US Energy Chief Says Oil 'Fear Premium' Over Iran Is Temporary, Says Prices To Fall In 'Weeks, Not Months'

Energy Secretary Chris Wright made the rounds on network TV Sunday to reassure viewers that the sharp rise in oil and gas prices due to the Iran war - which Trump has no problem sticking US consumers with for a while - would prove short-lived, and has downplayed the spike as a transient "fear premium" vs. a fundamental supply issue.

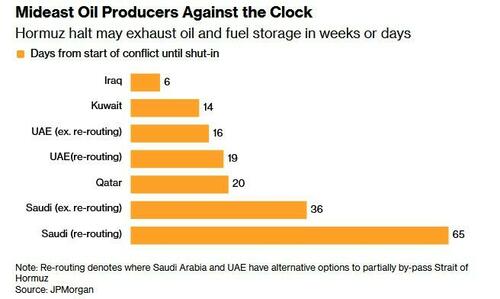

In conversations to CBS, CNN, and Fox News, wright emphasized that global energy markets remain well-supplied despite disruptions to tanker traffic through the Strait of Hormuz - the narrow waterway that carries roughly one-fifth of the world’s seaborne crude.

"This is a disruption on the way to a much better place to end a 47-year war against America," he told Fox.

"The world is not short of oil today or natural gas," Wright told CBS' "Face the Nation," adding "You’re seeing a little bit of fear premium in the marketplace."

Energy Secretary Chris Wright says that the war with Iran, which is pushing up oil and gasoline prices, will last for “weeks, not months,” even in a worst case.

— Face The Nation (@FaceTheNation) March 8, 2026

On gas prices, he says that “they shouldn't go much higher than they are here because the world is very well supplied… pic.twitter.com/HYOZqeHon3

Wright also projected that gasoline prices could fall below $3 per gallon "relatively soon," and that any worst-case disruption would only last "weeks, not months" - a line he gave to both CBS and CNN.

The comments come as Brent crude futures have risen sharply in recent days, pushing U.S. pump prices higher and raising concerns about inflationary pressures ahead of midterm elections. The administration has framed the military operation - dubbed by some officials as aimed at neutralizing long-term threats from Tehran - as ultimately beneficial for global energy stability.

Wright also highlighted early signs of progress in restoring flows through the Strait of Hormuz. “A large tanker went through the Strait of Hormuz 24 hours ago,” he said, adding that U.S. and allied efforts are “massively attriting” Iran’s ability to launch missiles and drones.

He indicated that naval escorts could be provided for initial tankers to ensure safe passage, with normal commercial traffic expected to resume “relatively soon.”

Energy Secretary Chris Wright says the Strait of Hormuz will see normal traffic levels again “relatively soon,” but naval escorts might be necessary.

— Face The Nation (@FaceTheNation) March 8, 2026

“We're in engagement right now with people that want to get tankers moving out of the Gulf,” he says. “So, yes, there could be —… pic.twitter.com/nrf6PH43Vy

He repeated the "one large tanker has already gone through" talking point to Fox.

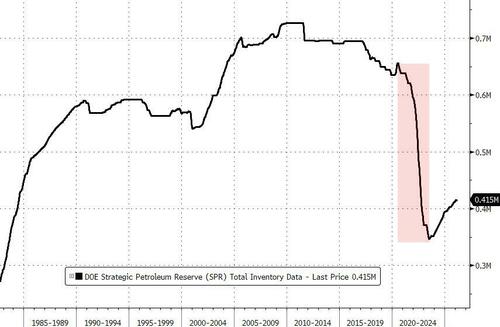

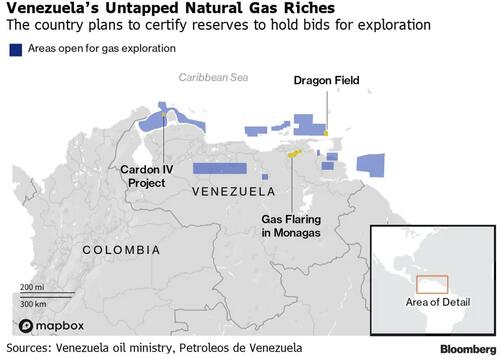

To address immediate supply pressures, Wright disclosed diplomatic efforts to reroute stranded cargoes. He said the U.S. had coordinated with India to divert Russian oil tankers originally bound for China, describing the move as pragmatic and temporary. “A lot of Russian oil hanging out on Asian waters,” he noted, adding that India - already increasing imports from the U.S. and Venezuela - had proven “a great partner.” Wright stressed no change in U.S. policy toward Russian oil sales, framing the rerouting as a way to quickly bring barrels to market and ease refining bottlenecks in Asia.

Wright also justified the Iran was as a necessary step to end Tehran's decades-long disruption of energy markets.

"Iran has terrorized America, the neighborhood, and energy markets for 47 years," he said with a straight face. "We believe this is a small price to pay to get to a world where energy prices are returned back to where they were."

Meanwhile, he confirmed that there's no actual plan for what post-conflict Iran will look like (shocker!).

"We don’t know what regime will be in place at the end of this conflict," he told CBS. "What we do know is that regime will not have a massive weapons arsenal…and will no longer be a massive threat to Americans and to the Middle East and the global oil supplies."

When asked if the U.S. will employ a strategy in Iran similar to Venezuela, working with members of a deposed regime, U.S. Energy Secretary Chris Wright says “we don’t know what regime will be in place at the end of this conflict.”

— Face The Nation (@FaceTheNation) March 8, 2026

“What we do know, that regime will not have a… pic.twitter.com/7mrne54PQ0

And there you have it, the talking points are officially OUT.

Tyler Durden Sun, 03/08/2026 - 15:05

File image: Tulsi Gabbard is the United States Director of National Intelligence

File image: Tulsi Gabbard is the United States Director of National Intelligence

AFP/Getty Images

AFP/Getty Images

Occupied northern Cyprus, Shutterstock/Middle East Forum

Occupied northern Cyprus, Shutterstock/Middle East Forum Boats are docked at the Aqualand Marina as emissions spew out of a stack at the Morgantown Generating Station on June 29, 2015, in Newburg, Md. The PJM Interconnection’s market monitor on March 4, 2026, urged federal regulators to reject an application from GenOn to sell the power plant to TeraWulf. Mark Wilson via Getty Images

Boats are docked at the Aqualand Marina as emissions spew out of a stack at the Morgantown Generating Station on June 29, 2015, in Newburg, Md. The PJM Interconnection’s market monitor on March 4, 2026, urged federal regulators to reject an application from GenOn to sell the power plant to TeraWulf. Mark Wilson via Getty Images

Recent comments