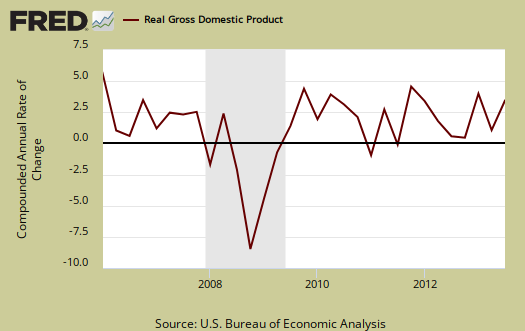

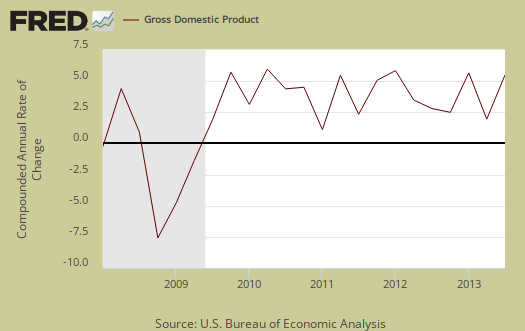

Q3 2013 real GDP had yet another blow out revision upward and is now 4.1%. Originally GDP was reported to be 2.8% for the third quarter, then it was revised to 3.6%. Now we have another revision showing a whopping large third quarter GDP. This is the largest quarterly economic growth since Q4 2011. Increased consumer spending was the cause for the large estimate jump as PCE was revised upward by 0.4 percentage points Changes in inventories accounted for 40% of Q3 GDP. Actual economic demand is now stronger in the third quarter than in Q2.

As a reminder, GDP is made up of: where Y=GDP, C=Consumption, I=Investment, G=Government Spending, (X-M)=Net Exports, X=Exports, M=Imports*. GDP in this overview, unless explicitly stated otherwise, refers to real GDP. Real GDP is in chained 2009 dollars.

The below table shows the Q3 revisions and percentage point spread between the major components of Q3 GDP. Investment shot way up and changes in private inventories is part of the investment component of GDP.

| Comparison of Q3 2013 Component Revisions | |||

|---|---|---|---|

|

Component |

Q3 2013 3rd Revision |

Q3 2013 2nd Revision |

Spread |

| GDP | +4.13 | +3.61 | +0.52 |

| C | +1.36 | +0.96 | +0.40 |

| I | +2.56 | +2.49 | +0.07 |

| G | +0.08 | +0.09 | -0.01 |

| X | +0.52 | +0.50 | +0.02 |

| M | –0.39 | -0.43 | +0.04 |

This next table shows the percentage point spread breakdown from Q2 to the new Q3 GDP major components. Here we see consumer spending is down in comparison to Q2. Exports show less growth but imports also decreased.

| Comparison of Q3 2013 and Q2 2013 GDP Components | |||

|---|---|---|---|

|

Component |

Q3 2013 |

Q2 2013 |

Spread |

| GDP | +4.13 | +2.49 | +1.64 |

| C | +1.36 | +1.24 | +0.12 |

| I | +2.56 | +1.38 | +1.18 |

| G | +0.08 | -0.07 | +0.15 |

| X | +0.52 | +1.04 | -0.52 |

| M | -0.39 | -1.10 | +0.71 |

Consumer spending, C in our GDP equation, now shows more growth than Q2. Most of consumer spending, was in goods, which added 1.03 percentage points to GDP growth contribution. Services was significantly revised and now adds 0.32 percentage points. The 2nd revision showed services only adding 0.02 percentage points to Q3 GDP. Health care alone was 0.31 percentage points of Q3 GDP. Below is a percentage change graph in real consumer spending going back to 2000.

Graphed below is PCE with the quarterly annualized percentage change breakdown of durable goods (red or bright red), nondurable goods (blue) versus services (maroon).

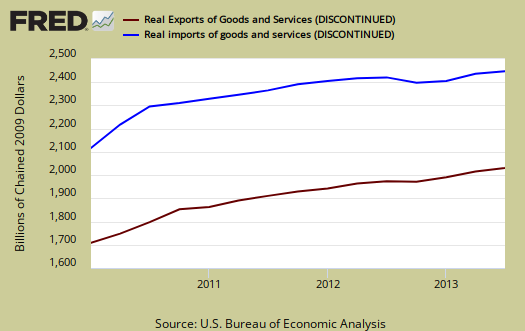

Imports and Exports, M & X added 0.14 percentage points to Q3 GDP as imports grew less than exports. The same scenario happened in Q2 but by volume via the Census, the trade deficit is still huge . We believe import and export pricing, since GDP is real valued, is why this is the 2nd quarter for trade not to negatively wallop the economy.

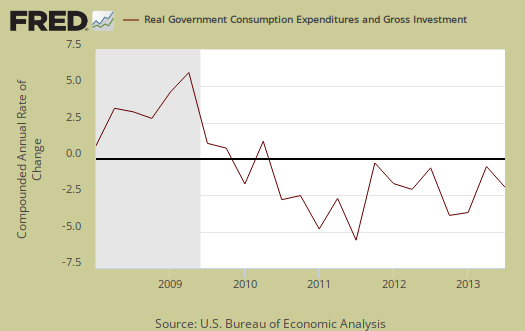

Government spending, G was +0.08 percentage points of Q3 GDP, or virtually unchanged between revisions. Below is the graph of government spending showing clearly the never ending budget cuts have been a real drag on economic growth.

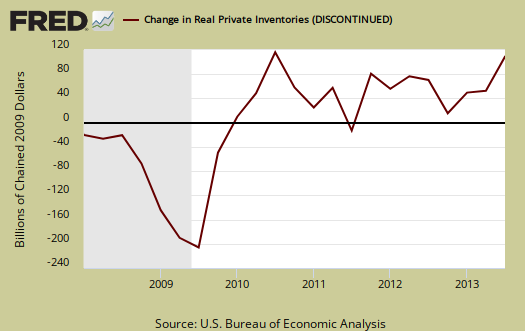

Investment, I is made up of fixed investment and changes to private inventories. The change in private inventories alone gave a +1.67 percentage point contribution to Q3, basically unchanged from the previous GDP estimate. Changes in private inventories in Q2 were a +0.41 percentage point contribution to GDP. Below are the change in real private inventories and the next graph is the change in that value from the previous quarter. What goes up usually comes crashing down and note the 2009 time frame in the below graphs. Sudden inventory accumulation might mean businesses are not selling their wares well so stuff is sitting on the shelves. For now be aware there is an oversupply of petroleum lying around and we hope to examine inventories again to see what gives in terms of oversupply versus people not buying. Regardless of cause, a massive increase in non-farm inventories implies a much lower Q4 GDP.

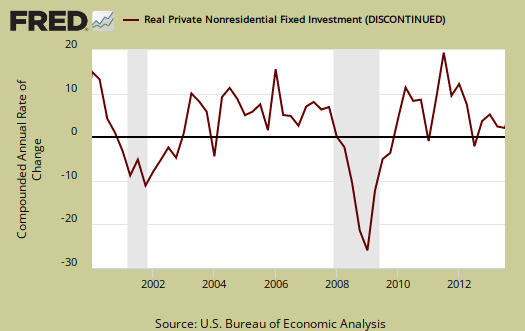

Fixed investment is residential and nonresidential and shows some growth in the Q3 GDP report, about as much growth as it was in Q2. Overall, fixed investment contributed +0.89 percentage points to GDP. Nonresidential was revised significantly up, 0.42 to 0.58 percentage points.

Part of fixed investment is Residential fixed investment. Residential was revised down, from +0.38 to +0.31 percentage points to Q3 GDP. One can see the housing bubble collapse in the below graph and also how there is no meteoric recovery in terms of economic growth, but a modest one, for the last three quarters, in spite of all of the housing hype talk. Still, better than negative, but not the massive growth engine implied by the housing market hype machine.

Nominal GDP: In current dollars, not adjusted for prices, of the U.S. output,was $16,912.9 billion, a 6.2% annualized increase from Q2. In Q2, current dollar GDP increased 3.1%. That's double the growth.

Real final sales of domestic product is GDP - inventories change. This figures gives a feel for real demand in the economy. This is because while private inventories represent economic activity, the stuff is sitting on the shelf, it's not demanded or sold . Real final sales increased 2.5%, revised upward from 1.9%, for Q3. Q2 real final sales were 2.1%. This means, in spite of the massive private inventory accumulation, the economy really did pick up some in Q3, all due to consumer spending.

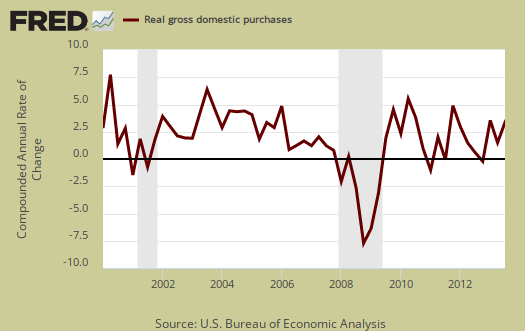

Gross domestic purchases are what U.S. consumers bought no matter whether it was made in Ohio or China.   ; It's defined as GDP plus imports and minus exports or using our above equation: where P = Real gross domestic purchases. Real gross domestic purchases increased 3.9%, revised up from 3.4%, in Q3. Q2 was 2.5%. Exports are subtracted off because they are outta here, you can't buy 'em, but imports, as well a know all too well, are available for purchase at your local Walmart. When gross domestic purchases exceed GDP, that's actually bad news, it means America is buying imports instead of goods made domestically. Considering how inventories saved the GDP day for Q3, a 3.9% increase in gross domestic purchases isn't great news. All hail Amazon, Apple and Walmart as they love to manufacture and import from China. Just in case you are reading this, Motorola is manufacturing Android phones in the United States, thanks Google and Walmart recently announced initiatives to sell more U.S. made products.

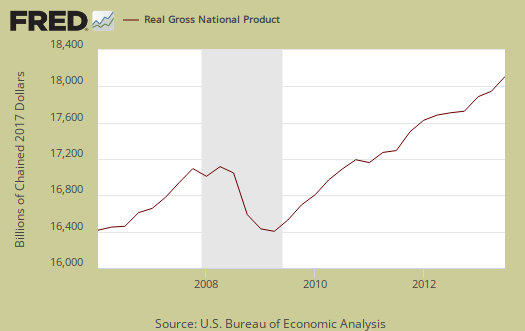

GNP - Gross National Product: Real gross national product, GNP, is the goods and services produced by the labor and property supplied by U.S. residents.

GNP = GDP + (Income receipts from the rest of the world) - (Income payments to the rest of the world)

Real GNP increased 4.4% for Q3. In Q2 GNP increased 2.7%. This is no surprise as the revision scaled well against the GDP revision. GNP includes, whereas GDP excludes, net income from the rest of the world. GNP increases beyond GDP if Americans made out like bandits from foreign investments more than foreigners cashed in on investments within the U.S. borders. The fact GNP is more than GDP implies a lot of super rich and Wall Street types made beaucoup bucks abroad.

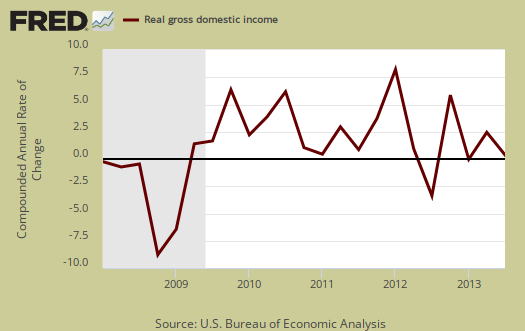

GDI - Gross Domestic Income: Gross Domestic Income is all income from within the borders of a nation and should normally equal GDP. GDI is wages, profits & taxes minus subsidies. Real GDI was significantly revised and increased 1.8% vs. the originally reported 1.4% in Q3. Q2 GDI was a 3.2% increase. The BEA says GDI measures the economic output as the costs incurred as well as incomes earned in the production of GDP. The BEA also states GDI can have statistical discrepancy over short time periods. Still GDI is so off from GDP, this cannot be good news for most Americans in terms of jobs, wages and labor.

Below are the revised percentage changes of Q3 2013 GDP components, from Q2. There is a difference between percentage change and percentage point change. Point change adds up to the total GDP percentage change and is reported above. The below is the individual quarterly percentage change, against themselves, of each component which makes up overall GDP. Additionally these changes are seasonally adjusted and reported by the BEA in annualized format.

|

Q3 2013 GDP Component Percentage Change (annualized) |

|||

|---|---|---|---|

| Component | Percentage Change from Q2 | ||

| GDP | +4.1% | ||

| C | +2.0% | ||

| I | +17.2% | ||

| G | +0.4% | ||

| X | +3.9% | ||

| M | +2.4% | ||

Other overviews on gross domestic product can be found here, including more in depth Q3 previous estimate overviews.

"Santa Clause rally" and this crap

I was in a place where I was forced to listen to CNBC against my will (or at least had to be subjected to it to conduct business). The teleprompter readers paid $500,00 + because they don't have a brain/ask questions were slobbering over themselves over this crap and Dow record highs. Again, for those of us in the real world (i.e., non-banksters, non-DC politicians/lifetime jobs, etc.), how's it feeling? Does it feel like the Dow is reflecting good times are here again? GNP? GDP kicking ass on the homefront? Or are we using our college degrees to wipe our asses during rare breaks on the factory floor? Applying for job number 3,999 while some dick calls us for an alumni donation and extols the virtues of college networking? Praying to God we don't break our leg on the scaffolding the bossman saved $ on because BS GDP stats don't pay the bills at the ER and self-insured folks get some sh***y help when push comes to shove.

But hey, GDP kicking ass! Freaking awesome! Me like lies! Me like blue and red puppets being controlled by the same ass-raping hands destroying this country. GDP is awesome? Yeah, my bank account and the tales of woe from across the US say otherwise. Didn't the propagandists in DC recently say they were going to revise how GDP and/or GNP were computed? Like, "If a unicorn farts in the wind but no one is around to hear it, chalk $1 up to both GDP and GNP because unicorn methane is energy production for imaginary gnomes' cars." Yup, Alice in Wonderland time, and these bastards in charge are the perpetual joke, but they don't know it and don't care. Like we left one dynastic Empire so that we could have Bush I, II, and III, Clinton I, II, and III, etc. So spying is good unless you have something to hide. Laundering $ is good for the GNP, but only if you are a TPTF and above the law per Eric Holder. Farce, farce, farce.

GDP kicked ass due to inventories

Actual demand is still mediocre, should have mentioned that.

No lie higher education has turned into some product and you, dear Alumni, are perceived only as a potential contributor to the great granfalloon.

And we refuse to donate to criminals/scammers anymore

F them, f them all. Sick of their lies. At all levels, the lie = work hard + be good to other people + get an education = you can have a semi-comfortable life. And if you donate to us, we'll help see others get the same opportunity. Property taxes go higher and higher and the folks for K-12 get richer and richer and we get less and less. College, same thing. Grad school - hundreds of blogs on that topic in every field. US News "rankings"? Education officials? Lobbyists? Private and public schools? All the same. No more! It's all lies, and since the lies are becoming increasingly transparent and their attempts to steal and enrich themselves at our expense even more transparent, I say, with the skills I learned in Kindergarten, "F them all!" Give a man or woman an education Thomas Jefferson envisioned. Let them learn to question the whole freaking system. Let them read, and read, and read some more. The Matrix is doomed, and all the scammers and self-enriching pigs at the trough can go read some Animal Farm for all I care.

we need open source school

We need open source school where the mastering of the material is verified and then the person can get a certificate that is just as valid as a degree from Harvard. Seriously, education is so out of whack, where the person isn't someone to be educated and helped along, but is instead, a product, I don't know how long the U.S. can remain #1 in higher education.

K-12 very obviously is a mess. With the Internets, self-teach is so easy to do and so many great people have put up information, all on their own initiatives, all for free yet none of this is being recognized as valid through a "diploma" or "graduation" of level "X" grade. It's free, what's not to like but it needs to be validated.

Do we really need diploma or validation?

If you can do it, what is stopping you? (not you personally, dear reader, but all of us).

We take diploma in hand and go ask the Massah, "Massah, may I pleeeeese live in the house?" For what? The chance to compete against 27 other people, wherein your talent is buried because they like the tall, good-looking guy, or the cute chick with the big assets, the kind they hire to read teleprompters because they really can't do anything else right? Not you, the one who spent night after night learning how to flog that database until it could beat any horse on the track.

Forget them.

Instead of diplomas, let's figure out how to work together, cooperate, compete. In 1954 a priest in Spain took workers who had tried working for others, and in a country under a dictatorship no less, and taught them the principles of cooperative work, and technical engineering. They borrowed money from their neighbors and families and bought a paraffin stove mfg plant and ran it as co-owners. Today the Mondragan Cooperatives net about $14 million a year, they have their own university, their own bank, and are doing a damn site better than the rest of Spain. There are thousands of cooperatives here, with earnings in the billions.

We don't need no stinkin' diplomas for that. Just competency, investing the same amont of time and effort and evaluating ourselvs and each other so we KNOW we have the same knowledge that some diploma is supposed to represent (but in reality doesn't) . and a willingness to decide that we and our neighbors are just as good, just as smart as the owner of the business we might hire out to.

Back in 1865-1920 the Industrial Unions pushed to get worker control of what they did. Mother Jones and others knew that would require some ownership, and where that wasn't possible Big BIll and, later, for example, the folks with the UE like Matles told us that we needed to make the decisions even if we didn't own, for our own good. They were tarred with the labels of socialist and communist, but they weren't, obviously, because they weren't wanting state control of the assets, they wanted worker control and a fair share of what the workers, and the workers alone, were making possible. Of course, the business unions, government, and the wealthy tyrants conspired to end that, and brought us to where we are today

We could do this.

truly need something to validate self-teach, mastery

via our online world. Reality is on so many topics, one can master them between all of the online resources. Many top universities have entire courses online, for free, yet they will not give credit because, of course, that person isn't paying tuition.

I believe there are some universities wanting to give credit for the initiative and they should. This massive go into debt up to your eyeballs for the paper which states you are "educated" has got to end. We also need employers to get back into the training,m apprentice, foot the bill for education, along with the paper which says the employee completed x.

Mexico should teach us how...

First however -> " go into debt up to your eyeballs for the paper which states you are "educated" has got to end"

This is costing us more than we know.

Anyway...

I find this more than humerous...

Mexico is training people, even paying them to go to school, to get better jobs than we are creating here.

http://mobile.nytimes.com/2013/11/19/world/americas/in-the-middle-of-mex...

We are richer as a country because of immigration. Of that I have no doubt. I also have no doubt that legalizing and encouraging immigration while there are from 3 to 25 people wanting every stinking little job out there is bad for everyone concerned - and the CBO backs that up, writing that unemployment will increase for at least a decade after we pass immigration reform.

But what I find the most funny are people here that are nearly apoplectic over immigration. These people in Mexico aren't trying to get across our borders - they have health care provided by their taxes that won't bankrupt them, and now jobs with school, in addition to training, paid for by employers. The ones who are coming over are competing for jobs that will keep one poor, hardly worth fighting over.

I wonder where they learned to do this "investing in your own country\people" from? Maybe we should follow in their footsteps.

about time, NAFTA

really accelerated illegal immigration, it wiped out corn farmers in Mexico and other countries, so el norte they went.

EP is a spin free zone on immigration, and we do take it on by the theory and statistics.

This is all news to me that Mexico is offering health care plus employer paid training, about time! I thought I read they just privatized the oil fields, very bad news for the people.

Bottom line, nations which invest in the people, create an economy for them will not send their excess labor outside the nation, they only do that when they want to shed people, as most of our ancestors were shed by Ireland, Sweden, Germany, Scotland and so on.

Felices fiestas hermano.

Espero que te va a traer la paz.

watch 4th quarter PCE

i have real retail sales growth at .95% in October, .91% in November, adjusting sales for each business group with the appropriate CPI component...that suggests inventories are moving and maybe a double digit annual growth rate in personal consumption expenditures for goods (which accounts for ~23% of GDP) in the fourth quarter...if we see any decent growth in services spending in the 4th quarter, PCE could drive GDP to a big upside surprise...

rjs

possible, do retail sales ok?

I had/have major technical difficulties so I couldn't get to retail sales. If you would cover your findings in an Instapopulist that would be awesome.

I had to replace parts of the motherboard on a laptop and of course the part took 8 days instead of 2 to arrive, plus some sort of OTA update on my Android phone destroyed it and I had to reinstall the OS/firmware. Anyone interested I put Cyanogenmod 10-1.3 on it instead of Stock ROM.

Anywho, was down to a quad system. and had to skip numerous reports. Will be doing something on capacity soon, not a regular Industrial production, focus is on U.S. capacity.

The holiday is more techno geek out fun but I hope to get to some updates on this site.

I do think you're probably right on Q4, so the above conclusion is probably wrong, that the inventory build up now will lead to lower Q4 GDP, I think you're right, but would like to see the details.

There are probably price deflators somewhere for retail sales from the BEA. Price deflators, import/expert price adjustments are the hardest thing to verify I've found, but we shouldn't ignore them, that's of course when funky things go on (as if adding $300 billion in "IP" for economic growth is not?)

i hope to

covered retail sales & wanted to post it last sunday, but got involved in a plumbing fix and finished late...then a doctors appt & other work screwed up monday...then i thought i'd add a paragraph on the adjustment with CPI & put real sales up wednesday or thursday, but i never got past the back of the napkin calculations...so today i'm covering GDP, CPI and IndPro for my mailing tomorrow, and intend to add inflation/deflation adjustments to retail to the CPI coverage...

so i'll have it done tomorrow morning, but i'm not even sure if i'll post it on my own blog then, as my brother is in from Houston & we have family plans...but the rest of my week looks free after that, so i should be able to get it up while working on my aggregate blog during what should be a slow news week..

rjs