30 Ways Trump Impacted The World In His First Year

Authored by Travis Gillmore and Cathy He via The Epoch Times,

President Donald Trump used his first year back in the White House to set the tone for his second presidency, changing the nation and the world in the process.

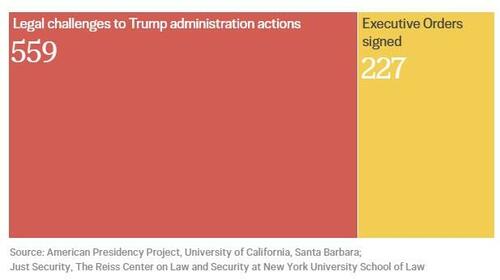

Through more than 225 executive orders, the president reorganized federal government policy and focus, while advancing his America First agenda.

On the world stage, Trump reset global trade policy, brokered peace deals, and used the U.S. military in several defining moments.

Here are 30 ways the Trump administration has transformed the country and beyond.

1. One Big Beautiful Bill Act

In July 2025, Congress passed Trump’s signature domestic policy legislation—the One Big Beautiful Bill Act—that implemented sweeping changes to tax and social policies over the next 10 years.

The legislation included making Trump’s 2017 tax cuts permanent; tax breaks on tips, overtime, and Social Security income; completing the border wall, adding $150 billion in defense spending, and imposing work requirements for Medicaid.

Other elements allow for accelerated depreciation deductions meant to incentivize business development and tax exemptions for interest paid on American-made vehicles.

President Donald Trump arrives to speak on his policy to end tax on tips in Las Vegas on Jan. 25, 2025. Mandel Ngan/AFP via Getty Images

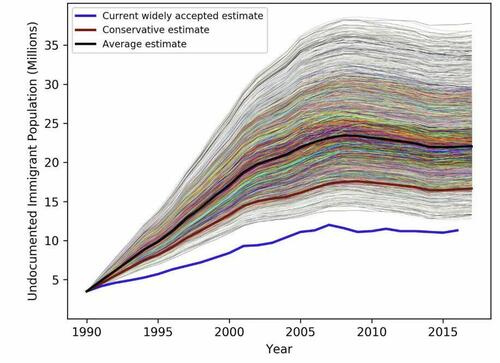

2. Curbing Illegal Immigration

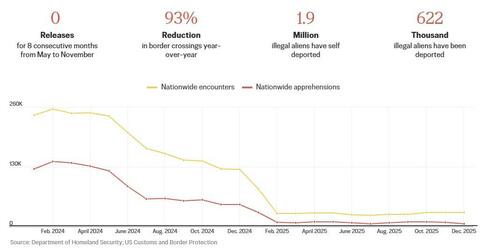

After the president enacted strict border security policies, including invoking the Illegal Alien Enemies Act of 1798, illegal immigration plummeted to the lowest numbers ever recorded.

Zero illegal immigrants were released by authorities for eight straight months, starting in May 2025, and more than 2.5 million illegal immigrants living in the United States were deported, according to the Department of Homeland Security.

Administration officials prioritized the removal of known gang members and violent criminals, while nearly 2 million illegal immigrants chose to self deport, some using Customs and Border Protection’s Home app.

Efforts to secure the border included hiring thousands of Immigration and Customs Enforcement and Border Patrol agents, ending catch and release policies, and expanding detention capacity.

Trump said deportations of illegal immigrants will benefit Americans by lowering crime and reducing competition for jobs and housing.

A U.S. Border Patrol agent from the Big Bend Sector takes part in a binational patrol called “Operation Mirror” with Mexican Army personnel to deter migrant crossings from Ojinaga, Mexico, to Presidio, Texas, on Nov. 4, 2025. Herika Martinez/AFP via Getty Images

3. Expanded Travel Bans

Trump cited national security concerns when he fully restricted travel from 12 countries last year—including Afghanistan, Iran, and Somalia—then expanded the directive in December 2025 to include five more nations. Nineteen countries are also subject to partial restrictions.

Beginning Jan. 21, the State Department will halt immigrant visa processing for nationals from 75 countries. The move stems from concerns that those nationals would require welfare or public benefits in the United States.

Soldiers of the Somalia National Army walk near the frontlines at Sabiid, one of the towns they have liberated from the Al-Qaeda-linked terrorists, Al-Shabaab, in Somalia's lower-Shabelle region on Nov. 11, 2025. Tony Karumba/AFP via Getty Images

4. Birthright Citizenship

One of the first executive orders signed in Trump’s second term challenged traditional interpretations of the 14th Amendment by ending birthright citizenship for those born to illegal immigrants or individuals in the country on temporary visas.

States and groups filed lawsuits against the administration, and lower courts ruled to block the president’s order. A challenge to the blocks reached the Supreme Court, prompting a landmark decision restricting courts’ use of nationwide injunctions.

The high court has not yet ruled on the constitutionality of birthright citizenship.

The entrance to the U.S. Citizen and Immigration Services location where a New York City Council data analyst of Venezuelan origin was detained by Immigration and Customs Enforcement while making an immigration appointment, in the Long Island town of Bethpage, N.Y., on Jan. 14, 2026. Shannon Stapleton/Reuters

5. Visa Changes

The administration increased fees for H-1B visas for skilled foreign workers to $100,000, expressing hope that this would incentivize businesses to hire American workers.

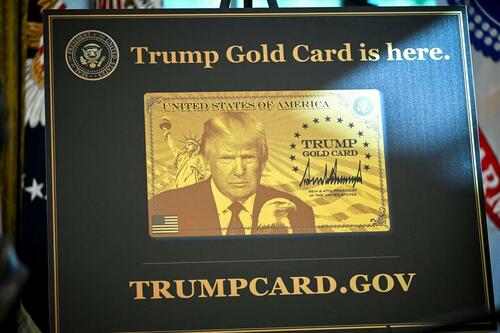

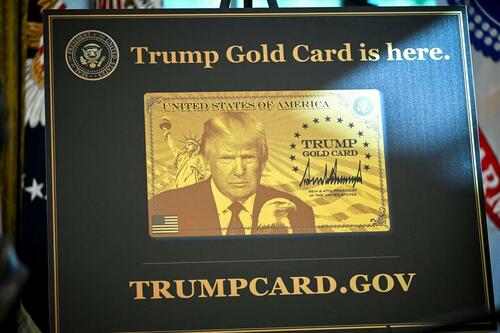

A newly introduced Trump Gold Card, available for purchase for $1 million for individuals and $2 million for businesses, will expedite residency processing for qualified applicants who pass background screenings.

The administration also suspended the green card lottery program in the wake of the Brown University shooting in December 2025. The diversity visa lottery awarded approximately 50,000 green cards each year to people from countries with limited representation in the United States.

A Trump Gold Card is displayed in the Oval Office as President Donald Trump speaks before signing executive orders on Sept. 19, 2025. Trump signed an order creating the Trump Gold Card expedited residency progam for a fee of $1 million for individuals and $2 million for sponsorships by corporations. Mandel Ngan/AFP via Getty Images

6. National Guard Deployments

The president first deployed the National Guard in Los Angeles to quell riots that erupted in June 2025 after protests targeted Immigration and Customs Enforcement agents.

Trump then sent troops to Washington to help combat high rates of violent crime in the capital. Subsequent deployments sent National Guard members to Portland, Chicago, and Memphis.

Democratic leaders challenged the deployments, and the Supreme Court in December 2025 ruled on a preliminary basis that the administration could not deploy National Guard troops to Chicago to protect federal immigration agents. Trump later withdrew guardsmen from Chicago, Portland, and Los Angeles.

National Guard members patrol the National Mall in Washington on Aug. 27, 2025. Madalina Kilroy/The Epoch Times

7. DOGE

On the first day of his second term, Trump established the Department of Government Efficiency (DOGE) to investigate and eliminate waste, fraud, and abuse in the federal government..

Initially led by Elon Musk, the department cites $215 billion in taxpayer savings on its website, derived from contract cancellations, lease terminations, the elimination of duplicate payments, and halting fraudulent activities.

Agencies most impacted by DOGE include the Department of Health and Human Services, the General Services Administration, and the Social Security Administration.

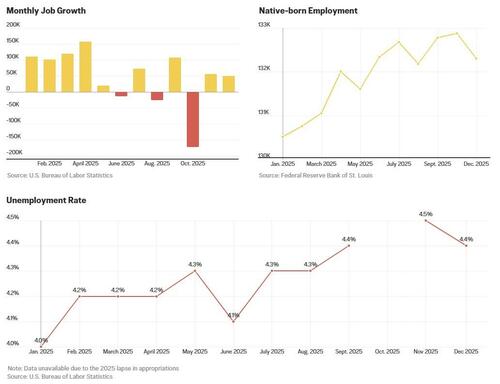

Efforts also included the large-scale layoff of federal workers, totaling about 317,000, of which approximately 92 percent left voluntarily after taking up buyout offers, according to the Office of Personnel Management.

Tesla CEO Elon Musk receives a key from President Donald Trump in the Oval Office on May 30, 2025. Musk served as an adviser to Trump and led the Department of Government Efficiency. Kevin Dietsch/Getty Images

8. Jan. 6 Pardons

On Day One, Trump pardoned nearly 1,600 people charged with various crimes for participating in protests and riots at the U.S. Capitol on Jan. 6, 2021.

He also commuted the sentences of 14 incarcerated individuals rather than granting full, unconditional pardons, thus leaving criminal convictions in place for some charged with seditious conspiracy—including Oath Keepers founder Stewart Rhodes and Proud Boys members Ethan Nordean, Joseph Biggs, and others.

People gather outside the DC Central Detention Facility, after President Donald Trump pardoned nearly 1,600 Jan. 6 defendants, in Washington on Jan. 20, 2025. Samira Bouaou/The Epoch Times

9. Pulling US Out of Climate Pacts

Trump initiated the United States’ withdrawal from the Paris Climate Accords for a second time on Jan. 20, 2025. In January 2026, the United States pulled out of the global benchmark climate treaty, the U.N. Framework Convention on Climate Change, and withdrew from the Green Climate Fund, which finances much of the U.N.’s climate initiatives.

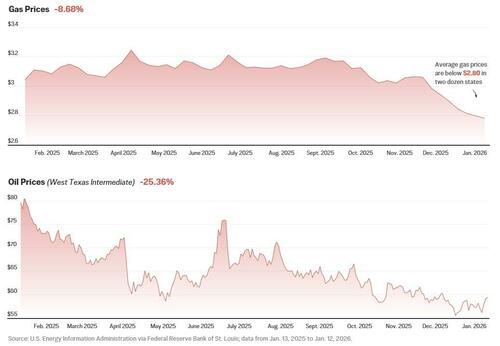

Domestically, the administration has moved to overhaul climate-related regulations, including rescinding electric vehicle mandates, halting offshore wind projects, and revoking a climate finding that would pave the way for expansive deregulation.

The COP30 logo is seen in front of the central building ahead of the COP30 Brazil Amazonia 2025 in Belem, Brazil, on Nov. 3, 2025. The Conference of the Parties (COP) meets annually to discuss and negotiate on climate-related issues. Wagner Meier/Getty Images

10. Eliminating DEI

Federal guidelines pertaining to diversity, equity, and inclusion (DEI) were eliminated on Trump’s first day in office. The change terminated training programs and requirements, along with positions related to DEI, and reprioritized merit-based hiring practices.

The administration, citing civil rights law, has also sought to ban DEI in universities and public schools that receive federal funding.

The moves were made amid a broader backdrop of corporations—including Amazon, McDonald’s, and Meta—rolling back their DEI policies.

President Donald Trump, joined by golf legend Tiger Woods, speaks during a reception honoring Black History Month in the East Room of the White House on Feb. 20, 2025. The Black History Month celebration comes as Trump has signed a series of executive orders ending federal diversity, equity, and inclusion (DEI) programs and cutting funding to schools and universities that do not cut DEI programs. Win McNamee/Getty Images

11. Dismantling Education Department

Trump is pushing Congress to eliminate the Education Department, with Secretary Linda McMahon leading the charge to phase it out. More than half of the department staff has been laid off, and many functions are being transferred to other departments.

The administration wants states to oversee administrative functions for their own education systems.

The Department of Education building in Washington on July 6, 2023. Madalina Vasiliu/The Epoch Times

12. Probing Universities

The federal government has withheld billions of dollars in funding from colleges and universities with recent histories of alleged civil rights violations and disruptive or violent pro-Palestinian protests, prompting legal challenges.

Settlements were reached with Brown, Columbia, Cornell, and others. Columbia agreed to pay a $200 million fine plus $21 million to Jewish employees harassed by co-workers and students.

The administration is currently locked in a legal battle with Harvard, with billions in federal funds frozen.

Harvard University in Cambridge, Mass., on July 4, 2025. Learner Liu/The Epoch Times

13. MAHA Agenda

Robert F. Kennedy Jr.’s appointment as secretary of Health and Human Services prompted a reimagining of the federal government’s approach to managing food and medicine.

Under the Make America Healthy Again (MAHA) initiative, Kennedy called on states to remove junk food from food stamp programs. Eighteen states have moved to do so.

The U.S. Department of Agriculture recently released a new inverted food pyramid that prioritizes healthy fats, proteins, fruits, and vegetables.

“The new guidelines recognize that whole, nutrient-dense food is the most effective path to better health and lower health care costs,” Kennedy said while unveiling the new guidelines.

Health Secretary Robert F. Kennedy Jr. and Secretary of Agriculture Brooke L. Rollins hold up ice cream cones during a press conference on the steps of the U.S. Department of Agriculture in Washington on July 14, 2025. Kennedy held a press conference along with Rollins, and others, as they announced that ice cream makers who are responsible for 90 percent of the nation’s ice cream and frozen dairy desserts are pledging to eliminate many artificial food dyes by the end of 2027. Michael M. Santiago/Getty Images

14. Lowering Drug Prices

The administration balanced the threat of tariffs on imported medications and ingredients with financial incentives to change the longstanding practice of major pharmaceutical companies of charging U.S. customers 400 percent or more for brand-name medications than they charge overseas customers.

More than a dozen pharmaceutical companies have entered into Most Favored Nation agreements with the United States so far, and Trump has asked Congress to codify this pricing policy into law.

Among the price reductions included in these agreements are Amgen’s cholesterol lowering drug Repatha from $573 to $239; HIV medication Reyataz, by Bristol Myers Squibb, from $1,449 to $217; and Hepatitis C medication Epclusa, by Gilead Sciences, from $24,920 to $2,425.

Health Secretary Robert F. Kennedy Jr. speaks next to charts displaying drug prices at an event in which President Donald Trump delivered remarks on lowering drug prices in the Oval Office on Nov. 6, 2025. Trump announced that his administration has reached agreements with drugmakers Eli Lilly and Novo Nordisk that would lower the price of some GLP-1 weight loss medications. Andrew Harnik/Getty Images

15. Gender Clarification

On his first day in office, Trump defined the federal government’s position on gender with an executive order declaring that the United States recognizes “two sexes, male and female.”

“These sexes are not changeable and are grounded in fundamental and incontrovertible reality,” the order reads.

Trump later barred federal funding from schools and institutions that allow men to compete in women’s sports.

The University of Pennsylvania, which was sanctioned for allowing a male to compete on the women’s swim team, agreed to strip that athlete, Lia Thomas, of all awards, including his 2022 NCAA national championship, and send a letter of apology to all female swimmers who competed against him.

Health officials in December 2025 moved to cut federal funding for hospitals that perform transgender procedures for minors.

In the wake of Trump’s policies, more than 20 medical clinics that offered gender transition procedures have paused or halted the treatments.

President Donald Trump joined by women athletes signs the “No Men in Women’s Sports” executive order in the East Room at the White House on Feb. 5, 2025. The executive order, which Trump signed on National Girls and Women in Sports Day, prohibits males who identify as transgender women from competing in women’s sports. Andrew Harnik/Getty Images

16. Redistricting Push

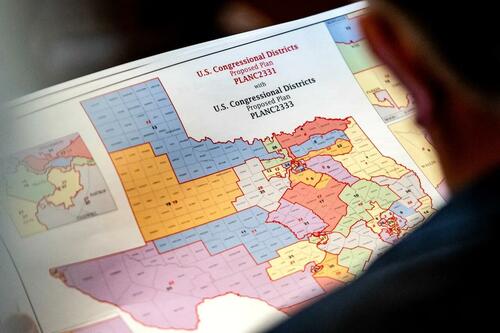

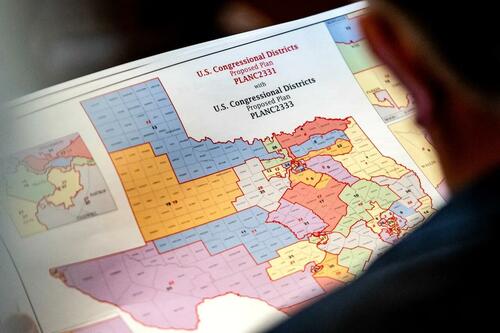

Trump’s push for Texas to redraw its congressional maps precipitated a nationwide effort to redistrict for partisan gain.

After Texas adopted new maps aimed at giving Republicans five extra House seats, California responded with a voter-approved ballot measure that redraws districts to favor Democrats in five seats.

Missouri, Ohio, and North Carolina redrew maps in favor of Republicans, while Utah helped Democrats. Other states, including Florida, are in the process of redistricting or are considering redistricting options.

Texas state Rep. Matt Morgan holds a map of the new proposed congressional districts in Texas, during a legislative session as Democratic lawmakers, who left the state to deny Republicans the opportunity to redraw the state's 38 congressional districts, begin returning to the Texas State Capitol in Austin on Aug. 20, 2025. Sergio Flores/Reuters

17. Eyeing Greenland

Trump upped the ante on his bid to acquire Greenland for national security purposes in January, prompting Danish and Greenlandic foreign ministers to meet with Vice President JD Vance and Secretary of State Marco Rubio at the White House on Jan. 14.

The White House has said purchasing the island is under consideration, along with other options, including military force.

Denmark, Greenland, and European leaders have pushed back on Trump’s comments. The president has reiterated that the island is critical for the United States’ security.

“There’s not a thing that Denmark can do about it if Russia or China wants to occupy Greenland, but there’s everything we can do,” Trump said on Jan. 14.

Danish Foreign Minister Lars Loekke Rasmussen and Greenlandic Foreign Minister Vivian Motzfeldt speak to the press after a meeting with lawmakers on Capitol Hill in Washington on Jan. 14, 2025. Madalina Kilroy/The Epoch Times

18. Resolved Global Conflicts

Trump threatened tariffs and applied economic pressure to help negotiate resolutions to eight conflicts around the world, some of which had been ongoing for decades.

Brokered cease-fires include those between the Democratic Republic of the Congo and Rwanda, as well as Thailand and Cambodia.

The president prioritized diplomatic solutions while wielding tariffs as a negotiating tool, emphasizing outcomes based on development and financial opportunities.

(Left) U.S. President Donald Trump (C) hosts the signing ceremony of a peace deal with the President of Rwanda Paul Kagame (L) and the President of the Democratic Republic of the Congo Felix Tshisekedi (R) at the United States Institute of Peace in Washington on Dec. 4, 2025. (Right) Malaysian Prime Minister Anwar Ibrahim (L) and U.S. President Donald Trump (R) watch as Thailand's Prime Minister Anutin Charnvirakul (2nd L) and Cambodia's Prime Minister Hun Manet (2nd R) hold up a document after the ceremonial signing of a cease-fire agreement between Thailand and Cambodia on the sidelines of the ASEAN Summit in Kuala Lumpur, Malaysia, on Oct. 26, 2025. Andrew Caballero-Reynolds/AFP via Getty Images, Mohd Rasfan/Pool/AFP via Getty Images

19. Ending Israel–Hamas Conflict

Trump oversaw a landmark peace treaty between Israel and Hamas, known as the 20-point Peace Plan, which resulted in the release of all Hamas-held hostages, living and deceased.

Trump called the moment the “historic dawn of a new Middle East,” celebrating an opportunity to pave a path toward peace in a region engulfed in struggles that date back millennia.

Egypt awarded Trump its highest honor, the “Order of the Nile,” and Israel made him the first non-citizen to ever receive its Israel Prize for his peacekeeping efforts.

Egyptian President Abdel Fattah El-Sisi and U.S. President Donald Trump sign a Gaza cease-fire agreement in Sharm El-Sheikh, Egypt, on Oct. 13, 2025. Trump is in Egypt to meet with European and Middle Eastern leaders in what’s being billed as an international peace summit, following the start of a US-brokered cease-fire deal to end the war in the Gaza Strip. Chip Somodevilla/Getty Images

20. Shifted Ukraine Policy

Trump ramped up pressure on Ukraine and Russia to bring the fighting to an end, suggesting Ukraine will have to cede territory it already lost in the war.

The Trump administration halted the Biden-era policy of free aid to Ukraine and negotiated arms sales instead.

Trump repeatedly expressed disappointment with Zelenskyy and Russian President Vladimir Putin for failing to work towards a peaceful resolution, though he said talks are ongoing and productive.

U.S. President Donald Trump speaks alongside Ukrainian President Volodymyr Zelenskyy during a press conference following their meeting at Mar-a-Lago in Palm Beach, Fla., on Dec. 28, 2025. Trump invited Zelenskyy to work on the U.S.-proposed peace plan to end the Russia–Ukraine war. Joe Raedle/Getty Images

21. Iran Strikes

Ten days into the Israel–Iran conflict in June 2025, Trump flexed America’s military might during a top-secret operation known as Midnight Hammer that destroyed Iran’s nuclear facilities.

The Fordow fuel enrichment plant—buried deep underground—was targeted along with two other plants by a fleet of B-2 bombers dropping 14 bunker buster bombs, and a barrage of Tomahawk missiles fired from submarines.

Two days later, the conflict ended in a cease-fire.

Chairman of the Joint Chiefs of Staff Air Force Gen. Dan Caine discusses the mission details of a targeted strike on Iran during a news conference at the Pentagon in Arlington, Va., on June 22, 2025. President Donald Trump addressed the nation last night after three Iranian nuclear facilities were struck by the U.S. military. Andrew Harnik/Getty Images

22. Backing Iranian Protesters

Iran’s violent clampdown on people protesting the Islamic regime drew criticism from the president.

Trump repeatedly voiced his support for the protesters, telling them to “take over the institutions” in a Truth Social post and promising them that “help is on the way.”

Human rights groups reported that more than 2,200 people were killed by Iranian officials since the protests began.

The president, on Jan. 16, said that the regime’s decision not to go ahead with scheduled executions of protesters impacted his decision not to strike Iran.

People gather during a protest in Tehran, Iran, on Jan. 8, 2026. Demonstrations have been ongoing since December 2025, triggered by soaring inflation and the collapse of the rial, and have expanded into broader demands for political change. Anonymous/Getty Images

23. Maduro Capture

In what may be a legacy-defining foreign policy action, Trump ordered the audacious military operation to capture Venezuelan leader Nicolás Maduro and his wife from their fortified compound in Caracas on Jan. 3.

The two were brought back to the United States and indicted in a New York federal court on several charges, including narco-terrorism conspiracy. Both pleaded not guilty

Secretary of State Marco Rubio said that prior to his capture, Maduro was given multiple opportunities to avoid the outcome.

In December 2025, the United States designated the Cartel de Los Soles as a foreign terrorist organization, with Maduro as its head. The Cartel de Los Soles is the umbrella term used to describe Venezuelan regime officials involved in drug trafficking.

Rubio said on Jan. 7 that the United States has a three-phase plan for Venezuela: stabilization, recovery, and transition.

Nicolás Maduro and his wife, Cilia Flores (rear), are escorted by federal agents after landing at a Manhattan helipad, as they make their way into an armored car en route to a federal courthouse in New York City on Jan. 5, 2026. XNY/Star Max/GC Images

24. Drug Boat Strikes

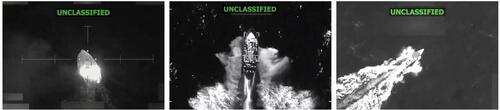

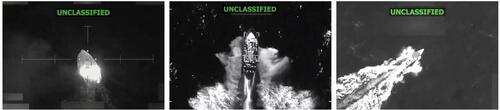

Since September 2025, the U.S. military has targeted narcotics trafficking operations by striking boats smuggling drugs out of Venezuela. The United States has also amassed an unprecedented armada in the Caribbean Sea.

The first known land strike was conducted on a facility used to load illicit shipments in December last year.

Since December, U.S. forces have seized oil tankers attempting to evade sanctions by turning off their transponders and flying false flags to avoid detection.

(Left) A vessel used for drug smuggling burns after the U.S. military struck it in the Eastern Pacific, in this screengrab taken from a handout video released Dec. 18, 2025. (Center) A still taken from footage of a boat strike targeting drug trafficking in the Eastern Pacific on Dec. 4, 2025. (Right) A still taken from footage of a strike on a drug boat in the Caribbean on Nov. 6, 2025. U.S. Southern Command/Handout via Reuters, @Southcom/X, @SecWar/X

25. Focus on Latin America

Trump resurrected and redefined the 19th-century Monroe Doctrine as the “Donroe Doctrine,” establishing U.S. strategic dominance in the Western hemisphere. The strategy culminated in drug boat strikes and U.S. forces deposing Maduro in the latter half of Trump’s first year, but the region was a key focus of the administration early on.

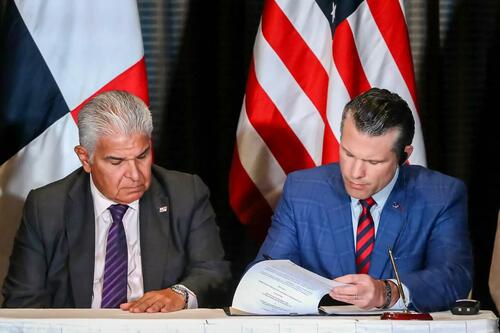

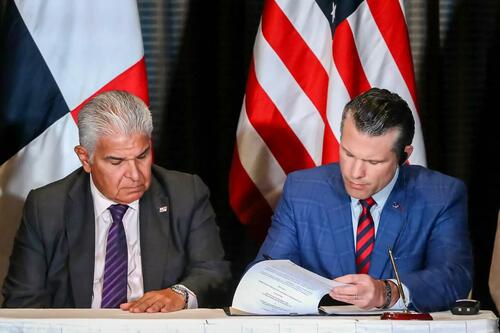

In early 2025, the president launched a pressure campaign threatening to retake control of the Panama Canal if Chinese influence was not removed from the area.

Last February, Panama announced it would not renew its Belt and Road infrastructure investment agreement with Beijing, a win for the U.S. administration.

Panamanian President Jose Raul Mulino looks on as U.S. Secretary of Defense Pete Hegseth (R) signs a bilateral agreement, in Panama City on April 9, 2025. Franco Brana/AFP via Getty Images

26. Trade War, Truce With China

Trump imposed two sets of tariffs on China: fentanyl tariffs over the country’s role in sending chemical precursors to Mexican cartels that traffic the drug into the United States; and reciprocal tariffs over Beijing’s decades-long unfair trade practices harming the United States.

Tit-for-tat tariffs imposed after last April’s “Liberation Day” saw U.S. levies reach as high as 245 percent for some Chinese products. After several bouts of escalation and de-escalation, the two sides reached a 1-year trade truce during Trump’s meeting with Chinese Communist Party leader Xi Jinping in South Korea in October.

Under the deal, Beijing agreed to resume buying U.S. soybeans, allow for the export of rare earths, and take measures to mitigate the flow of fentanyl precursors to the United States.

Shipping containers are seen at the port in Qingdao, in China's eastern Shandong Province on Aug. 12, 2025. China and the United States delayed higher tariffs on each other's imports for 90 days, hours before a trade truce between the world's two largest economies was due to expire on Aug. 12. STR/AFP via Getty Images

27. Tariffs and Trade Deals

The president’s expansive tariff policy has sought to reset global trade and reshore manufacturing to undo what U.S. officials describe as decades of unfair trade practices against the United States.

“Liberation Day” tariffs kicked off trade negotiations with dozens of countries. They’ve resulted in agreements with a host of nations, including the UK, the European Union, Japan, and South Korea.

Meanwhile, tariffs have raised record revenues—approximately $264 billion so far.

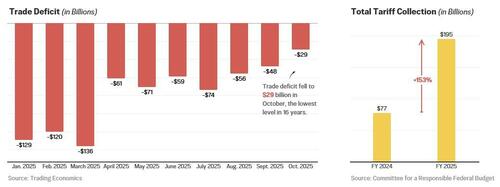

The trade deficit in October fell to the lowest level in 16 years. Tariff revenues have lowered the national debt, and the president has proposed $2,000 tariff rebate checks for citizens. Such a measure would require legislative approval.

The Supreme Court, however, is set to decide whether Trump’s global tariffs are legal. U.S. officials have said that even if they are overturned, the government has other authorities to use to continue levying tariffs.

A chart that shows the reciprocal tariffs the United States is charging other countries is on display at the James Brady Press Briefing Room of the White House on April 2, 2025. President Donald Trump announced new tariffs targeting goods imported to the United States from most trading partners, including China, Japan, and India. Alex Wong/Getty Images

28. Trillions in Investments

Trade negotiations led to a record level of investment in the development and expansion of manufacturing facilities nationwide.

Trump’s May 2025 visit to Gulf countries led to deals totaling more than $2 trillion with the United Arab Emirates, Qatar, and Saudi Arabia. Trade deals with the U.K., the European Union, Japan, and South Korea have led to more than $2 trillion in purchases and investment commitments in the United States.

The United States and Taiwan in January announced a $500 billion deal aimed at reshoring American semiconductor manufacturing.

Trump recently said the “unbelievable success” of tariffs will drive an economic revival in the United States.

Taiwan's chief trade negotiator, Yang Jen-ni (L), Taiwanese Vice Premier Cheng Li-chiun (C), and Taiwan’s top representative to the United States, Alexander Yui (R), speak at a press conference at the Taipei Economic and Cultural Representative Office in Washington on Jan. 16, 2026. Eva Fu/The Epoch Times

29. Shuttering USAID

The federal government reorganization included the dismantling of the U.S. Agency for International Development. The Trump administration eliminated approximately 94 percent of contracts, about $54 billion.

Rubio said the organization “strayed from its original mission of responsibly advancing American interests abroad.”

Since December, the United States has signed health deals with more than a dozen African countries under a new aid model, called the “America First Global Health Strategy.” The United States has pledged billions to improve the health systems of the countries, which have committed billions in matching funds.

U.S. Secretary of State Marco Rubio speaks with Kenyan President William Ruto (L) as they arrive for a Health Framework of Cooperation signing ceremony at the State Department in Washington on Dec. 4, 2025. Trump administration officials said the agreement would be the first in a series of agreements with developing countries, based on the “trade not aid” policy. Allison Robbert / AFP via Getty Images

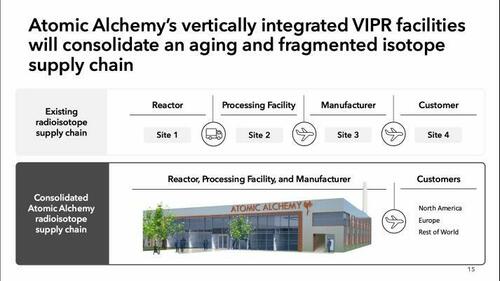

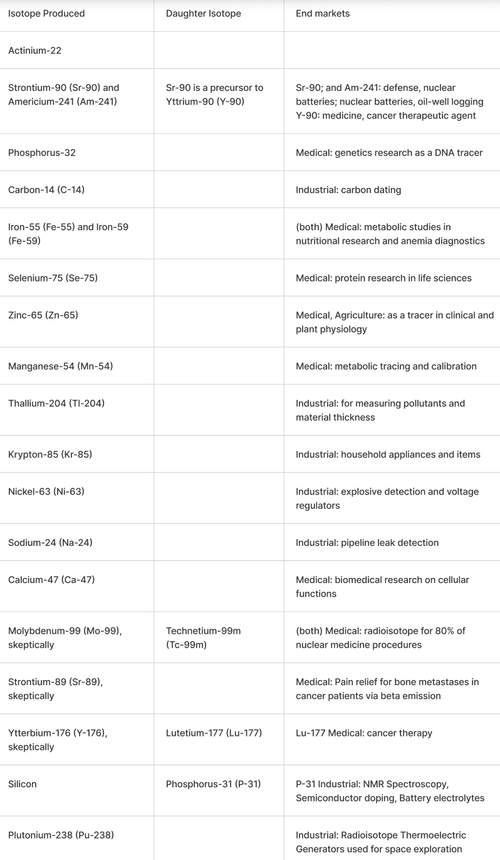

30. Securing Rare Earth Supply Chain

The administration, recognizing the threat posed by China’s chokehold on rare-earth refining, has made a series of domestic and international investments to build an alternative supply chain for critical minerals. Rare earth elements are essential for modern manufacturing, including for cars, electronics, and weapons systems.

Ramaco Resources plans to extract more than 450 tons of rare earths from its 4,500-acre Brook Mine near Ranchester, Wyo., on July 11, 2025. John Haughey/The Epoch Times

In July 2025, the Pentagon entered into a landmark partnership with MP Materials, the country’s largest rare earth miner, committing billions of dollars to support the company and becoming its largest shareholder. MP Materials and the Pentagon also entered into a joint venture with a Saudi state-owned mining company to build a rare earths refinery in the Gulf country.

In October 2025, the United States and Australia agreed to invest $3 billion in rare earth projects.

Tyler Durden

Tue, 01/20/2026 - 11:20

President Donald Trump speaks during the "Great, Historic Investment in Rural Health Roundtable" in the East Room of the White House on Jan. 16, 2026. Madalina Kilroy/The Epoch Times

President Donald Trump speaks during the "Great, Historic Investment in Rural Health Roundtable" in the East Room of the White House on Jan. 16, 2026. Madalina Kilroy/The Epoch Times

via AP

via AP

Recent comments