Karnage: Korea Kospi Suffers Biggest Crash In History - Is It A Buying Opportunity?

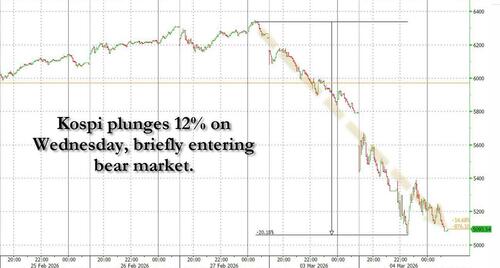

Yesterday we discussed the dramatic move in Korean stocks, which saw the Kospi tumble by 7.4%, its biggest drop since the August 2024 carry trade unwind, and which put a dramatic halt to the historic meltup in the country's stock market driven almost entirely by memory (Samsung and SK Hynix) and semiconductor stocks.

However, as we noted earlier this week when we pointed out the unprecedented pile up in the Korea ETF which was virtually identical to what happened in silver in January, just before the commodity crashed, the euphoric investor pile up in the main Korean index was screaming a "get me out of here" warning...

... and one which suggested that the pain for Korean stocks was only starting.

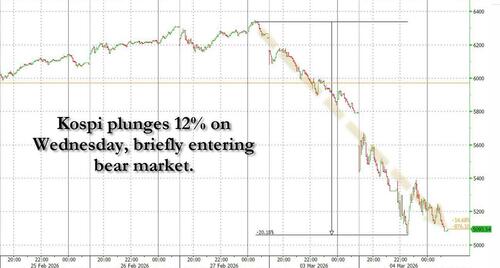

That proved accurate because overnight the Kospi suffered its biggest drop in history, surpassing both the covid and Lehman crashes, plunging by over 12% (one day after tumbling by 7.4%) in a move that was accompanied by a circuit-breaking trading halt, broad-based degrossing and leveraged liquidations (similar to what happened in crypto on Oct 10 last year). In fact, the move briefly tipped the Kospi into a bear market after the index dropped more than 20% from its all time high reached just 2 days earlier!

As Bloomberg describes the carnage, "panic swept across trading desks in South Korea as local stocks, by far the hottest in the world over the past year, extended their selloff into Wednesday." The report notes that the high-flying Kospi Index, which until last week was up 50% YTD (!) just suffered for its biggest two-day drop since 2008, and biggest one-day drop ever. The losses were driven by the heavyweights that had supercharged the market higher until last month — Samsung Electronics, SK Hynix and Hyundai Motor.

Trading in both Kospi and Kosdaq shares was suspended for 20 minutes after the gauges fell by the 8% circuit-breaking trigger.

“Moves are too extreme so forecasting feels almost impossible — analysis doesn’t really help,” said An Hyungjin, chief executive officer at Seoul-based Billionfold Asset Management Inc. “Retail investors seem to hesitate as well, bids are fading since yesterday. While we’re picking quality names and hedging, this isn’t a clear opportunity.”

As South Korean stocks crashed, Bloomberg notes, panic spread through Seoul’s financial district. At the small downtown office of Mirae Asset Securities, scores of clients hurriedly lined up to get their money out.

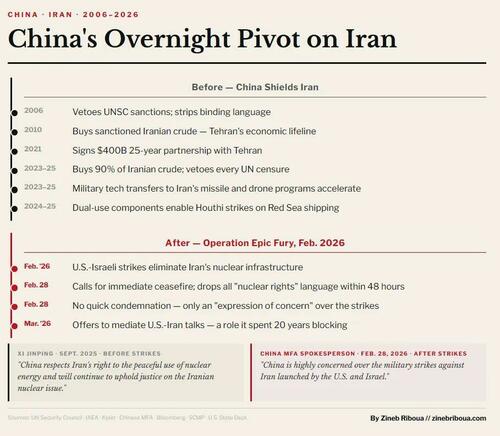

Some in the crowd had snapped up stocks on leverage — part of the mania that had turned the market into a national pastime (as we frequently point out, Koreans are momentum kamikazes and pile up with reckless abandon into anything that goes up or down with a clear pattern) and made the Kospi the world’s top-performing benchmark — and they were now desperate to unload them as the war in Iran rocked the global economy. They gestured and shouted to get the attention of Mirae employees who could help them sell the positions they couldn’t unwind online. As they waited for help, their phones flashed ever-growing losses — the Kospi was down 8%, then 10%, then 12% — added to their angst.

Amusingly, just last week, the crowd of retail investors packing into offices like this one was rushing to buy stocks, and tap into the AI frenzy powering the Kospi to one new record high after another. Even the president, Lee Jae Myung, had put up his own apartment for sale to buy stocks.

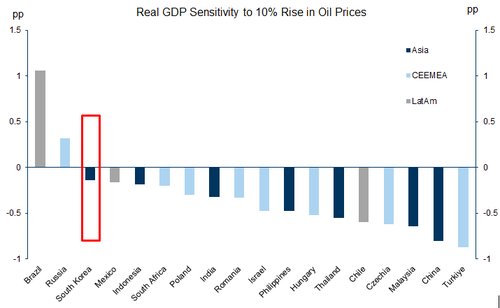

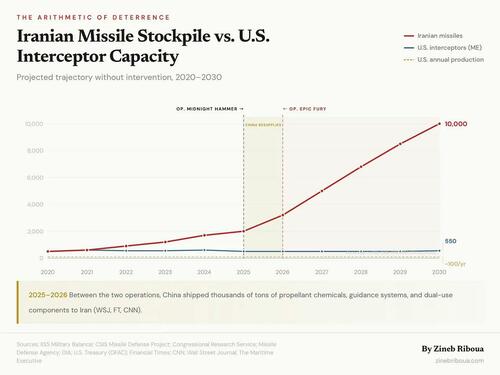

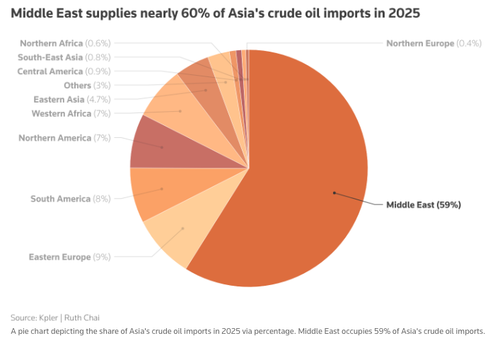

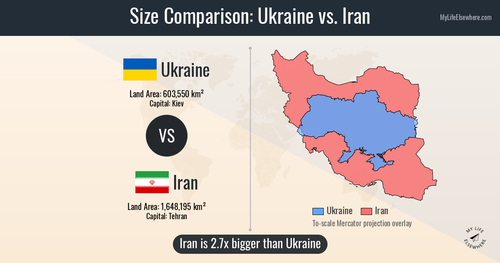

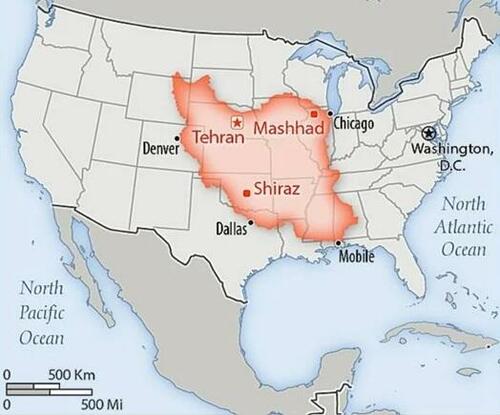

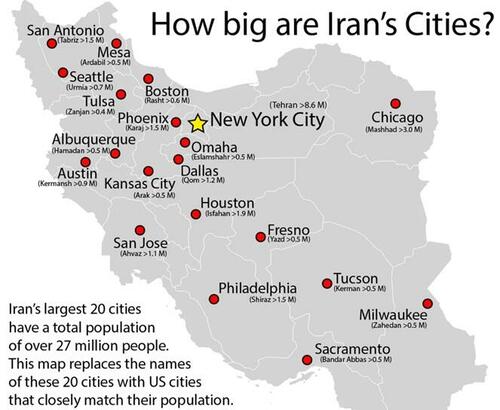

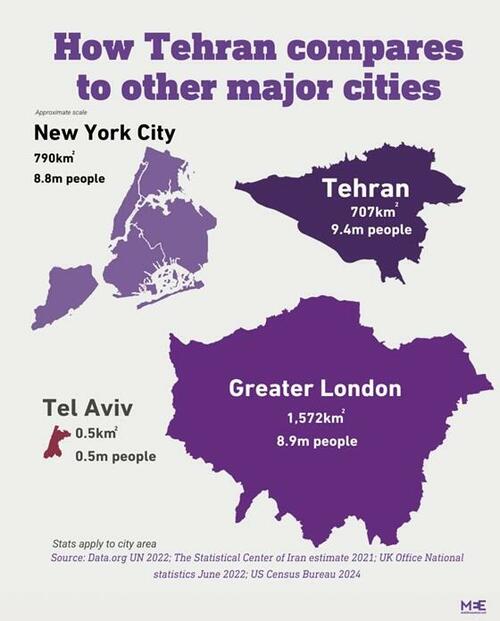

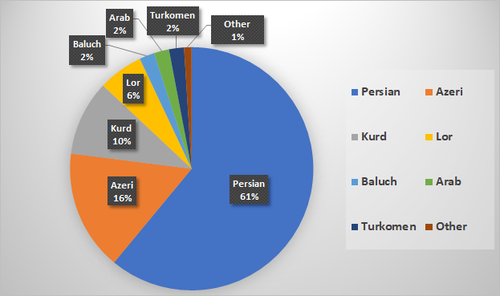

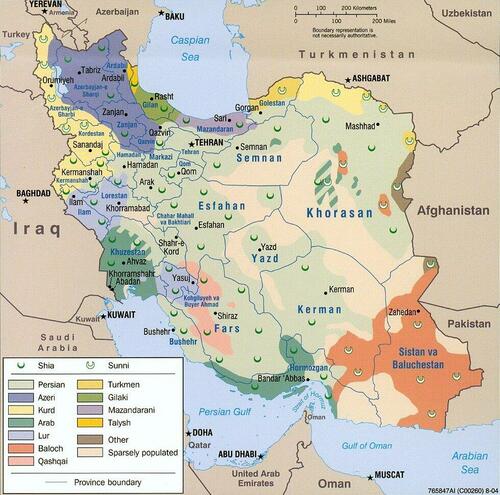

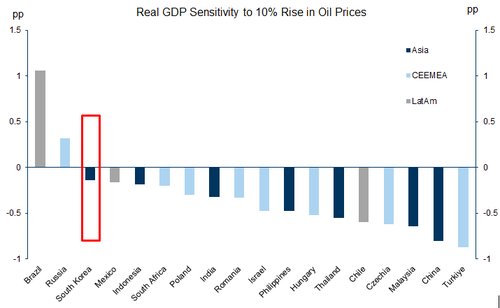

But by the end of the long holiday weekend, the math looked very different. The US and Israeli strikes on Iran had sent energy prices skyrocketing globally, and few countries in the world are as dependent on oil and gas imports as Korea to power its economy.

All at once, that collective fervor among the retail crowd in Seoul - the ants, as they’re known - turned into collective dread.

Seongchan Kim, a Busan‑based naval engineering student who invested the entirety of his 17 million won savings from his 18‑month military service into equities last November, has also added more into the market. “I tried short‑term trading before and lost heavily,” the 22-year old said.

Back at Mirae, an elderly woman was told to wait in line for an hour before she could see someone. She had no interest in talking. The leverage, the war, the promises of a rebound — nothing mattered at the moment. She just wanted out.

The borrowed money that fueled much of those stock gains - similar to what the Korean "ants" did with bitcoin before the stock market euphoria truly exploded in late 2025 - added an accelerant to the rout. By the close on Wednesday, the two-day plunge in the Kospi had reached more than 18%, the worst loss globally. Some $625 billion in market value, much of it coming from high-flying tech names like Samsung Electronics Co. and SK Hynix Inc., had been wiped out.

“It was a ferocious sell off — clean out of hedge fund hotel. That’s a nickname for crowded longs we use,” said Matthew Haupt, portfolio manager at Wilson Asset Management in Sydney.

Yet even after the declines, the Kospi is still up 21% this year and among the world’s top performers. But the episode shows just how fast a market dominated by leveraged, margin-fueled bets and amped up by frenzied day traders can sour, exposing the risks of an investment culture that had come to treat borrowing as a sure thing to bigger gains.

As we joke frequently on our X account, in Korea, leverage has become almost synonymous with the 14-million-strong legion of ants, turning what could have been an orderly stock market slump into chaotic unwind. Margin debt at a record of more than 32 trillion won ($21 billion) had forced a number of brokers to halt new loans after they hit their credit cap.

While we warned repeatedly, like for example here on February 25 when we joked that at some point the government would have to bailout the market...

... "few others on Wall Street saw a move this severe coming" (not our words, Bloomberg's) . There were the naysayers who warned about the overheated valuations, the high margin, the impact of elevated oil prices on the big crude consuming nation. But there were also the pragmatists who believed that the global shortage of memory chips that fueled gains, combined with policy reforms and encouragement by President Lee, would deliver further gains.

“Korea’s moves are at least somewhat indicative of the equity markets finally starting to take this risk seriously,” Ajay Rajadhyaksha, global chairman of research at Barclays Capital Inc., said on Bloomberg TV. “For the first day, day and half, the markets were completely underpricing this risk.”

Ironically, while we joked that a market bailout would be coming, one almost did arrive this morning, when Korea's Financial Services Commission Chairman Lee Eog-weon said that South Korea was "closely monitoring stock markets and will actively use its 100 trillion won market stabilization program in case of excessive market volatility." He added that the regulator would "closely monitor market-disruptive activities that may occur amid heightened volatility in the stock market; to strictly punish any violations."

Curious that he didn't make the same warning when it would have been much more useful, namely when retail investors were blowing their savings (and adding massive leverage) to pile into stocks, sowing the seeds for the Kospi's own momentum-drive destruction.

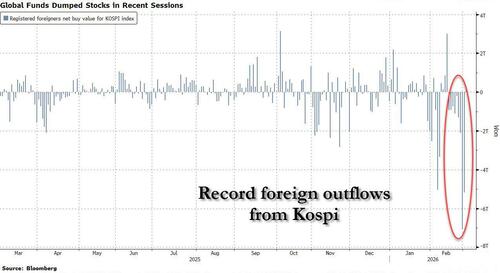

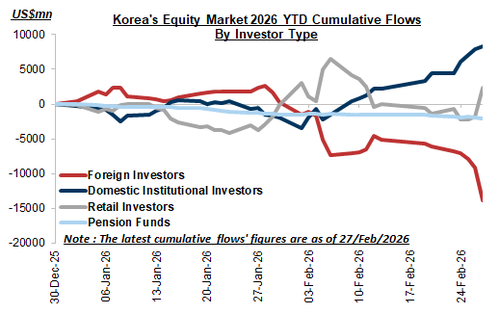

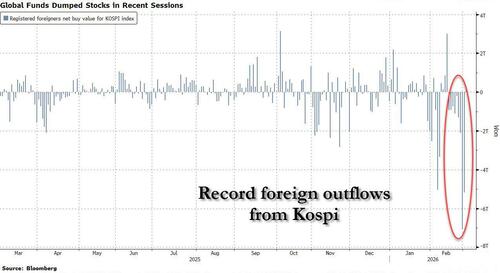

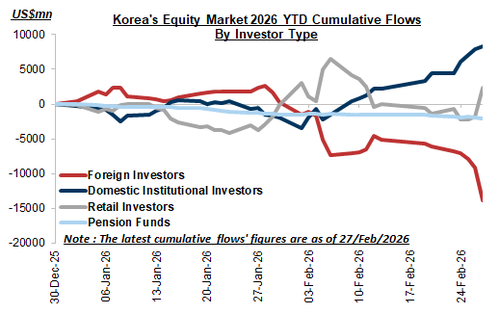

To be sure, as we also warned previously, there were clear signs of trouble even before this week: foreign funds that had spurred the market for much of last year abruptly turned net sellers in February, dumping a record amount of Korean stocks...

... while local retail investors continued to pile in.

Traders had also started swapping notes about certain funds bumping up against limits on their Korea exposure and various desks speculated about forced selling.

The rout in Korea accelerated this week even as global shares edged higher and oil dropped on hopes the war could be short lived. Those expectations have emboldened some investors, including Wilson Asset’s Haupt, to take a cautious long position. “Might not be for long, we will see. I just went long before it turned tactically oversold,” he said.

Which raises the question: after the biggest drop in history, is it time to buy the Kospi, if only looking for a short-term bounce?

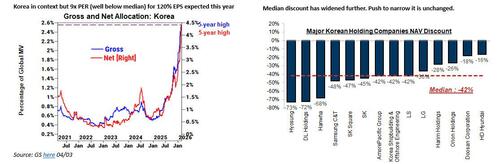

Well, according to Francois Theis at Goldman's EMEA desk, the answer is yes. This is how the desk frames it in a note published on Wednesday (available to pro subscribers):

18% correction, 2x circuit breakers, record single day loss (albeit both foreigners and retail turning net buyers today) and yet we are merely back to Feb 6th level on the KOSPI which remains the best performing index. 1 month of performance being unwound.

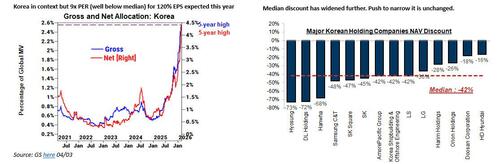

The context matters because as Goldman explains, Korea had been experiencing record net flow for 13th consecutive month and February was the highest monthly net inflows in Goldman PB record with net allocation in the GS Prime Book rising 170bps to 5.3% while gross allocation increasing to 2.85%. Both at all time highs here. In other words, everyone is in.

But to Goldman, that's not nearly enough. And this is how Goldman justifies calling it a bottom right here, right now:

A painful short term cocktail around degrossing but the fundamentals haven’t changed and these moves represent an opportunity. In today’s presentation, our Chief Asia strategist Tim Moe reiterated his outlook for the KOSPI 120% EPS growth in light of hyperscale spending in U.S. (arguably this is decorrelated to geopolitics), macro and EPS outlook unchanged across Asia. With regards to oil price increase, he highlights how a $20/bbl rise in oil price could have a 2% cumulative negative on APAC regional earnings (but IF sustained throughout the year, this remains a big IF) and Korea is among the least affected by oil prices in the first place.

Holdcos discount have widened a bit (although interestingly not the double Holdco like SK Inc.) and pref underperformed ord in the 2x days route despite the fact that they were trading -29% and 47% respectively vs ord (Both Samsung & Hyundai pref ~-4% vs ord in 3x sessions).

In terms of execution, these are the trades Goldman likes:

- Korea pref vs ord given further dislocation; we expect DPS increase (correlation) and push to close discount (buyback on pref line?)

- Holdco. We have refreshed the monitor below post close (ty John Kwon) and the discount has widened slightly post mkt drawdown making it a better entry point. We continue to recommend a barbell approach: 50% SK Square (given 30% discount target) and 50% on holdcos with the widest discount to NAV

- GS Korea Greatest Hits (GSXAKHIT): Selective alpha sectors across Defense, Shipbuilding, Nuclear, Cosmetics, K-pop, AI, Hold Cos that will likely continue to be supported by both domestic and international policy trends, offering strong alpha-generation potential. It overweights Defense over AI (Samsung/Hynix) relative to Kospi2.

For what it's worth, we don't know if this is the bottom for the Kospi. With massive leverage and gross exposure still embedded in the index, we doubt it and would suggest to wait for a much more powerful retracement before stepping in. We will, however, point out something else.

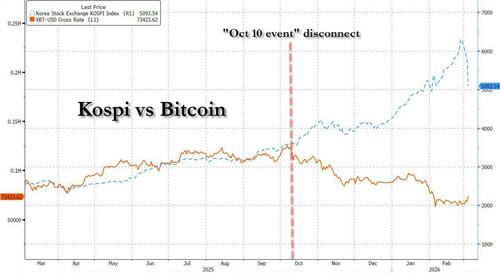

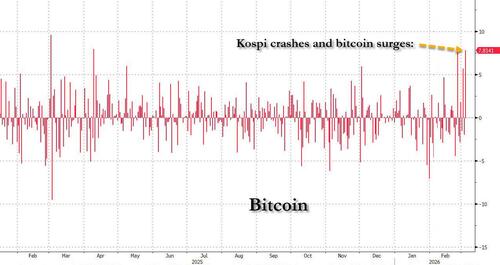

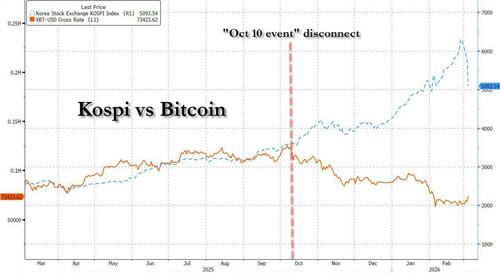

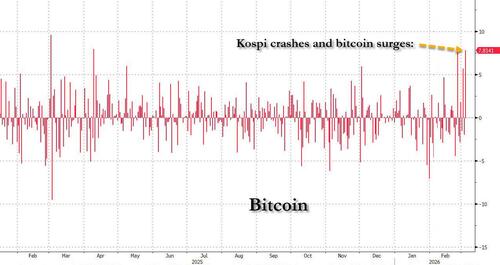

As we noted last month, the big disconnect in bitcoin with all other assets started when Korea's momentum kamikazes capitulated on bitcoin, especially after the Oct 10 meltdown, and started piling into memory stocks and the Kospi.

Well, as we said around the time Kospi was crashing last night, "watch what assets the money will rotate to" after retail got burned again.

The answer:

More in the Goldman note available to pro subscribers.

Tyler Durden

Wed, 03/04/2026 - 13:13

Illustration by The Epoch Times, Public Domain, Shutterstock

Illustration by The Epoch Times, Public Domain, Shutterstock Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters

Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images

Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images Illustration by The Epoch Times, Public Domain

Illustration by The Epoch Times, Public Domain (Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images

(Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images (Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

(Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

Adobe Stock image

Adobe Stock image Source: CIA World Factbook (2016)

Source: CIA World Factbook (2016)

The Epoch Times/Shutterstock

The Epoch Times/Shutterstock

Open source file image: Launcher for Iranian Zolfaghar ballistic missiles

Open source file image: Launcher for Iranian Zolfaghar ballistic missiles A view of houses in a neighborhood in Los Angeles on July 5, 2022. Frederic Brown/AFP via Getty Images

A view of houses in a neighborhood in Los Angeles on July 5, 2022. Frederic Brown/AFP via Getty Images The Google logo is projected onto a man, in this photo illustration. Leon Neal/Getty Images

The Google logo is projected onto a man, in this photo illustration. Leon Neal/Getty Images

Rep. Dan Crenshaw, R-Texas, was unseated in Tuesday's primary. Tom Williams / CQ-Roll Call via Getty Images file

Rep. Dan Crenshaw, R-Texas, was unseated in Tuesday's primary. Tom Williams / CQ-Roll Call via Getty Images file

Recent comments