Barry Eichengreen and Kevin H. O’Rourke have been updating us on the progress of this depression by comparing it to the big one, The Great Depression. Their original post, in April 6, 2009, captivated their audience.

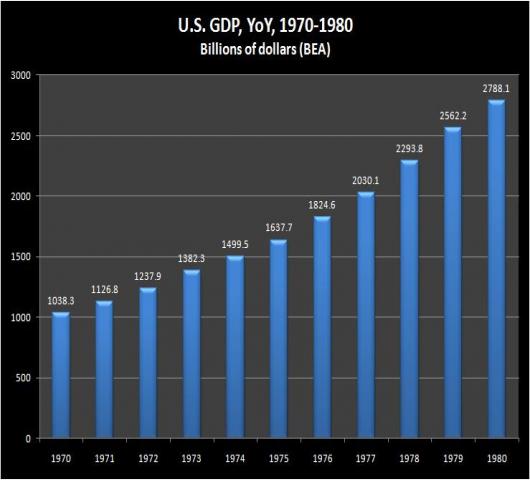

One thing that struck me was that we might compare the two events to the totally overlooked depression of the 1970s – The Great Stagflation. The reason why this one is missing and, perhaps, lost from official economic history is that it did not look anything like how we expect a depression to look – at least by the accepted, albeit vague, standard of what constitutes a depression. For instance, as shown in the graph below, year over year Gross Domestic Product enjoyed an unbroken expansion during the entire period.

Chart 1 (Source: Bureau of Economic Analysis)

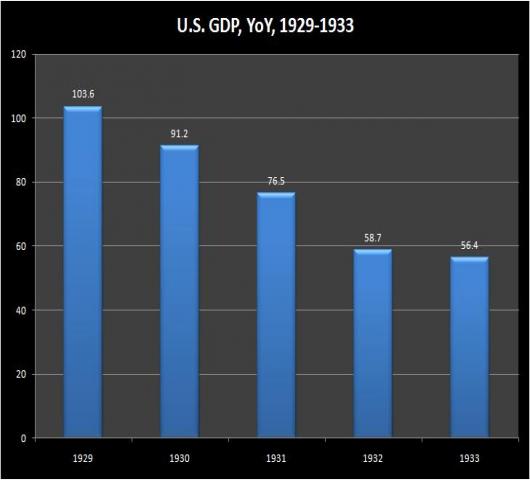

Compare this performance to the contraction of GDP during the Great Depression

Chart 2 (Source: Bureau of Economic Analysis)

Recent comments