"I Did Nothing Illicit": Bill Gates Begins Apology Tour Over His Epstein Ties

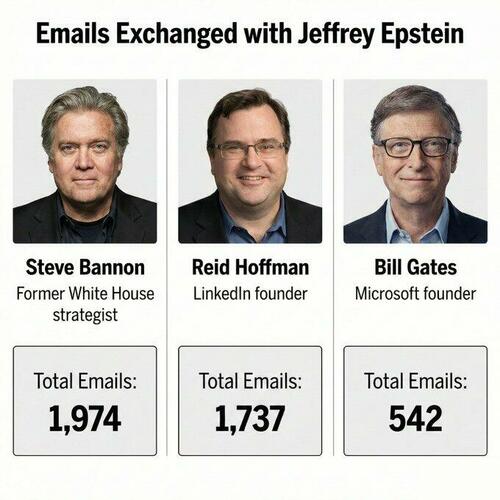

A week after Bill Gates abruptly pulled out as a keynote speaker at a high-profile global AI summit in India, the left-wing billionaire finally mustered enough nerve to "take responsibility for his actions" over his ties to late financier and sex offender Jeffrey Epstein during a town hall meeting with Gates Foundation employees.

The Wall Street Journal reports that Gates told employees at a town hall event for the foundation on Tuesday that he never spent time with Epstein's victims, and never visited Epstein's island.

He revealed that Epstein later learned about two affairs he had with Russian women, but said those relationships did not involve Epstein's victims. Gates said photos in the Epstein files show him with redacted women were taken by Epstein's assistants after meetings.

Did Gates fall into a Russian honeypot?

"I did nothing illicit. I saw nothing illicit," Gates emphasized, according to a recording reviewed by WSJ journalists.

Gates continued, "To be clear, I never spent any time with victims, the women around him."

"It was a huge mistake to spend time with Epstein" and bring Gates Foundation executives into meetings with the sex offender, Gates said, adding, "I apologize to other people who are drawn into this because of the mistake that I made."

Last week, the $86 billion philanthropic body's last-minute decision to yank Gates was a major embarrassment and came as the Epstein fallout worsened, with many high-profile people under fire.

Related:

-

"Law Must Take Its Course": King Charles Responds To Arrest Of Former Prince Andrew

-

Goldman Sacks Ruemmler As Epstein Scandal Claims Obama's Former Lawyer

"Knowing what I know now makes it, you know, a hundred times worse in terms of not only his crimes in the past, but now it's clear there was ongoing bad behavior," Gates said. He gave credit to his ex-wife, who "was always kind of skeptical about the Epstein thing."

Gates told staff he began meeting Epstein in 2011, despite the financier's 2008 guilty plea for soliciting a minor for prostitution. He said he was aware of the "18-month thing" that had restricted Epstein's travel, yet continued the relationship, even after his then-wife, Melinda French Gates, raised serious concerns in 2013.

He said the relationship continued through 2014 and that he flew on a private jet with Epstein and spent time with him in Germany, France, New York, and Washington. "I never stayed overnight," he said, or visited Epstein's island.

He said Epstein "talked about the kind of intimate relationship he had with a lot of billionaires, particularly Wall Street billionaires," and that he could help raise money for global health nonprofits.

"It definitely is the opposite of the values of the Foundation and the goals of the Foundation," he said. "And our work is very reputation-sensitive. I mean, people can choose to work with us or not work with us."

No matter what, the Gates Foundation has a dark cloud hanging over it because of Gates' involvement amid the deepening Epstein fallout.

Gates is worth billions, so why would he need Epstein to raise money for global health nonprofits? Something doesn't pass the sniff test in this damage-control town hall he held for his foundation's employees.

Tyler Durden Wed, 02/25/2026 - 08:05

European Commissioner Thierry Breton speaks during a news conference at the European Union office in San Francisco on June 22, 2023. Josh Edelson /AFP via Getty Images

European Commissioner Thierry Breton speaks during a news conference at the European Union office in San Francisco on June 22, 2023. Josh Edelson /AFP via Getty Images Source: Shutterstock

Source: Shutterstock

via Bookings Inst

via Bookings Inst

Chinese missile launchers are seen during a military parade marking the 80th anniversary of the end of World War II, in Tiananmen Square in Beijing on Sept. 3, 2025. Kevin Frayer/Getty Images

Chinese missile launchers are seen during a military parade marking the 80th anniversary of the end of World War II, in Tiananmen Square in Beijing on Sept. 3, 2025. Kevin Frayer/Getty Images A security guard stands beside a screen showing a video about China's atomic and hydrogen bomb research during an exhibition on the Chinese regime's rejuvenation at the Military Museum of the Chinese People's Revolution in Beijing on Oct. 17, 2007. China Photos/Getty Images

A security guard stands beside a screen showing a video about China's atomic and hydrogen bomb research during an exhibition on the Chinese regime's rejuvenation at the Military Museum of the Chinese People's Revolution in Beijing on Oct. 17, 2007. China Photos/Getty Images An undated aerial photo shows the Argonne National Laboratory in Illinois. Argonne National Laboratory/Getty Images

An undated aerial photo shows the Argonne National Laboratory in Illinois. Argonne National Laboratory/Getty Images via state media: CM-301/YJ-12

via state media: CM-301/YJ-12

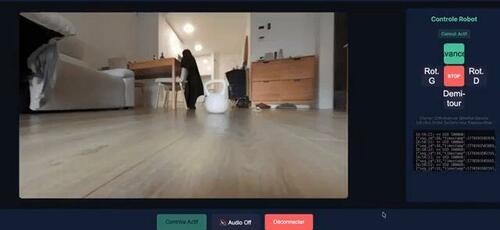

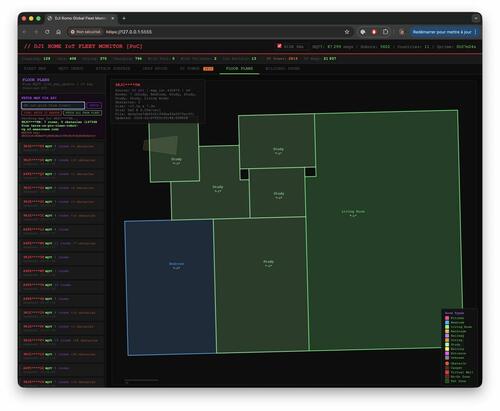

Azdoufal says he could remote-control robovacs and view live video over the internet.

Azdoufal says he could remote-control robovacs and view live video over the internet.

Rost9/Shutterstock

Rost9/Shutterstock

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

The DeepSeek app on an iPhone screen in San Anselmo, Calif., on Jan. 27, 2025. Justin Sullivan/Getty Images

Recent comments