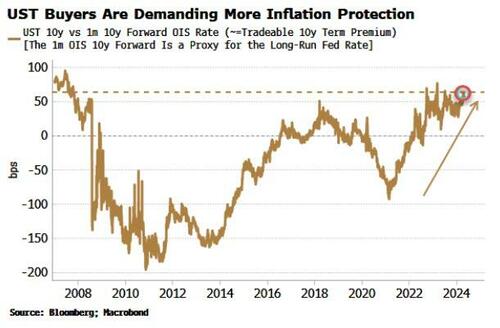

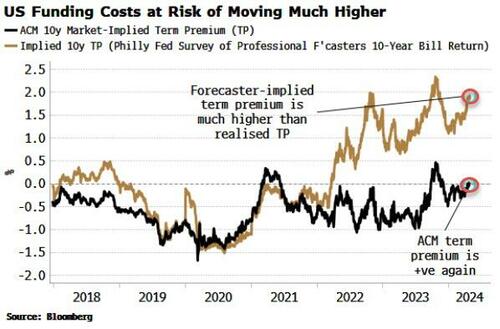

Barry Ritholtz: Interesting. Let’s stick with the Fed ’cause there’s some really interesting quotes of yours. I wanna throw your way. Quote, there’s really no need for the Fed to lower interest rates. Could be the most controversial thing I’ve heard you say the past few months. Tell us why you think the Fed Yeah. Is fine at five, five and a quarter.

Ed Yardeni: Well, I think the, the, the, the Fed fed officials have this notion that the realinterest rates matter. That if the Fed funds rate at five and a quarter five, five and a half percent and the inflation rate is five or 6%, then you obviously don’t, you know, you have a very low real interest rates inflation adjusted interest rate. Right. I have a problem with that whole, that whole concept anyways. How do you inflation adjust an overnight rate and, and, and what behavior does that actually impact? But now they’re saying, you know, now that inflation’s come down, let’s say to 3% right.

That the real rate’s gone up and oh my God, it’s gonna be restrictive, it’s gonna push the economy into

recession. I said, that’s not my model for recessions. My model is inverted yield curves, financial crisis,

credit crunch recession. And I don’t see that that happening. So the economy’s demonstrating that

there, there’s no call for a for freezing, but there’s this view that comes from Milton Friedman that

there’s this long and variable lag right. Between monetary policy and the economy. And I I, I dispute

that. I say, well actually there’s, there’s no lag at all. That’s just tell me when the crisis is gonna hit, then

the next day will be the credit crunch and the day after that will be the recession.

00:33:52 [Speaker Changed] To be fair to Milton Friedman Sure. Back in the seventies, we had a lot less

data. The Fed didn’t even announce, like people, the young folks today don’t realize Yeah. There wasn’t

even a fed announcement. Correct. That rates had been changed. Yeah. You, you had to track the bond

market and, and money supplied have a sense of was going on. So maybe there was a long and variable

lag in the seventies or even the eighties, but today the Fed tells us what they’re gonna do, then they go

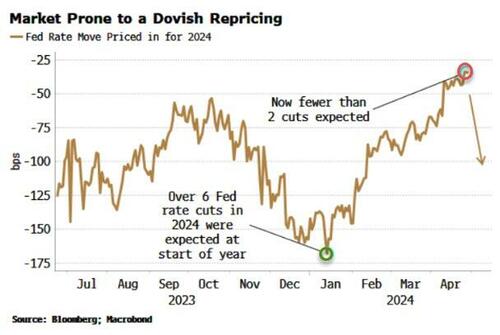

out and do it. Yeah. There, there’s no surprises. A another phrase of yours that relates directly to this

Wall Street seems to be expecting four or five, six cuts. You’ve been saying fewer and later maybe two

or three cuts and that’s it. Maybe

00:34:35 [Speaker Changed] And maybe not. Maybe not. Yeah.

00:34:37 [Speaker Changed] So, so I I know a lot of people that are banking on rate cuts coming. Yeah.

You’re much less convinced. I I think

00:34:44 [Speaker Changed] It’s, it’s people who would like to see the bull market continue and, and

think that the only way that’s gonna happen is if the Fed provides the sweetener to, to, to make that

happen. But I think the stock market’s already demonstrated that they’ll take the trade in. In other

words, if, if the deal is rates don’t come down, but the economy remains fairly strong and earnings come

in strong and we we have another technology, boom, then we can live with that. Y

00:35:11 [Speaker Changed] Your latest report, your latest topical study in praise of profits, those people

who have been claiming zero interest rate policy and quantitative easing are the only things that we’re

supporting the stock market in the 2010s. And now that rates have gone up, you’re gonna see how how

important the Fed was to equity prices. That’s not proving to be true quite

00:35:33 [Speaker Changed] Yet. Well, yeah, I think that’s another problem with the macroeconomic

models and, and the financial press quite frankly. And that is always this focus on the Fed and on

Washington and you know, the, the policy makers and I keep pointing out that it’s amazing how well this

country has done or for so many years despite Washington Right. Despite the meddling of the

government. And what we have to do is give ourselves, ourselves credit, us working stiffs, we go to work

every day and we try to do things that make things better for our us, our families, our communities. And

you know what we succeed despite the, the meddling of, of, of Washington. And that’s what kind of

what gives me hope. That as crazy as things are in our political system, the economy just continues to

deliver. And anybody who, you know, didn’t like democratic president, that bet against the stock

market, anybody who didn’t like a Republican president that better against the stock market than

missed some pretty awfully good returns.

00:36:35 [Speaker Changed] I heard Obama was gonna kill the stock market. Yeah. Didn’t happen. I

heard, oh, now Trump is in, he’s gonna kill the stock market. Didn’t happen. This Biden’s gonna kill the

stock market. Yeah. Didn’t happen. Didn’t happen. I mean, the takeaway is pay attention to profits and

ignore what’s going on in, in DC

00:36:52 [Speaker Changed] Companies, businesses, whether they’re public or private, we’re all become

very, very good at managing in challenging times. And sometimes those challenges come from the

government, you know, it shouldn’t be that way. The government should be in our side, not kind of

trying to pick in our pockets. And yet we do remarkably well.

00:37:12 [Speaker Changed] So one of the things you said about inflation, I found both to be fascinating

and unique and very insightful. You were the first person I saw that pointed out. CPI tends to go down as

fast as it went up. Yeah. There’s a symmetry here. Symmetry. When you get a giant surge Yeah. You’ll

get a giant collapse. Correct. Which is what we saw in 22 and 23. Yeah. You go back to the seventies, it’s

long, it’s slow, it builds, it’s structural that sticks around for a long time. Again, I have to ask, what is it

that makes this so symmetrical? Why is it that way?

00:37:46 [Speaker Changed] Well, the seventies was with the benefit of hindsight, certainly so far an

outlier. You had two energy shocks. You had, you started out the decade with ni Nixon devaluing the

dollar by closing the gold window. So Right. The dollar took a dive commodity price award, the anchovy

didn’t show up in Peru. So that affected soybean prices somehow other I wish Yeah,

00:38:08 [Speaker Changed] Well, butterfly effect.

00:38:09 [Speaker Changed] Yeah. Yeah. It was really crazy kind of stuff. And inflation was coming down

after, you know, the, the 73 energy crisis, but then we had a one in, in 79 and it went back up also, labor

unions were very powerful. The 30%

00:38:24 [Speaker Changed] Weight spiral.

00:38:25 [Speaker Changed] Sure. Yes. 30, 35% of the labor force had union contracts and they had cost

of living adjustments. Now I think something like 10% of the labor force is the private sector labor force

is unionized. So the, and they don’t, colas aren’t widespread. So you didn’t have this kind of automatic

wage price spiral, which is what we had in the 1970s. But in the current situation, look, we had a terrible

pandemic. I mean, you have to, you know, you have to be realistic. You have to, you know, go with the

flow of what’s actually happening instead of just imposing a model. And what a lot of the models missed

is, hey, we had a pandemic, it disrupted supply chains. And that lasted for a certain period of time and

they got fixed. And by the time they got fixed, consumers had already gone on a buying binge for goods

and said, you know, no moss, they didn’t really need any more goods.

00:39:17 And they swung over to services. And so goods inflation’s come down. By the way, I think the

other thing that the folks missed on why not getting inflation right, is they didn’t look at it globally. I

mean, it was, it was a layup that certainly it became obvious in fairly early on last year that China was in

a property bubble depression. And again, I’ve been doing this for a while and I saw it in Japan in the

eighties. I saw it in the United States in 2007, 2008. And these property bubbles, they, it takes five to

seven years to get out of the deflationary consequences of them. And now people are starting to

recognize that the Chinese are so desperate to goose up their economy, that they’re, they’re, they’re

going wild in production. They’re, they’re producing a lot of cheap cars and appliances. Right. And

they’re exporting them around the world. And that’s extremely deflationary

00:40:10 [Speaker Changed] Huh. Really intriguing. Let’s talk about housing for a moment. Lots of folks

are deeply concerned about commercial real estate. I I know you’ve been a little more sanguine than

some of the doomsayers in that space. What’s going on with commercial real estate?

00:40:24 [Speaker Changed] Well, I, again, I put the commercial real estate story in the context of rolling

recessions. And by the way, now we’re seeing some rolling recoveries, for example, demand for, for

goods by consumers is now starting to show more activity. But yeah, the idea was that, okay, we, we are

in a rolling recession of the commercial real estate market, but commercial real estate is a very diverse

kind of right market.

00:40:50 [Speaker Changed] It’s in it’s multifamily homes. Yeah. It’s warehouses, it’s medical facilities.

It’s not just offices. Yeah.

00:40:55 [Speaker Changed] The other thing I’d point out is that in the Great Depression, there was no

distressed asset funds. And again, this came from my understanding of the SNL crisis is the SNL crisis was

finally resolved with the resolution trust corporation. The, the RTC and Wall Street said, Hey, this is a

great idea. Why don’t we do this? Why don’t we like, you know, put together a lot of money and just

wait for something to blow up and buy stuff at 25 cents on the dollar. You know, and then we have

plenty of cash to fix these things and restructure them. I heard about a mall going out outta business in

Arizona that’s now a, a pickleball facility. And so the, and so it’s, we have, we have a remarkably good

industry that knows how to deal with distressed assets and clear the markets so that instead of having a

calamity in the banking sector, somebody loses a lot of money in their portfolio. It’s reduces your rate of

return in some portfolios, but somebody gets a really good deal out of it. Right. And turns it around and

is hiring people again.

00:41:55 [Speaker Changed] Right. There’s no such thing as toxic assets. Only toxic prices. Correct. So

let’s talk about residential real estate. What’s happening in that space? Clearly a, a huge shortfall in

supply. How long does this take for that to get fixed?

00:42:09 [Speaker Changed] Yeah, that’s, that’s a very complex situation and I think it reflects a whole

bunch of different developments. Certainly one of them is that a lot of people refinanced their

mortgages at record, low mortgage rates, and they’re kind of hesitant to sell their house. They don’t

want to sell their house and buy another house if they still need a mortgage at these kind of mortgage

rates.

00:42:34 [Speaker Changed] So Right. They’re, they were 3.5%. It’s 7% now. Yeah.

00:42:37 [Speaker Changed] Yeah. So’s

00:42:38 [Speaker Changed] That’s a bad trade.

00:42:39 [Speaker Changed] Not only that, but it’s like, it makes you feel smart living in a house where

you’re not paying much in, in a mortgage. And by the way, 40% of people who own houses, 40% of them

don’t even have a mortgage. That goes back to, to the story about the older Americans, the, the baby

boomers. Right. You know, don’t really have much in the way of expenses, but maybe they’re not

moving either. I mean, a lot of people may be moving down south, but some people are, are saying, you

know, it wasn’t a bad winner here in New York. May maybe we’ll stay, maybe we’ll get a, a small place

in, in Florida. So there’s a lot going on here. But look, the home builders, who would’ve thought with

mortgage rates at these levels that the home builders would be, you know, such great performers in the

stock market. But it’s this great opportunity for home builders. Yeah. I think a lot of this has to do with

regulation. It’s hard to get land, it’s hard to get permission to do what you want in building, in building

housing. So I think a lot of that is really more, once again, the government meddling.

00:43:33 [Speaker Changed] But that’s local government, not not national government. You know, you

don’t, you under build single family homes for a decade as the population grows. Right. I’m more

surprised we didn’t anticipate this coming sooner rather than later. Everybody felt Yeah. Post financial

crisis. Oh, that’s it. We’re, we’re never gonna see a demand for housing again. Yeah. And

00:43:53 [Speaker Changed] It’s having a tremendous impact on younger people that, you know, some

of ’em are still living, living at home and they’re delaying obviously having families. And even if they have

an apartment, they may be delaying having families. So this, this is having demographic consequences

that will have an impact along the way.

00:44:11 [Speaker Changed] We saw reduced household formation during the 2010s. But that seems to

be picking up again. Right. I know that’s something you track when household formation rises, demand

for houses tend to follow. Right.

00:44:22 [Speaker Changed] Absolutely. And so again, we’ve had this, this rolling recession that’s hit

housing, single family housing, and yet home prices are all time record high. So you really have to be

very flexible in, in looking at this economy and recognize how things change and you know, how models

that used to work don’t work anymore. Let’s

00:44:42 [Speaker Changed] Talk about fiscal stimulus. You wrote a really interesting piece A couple of

weeks ago. We had the CARES act, CARES Act one was 10% of gdp. DP Cares Act two cares, act three

cares, act three under the Biden administration, the two previous CARES act under the Trump

administration, the CHIPS Act under the current administration, the infrastructure bill, the Inflation

Reduction Act. Many of these are not single year spends. Correct. But decade long programs, given the

work you’ve done with Tobin on fiscal stimulus, how big a wind is at the back of this economy given the

coming decade of fiscal spend?

00:45:22 [Speaker Changed] I think again, the answer is in the data and what the data shows is that, you

know, there’s this monthly report called construction put in place that comes out from the government.

And it’s e every month. The numbers are phenomenally strong outside of residential construction. So

what we’re seeing is that infrastructure spending all time record high, all these programs really are

translating into actual dollars being spent on rebuilding or building new infrastructure. When you look at

the private sector, construction of structures, you see that manufacturing facilities are soaring. So we’re

building lots of those, you know, ev plants and battery plants and semiconductor plants and so on.

00:46:08 [Speaker Changed] You’ve been talking about onshoring, so the reverse of what we saw in the

eighties and nineties of offshoring Yep. How significant an economic factor is. And and, and obviously a

lot of this traces back to the pandemic. Yeah. When we, we couldn’t get, you know, medical protective

equipment or masks or really, it was shocking to realize how much crucial infrastructure we decided to

outsource, how substantial a chunk of the economy can all this onshoring be and how long lasting is

this?

00:46:40 [Speaker Changed] Well, that’s, that’s a a great question. I’m thinking that as you said, it’s, it’s,

it’s got legs. It’s gonna be with us for a while. And then of course once these facilities are built, they’re

gonna be a lot of automation and robotics there. But they’re still gonna need to, to be supported. I

mean, even artificial intelligence, given what we know about it today, requires a tutor to say, no, no, no,

you, you know,

00:47:06 [Speaker Changed] Stop hallucinating.

00:47:07 [Speaker Changed] Yeah. Stop hallucinating. Right. So humans are still gonna be essential and

we’ve got a very tight labor market for, particularly for skilled workers. And as a result of that, I think

that the onshoring effect continues. I mean, we’ve got really cheap energy here. Natural gas prices are

low because

00:47:24 [Speaker Changed] Record, record oil production. Yeah. I mean, all time highs.

00:47:27 [Speaker Changed] I mean, you know, you, you reduce your transportation costs if you produce

here rather than, than elsewhere. But the labor problem is a problem. But I think it gets solved with

innovation, with technology and providing robotics automation.

00:47:40 [Speaker Changed] What about the high skilled immigration? That that used to be a big part

Yeah. Of the labor market in the nineties. I’m

00:47:45 [Speaker Changed] Struggling with that immigration issue. I mean, we’re talking not tens of

thousands or hundreds of thousands. We’re talking a few million. This is

00:47:53 [Speaker Changed] Shortfall of, of bodies to fill jobs.

00:47:56 [Speaker Changed] Yeah. But you got the migrants coming in and the question is, at what point

will they be allowed to work? At what point will they be actually reflected in the official statistics and

how many of ’em will actually be left here depending on the politics? I mean, there’s one presidential

candidate that has basically said that he’s gonna send them all back. So it’s How

00:48:18 [Speaker Changed] Realistic is that? We’ve we’ve heard that before. Yeah. It doesn’t really

happen, does it? Well,

00:48:22 [Speaker Changed] The reality is that what we need is a lot more legal, migration. Legal.

00:48:27 [Speaker Changed] So what I’m, when I talk about immigration, I’m really talking about Silicon

Valley and c-suite executives and high skilled people coming from Yeah. Places like China and India and

Vietnam and Turkey and other places where Eastern Europe, where they’re highly educated Right. In the

STEM area, which we certainly could use more of. We could

00:48:50 [Speaker Changed] Use more of. Absolutely. And, and, and for many of them, they, they wanna

be here. They’d love to be invited here. And it’s, it’s safer here. You know, if you’re in, in Taiwan, well,

why not? Why not bring more people over from there, from Eastern Europe with, you know, with, with

skills. But legal migration is the way to go because then you know that the people that are coming in are

gonna be working as opposed to being a burden on, on the social system. But that gets so political these

days. It’s right. It’s hard

00:49:17 [Speaker Changed] To talk

00:49:17 [Speaker Changed] About. It’s, it’s hard to talk about.

00:49:19 [Speaker Changed] You mentioned legs. Let’s talk about legs, quote. This is a long-term bull

market. Discuss where we are in this bull market and how long could the long-term be?

00:49:31 [Speaker Changed] Well, look, I, I think what clearly everybody knows and certainly has had a

big impact on the psychology and the thought process that went to thinking about the past couple years

is that recessions, cause bear markets, the bear, the bear market anticipates that the way things are

going in the credit system, we’re gonna get a, a bear market to stocks. And what happens is earnings

expectations go down and then valuations go down and earnings get really whacked because not only

do revenues go down, but the profit margin goes down. Right. So everything goes wrong. And the only

question is, are you gonna be down 25% or 50% and is it gonna last a year or is it gonna last several

years? And so there’s a lot of uncertainty around that. And people say, get me out. I don’t wanna take

risk. So I think to have an opinion about how long this bull market’s gonna last, you have to have an

opinion of, well, when, if we didn’t get a recession, now we had the most anticipated recession of all

times.

00:50:29 Right. The past two years, the Gadot recession, the no-show re recession, maybe it’ll show up.

But if, if you agree with me that, that historically you need to see that tight monetary policy causes

financial crisis, credit crunch recession. And that’s not very likely, especially now that the Fed has pretty,

I I think, I don’t think they’re gonna be raising rates again. And if we get into trouble, I think they will

lower interest rates. So it’s how do you get a recession when the Fed now is on the right side of the

monetary policy cycle and they have room to lower rates if that’s necessary. But I raised the question of

whether that’ll even be necessary. ’cause I think the economy remains resilient. I think interest rates are

appropriate where, where they are right now. And so I don’t see a recession and I’ve been promoting

the idea of the roaring 2020s scenario.

00:51:16 [Speaker Changed] Well, it’s 24, so you’re saying 4, 5, 6 more years to go. Yeah. So it, it’s

interesting. ’cause and

00:51:22 [Speaker Changed] Those could be the, the, the biggest of, of the

00:51:25 [Speaker Changed] Roar always the end of the bull market Yeah. Is the, is the greatest gains.

Yeah. So when we look back at the past two years, we’re recording this towards the end of the first

quarter in 20 24, 20 22 s and p was off not quite 20%, about 19%. The Nasdaq down about 30%. No real

recession on an inflation adjusted basis. You had a couple of negative quarters of GDP, but you never

had the full broad right. Requirements of an actual recession and then the great recovery in 2023.

Where does that leave us standing here? You mentioned not too long ago that hey, this market’s come a

long way. Maybe it’s time for a breather.

00:52:09 [Speaker Changed] Yeah, about a year ago. Really Now, I, I predicted that we would get to

5,400 by the end of this year.

00:52:17 [Speaker Changed] Not that far away.

00:52:18 [Speaker Changed] That’s, that’s the problem I’m having here is like, yeah, I don’t wanna see

this by the middle of the year. You know,

00:52:23 [Speaker Changed] I was gonna say, you go away in August and take the rest of the year off.

00:52:27 [Speaker Changed] Well, same thing happened last year, by the way. Right. I thought we’d get

to 4,600, we got to 4,800, but we got to 4,600 by the middle of last year instead of the end of last year.

And so yeah, I was, I said, well, yeah, I’m not gonna raise my forecast here. And then I did actually

anticipate the correction that, that we had 10% and then that was down the low was made October

27th. And it’s been vertical since then as the ai.

00:52:50 [Speaker Changed] And just to put, just to put this in context, you take the sell off in 2022, you

take the recovery in 2023 and the average over those two years, you’re flat. You’re flat for, for two

years. Yeah. That’s why every time people say, oh, we’ve come so far, so fast. Yeah. Flat over two years.

Yeah. Doesn’t seem that far.

00:53:07 [Speaker Changed] That’s not much of a return.

00:53:08 [Speaker Changed] Yeah, that’s exactly right. So you’re talking about AI again, many people

seem to like to talk about that as a bubble. What do you see going on in, in that sector?

00:53:19 [Speaker Changed] Well, I think at this point, given what I’ve experienced personally with

things like chat, GPT, you know, when, when I, I think the Roaring 2020s started to get discounted in the

stock market on November 30th, 2022, that’s when OpenAI introduced chat, GPT. And so I immediately

signed up for the $20 a month version of it. Pretty,

00:53:45 [Speaker Changed] Pretty reasonable, right?

00:53:47 [Speaker Changed] About $20 a month through,

00:53:48 [Speaker Changed] Through your Microsoft account.

00:53:50 [Speaker Changed] Yeah. And, and I thought, man, this is really great. Maybe it’ll write my, my,

my research for me and I can just, you know, do it from the beach. And, and I found out that I was

spending more time finding the mistakes that, you know, I mean, it’s, you know,

00:54:07 [Speaker Changed] I mean, it’s only gonna get better.

00:54:08 [Speaker Changed] It’s only gonna get better. I mean, right now it’s kind of like autofill, you

know, where you’re typing on word and it starts to anticipate what the next word might be. So it’s kind

of like autofill and speed and steroids. I mean, it, it actually gets you back to the old idea that Benjamin

Franklin gave us, which was the speed, you know, haste makes waste and So it’s, it’s too fast. It sounds

kind of credible. And I saw somebody did a, some really beautiful videos and one was a bull in a, a China

shop, and the bull kept hitting all the, the China and none of it broke. So, you know, the editor has to go

back and explain to the artificial intelligence that when the bull hits that you, you gotta show what is

being broken. So it, it requires a tremendous amount of handholding, babysitting, editing, from what

I’ve seen so far. But so much money is being thrown in this area. And it’s, it’s basically just hyper

computing. It’s, you know, the ability to, to anticipate what’s gonna come next, but some human is

gonna continue to need to, to monitor these things.

00:55:11 [Speaker Changed] I have personally found that I spend less time with Google when I’m

researching a topic and more time with either chat GBT or perplexity, which is either clawed or I’m

forgetting the other engine that drives that because it organizes the answers in such a usable way. Yes,

it does. And Google has just become a massive ads and Yeah. They were getting away with this for a long

time, and suddenly people accuse him of being a monopoly. Clearly they’re not. Yeah. If a simple app

can eat their lunch the way they are, well,

00:55:43 [Speaker Changed] That’s the wonderful thing about technology is capitalists use technology

are always looking for opportunities to put somebody outta business that’s got a great business model.

I, I understand that the CEO of Nvidia runs the company with the assumption that it’s, it’s gonna go

outta business unless he’s constantly thinking about what the next new, new thing is. And, you know, he

started out with gaming and then went to Bitcoin mining and those worked until they didn’t work. And

now he’s got GPU and he realizes that there’s gonna be something after GPU.

00:56:14 [Speaker Changed] Since you mentioned Bitcoin, I saw a quote of yours asking the question, is

Bitcoin digital tulips? Tell us about Bitcoin.

00:56:23 [Speaker Changed] I don’t want to get any hate emails

00:56:27 [Speaker Changed] From

00:56:27 [Speaker Changed] People who love,

00:56:28 [Speaker Changed] Have fun being poor, Dr. Ed.

00:56:30 [Speaker Changed] Well, that’s, that’s the thing is I wanna confess that I’ve got a tremendous

amount of fomo, you know, when it comes to Bitcoin. You know, I, I kept looking at it at, you know,

when I was two digits in price and three digits, and it just kept going up and up and I said, this is this,

this, this has gotta be a, a bubble. It may still be a bubble in the sense that it’s, there is a comparison

with the tulip bubble in, in, in Holland centuries ago. But there’s a huge difference in that is once the

tulips were sold to all the suckers in, in Amsterdam, that was the end, you know? Right. That was the

beginning of the end of the, the bubble burst. Real, real quick, what’s unique about Bitcoin is it’s a

market that’s open 24 by seven on a global basis. And there’s a lot of people like myself with fomo. I’ll

probably get in at the top,

00:57:20 [Speaker Changed] Let me know when you buy so I can sell mine. Exactly. I have a little bit, I

have a little bit of Bitcoin and a little bit of t that we bought a couple of years ago. I mean, maybe I’m

breakeven. I I don’t even pay attention to it. I think of it as like a single company. Yeah. Like, hey, it’s an

Amazon or an Apple, and if it works out great, not,

00:57:36 [Speaker Changed] I’m not gonna tell anybody that they’re wrong to Right. To have it. I mean, I

just, you know, you, you need that on a global basis. You, you continue to have buyers and so far so

good.

00:57:46 [Speaker Changed] It, it would’ve been nice to buy it when it was a hundred bucks. Yeah. That

would’ve been, that would’ve been fun.

00:57:50 [Speaker Changed] Look, I I, I’m an old fashioned kind of a, of economist and strategist. I need

earnings, I need dividends, I need rents, I need something I can, I can value. I, I don’t really have any,

any, any of that.

00:58:00 [Speaker Changed] You’re not a commodity investor really.

00:58:02 [Speaker Changed] Not really. No. I mean, commodities go up, they go down, you know, and

it’s the old story. The high, the best cure for high commodity prices is high commodity prices.

00:58:09 [Speaker Changed] Classic.

00:58:10 [Speaker Changed] But again, that makes Bitcoin different because, you know, it, the algorithm

is such that higher prices don’t lead to more supply, though it does lead to more competitive doge coins

and things like that. Huh.

00:58:22 [Speaker Changed] Really interesting. Let’s talk about the book that you put out not too long

ago. Predicting the markets You cover four decades as an economist, right. And a strategist on Wall

Street, and you put out so much research every day. How on earth did you find the time to put this

together?

00:58:41 [Speaker Changed] Well, I don’t play golf.

00:58:43 [Speaker Changed] Okay.

00:58:43 [Speaker Changed] So that, that saves a lot of time. Same, same. I do play tennis. Yeah. And

that’s only about an hour, but I really enjoy it. And when it, it comes to the book, you know, I’ve been

doing this for a while, you know, more than four decades, and by 2015, 16, I got inspired to like, put

together what I’d learned and mistakes made and insights accumulated. I felt like, you know, anybody

who’s just kind of getting into the, into the business, they’re not gonna be able to experience what I

experienced. It’s exactly what the title says is a professional autobiography. I, I actually did have quite a,

quite a good time writing it.

00:59:18 [Speaker Changed] And you talk about predicting everything from stocks, bonds, commodities,

currencies, earnings, how challenging is it predicting the future when you know the world is so uncertain

and there are so many random events.

00:59:34 [Speaker Changed] Well, that’s what makes it so interesting, right? Is, you know, there, there’s

no clear way to get it right all the time,

00:59:41 [Speaker Changed] But you’ve gotten it a lot more right. Than most people. And, and we’ll go

through a quick list of things. I have to ask you what you saw in each of these. Okay. That led you to the

right prediction, starting with in the early eighties you identified disinflation coming from globalization

and technology and the bullish result of that into the equity markets. What were you looking at that led

to that conclusion?

01:00:07 [Speaker Changed] Well, in, in the early eighties, my focus was on disinflation, attributable to

the Fed tightening up on monetary policy and that we would have a pretty severe recession and that

would potentially be deflationary.

01:00:22 [Speaker Changed] And we ended up with a double in, what was it, 81 and 80 and 81 or 80 and

82. Yeah.

01:00:28 [Speaker Changed] But then along the way it, globalization became a big deal in terms of my

analysis, especially with the end of the Cold War in the late 1980s, I’d observed, based on the US CPI,

going all the way back to the 18 hundreds, the CPI has these peaks historically, they’re not random.

They’re actually associated with wars. Huh. And so my thought was that wars are obviously inflationary,

you know, world trade gets cut off. Competition is, is cut off. Commodity prices go up during war times.

And so I said, well, wait a second. So if this is the end of a great war, the Cold War was, you know, there

was some heat to it between Vietnam and Korea and all that, but it was maybe even a continuation of,

of World War ii in, in, in some ways

01:01:20 [Speaker Changed] Big spike in the mid forties, early fifties in inflation. Yeah.

01:01:24 [Speaker Changed] That was actually one of the models that I looked at for thinking about the

current situation, is that we had this huge spike in the, after the war in durable goods inflation because

all the soldiers came back and they wanted cars. And Ford was building bombers. And so it took ’em a

couple years to retool and then all those durable goods inflation came down like a stone, just the way it

did in the current environment when we saw durable goods inflation going up with the supply

disruptions. And then once the disruptions were ameliorated, it came right back down.

01:01:57 [Speaker Changed] I, I think that’s the best parallel to the post pandemic. Yes, I agree. People

talk about the seventies and, and the nineties, really. You think about moving from a wartime footing to

peacetime footing and that whole transition and pent up consumer demand. Yeah.

01:02:11 [Speaker Changed] So when, when the Cold War came to an end in the late eighties, the Berlin

Wall comes down. Most economists were saying, this is gonna be terrible for inflation. ’cause all these

people behind the Iron Curtain are gonna want everything. It’s gonna be terrible for interest rates ’cause

they’re gonna need to borrow money. And, you know, it could work the other way around. It could be

that all these, all these people create bigger markets, more competition, more globalization as, as we

call it now. Deante was a very powerful disinflationary force. Huh.

01:02:39 [Speaker Changed] Really interesting. In 93, we talked about this earlier, but I want to spend a

little more time on this. You called Technologies’s growing impact, the high tech revolution. Like that’s a

big weighty phrase. What made you realize, hey, this is more than just an incremental shift Yeah. In how

we spend money. This is revolutionary, right? What were you looking at?

01:03:03 [Speaker Changed] I have to admit, I’m a bit of a geek. I, I grew up in California, in Campbell,

California, which is right next to San Jose. And my father worked for IBM and this was back in the, in the

sixties. And he, he used to bring home four train COBOL manuals and things like that. I had a lot of

technology around me in, in California. I wish they wouldn’t have moved back to the Northeast. ’cause

I’d probably be a billionaire by now. ’cause I would’ve gotten into all that

01:03:29 [Speaker Changed] And the better weather to

01:03:30 [Speaker Changed] Say nothing better and a better, better weather. But yes, I’ve, I’ve always

had this fascination with technology and it’s been my view that economics has been badly merchandised

as the optimal allocation of scarce resources. It’s, that’s just a depressing idea that what, there’s only so

much and we all have to figure out the best way to distribute it. Well, no, no, no. Economics is actually

about technology solving that problem through, its,

01:03:57 [Speaker Changed] It’s about abundance, not scarcity. Yeah.

01:03:59 [Speaker Changed] Yeah. And so I started to, you know, I, I was an early believer in the internet

and so early that in 1995, as I mentioned before, I had my own website and, you know, I had

publications on there. They didn’t auto the charts didn’t automatically update. I wrote some of it, but

then I had a software programmer who knew what we was doing, kind of really polish it off again, at, at

Deutsche Bank, which, you know, CGL Lawrence, Deutsche Bank, we had Frank Huron’s team coming in

in the nineties. So there was a lot of technology analysts. And so our morning meetings were full of

discussions about technology and what impact it, it was doing. I mean, even when I was at EF Hutton,

which was in the eighties, there was a lot of excitement about a company called Mitel, which was a, a

telecom company. And as a matter of fact, you know, e even back then, there was, there was a lot of

hoopla about all this stuff.

01:04:55 [Speaker Changed] Where did Quaran end up? Was it Credit Suisse first Boston? I remember

he was in a big shop. I

01:04:59 [Speaker Changed] Don’t think, I think he, I think I, I really don’t know. I think eventually went

off on his own, but, you know, he did extremely well.

01:05:06 [Speaker Changed] When was it clear to you that the technology revolution had morphed into

a bubble in the late nineties

01:05:14 [Speaker Changed] When Alan Greenspan started to talking about justifying what had

happened in the stock market as a lottery?

01:05:21 [Speaker Changed] He, what year was that?

01:05:22 [Speaker Changed] It was 1999. He gave a testimony about, about the stock market, and he

said, well, you know, yeah, things look stretched, but you know, you have to look at the stock market as

a lottery. People buy a lottery ticket. It’s not necessarily a rational thing, but, you know, the, the payout

is so great that it attracts a lot of buyers. So he, he, he gave what, what I call the, the, the lottery

testimony. And that, that was one aspect of it. The thing that really nailed it for me, it, you know, really

was a amazing timing was Barons ran a, a piece, I think it was actually at the beginning of 2000, or

maybe in late 1999, where they said that all these dot coms were burning cash and they weren’t gonna

get another round.

01:06:07 [Speaker Changed] Amazon dot bomb, I think was the, the headline of, I don’t remember if that

was Howard Marx or, or Baron’s or both. Yeah. But that was January, 2000. Yeah. The timing was pretty

good.

01:06:20 [Speaker Changed] Yeah. I think also Jeff Bezos made the front cover of Time Magazine. Time

Magazine. Yep. And that was the, the curse. The, the

01:06:26 [Speaker Changed] December 99. Yeah. It was a quarter later. It was done. Let’s talk about the

two thousands. You identified the coming commodity boom after China joined the World Trade

Organization in 2001. In hindsight, that’s perfectly obvious. A lot of people missed it. Yeah. What led you

to that conclusion?

01:06:46 [Speaker Changed] I’d seen lots of photographs in a few videos of what China looked like in the

1980s. Not China overall, but, you know, some, some of the urban areas, Shanghai and things like that.

They’re all riding bicycles. Right. They’re all riding bicycles in the 1980s. And then I’m looking at some of

these pictures of what’s going on after they joined the, the, the World Trade Organization in 2011 and

2001. They, they’re all riding cars. And I’m reading about how you gaining all this migration away from

the villages to the towns and urban from

01:07:22 [Speaker Changed] The farms to the city. Yeah.

01:07:23 [Speaker Changed] From the farms to the city. And so urbanization always has a tremendous

impact on an economy. We started to see all these ghost cities being built. ’cause the Chinese viewed

empty apartments as a good place to stash some of their wealth. The commodity demand was pretty

obvious, and you could see it in the charts. And I was recommending overweighting materials, energy,

and industrials. MEI, this is after I, I and everybody else recommended, TMT, you know, technology,

media and telecom. That was what we all did in the 1990s. And then in the 2000 there was MEI.

01:08:00 [Speaker Changed] So let’s talk about the period leading up to the great financial crisis. It was a

lonely time to be a bear. Everybody was pretty bullish. What led you to turn bearish on financial stocks

before the GFC? Yeah,

01:08:16 [Speaker Changed] I, look, I don’t, I don’t want to take any credit for getting that, that market

right. Other than getting the financials, which actually, when I think about it was a pretty good call. But

yeah, I think in 2007 we started to get lots of news suggesting that the, the subprime mortgage market

was gonna take the, could take the system down. And so I recommended Underweighting financials.

You know, the, the better call would’ve been just get outta financials.

01:08:46 [Speaker Changed] Yeah. I recall being on TV in early oh seven talking about derivatives and

subprime, and the anchors laughed at me. In hindsight, we all know what happened. Yeah. But

throughout oh seven, yeah. There wasn’t a lot of love for anyone who was bearish.

01:09:03 [Speaker Changed] No, no.

01:09:04 [Speaker Changed] What sort of pushback did you get at the firm when you were talking about

by then, you had already launched your own firm

01:09:10 [Speaker Changed] At 2007. Yeah.

01:09:11 [Speaker Changed] So, so what sort of pushback did you get from clients saying underweight

financials here wa was there, what was the response like?

01:09:18 [Speaker Changed] Well, you know, I’ve been around for a while as I, as I’ve said a few times

on, on the program here, and I’ve got very good relationships with these people. And, you know, many

of them have been listening to me and, you know, talking to me for, for years. So they kind of respect

my opinion. I didn’t really get much pushback. I mean, you know, I, I explained why and they said that

makes sense.

01:09:39 [Speaker Changed] What about the bottom call March, 2009?

01:09:42 [Speaker Changed] I’m very proud of that one. I was at Merrill Lynch. One of my accounts was

Merrill Lynch Asset Management in Princeton. I walked into the meeting, we were all depressed. You

know, this was, this was actually March 6th, 2000 day or two before. Yeah. So March 6th, the official OI

think was March 9th. Right. But so I, I come out of the meeting and some, one of the traders kind of

walked by and said, how, how’s the market said it just hit 6 6 6 on the s and p 500. I said, that’s the

double number

01:10:16 [Speaker Changed] By that number.

01:10:17 [Speaker Changed] Yeah. So actually I used that in, in marketing. My, my, my thought. I said,

you know what, this is like the Da Vinci code. You know, it’s that 6, 6 6 was, was it? But no, I I i, I thought

that, you know, the bull bear ratio, which I tend to follow quite a bit, was down to 0.6. Everybody was

bearish.

01:10:38 [Speaker Changed] Everything was at an extreme in March oh nine. I mean, where, whether

you look at sentiment or what have you.

01:10:44 [Speaker Changed] Yeah. There’s also, there was the issue of Mark to market. And I had started

a conversation with Gary Ackerman, who was a congressman from, from Queens. I actually went to his

office, I recall, and I said, you got, you gotta stop this mark to market stuff. It’s, it’s like a doom loop. And

he listened. He didn’t say anything. But then it was in, in, in March, I think March right around after we

bought him that he gave a speech in Congress in which he said they were gonna hold he hearings and try

to determine why, why the regulatory agency hadn’t eliminated Mark to market.

01:11:26 [Speaker Changed] There was a FS B rule change not long after then. Yeah, that’s right. The

financial Accounting standards board. Yeah. In the beginning there was some mark to make believe.

Yeah. We used to call it, but at a certain point, if you’re holding treasuries, they’re in your hold to

maturity account. Why do you have to mark it every

01:11:43 [Speaker Changed] Day? Exactly. It’s not relevant. Exactly. That was the point I made. And

Ackerman bought into it, and he was on the committee that made a difference. So it, it all kind of came.

So, so I kind of under knew what was going on in Washington, which is occasionally is, you know, has

given me some, some insights and not often.

01:12:00 [Speaker Changed] So you’ve been pretty steadfastly bullish throughout the 2010s and 2020s.

Yeah. What has kept you on the right side of this bull market trend? This whole time,

01:12:10 [Speaker Changed] As a matter of fact, during that period, I kept a, a log book or a diary of

what I call panic attacks. And so, you know, when Brexit occurred, people got

01:12:20 [Speaker Changed] All 2013. Yeah. Something like that.

01:12:23 [Speaker Changed] Yeah, something like that. Anyways, when Brexit occurred, there was

expectations that the market would take a dive, and it did for two days. Right. And I said, okay, there’s

another panic attack because, you know, the great financial crisis was so traumatic that ever since then,