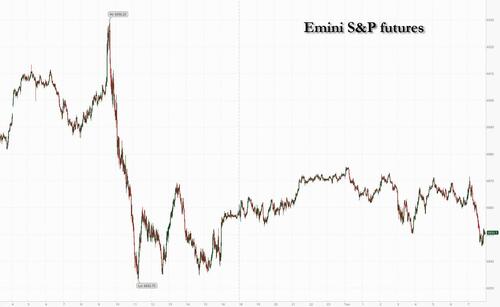

Jittery Futures Erase Gains Amid AI Doomsday Fears

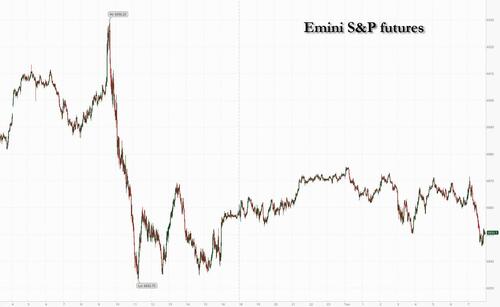

A short rebound in stocks fizzled after Monday's drop, as worries about the disruptive impact of artificial intelligence continued to unsettle markets which digested yesterday’s AI scare, and await today’s Claude / Anthropic presentation, while preparing for tonight’s State of the Union address (“SOTU”). Some have suggested that Trump may attack power generation risks during SOTU as he deals with affordability.As of 8:00am ET, S&P 500 futures traded unchanged, erasing an earlier 0.3% gain. The benchmark fell 1% in the previous session following a sharp drop in dealer gamma and a report that rehashes well-known fears about AI. Nasdaq 100 contracts climbed 0.1%, as AMD soared 11% on a $100 billion deal with Meta for data-center gear and a minority investment in the chipmaker. Other Mag7 are all mostly higher while an ETF tracking software firms was flat. IBM remained little changed following a 13% tumble. Nvidia Corp. fell 1.2% ahead of its results on Wednesday. Sentiment was also dented after Jamie Dimon said he’s starting to see parallels with the pre-financial crisis era, when a rush to make loans ended disastrously. At midnight, the US's 10% blanket tariff went into effect with Trump threatening to raise to 15%. Bond yields aso reversed an earlier gain and were unchanged while the USD was bid driven by a spike in the USDJPY after Takaichi pushed back on rate hikes. Commodities are seeing a muted move today with Energy up, Metals down, and Ags mixed; oil has closed in a tight range the last 3 sessions and remains in those levels. Today’s macro data focus is weekly ADP, home price indices, regional Fed activity indicators, and Consumer Confidence.

In premarket trading, Mag 7 stocks:are mostly higher (Alphabet +0.1%, Amazon +0.1%, Apple +0.4%, Nvidia -0.7%, Meta -0.4%, Microsoft +0.1%, Tesla -0.5%)

- Advanced Micro Devices (AMD) rises 11% as Meta Platforms Inc. will deploy 6 gigawatts’ worth of data center gear based on processors from the company.

- Blue Owl (OWL) slips 2% following a downgrade to hold at Deutsche Bank, which also reduces price targets and estimates across its wider alternative asset manager coverage.

- BWX Technologies (BWXT) rises 8% after the nuclear power company reported adjusted earnings per share and revenue for the fourth-quarter that beat the average analyst estimate.

- Hims & Hers Health (HIMS) falls 5% after the telehealth company’s guidance projected subdued profits for 1Q and the full year, citing a step-up in investments. While the full-year guidance implied a growth acceleration beyond 1Q, analysts were more cautious given its copycat weight-loss drugs face regulatory risks.

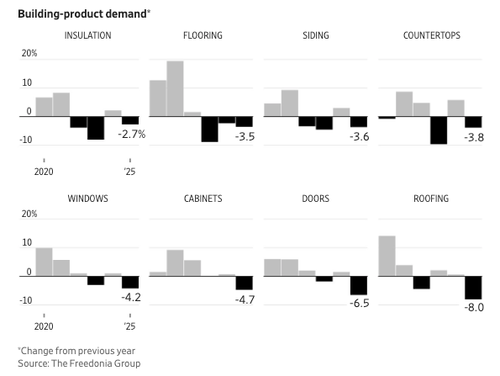

- Home Depot Inc. (HD) rises 2% after reporting a key sales metric that beat expectations in the latest quarter on steady demand, though the retailer cautioned that macroeconomic challenges remain.

- Keysight Technologies (KEYS) rises 15% after the measurement instruments company guided for above-20% growth for revenue and earnings in FY26, beating estimates. Booming AI workloads, along with faster growth in other business areas including wireless and defense, are all boosting growth, according to analysts.

- Kratos (KTOS) falls 3% after the defense contractor forecast revenue for the first quarter that missed the average analyst estimate.

- MediaAlpha (MAX) rises 11% after the insurance technology platform reported its fourth-quarter results and gave an outlook. Analysts downplayed the risk of AI-related disruption.

- Palvella Therapeutics (PVLA) rises 29% after the drug developer said a late-stage trial of its experimental therapy for lymphatic malformations met its main goal.

- Paymentus Holdings (PAY) falls 9% after the cloud-based bill payment company’s revenue guidance for 2026 came in below the average analyst estimate.

- Planet Fitness (PLNT) falls 5% after the operator of fitness clubs gave an outlook for 2026 adjusted Ebitda growth that implies the profit measure will fall short of Wall Street expectations.

- Super Group (SGHC) rises 16% as the gaming company’s full-year revenue forecast exceeded Wall Street’s estimates.

- Vir Biotechnology (VIR) jumps 57% after the drug developer gave updated data from an early-stage trial for its investigative therapy for prostate cancer and said it is collaborating with Astellas Pharma on the same asset.

- Whirlpool (WHR) falls 8% after the maker of kitchen appliances announced concurrent separate underwritten public offerings of shares of common stock and depositary shares.

- Ziff Davis (ZD) falls 10% after the digital media and Internet company reported fourth-quarter results that missed expectations. It also deferred its 2026 outlook as it evaluates options.

In corporate news, Anthropic is said to be offering some current and former employees the ability to sell shares at a valuation of about $350 billion. Meta and EssilorLuxottica are said to be at odds on pricing for smart glasses as demand surges. Jane Street is being sued for alleged insider trading by the administrator winding up the affairs of Terraform Labs.

After yesterday's market fragility which was sparked by last week's plunge in dealer gamma...

... and reinforced by a hypothetical report which echoed what we first said in 2024, nervousness abounds, and the market will be tested again when Anthropic holds its livestream at 9:30 a.m when even more volatility is likely. Adding to nerves, Jamie Dimon said he’s starting to see parallels with the pre-financial crisis era, when a rush to make loans ended disastrously.

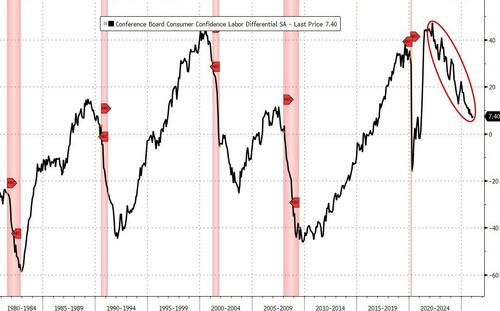

The so-called AI scare trade has become a dominant theme for stocks, with selling spreading beyond software to hit insurance brokers, private credit and even real estate services. The flight is one of several shifts beneath the surface of a US market that is little changed in 2026 after years of tech-led gains. Traders are also contending with a range of other risks, from trade uncertainty to brewing tensions between the US and Iran. Focus on Tuesday will turn to President Donald Trump’s State of the Union address and consumer data that, in the previous reading, plunged to the lowest level since 2014. Anthropic meanwhile, will give a demo of its AI enterprise agents.

“We are reducing our risk levels by a notch,” wrote Mohit Kumar, chief economist and strategist for Jefferies International. “Ongoing concerns over AI disruption and the possible exposure to private credit and private equity have made investor sentiment fragile. If we do get an escalation in geopolitical risks, markets may face some wobbles.”

For Emmanuel Cau, head of European equity strategy at Barclays Plc, fears about labor-market disruption need to be counterbalanced by the job creation that typically accompanies technological progress. As for software stocks, which have now been mispriced, “it’s very hard to go prove the market wrong on that,” Cau told Bloomberg TV. “What we are trying to do from an equity allocation standpoint is to be exposed to some of these old-economy, more tangible parts of the market.”

The quest for shelter from AI disruption has moved Goldman Sachs Group Inc. to push a new basket of capital-heavy companies, including utilities, miners, some industrial firms and even luxury-good makers. The selection has outperformed a basket of capital-light businesses by 35% since the start of 2025.

“Markets are rewarding capacity, networks, infrastructure and engineering complexity—assets that are costly to replicate and less exposed to technological obsolescence,” the Goldman team, including Guillaume Jaisson, said in a note.

In geopolitics, Trump said an Iran strike would be “easily won” but he would prefer a diplomatic deal.

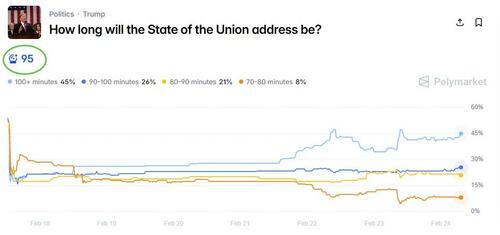

After Trump’s new 10% global tariff went into effect on Tuesday and a timeline for a proposed higher rate of 15% is still in question, investors will listen for any further comments on trade in his State of the Union speech. “It’s going to be a long speech,” Trump said. The US is also said to be readying a spate of additional national security investigations that would enable Trump to impose new duties. An EU assessment found that Trump’s new policy will increase levies on some exports, including cheese and some agricultural products, above the level permitted in their trade pact.

“The focus for investors will be on three issues: tariffs, Iran and the Fed,” said Joachim Klement, head of strategy at Panmure Liberum. “Any hint that a military strike against Iran is imminent should trigger another rally in oil and gold prices. If Trump uses his platform to bully the Supreme Court or the Fed, Treasury markets will not take that lightly.”

Home Depot, Keurig Dr Pepper and Fidelity National are among companies scheduled to report results before the market open. Home Depot’s commentary on the housing market will be a key focus and whether consumers remain on the sidelines for big projects due to high interest and mortgage rates. Earnings from HP and Workday follow later.

European equities edged lower on Tuesday with banking and insurance stocks leading declines, while automobiles and utilities were the biggest outperformers. The Stoxx 600 falls 0.2% to 626.46 with 242 members down, 351 up, and seven little changed. Here are the biggest movers Tuesday:

- Convatec rises as much as 11%, most since November 2024, following full-year results that showed stronger-than-expected second-half revenue performance and raised medium-term growth guidance

- Edenred shares gain as much as 9.3% after the payment solutions firm delivered better earnings and cashflow than anticipated against a backdrop of low expectations, according to Barclays

- Endesa shares jumped 6.2% to the highest level since June 2008 after the Spanish utility firm reported net income for the full year that beat the average analyst estimate and gave a new guidance that Jefferies says is ahead of consensus

- Sika shares gain as much as 3.1% after its board of directors proposes to the Annual General Meeting on March 24 that the gross dividend be increased by 2.8% to CHF3.70 from CHF3.60 previous year, according to a statement

- Banks are the worst performing sector in Europe on Tuesday, tracking declines for US peers, as fears about AI disruption and private credit lending continue to rattle the market

- Novo Nordisk shares fell as much as 4.4% on Tuesday to the lowest intraday level since June 2021, after analysts cut recommendations and price targets for the Danish drugmaker

- Rio Tinto shares drop as much as 1.5% in London after Barclays downgrades to equal-weight from overweight. The analyst says the move reflects near-term headwinds, including iron ore seasonality

- Galenica falls as much as 8.2%, most since July 2022, after UBS downgraded the stock to sell from neutral, expecting liberalization of OTC drug shipments to pose downside risk to sales growth and margin expansion

- Wienerberger falls as much as 6.6%, the most in 10 months, after Morgan Stanley said the full-year outlook of the brick manufacturer came in below estimates ahead of its capital markets day

- MTU Aero shares fall as much as 6.4%, the most since April, after the German engine manufacturer’s cash flow missed expectations

Asian stocks showed resilience after US peers witnessed another selloff on AI disruption fears, as investors snapped up shares of the region’s tech hardware companies — particularly semiconductor makers.The MSCI Asia Pacific Index was up 0.1%, reversing an early decline that followed a 1% slide in the S&P 500 Index on Monday. Chipmaking giants TSMC, Samsung Electronics and SK Hynix were the biggest boosts to the Asian benchmark. They also helped key local gauges in Taiwan and South Korea rally more than 2%. The so-called “AI scare trade” was back in focus after a report by Citrini Research outlined the potential risks to various segments of the global economy, and subsequent warnings from Anthropic and Nassim Taleb soured sentiment. Like in some recent episodes of AI-led selloffs, Asia was able to perform better as the region’s tech sector is dominated by tech hardware firms, notably memory and logic chip makers, which are seen benefiting from sustained demand tied to AI infrastructure build-outs. “Clearly semiconductors are huge winners,” Alap Shah, co-author of the Citrini report, said on Bloomberg Television. “Things that are upstream to semiconductors are huge winners — so everything required to construct a data center.”

In FX, the yen tumbled following local media reports that Prime Minister Sanae Takaichi voiced apprehension about more rate hikes in a meeting with Bank of Japan Governor Kazuo Ueda. Currency markets otherwise calm, with Bloomberg Dollar Spot Index up 0.1%.

In rates, treasuries are unchanged the curve flatter as 5s30s spread partly unwinds Monday’s sharp steepening move.US 10-year yield near 4.035% is less than 1bp higher on the day with bunds and gilts in the sector outperforming by 1bp and 2bp respectively; 2s10s and 5s30s curve spreads are 0.5bp and 1.5bp tighter on the day. European bonds marginally outperform following UK’s £3 billion auction of 2033 bonds and French manufacturing confidence gauge. US session includes packed economic data and Fed speaker slates as well as a 2-year note auction at 1pm New York time.

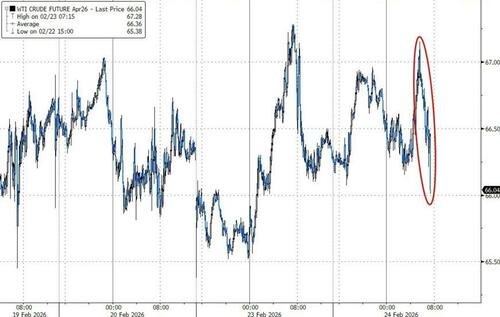

In commodities, gold prices are down and below $5,200/oz, but copper rallying on the return of traders in China after the Lunar New Year break. Oil little changed, with Brent sitting around $71.50/barrel. Bitcoin weaker and getting close to $63,000.

The US economic calendar slate includes weekly ADP employment change (8:15am), February Philadelphia Fed non-manufacturing activity (8:30am), December FHFA house price index, 4Q house price purchase index and December S&P Cotality home prices (9am), February Richmond Fed manufacturing index and consumer confidence and December wholesale trade inventories (10am) and February Dallas Fed services activity (10:30am). Fed speaker slate includes Goolsbee (8am, 9:30am), Collins and Bostic (9am), Waller (9:15am), Cook (9:30am) and Barkin (3:15pm)

Market Snapshot

- S&P 500 mini unch

- Nasdaq 100 mini +0.1%,

- Russell 2000 mini +0.1%

- Stoxx Europe 600 little changed,

- DAX -0.1%,

- CAC 40 little changed

- 10-year Treasury yield little changed at 4.03%

- VIX -0.1 points at 20.93

- Bloomberg Dollar Index little changed at 1190.43,

- euro unchanged at $1.1785

- WTI crude +0.3% at $66.49/barrel

Top Overnight News

- Trump dismissed reports the Pentagon fears a difficult Iran campaign, saying the Joint Chiefs chairman believes military action would be “easily won.” The president insisted he prefers a diplomatic deal. BBG

- The Trump administration is considering new national security tariffs on a half-dozen industries in the wake of a Supreme Court decision last week that invalidated many of the president’s second-term levies. The new tariffs being considered could cover industries such as large-scale batteries, cast iron and iron fittings, plastic piping, industrial chemicals and power grid and telecom equipment. WSJ

- US President Trump will use the State of the Union address to sell the public on the economy and unveil new measures to lower cost ahead of the mid-terms: WSJ.

- China has restricted exports of rare earth magnets and other critical materials to dozens of leading Japanese companies in an escalation of a dispute with Tokyo. FT

- Chinese AI startup DeepSeek's latest AI model, set to be released as soon as next week, was trained on Nvidia's most advanced AI chip, the Blackwell, a senior Trump administration official said on Monday, in what could represent a violation of U.S. export controls. RTRS

- Japanese PM Takaichi expressed reservations about additional interest rate hikes during her meeting with Bank of Japan Governor Kazuo Ueda last week. FT

- The UK announced new sanctions on Russia — its biggest since the early months of the Ukraine invasion — targeting energy firms and suppliers of military equipment. BBG

- Zelenskyy said Russia and Ukraine were at the “beginning of the end” of Europe’s biggest conflict since the second world war, but urged Washington to see through Putin’s negotiating “games.” FT

- Trump is implementing a new global tariff at 10% rather than the 15% rate announced over the weekend after his defeat at the Supreme Court. His move to apply a 10% for the time being rather than the 15% tariffs follows a backlash to the higher rate from several US trading partners such as the EU and UK. FT

- Alap Shah, co-author of a Citrini report that triggered yesterday’s selloff, suggested governments consider taxing AI to cushion the impact of job losses. BBG

Trade/Tariffs

- US President Trump's 10% global tariff rate takes effect.

- China's Commerce Ministry called on US to abandon unilateral tariff; will adjust countermeasures and monitor US actions. Willing to hold 6th round of trade talks with the US.

- China MOFCOM adds 20 Japanese companies including Mitsubishi Heavy Industries to its export control list for military activities which bans exports of dual-use items, while it will add another 20 groups to a watch list.

- EU warns the US that President Trump's new tariff policy breaks the trade agreement.

- Japan's finance minister Katayama said will closely examine details of US Supreme Court decision on tariffs, adds will steadily carry out US-bound investment package and Japan must be aware that US tariffs on cars remain in effect.

- Japan's Trade Minister Akazawa held a phone conversation with US Commerce Secretary Lutnick on Monday, and both sides affirmed investment plans in the call.

- US President Trump's administration is likely to face tough legal obstacles if it opposes refunds for the tariffs struck down by the US Supreme Court, according to Bloomberg.

- US President Trump reportedly considers new national security tariffs after SCOTUS ruling, in which new levies on a half-dozen industries would be issued separately from the new global 15% flat-rate tariff, according to WSJ.

- Taiwan Vice Premier said preferential terms reached with the US under tariff and trade deal would not change, and that they will have proactive talks with the US to ensure their interests protected under deals already reached with Washington.

- China announces that the hot-rolled steel coil issue with South Korea has been resolved.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a mostly positive bias as key participants returned to the market and with the region attempting to shrug off the weak lead from Wall St, where sentiment was weighed on by trade uncertainty and AI disruption concerns. ASX 200 struggled for direction as outperformance in the mining, energy and resources sectors was offset by losses in tech, real estate and financials, while participants continued to digest a slew of earnings. Nikkei 225rallied to back above the 57,000 level on return from the long weekend, but is off today's best levels amid losses in tech stocks and after China's MOFCOM added 20 Japanese companies to its export control list, which bans Chinese exports of dual-use items. Hang Seng and Shanghai Comp were mixed with the mainland boosted on return from a 10-day closure and got the first opportunity to react to the recent US tariff developments, which are seen to benefit China the most, while the Hong Kong benchmark underperformed in a reversal of the prior day's rally amid notable losses in tech and pharmaceuticals.

Top Asian News

- Several senior US officials said the “rate checks” carried out when the yen weakened in January were initiated by US Treasury Secretary Bessent rather than at Japan’s request, according to Nikkei. US officials indicated that coordinated intervention to buy yen and sell dollars would have been considered if requested by Japan.

- Japanese Finance Minister Katayama said Japan is keeping close dialogue with the US on Forex, according to the Wall Street Journal.

European bourses (STOXX 600 -0.1%) are broadly weaker, with the IBEX 35 (-0.7%) the clear laggard as Banks weigh on the index. On the other hand, the SMI (+0.6%) is printing modest gains. European sectors, on the contrary, show a positive bias, with Utilities (+1.7%) and Materials (+0.7%) outperforming, helped by the likes of Sika (+1.9%), Givaudan (+2.2%) and Croda (+2.7%). Sika shares are rising this morning as the Board proposes to lift the gross dividend per share by 2.8%. Croda announced its FY25 earnings, with its revenue and EBITDA metrics rising Y/Y and FY26 guidance in line with forecasts. This is helping the broader Chemicals sector rise. On the other hand, Banks (-1.1%) have been hit this morning following weak Q4 earnings by Standard Chartered (-1.9%) and the effects of Anthropic's Claude on jobs as the code can now automate COBOL modernisation efforts.

Top European News

- French Business Climate Indicator (Feb) 97 (Prev. 99).

- French Business Confidence (Feb) 102 vs. Exp. 104 (Prev. 105).

FX

- DXY is mildly firmer this morning, and trades at the mid-point of a 97.69-97.95 range; the high of the day is a pip above its 50 DMA. The theme in the US remains firmly on a) the trade situation and b) the growing woes surrounding AI – spurring increased uncertainty about the US economy, and hence the USD. Nonetheless, the index is firmer this morning, largely thanks to considerable pressure in the JPY (more on that below). For the time being, focus will be on some Tier 2 US data including Consumer Confidence, Richmond Fed Index and ADP Employment Change Weekly – Fed speak today includes, Waller (voter, dove), Cook (voter, neutral), Barkin (2027 voter, neutral), Goolsbee (2027 Voter, Dovish), Bostic (retiring, hawk), Collins (2028 voter, neutral). Thereafter, US President Trump is set to deliver his State of the Union address, where he is expected to speak on the economy, new policies and potentially trade (02:00 GMT Wednesday / 21:00 EST Tuesday).

- JPY is shunned today, currently off by around 0.8%, with USD/JPY trading at the upper end of a 154.52 to 156.27 range – the pair currently pivots its 50 DMA at 155.97. Overnight, pressure stemmed from reports that US Treasury Secretary Bessent initiated rate checks, rather than those occurring at the request of the Japanese. The weakness in JPY was then exacerbated by source reports that PM Takaichi relayed to BoJ Governor Ueda her reservations about further rate hikes; she was reportedly "stricter than at the previous meeting", in November. As a reminder, the PM and Ueda met last week, where traders assigned some risk that the PM would ask Ueda to cull future rate hikes; despite this, Ueda suggested that the PM "didn't have any particular requests".

- Finally, G10 peers are broadly incrementally firmer/flat against the USD. Antipodeans benefit from the constructive sentiment seen in the APAC session, and as base metals remain bid. EUR/USD remains steady within a narrow 1.1767-1.1796 range; the low for today is a handful of pips below its 50 DMA at 1.1772.

Central Banks

- Japanese PM Takaichi reportedly relayed to BoJ Governor Ueda her reservations about further rate hikes, according to Mainichi citing sources.

- Chinese Loan Prime Rate 1Y (Feb) 3.00% vs. Exp. 3.00% (Prev. 3.00%).

- Chinese Loan Prime Rate 5Y (Feb) 3.50% vs. Exp. 3.50% (Prev. 3.50%).

- NBP's Glapinski said monetary policy needs to be cautious.

Fixed Income

- JGBs were boosted this morning by a Mainichi report that PM Takaichi relayed reservations to BoJ Governor Ueda about further tightening, with Takaichi's stance described by the sources as "stricter" vs their last meeting. This lifted JGBs by around 30 ticks to a 133.10 peak.

- USTs flat, in a narrow 113-07+ to 113-13 band. Awaiting further updates on the AI disruption narrative, US-Iran and numerous Fed officials. From those, the most pertinent include Cook (voter), who, in early February, said she supported waiting after December to cut again and described tariff price-rises as temporary. Waller (voter) has already spoken post-SCOTUS, saying the impact would likely be limited. The docket also includes 2027 voters, Barkin & Goolsbee, and 2028 voter Collins.

- Bunds firmer by around 10 ticks, holding just off a 129.73 peak which is just above Monday's 129.71 best. ECB's Lagarde theoretically headlines the docket, though she has spoken extensively recently. As such, the benchmark will likely conform to leads from USTs and the global risk tone if there is an AI/tariff/US-Iran update.

- Gilts also firmer by around 10 ticks and at a 92.97 peak, taking out the high from January and notching a fresh YTD and contract best. For the UK, the main event is the Treasury Select Committee. Pertinently, Governor Bailey headlines the outing alongside known dove Taylor and the hawkish Greene & Pill. The Governor and the two hawkish members are the focus, for any hint that the recent string of data and/or tariff updates have pushed them towards easing in the near-term. Commentary that will, by extension, inform on the ongoing debate between March and April, with 21bps of easing implied for March and 27bps in April.

- Italy sold EUR 2.5bln vs exp. EUR 2-2.5bln 2.20% 2028 BTP Short Term & EUR 2.0bln vs exp. EUR 1.5-2bln 1.10% 2031, 1.80% 2036 BTPei.

- UK sold GBP 3bln 4.125% 2033 Gilt: b/c 3.37x (prev. 3.18x), average yield 4.075% (prev. 4.296%), tail 0.2bps (prev. 0.2bps).

- Japan's Finance Ministry is said to mull tweaking liquidity-enhancement auctions and reduce super-long supply further to steady yields.

- Australia sold AUD 1.2bln 4.25% March 2036 bonds, b/c 2.71, avg. yield 4.6969%.

Commodities

- Crude benchmarks remain mostly firmer amid the ongoing geopolitical update between the US and Iran over the last few week which has seen a gradual escalation over recent weeks. WTI and Brent trade at the upper end of their respective USD 66.16-66.95/bbl and USD 70.87-71.78/bbl, ranges.

- Spot gold has eroded some of Monday's upside, hovering just below the USD 5,200/oz mark, with recent USD strength weighing. XAU and XAG trade in the lower ranges of USD 5135.135-5250.005/oz and 84.785-88.756/oz, respectively.

- Copper prices have picked up, coinciding with its largest buyer, China, returning to the market after the holiday period. As such, the red metal trades above the USD 13k/t mark. That aside, there hasn’t been much newsflow regarding the red metal. Currently, 3M LME copper trades in the upper range of USD 13.005-13.061k/t.

- UBS said spot gold may reach USD 6,200/oz in the near future as the factors fuelling its recent rally remain intact.

- The UK imposes new sanction on Russia's Transneft oil operation.

- Shanghai Gold Exchange said it is to cut margin ratio and price limits for some gold and silver contracts from the closing settlement on February 24th.

- Chevron (CVX) has entered exclusive talks to take over Lukoil's stake in Iraq's West Kerner II oil field (480k bpd), as US sanctions pressure the Russian firm to divest.

- New Zealand is to lower the price cap on Russian crude oil.

Geopolitics: Ukraine

- Russia's Kremlin highlights that the special operation goals have not yet been achieved, cannot provide a date for the next round of Ukraine talks.

- Russian Foreign Ministry Spokesperson said Russia will seek to find a solution to the problem of NATO's expansion to its borders by military or political means. Added that without solving the problem of NATO's expansion to Russia's borders, it is impossible to solve the situation in Ukraine.

- Ukrainian President Zelensky said we will do everything necessary to ensure a strong and lasting peace.

Geopolitics: Middle East

- Iran reportedly nears a deal to purchase anti-ship missiles from China, according to sources.

- Israeli official tells Yedioth Ahronoth that a US attack on Iran is imminent.

- US President Trump said top general Dan Caine predicts an easy victory over Iran, which is at a contrast to recent comments by Caine, according to NYT.

- US President Trump is growing frustrated by the limited military options against Iran, with advisers warning that strikes may not be decisive and risk escalating the conflict, according to CBS News.

- US President Trump on Truth said "If we don't make a deal, it will be a very bad day for Iran".

Geopolitics: Other

- China said it is open to nuclear talks in Geneva and urges the US to resume strategic stability dialogue with Russia.

- South Korea and US are reportedly at odds over war games’ scale with the US pushing back on South Korea's request for smaller drills, forcing the postponement of a major joint military briefing, according to SCMP.

US Event Calendar

- 9:00 am: United States Dec FHFA House Price Index MoM, est. 0.3%, prior 0.6%

- 10:00 am: United States Feb Richmond Fed Manufact. Index, est. -4.5, prior -6

- 10:00 am: United States Feb Conf. Board Consumer Confidence, est. 87.1, prior 84.5

- 10:00 am: United States Dec F Wholesale Inventories MoM, est. 0.2%, prior 0.2%

Central Bank Speakers

- 8:00 am: United States Fed’s Goolsbee Speaks on Economy

- 9:00 am: United States Fed’s Collins Gives Opening Remarks

- 9:00 am: United States Fed’s Bostic in Moderated Discussion

- 9:15 am: United States Fed’s Waller Gives Keynote Address

- 9:30 am: United States Fed’s Cook Speaks on AI

- 9:30 am: United States Fed’s Goolsbee on Bloomberg TV

- 3:15 pm: United States Fed’s Barkin & Collins on Panel

Main Rating Changes:

DB's Jim Reid concludes the overnight wrap

Luke and Galina in my team have published a timely piece (link here) examining a group of global stocks that have sold off sharply in recent weeks amid rising fears of AI-driven disruption. They look at how valuations have adjusted, analysing PE and PEG ratios, and assess how far current prices now sit from our equity analysts’ targets. The most compelling section, for me, comes at the end, where those analysts explain why they believe these companies are far better positioned to withstand AI disruption than the market currently assumes.

It's good timing for the note as just as US equities had fought their way back to flat yesterday, shaking off weekend tariff uncertainty and an early sell off in futures, the AI disruption narrative resurfaced once again. In the final hour or two of European trading, the S&P 500 rolled over sharply, eventually closing -1.04% down on the day, while 10 year US Treasury yields fell by -5.2bps. The declines included IBM posting its worst day since the 2000 tech bubble burst, while the software component of the S&P 500 (-3.82%) dropped to its lowest level since the Liberation Day turmoil last year, with the VIX peaking at 22.0, not far from its YTD high of 23.1. Elsewhere, Brent crude briefly touched its highest level since July on renewed fears of a potential US strike on Iran, before fading to close marginally lower on the day.

Much of the AI-related sell off was attributed to a Citrini Research memo from the future, "The 2028 Global Intelligence Crisis", outlining a hypothetical scenario in which AI adoption drives the US unemployment rate into double digits by mid 2028. The note had been forwarded to me around ten times late last week and was ubiquitous across my social media feeds, so it was something of a surprise to see it cited as the catalyst for the sudden mid afternoon sell off in London. As with Matt Schumer’s viral “Something big is happening” piece a few weeks ago — which was also linked to significant equity losses — the argument leans heavily on narrative and emotion rather than hard evidence. That doesn’t mean it will ultimately be wrong, but in both cases the vibes to substance ratio is undeniably high. I’ll stop there, before anyone accuses my own research of the same thing.

The net result was a renewed sell-off in stocks perceived to be at risk from AI disruption. Software stocks were again affected, with that component of the S&P 500 falling -3.82% (and now -31.8% down from its October peak), including sharp declines for Workday (-6.24%), Adobe (-4.61%) and Oracle (-4.57%). But various other companies were also hit, with IBM (-13.15%) the worst performer in the S&P 500 after Anthropic said Claude Code could modernise COBOL, a legacy programming language run mostly on IBM machines. Meanwhile, several of the names namechecked in the Citrini report, including Capital One (-8.84%), American Express (-7.20%) and Doordash (-6.60%) saw outsized declines, while KKR (-8.89%) led the losses among PE firms as private credit fears again rose. More broadly, the Mag-7 (-1.51%) saw a modest underperformance, and the equal-weighted S&P 500 (-1.12%) also saw a sizeable decline as the broad array of losers outweighed the gains for defensive sectors like consumer staples (+1.46%), healthcare (+1.15%) and utilities (+0.72%). And credit also came under pressure, with US IG spreads +2bps wider and HY +10bps wider.

When it comes to tariffs, the weekend news injected another dose of uncertainty for markets, with big questions surrounding the trade deals the US agreed last year. Notably, the EU have paused the process of ratifying the US trade deal, and the chair of the EU Parliament’s trade committee, Bernd Lange, said yesterday that “We want to have clarity from the US that they are respecting the deal because that’s a crucial element.” The EU concern is that a stacking nature of the 15% Section 122 tariffs would bring total tariff rates for some products above the 15% maximum agreed by the EU and the US. The UK are another with an unclear situation, as they reached a 10% tariff deal last year, but could now face the 15% global tariff rate that would be higher than the deal already agreed to. Indeed, the UK government haven’t ruled out retaliation, with a spokesperson for PM Starmer saying that “Nothing is off the table at this stage”.

Back on the US side, it was also unclear how Trump would respond to these developments. But he did post yesterday that countries which “play games” would “be met with a much higher Tariff, and worse, than that which they just recently agreed to.”

In the meantime, the new Section 122 tariffs have just come into force at midnight Eastern Time. At the moment the rate is 10% with White House officials stating that they are working on a formal order to raise to 15%. Perhaps the stacking concern is delaying things for now. Late yesterday, we also saw the WSJ and Bloomberg report that the administration was preparing new Section 232 national security

investigations into several industries including batteries, telecom equipment and industrial chemicals. Remember that Trump’s delivering the State of the Union address tonight, so it’s possible we might get a better sense of the next steps on tariffs. As I mentioned in my CoTD yesterday (link here), net-net we still think the effective tariff rate will fall this year and that the world post-SCOTUS will see lower tariffs than the pre-SCOTUS world. For more on the latest state of the world of US tariffs, see Matt Luzzetti's latest trade chart book here.

Elsewhere, geopolitics remained in the spotlight, as speculation continued to mount about a potential US strike on Iran. There wasn’t much fresh news yesterday, although it was reported by multiple outlets yesterday, including Bloomberg, that the State Department had ordered the evacuation of some people from their Beirut embassy. The US-Iran talks are reportedly still ongoing, and Bloomberg also said that the US’ Steve Witkoff and Jared Kushner would be in Geneva this week for more discussions on Thursday. Escalation concerns saw Brent crude rise to as high as $72.50/bbl intra-day, its highest since July, but it was down by -0.38% to $71.49/bbl by the close. It's back up +0.6% in Asia.

The risk-off mood boosted US Treasuries, as investors made a push into safe havens. Indeed, the 10yr Treasury yield (-5.2bps) fell back to 4.03%, its lowest level since November, and the 2yr yield (-3.9bps) fell to 3.44%. The front-end rally came despite somewhat less dovish comments from Fed Governor Waller, who said he may favour a pause in rates at the March meeting if the February labour market data showed continued improvement. However, he did add that “if the good labor market news of January is revised away or evaporates in February” then he’d again back a 25bp cut, suggesting that Waller remains among the more dovish FOMC members.

Earlier in Europe, yields also moved lower across the continent, with those on 10yr UK gilts (-3.9bps) and Italian BTPs (-2.4bps) both reaching their lowest level since December 2024, whilst 10yr bund yields (-2.7bps) were down to their lowest since November, at 2.71%. The equity moves were more mixed in Europe, with the STOXX 600 down by a more moderate -0.45%, as the more tariff-sensitive DAX (-1.06%) underperformed but Spain’s IBEX 35 (+0.56%) recorded a record high. Separately, this week is also set to see German Chancellor Merz travel to China, and our economists have a note of what to expect (link here).

Looking at other asset classes, the backdrop around the tariffs, AI and Iran boosted traditional safe havens. Gold rose +2.35% to $5,227/oz, the highest since its record levels in late January, while the Japanese yen (+0.26% versus the US dollar) and the Swiss franc (+0.12%) were the best performing G10 currencies. By contrast, Bitcoin (-4.47%) had its worst day in over two weeks.

Asian equity markets are mostly shrugging off the US weakness with the KOSPI (+1.99%) again at the forefront of gains in the region, surging to a record high, supported by advances in exporters and local chipmakers. Chinese markets are returning from their week plus break with the CSI (+1.11%) and the Shanghai Composite (+0.94%) in a positive mood along with the Nikkei (+0.99%) after yesterday's holiday. Conversely, the Hang Seng (-2.12%) is the weakest performer, suffering losses in technology and pharmaceutical shares. S&P 500 (+0.22%) and NASDAQ 100 (+0.34%) futures are bouncing back a little with European futures seeing a similar move. US Treasuries are around +1-2bps higher across the curve after the sizeable rally yesterday.

Looking at the day ahead, President Trump will deliver the State of the Union address tonight. Otherwise, US data releases include the Conference Board’s consumer confidence for February, the FHFA house price index for December, and the Richmond Fed’s manufacturing index for February. Finally, central bank speakers include the Fed’s Goolsbee, Collins, Bostic, Waller, Cook and Barkin, the ECB’s Kocher, and BoE Governor Bailey, and the BoE’s Greene and Taylor.

Tyler Durden

Tue, 02/24/2026 - 08:45

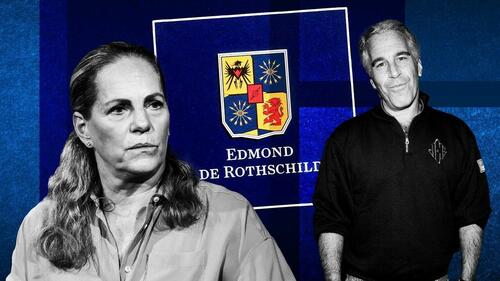

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Source: AFP

Source: AFP via ABC News

via ABC News via AFP

via AFP

Zelensky awarding a medal to a Ukrainian soldier on February 23, 2026 Source: Office of the President of Ukraine.

Zelensky awarding a medal to a Ukrainian soldier on February 23, 2026 Source: Office of the President of Ukraine. Thorbjorn Jagland, a former prime minister of Norway, in Oslo February 12th.

Thorbjorn Jagland, a former prime minister of Norway, in Oslo February 12th.

French M51 submarine-launched ballistic missile. Photo credits: Marine Nationale

French M51 submarine-launched ballistic missile. Photo credits: Marine Nationale

Anadolu/Getty Images

Anadolu/Getty Images

Recent comments