The Federal Open Market Committee is not going to stop quantitative easing just yet. This is no surprise considering the weak economic conditions and as we pointed out, an inflation rate below expectations. The risk of deflation is real.

The Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month.

The tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and labor market. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, but it anticipates that inflation will move back toward its objective over the medium term.

Don't bank on the Fed stopping quantitative easing by December either as we pointed out. They are continuing to assess market conditions and are basing the decision on sustainable increases in labor market conditions and wanting to see the inflation hit the 2.0% annual target.

Asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's economic outlook as well as its assessment of the likely efficacy and costs of such purchases.

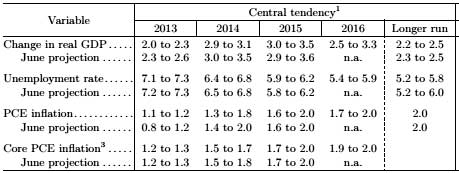

The FOMC also released their new economic projections and notice how the PCE index is below the Federal Reserve 2.0% annual target rate. In other words, they expect inflation to be too low for the short term.

Graphed below is the PCE price index, in red, scale on the left, and the PCE price index minus food and energy in blue, scale on the right. This is the percent change from one year ago. We are seeing low inflation similar to the deflationary period of 2008, caused in part by the Great recession and a massive drop in global economic demand. For those watching quantitative easing, you might take a look at this article on the Fed's concern for potential deflation Think about these low inflation numbers while the Fed is buying every Treasury bond and mortgaged backed security in sight. If quantitative easing ends, assuredly inflation will decrease.

Additionally contemplate the Fed buying up mortgage backed securities, yet the residential real estate market is cooling down. Bernanke also mentioned the tightening of financial conditions, which are easily visible in revolving consumer credit reductions.

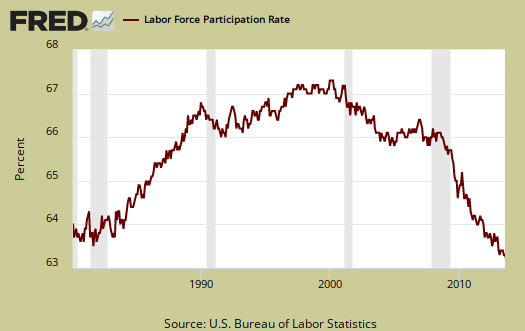

There was a lot of discussion on the labor participation rate, which is at record lows, 63.2% and has dropped 0.3 percentage points in the last year. The low labor participation rates implies people are simply dropping out of the count, not being able to gain employment. The unemployment rate will go down when people simply drop out of the labor force. During the press conference, Bernanke amplified this fact, although had hope in the next year things would be different, although the sun will come out tomorrow economically is now a repetitive half a decade song being sung by policy makers.

To say that the job market has improved does not imply that current conditions are satisfactory. Notably, at 7.3 percent, the unemployment rate remains well above acceptable levels. Long-term unemployment and underemployment remain high. And we have seen ongoing declines in labor force participation, which likely reflects discouragement on the part of many potential workers.

The Federal Reserve is now getting some flak over not stopping the asset purchases and this is most amusing, for the press and Wall Street tried to nail the date, the Fed always stated the conditions were inflation and labor market conditions. Wall Street watching just the unemployment rate for the Fed to wind down their quantitative easing is one of the reasons they were so wrong in assuming tapering would be announced this month by the FOMC.

Needless to say, the FOMC kept the federal funds rate unchanged and is much more explicit on their criteria to justify a rate increase.

the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

A question in the press conference asked about the debt ceiling shenanigans Congress likes to pull. Bernanke called this an economic shock to not raise the debt ceiling and called on Congress to be responsible. The press conference opening statement has a gem on how badly the sequester hurt the economy, not amplified of course by Wall Street, which cut into the employment gains referenced.

Federal fiscal policy continues to be an important restraint on growth and a source of downside risk.

Importantly, these gains were achieved despite substantial fiscal headwinds, which are likely slowing economic growth this year by a percentage point or more and reducing employment by hundreds of thousands of jobs.

Once again Bernanke called on Congress to address income inequality, noting much of policy is under the control of Congress and this administration that could really help the middle class. Needless to say that ain't gonna happen soon, Congress has abandoned helping the middle class economically. So, quantitative easing continues and tapering for September is a no-go.

Comments

Why people should read EP

Been watching Bloomberg, who got it as close that the Fed wasn't going to taper, yet this site appears to be the only site which said odds on the FOMC would not. Unfortunately we don't have the readership of large news organizations, but seemingly we should!

Ben can help the middle class more than Congress

All he has to do is end QE. That would take away the juice that is pushing the stock market to record highs. The trajectory of the S&P 500 has been exactly that of the growth in Fed assets. The stock market is benefiting the upper class only, which is widening the income gap.

I do agree deflation ought to concern them, but we're probably alone in that worry other than the Fed. The market is paying no attention. PPI and CPI consistently show modest if any inflation, but no deflation. While they definitely are concerned about the sharp increase in interest rates, I don't sense any explanation from Bernanke why that occurred. Obviously it had something to do with the talk of tapering QE, but wouldn't it be logical to assume that the market was trying to find the interest rate at which Treasuries would be priced at without QE, which means the rate if the buyer who has been snapping up 75% of new issuance were to quit buying. That market clearing rate is probably even higher than what we have seen so far. Add to that an even more interesting risk. China and Japan have been holding steady on their Treasury portfolio, no longer buying. What if they had to sell? What if China had to dump $1 trillion to rescue their banks? The market clearing rate would then be 7% or higher for 10 years and up. If the Fed is contemplating this prospect, I wonder if they have to continue QE as they are in a race to mop up as many bonds as they can before such a calamity strikes - in other words help the Treasury get their duration into the 2 year or less area, like Japan has now done. That keeps interest costs down until some really bad day arrives when the Fed is forced to push up Fed Funds rate.

Also, don't be surprised if you hear the banks squawk louder. QE and ZIRP are really starting to pinch their bottom line and the removal of quality collateral from the system is worrisome. This alone, I thought, would force them to taper on QE, so I was wrong on that point. From a market practitioner perspective, this is really concerning, and suggests that your fear about deflation is right on and underestimated by the market.

Who cares? The game is RIGGED, nothing matters, honestly

Who cares, honestly. QE, really? ZIRP, really? Who sits at the Fed's table? Who controls the Fed? Where's Corzine? In jail, or still free? Is Dimon still on the Board of Governors at the NY Fed despite White Whale, derivatives, bribing govt. officials in Alabama, oil, silver, aluminum manipulation, mortgage fraud? At this point the whole circus tent is burning down with the folks inside and the jackasses in charge are having us debate whether Bozo looks better with blue or red shoes or which corrupt jackass will sit at the head of the Bankster-controlled Fed. You know what? I don't care anymore because it's obvious we're all burning to death. Words, words, words mean nothing. There's democracy for you - it means nothing! The folks in charge will remain in charge and keep getting richer no matter what, no matter who or what runs or gets elected, or or what sits in this or that CEO's office, etc.

Oh, will QE or ZIRP until 2099 help us? I'm guessing not, but it sure as Hell will help create Monopoly $ for the banksters, their relatives and cronies, and inflate us to death. Unemployment, gosh is it 6 or 7% like Bloomberg or CNBC or politicians tell me? Or is it truly closer to 25% or above? And those with jobs can work part-time gigs for 1980 wages. What an honor. So glad we all got those degrees and arthritis busting our asses in jobs across the globe.

But hey, call me a cynic, but this whole thing is a circus. Words, words, words, and the clowns in charge don't give a sh*t because they run it and keep getting richer. So where's the real change? Where's the outcry? Where's the reform? Where's the PRISON TIME in a maximum security state prison or FCI for life without parole after tens of millions of people have been destroyed, watched as friends and family killed themselves or became homeless, or just gave up on hope? Eh? Where? Words, words, words. Because all I see is the same old corruption and bullsh*t and crickets and tumbleweed. And words, more words. But hey, someone over there went through a Stop sign. And if he doesn't pay his fine within 30 days, he'll be in jail right quick. Ain't it great. More words. And while reading these words, some assclown probably made ten billion dollars for bribing an official here or there and betting against his own country's safety or selling national security info. and calling it "profit seeking." Awesome, how far we've evolved from sludge.

Honestly, one thing Bernanke is right on

He cannot make Congress and this administration enact policies needed to employ America.

Right now we have evil Zuckerberg lying and strong arming Congress to get more cheap labor. They are going to pass TPP, list goes on and on about how this government is making sure Americans are economically screwed and the Fed just doesn't have a lot of power to counter that.

how is QE/ZIRP hurting banks?

I thought they were getting free money, borrowing at nothing and making money off of the margin.

On Treasuries most interesting. I agree the Fed should quit pushing this drug that somehow if Wall Street does well that helps the economy. We should do an analysis, markets up, they layoff, record profits, they offshore outsource, market goes down they use it as an excuse to have an internal employee bloodbath.

I just did up CPI, I am having technical issues so didn't get to it, but decided to overview it for exactly the reason you mention, Wall street/traders are oblivious to anything beyond what number is programmed into the HFT platform.

ZIRP + QE helps banksters, fuc** us

Of course it helps the banksters, free loot to invest in the DJIA and commodities. That's the only reason we have regular folks withdrawing money to live on (in Versailles parlance, the 'commoners that eat cake aka the 99%ers') while the DJIA reaches records.

But that's how lame and idiotic banksters making six to ten figures are. They sit at the Fed table, get a pass from future bankster defender Holder and others at the DOJ and SEC and CFTC, know all the players on the inside, and still lose on the markets despite rigging it all! I mean these people can actually forge signatures and get away with it, bribe/lobby Congress, meet with officials every day all day, and still lose $? How freaking stupid do you have to be to do that?! I mean I've had jobs for less than $10/hr. where you'd be fired for not, well, doing a task like placing something here or there or doing this or that one time! One time. And that was for close to $10/hr. And these are the "best and brightest"?! Ha. Ha. Ha! HA HA HAHAHAHAHAHHAHAHAHAHAHHAHAHAHAH! I love idiocy and lies and double standards.

It's killing Net Interest Income

It's true the big banks get 0.25 on their potload of reserves, which cost them nothing. But their bread and butter, anywhere from 50% to 75% of their net income, is NII, or the spread between their weight average cost of funds and interest rate on earning assets. This is where they are getting killed. A flat yield curve is just deadly for banks for any prolonged period of time, and in a ZIRP environment where yields in general are being pushed to zero, it can be fatal eventually. Add to this the whole problem of collateral shortages, and you have an exposed industry, including community banks. If this goes on through 2016 many of them will only be able to survive by enacting substantial cuts in their expense base, which in banking means getting rid of people.

I was going to say park offshore

But like most U.S. policy, it is the smaller companies and in this case banks which get killed for they are not able to offshore outsource and manipulate global markets.

The TBTF are probably just fine, correct?

Not necessarily

Smaller banks have much higher profit margins and therefore higher spreads from their customer base. Big banks are squeezed because their customers are largely multinationals who don't really need them. The biggest complainers about QE have been the CEOs of Goldman Sachs and Wells Fargo.

winners & losers of QE

This would make for an interesting post, the winners and losers of QE, in terms of profits and easy money. I'm fairly certain MBSes are the winners and as you note, T-bills, but the trade offs on the minute are not known.

The big thing here is jobs. Right now we have Zuckerberg lying his head off, demanding more guest worker Visas and I think all of America should apply to Facebook to watch them reject all. These companies have absurd rejection rates, like 97-99.9% for applications received, so their claim is really bullshit. You don't have to have an IQ of 168 to do server maintenance or even write some code, and the reality is they like H-1B due to indentured servitude plus they made huge savings on labor costs.

I'm just glad I went out on a limb over a month ago and pointed to the odd lack of inflation considering these purchases and said taper wouldn't happen. I'll leave the nasty effects to you if you are of a mind to educate us further.