The latest report from the Congressional Oversight Panel is out and they are making no bones about another shoe to drop, Commercial Real Estate (the link goes to a post warning on CRE from last July). On their main page is this:

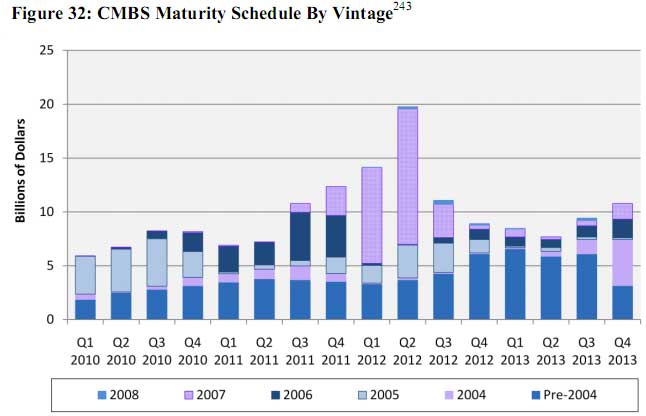

Nearly $1.4 trillion in commercial real estate loan debt will come due for refinancing in the next several years. The Panel's February report expresses concern that a wave of defaults and losses could jeopardize the stability of many banks and prolong an already painful recession.

Let's cut to the chase and say Congress and the Obama administration have blown off Commercial Real Estate generally. Here is COP's conclusion:

The Panel is concerned that until Treasury and bank supervisors take coordinated action to address forthrightly and transparently the state of the commercial real estate markets – and the potential impact that a breakdown in those markets could have on local communities, small businesses, and individuals – the financial crisis will not end.

Here are some CRE*facts from the report:

- Nearly half of CRE loans are more than property is worth

- 2,988 community banks are heavily weighted with CRE

- Smaller banks hold disproportionate CRE, not securitized

- CRE property values have fallen 40% since 2007

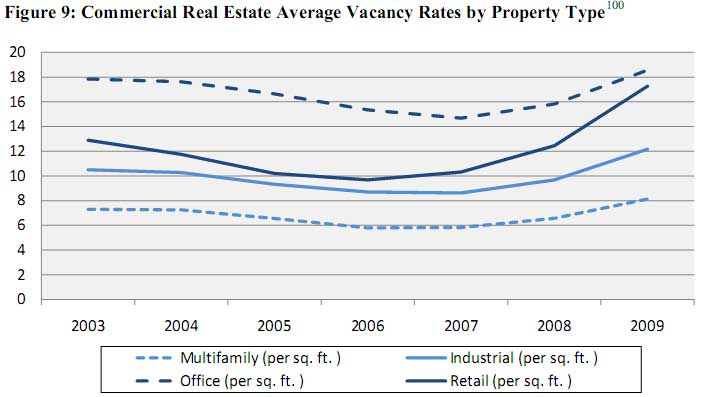

- Vacancy rates 18% for office space, 8% for apartments

- Vacancy rates, rents buffered by long term lease locks

- Rents have fallen 40% for office space, 33% for retail space

- Losses to occur in 2011 and later

- Loss estimates are between $200 to $300 billion

- CRE market 6.5% of all credit debt, $3.4 trillion

- CRE's private equity is 68% pension funds

*CRE means Commercial Real Estate

Some more differences are Big banks securitize their mortgages, community banks have a tendency to hang onto the original loan. Multifamily housing (apartments), make up 26.5% of the CRE market. Commercial mortgages are shorter in duration than Residential, about 3-10 years.

The report goes through some history on CRE's role in the 1980's S&L crisis, but I note, doesn't mention a major tax shelter change which left a hell of a lot of upper middle income investors holding the bag, with CRE being a common shelter vehicle (1987).

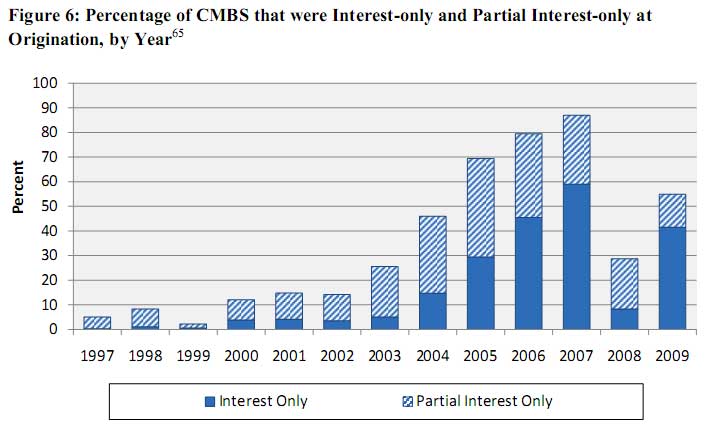

Bottom line, the GAO found out that CMBS underwriting was at it's most lax in 2007 and these loans mature later, note when this 2007 lax bombshell hits in the below 2nd graph.

Other elements in the report are TARP warrant sales are projected to be $9.3 billion and starting on page 80 is a large section discussing accounting rules and keeping toxic waste off of the books. There is also a history of the commercial real estate boom & bust in the 1980's in an appendix.

Ya all remember that S&L crisis, ya know the one that really hurt the economy?

Read Residential Real Estates, a ticking time bomb to see what's going on in residential real estate.

Comments

Reliving the Lost Decade

Part of the problem is that to acknowledge CRE problem + home mortgage problem means that a good portion of the financial sector is insolvent. In order to resolve that situation means a great deal more government intervention to resolve the insolvent situation a la Resolution Trust Corp. of the 80's.

But we will continue to blow it off and limp along just like Japan has.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Yes on reliving that Lost Decade, but ONE EXCEPTION

That exception being the Resolution Trust Corp. was based upon a new concept known as credit derivatives.

Now, that fellow who "invented" those claim that they were paramount in clearing up the S&L meltdown and corruption mess, but I have two problems with that.

Problem number one: Reagan doubled the social security tax, and began moving some of those funds toward the resolution of that mess (the other funds being used to take up the slack in the budget when the legislation for the tax cuts for the super-rich passed).

Problem number two: There's never been any real, hard data to demonstrate that those credit derivatives actually functioned as claimed. Those S&L's actually had real assets on their books, so eventually there was value regained.

Whereas, today, those credit derivatives and various multiples based upon those derivatives, have little or no actual value; other than earning billions for those who peddled them.

Until someone comes up with another clever scam enough rubes will fall for, it appears to be decades of deleveraging ahead.

RTC was based on derivatives???

Wow, that's the first I've read on that. Talk about a great post, to put up the details on what exactly happened there and how that all worked! I seriously have never seen any mention on that at all...(hint, hint, you should answer this with a blog post detailing it, seriously, such a post would be a "reader winner", I'm sure of it).

more it's been the RTC worked just great and was touted often as a better alternative to this financial oligarchy pig fest that they did.

Sorry, working on another post

Sorry, but I'm deeply immersed and in the middle of the causal factors tied to the quick rise in healthcare insurance costs at the moment.

And the big problem with your constructive suggestion is finding any valid and verifiable information regarding the interactions between the S&L bailouts and credit derivatives, other than it's creator's remarks on the matter. (Which was why I made mention of the increase in social security taxes regardint this.)

Sorry, forgot to present the synopsis

Don't mean to ignore you, so here's the generalized framework:

The creator of those credit derivatives aimed at the S&L recovery and utilized by RTC (wish I could recall that fellow's name);

Next, around the early '90s, probably 1993, the Group of Thirty notes some movement in the credit derivatives markets and contacts JP Morgan about their probity.

They communicate back to them, and the G30 releases a report advocating for the use of credit derivatives, but suggesting that "legal risk" should be removed in this arena.

Next, JPMorgan Chase comes out with a report, titled: Glass-Steagall: Overdue for Repeal.

Then, to get rid of "legal risk," the Derivatives Research Group forms, made up of the usual suspects, and lobbies congress to pass legislation removing said legal risk.

Next, we have that Gramm-Leach-Bliley Act (Financial Services Modernization Act) passed after several tries, followed by the Commodity Futures Modernization Act, thereby removing legal risk and oversight.

Meltdown to follow.....