Credit - A Little Bit Louder Now

Submitted by Peter Tchir of Academy Securities

Credit'Hey, hey, A, yeah, yahhh... you make me wanna shout!!'

After a tumultuous week, if there was one thing we could do for you, it is put a song in your head that hopefully makes you smile. Seriously, a song featured in Animal House and Wedding Crashers should make you smile, at least for a moment.

This week’s T-Report follows up last weekend’s Is Credit Whispering? Or Shouting?

We examined the risks to credit markets, from several angles, and explored potential vulnerabilities. The main focus was on the risk of potential “contagion” (though we didn’t use the word) of “selling what you can” instead of what you might want to.

On a “housekeeping” note, we often use ETFs in T-Reports. Whether we are just pointing something out, or taking a view, one way or another, it is meant to be a “badge of honor” to the ETFs selected (except single stock leveraged ETFs, but that is another story). We use ETFs when we feel they “represent” a market or a sector well. Especially when there is no “index” that people follow that tracks that sector. ETFs have multiple advantages over obscure indices. Everyone can see them trade in real-time during market hours. You can see their holdings, their volume, their NAV, etc. You can even trade them. Like any other stock, “price charts” don’t do a good job with dividends/total return, but we try to highlight that, when total return is the focus.

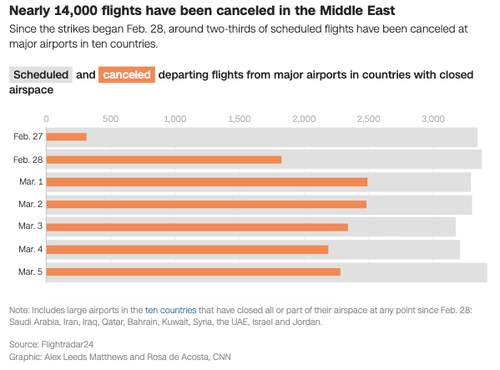

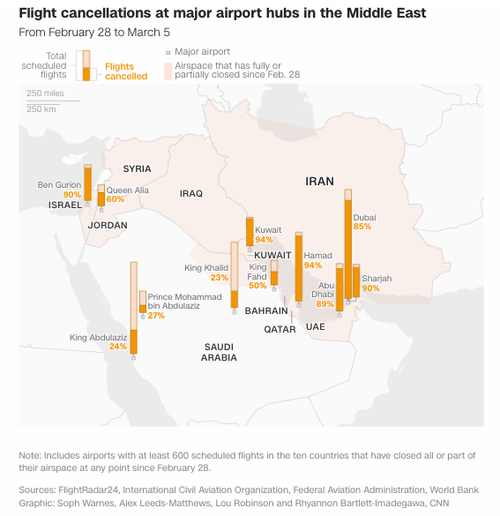

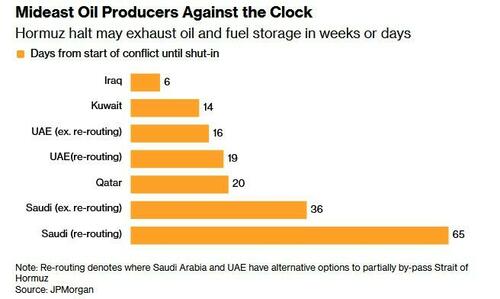

IranWe will continue to keep you as informed as possible of our views on the conflict in the Middle East and the market ramifications.

-

Webinar from last Sunday night.

-

Three Themes Driving Markets from Tuesday.

-

Tuesday’s Iran War Update SITREP.

-

The Spider Web podcast from Thursday. We don’t actually call it that, but I think it is “catchy.”

-

Finally, with reference to Mrs. Robinson, we published NFP and Plastics on Friday. Jet fuel was also featured.

-

I had the pleasure of going on Bloomberg TV on Monday morning (the 52:25 mark). Why Markets Will Move Past Iran, on the Schwab Network, from the NYSE, also on Monday. Finally, on CNBC, Attacks on LNG Facilities Worry Me, from Thursday, via laptop from a weirdly set up hotel room in D.C.

-

Our Academy in the News webpage has links to General Deptula on CNN, General Spider Marks on CNN (multiple times), General Robeson on Bloomberg TV, and Joe Zacks (former CIA Deputy Assistant Director) on CBS Face The Nation.

As of Sunday morning, with an immense amount of input from the Geopolitical Intelligence Group, we are still looking for the parties to find some sort of “off-ramp” soon. Soon being measured in days, and maybe weeks, but definitely not months. We could be wrong, and will know more by Monday morning and will update you if our timing or view changes.

We seem to be at the lower-end of the “fear spectrum” on this issue. Worried, concerned, and cannot rule out a lot more pressure on markets and the global economy, but that is not our base case.

A Little Bit Quieter NowYes, the song says “softer” but that could be interpreted as negative, and there were some positive developments this week, at least with respect to my concerns.

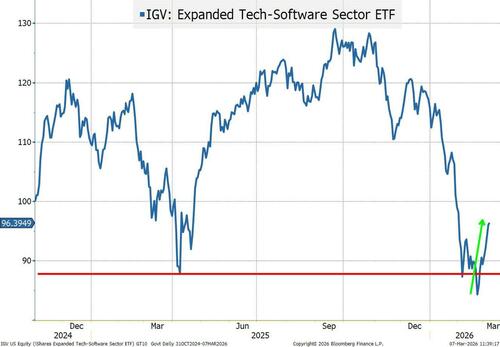

The software sector, as represented by this ETF, reclaimed levels above its post-Liberation Day lows. It was up every day this week, including Friday. A technical bounce, or re-thinking the software is “doomed” narrative? A bit of both?

Given the relative importance of the software sector in private credit, this could provide welcome relief!

We saw BDCs bounce this week as well. I track BIZD, a $1.5 billion ETF, as a proxy for this market. While higher on the week, it closed below Monday’s close and is well off the week’s highs that occurred on Monday.

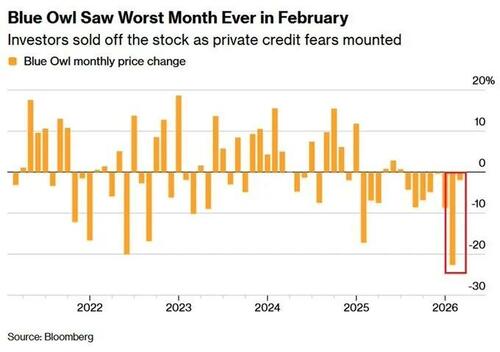

Unfortunately, several of the stocks that are categorized as “private credit” related companies finished the week poorly, in some cases at 52-week lows.

Everybody Shout NowIf it weren’t for you meddling headlines.

There is always the risk that headlines massively overstate the problem(s). Headlines and titles are designed to do that. You can’t create “click bait” without some aggressive headlines.

So, part of me wants to downplay the headlines. But the headlines seemed to write themselves this week.

Limiting redemptions. Limiting withdrawals. Even the dreaded 4-letter word – GATE – crept into conversations and stories.

-

These products were not designed to be liquid. Some of the limits were always in place, but they just weren’t a limiting factor until recently. Some still aren’t a limiting factor. So, these headlines versus reality are skewed towards too much fear! But they seemed to cause markets to move, which is not comforting. In a “healthy” market, we’d absorb inflated headline risk, but we are clearly still in the “where there is smoke, there is fire” part of the narrative.

Defaults, fraud, and jump to default. If you didn’t see any headlines around defaults and frauds this week, you did well. I heard more “cockroach” stories this week than I needed to, or wanted to (please don’t bring up cockroaches during dinner – it doesn’t make the meal more enjoyable in any way, shape, or form).

-

Jump to default has a “special place” in my heart. Jump to default refers to the potential for a bond (or loan) to go from “money good” or “near-par” or “unstressed” overnight. I’ve been in credit a LONG time, and jump to default takes up more time than has ever really been warranted.

-

Was there a day when “jump to default” occurred? Sure. When loans sat on bank balance sheets in accrual accounting books, with no capital relief for treating them as mark-to-market. Extend and Pretend ruled the world. Problems would be put off as long as possible and in some cases the problems fixed themselves over time (markets changed, etc.). With enough “extend and pretend” when the banks could not “extend and pretend” (the recovery values would be low and on the accounting side of things), it looked like a “jump to default.” But it was really more about accounting than anything like “last month this loan looked good, and today it looks bad.”

-

With fraud this can happen (and it seems to have happened in a few recent cases).

-

Has “jump to default” really existed in the past few decades? A few months ago, I would have argued vehemently that it didn’t. The leveraged loan market has become robust. It trades regularly in the secondary market. There is price discovery. You can see loans trade down and then sometimes back up. The high yield bond market has changed to include big, large, well-known, and often public companies, where there are “lots of eyes” on the bonds and price discovery works. It doesn’t mean you don’t have defaults, it just means that you rarely have “large gaps” and certainly not from 100 to 0 “overnight.” For the life of me, I think there was only one case that I can remember where a bond quite literally went from near-par to bankrupt (and a low price) almost overnight. If my memory is correct, it was a company that had one product (glass for cell phones) and only one customer, and that customer dropped them. So, until recently, I would have fought the concept of “jump to default” kicking and screaming the whole way.

-

NCAA bonds are more common. I had no idea what the desk meant when they made fun of a bond that went NCAA. It meant No Coupon At All. In the high yield market, with semi-annual coupons, it meant that from time of issue to the first coupon, in 6 month’s time, the company wasn’t able to pay. I rarely see it, but I’ve seen it happen in the wild.

-

If you include bonds that elect to PIK (Pay In Kind) in that category, it is less rare. Still not common. Also, since the company has the right to PIK, it doesn’t even seem that unnatural to me that some would choose to PIK. Having said that, the usage of the term PIK has “picked” up in recent conversations about the market.

-

-

The loan that went from par to 0 in a few months. That was a headline that hit. Is that the norm? Heck no, if it was, it wouldn’t have generated so much interest. But am I rethinking defending the “impossibility” of jump to default?

-

A little. Just a little. Smaller loans with only a handful of investors who have read the documents, and understand the company, are less likely to face “price discovery” every day. It is price discovery that prevents “jump to default” from happening. Without price discovery, then yes, we can see jump to default (though no recovery seems pretty extreme).

-

Mark-to-market is always tricky in credit. It can be tricky in every asset class, but I find credit to be susceptible to "liquidity” events, where prices go below “reasonable” levels. The most extreme example (and there was forced selling involved) was the “super senior” tranches of synthetic CDOs. If you look at the 10-year CDX IG tranches, I think it is still accurate to say that NEVER has there been a loss in the mezz tranche (losses start at 3% of portfolio losses and get absorbed until 7% of portfolio losses). That is for well over 20 years now. Yet super senior (call it 15% loss absorption) traded at incredible discounts. This is both meant to be:

-

Soothing – prices in credit can be far lower than any economic reality indicates, purely because of the nature of credit market liquidity.

-

Scary – prices in credit can be far lower than any economic reality indicates, purely because of the nature of credit market liquidity.

If the credit risk is already mispriced too aggressively, then we have nothing to fear. If we haven’t reached that stage, then we have a lot to fear, which is what my concerns about “Sell what you Can” are rooted in.

A Little Bit Louder NowThe first “true line of defense” in whatever is going on in private credit is likely going to be the leveraged loan market.

While not a “true” proxy for private credit, it is probably the “best proxy” for those looking to shed “similar” risk-reward instruments in their private credit holdings.

BKLN ($6 billion) finished higher on the week, though off its highs. SRLN ($5 billion) finished a touch lower on the week, and off its highs of the week. While I consider HYG and JNK largely interchangeable on the high yield bond side of things, BKLN and SRLN are quite different in terms of portfolio construction.

According to Bloomberg both ETFs were trading about 0.6% below NAV. Is that accurate? I’m not sure. (It is harder to get a good NAV calculation for loans compared to bonds, and in turn, far more difficult to get for bonds than for equity-based ETFs). Keeping a close eye on this as I’m an adherent to the ETF Spiral™ theory, that the “arbitrage” tends to push markets in the direction of the arb (in this case lower) at least during the early stages of a real NAV discount developing (again, I’m not sure we have that here, but want to highlight).

Both leveraged loan ETFs had outflows on the week, though BKLN still has more shares outstanding than in late April (post-Liberation Day) and in early October (presumably peak rate cut fears).

Which brings us to one odd point:

-

Is floating rate good or bad?

-

It is good for those who are borrowing the money as they pay less.

-

It is bad for lenders as they receive less.

-

Do the two things just cancel each other out?

-

In theory, somewhat. If people are already looking to sell an asset class because of credit concerns, then 50 bps of rate cuts might cause them to want to sell due to lower returns if the 50 bps of hypothetical cuts isn’t viewed as helping credit quality that much.

-

Investors are likely to reduce exposure ahead of cuts, while the companies don’t benefit until the cuts actually occur.

-

-

I am keeping a close eye on this market and it isn’t “shouting” (or screaming) but it is “a little bit louder now.”

Remember When LCDX Traded Worse than HY CDX?

If I lost you with that title, it is completely understandable. LCDX was a leveraged loan CDS index. I think it died a well deserved death a long time ago. HY CDX still exists and is traded to this day.

So, we had an index that was referencing senior secured loans (LCDX).

There were a large number of companies that were in both indices (their unsecured bonds were referenced in HY CDX and their Senior Secured Loans in LCDX). On this overlapping set of names, you would certainly expect the loans to recover more in the event of a Credit Event (default in CDS language).

I guess in theory, the non-overlapping loans in LCDX could have a higher likelihood of default than the non-overlapping bonds in HY CDX (but I don’t remember that being obvious). I guess in theory, despite seniority in the cap structure, the non-overlapping loans that defaulted could have lower recoveries than the non-overlapping bonds (recovery can depend a lot on industry, but I don’t remember that being obvious at the time).

What was obvious (or seemed obvious at the time) was that there was a giant unwind going on.

-

Own 2X of LCDX and short 1X of HY CDX (or some leveraged ratio). Makes a lot of sense. It was positive carry and historically, it worked well on the downside too. It was a bit tricky if spreads tightened as LCDX was somewhat capped in price terms as the underlying LCDS could cancel if a loan was refinanced at better terms. If you were bearish, this was a good way to get paid to have some downside risk protection – in theory.

-

But it didn’t work and stories about the size of the unwind looming (or ongoing) pushed levels to what seemed like absurd levels. I remember wanting to load up on LCDX (having done a lot of the credit work, rel val of names, etc., and being a contrarian in general) but not being allowed to, because senior people were “scared” of this unwind.

-

I only recite this story because it fits my concerns that credit can get oversold, but it still hurts while it is being oversold, and it can be very difficult to get people to stand in the way of a falling knife. I certainly wouldn’t have managed to time the “bottom” of that relationship, but it was close and when it reversed course, it reversed course rapidly, because it was so obviously mispriced.

“Obvious” mispricing (too low) can occur in credit, even if it seems “obvious” at the time, and not just in hindsight. So yes, I remain wary of “selling what you can” becoming a reality with broader ramifications for credit markets.

Bottom LineOn credit, I remain wary of “selling what you can” becoming a reality with broader ramifications for credit markets. Not pounding the table bearish, but very cautious and defensive here. If Academy is correct on reaching a conclusion in the Iran war, credit markets should bounce, which is a large mediating factor in “only” being cautious/defensive. If we are having the same conversations next Friday as we had this past Friday, credit will suffer from the economic damage being done – again, far from being our base case, but a possibility.

On equities, conflict resolution would set up for a nice rally. Will continue to watch IGV closely as a “tell” that the market is done with the “AI is killing software” narrative.

Weirdly, I’m probably less cautious on equities than credit – the relief rally will be bigger, but then the risk that the credit fears persist could return – which would hit credit first, but would also drag equities along for the ride. XLE finished up on the week, but down from Monday’s highs, when we might have seen “the end of short covering.” I still really like the energy sector long term (globally), but heading into this past week we recommended taking profits here. We were clearly early as Monday trading kept pushing things higher, but now it seems to be settling into a pattern that could lead us lower fairly quickly in the event of conflict resolution.

On rates, last weekend we were indifferent at 10s below 4%, but now we’d be buying.

We continue to hope that the events in the Middle East lead to a peaceful resolution, putting the Iranian people on a better path to prosperity and freedom, while minimizing the loss of life for everyone in the region. And our best wishes and support to all those involved in our military and intelligence efforts!

Tyler Durden Sun, 03/08/2026 - 18:35

Nikita Casap appears at his arraignment in Waukesha County Circuit Court, in Waukesha, Wis., on May 7, 2025. Mark Hoffman/Milwaukee Journal-Sentinel via AP, Pool

Nikita Casap appears at his arraignment in Waukesha County Circuit Court, in Waukesha, Wis., on May 7, 2025. Mark Hoffman/Milwaukee Journal-Sentinel via AP, Pool

File image: Tulsi Gabbard is the United States Director of National Intelligence

File image: Tulsi Gabbard is the United States Director of National Intelligence

Recent comments