A Montreal Narco Network Busted For Allegedly Smuggling Super Fentanyl Into America

Submitted by The Bureau's Sam Cooper,

An elite Montreal-based narco network allegedly exported carfentanil and next-generation synthetic opioids 100 times deadlier than fentanyl to American consumers via the dark web, leading to the arrest of four yesterday, after 13 months of joint surveillance by U.S. federal agencies and Quebec police, and a seizure of more than 600,000 tablets of synthetic drugs in December.

The four suspects charged are reportedly connected, through their alleged street gang affiliate, to the Wolfpack Alliance — a network tied by DEA sources to a British Columbia fentanyl superlab, and by Canadian law enforcement and expert sources to Canadian outlaw motorcycle gangs, Iranian organized crime, and the Sinaloa Cartel.

On Wednesday, Quebec’s ENRCO — the unit mandated specifically to target organized crime leadership — arrested four residents of Montreal’s South Shore suburbs on charges connected to a network that had been, for more than a year, allegedly manufacturing and exporting carfentanil and industrial quantities of substances newer and deadlier than fentanyl to consumers in the United States. The investigation was conducted jointly with U.S. Homeland Security Investigations and U.S. Customs and Border Protection.

The four suspects are: Darren McAlpine, of Delson; Geneva Fournier, of Châteauguay; and Wanya Nathan Ellis and Cheyanne Buchanan-Dennis, both of Sainte-Catherine. All four municipalities sit in the region directly south of the Montreal Island. They appeared by videoconference before a judge at the Longueuil courthouse and face charges of possession for the purpose of trafficking, drug trafficking, and possession of a prohibited weapon.

The arrests followed searches executed on December 17, 2025, at addresses in Châteauguay and Sainte-Catherine. No U.S. federal charges have been publicly announced.

The December searches produced a seizure that reads like an inventory of the post-fentanyl synthetic opioid market.

Quebec police pointed to more than 600,000 tablets — comprising 288,000 metonitazene tablets, 128,000 methamphetamine tablets, 180,000 benzodiazepine tablets, and 10,000 MDMA tablets — alongside 81 litres of protonitazene in liquid form, cannabis, cocaine, dark web trafficking equipment, a loaded 9mm firearm, and 9mm ammunition.

The 81 litres of liquid protonitazene is an industrial-scale volume of a still-emerging synthetic opioid. The DEA permanently placed protonitazene in Schedule I in 2024; on February 11, 2026, it separately finalized Schedule I status for variants of metonitazene and protonitazene.

“Metonitazene and Protonitazene are substances not widely known to the public at present, but they are considered more potent than fentanyl,” Quebec police said yesterday.

In a previous interview, retired acting DEA chief Derek Maltz told The Bureau that chemicals like nitazenes are amplifying the existing threat from Chinese-supplied fentanyl — which he and many U.S. experts view as an intentional, war-like attack from Chinese state-linked networks aligned with Latin cartels.

“We’re getting crushed with carfentanil, xylazine, etizolam, isotonitazene — all those different new psychoactive substances which are coming out of China. So it’s just another phase of the attack,” Maltz said.

Six weeks before the Quebec arrests, on February 10, 2026, Montreal’s regional public health directorate had already issued a public warning about protonitazene’s effects — suggesting that product from this network, or a network supplying the same substances, was already circulating in Montreal’s drug supply while the police operation was still running.

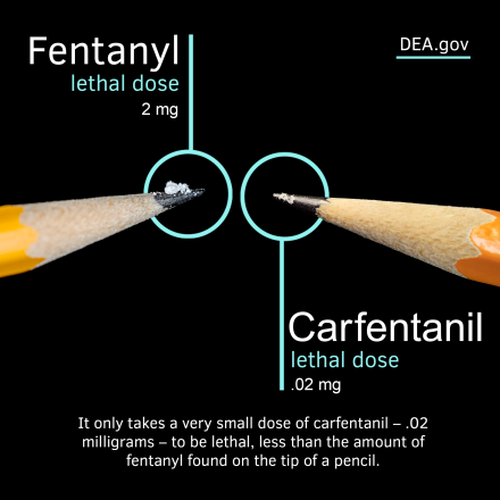

Carfentanil was developed to tranquilize elephants.

According to the DEA, it is 100 times more potent than fentanyl — which itself is lethal at the 2-milligram range — and 10,000 times more potent than morphine. Russian special forces deployed an aerosolized version against Chechen hostage-takers in a Moscow theatre in 2002. More than 120 hostages died. The DEA reported in 2025 that it had tested more than 100 kilograms of carfentanil mixed with other drugs in 2024 alone — more than the previous three years combined — and that the substance is now predominantly appearing in pill form, pressed to resemble prescription medications.

Targeting America: The Montreal Network Exporting Carfentanil — 100 Times Stronger Than Fentanyl — Into the United States https://t.co/9FFnY4KPrU

— Sam Cooper (@scoopercooper) February 26, 2026

The network now charged in Montreal was allegedly supplying fentanyl southbound into the United States — a politically sensitive finding given that the Trump administration has partly justified tariffs against Canada on the allegation that Chinese Communist Party and Mexican cartel networks have increasingly leveraged Canada for fentanyl production, particularly via Vancouver, and shipment to the U.S. This new case adds Montreal as a major alleged node, one already associated with Mexican cartel human trafficking networks moving South American nationals from Montreal into New York State.

Evidence from the Canada Border Services Agency has identified China and Hong Kong as import sources for earlier nitazene variants. The seizure in this case — 288,000 metonitazene tablets and 81 litres of liquid protonitazene — represents the largest documented seizure of these substances in Canada on the public record.

Radio-Canada reported that the network is connected to Zone 43 — a Montreal street gang originating in the Montréal-Nord neighbourhood, Crips-affiliated, and engaged in a violent conflict with a rival Blood-affiliated group called the Profit Boys.

Vancouver Police arrested five Zone 43 members in June 2024 and seized more than 24 kilograms of drugs following a 14-month investigation into the gang’s expansion into British Columbia. VPD Organized Crime Section head Inspector Phil Heard described Zone 43 as posing “a very significant risk to the public,” noting the gang had been operating in Vancouver for several years and was actively seeking to take over drug lines and territory.

In B.C., Zone 43 reportedly operates in affiliation with the Wolfpack Alliance.

The Wolfpack is where the Mexican transnational architecture emerges and intersects with Ryan Wedding’s Sinaloa Cartel networks, a U.S. government source told The Bureau.

NEW: Ex-Olympian Ryan Wedding, accused of running a transnational cocaine trafficking operation, is escorted in handcuffs in Ontario, California. pic.twitter.com/S8yX96HAmm

— Fox News (@FoxNews) January 23, 2026

The source linked the Wolfpack and Wedding associates to what investigators have called the Falkland superlab, a large-scale drug production operation in British Columbia’s interior. Canadian law enforcement and expert sources have separately identified connections between the Wolfpack network and Canadian outlaw motorcycle gangs, Iranian organized crime, and the Sinaloa Cartel.

As reported previously by The Bureau, starting in the fall of 2022, pressure at the U.S. southern border began pushing Mexican nationals — and, by inference, cartel operatives — northward into the Canadian pipeline. From January to mid-October 2022, 7,698 Mexican asylum seekers took direct flights from Mexico City to Montreal, according to The Canadian Press. Nonprofit refugee assistance officials said most flew to Canada because they had learned of the Trudeau government’s visa-free policy and the availability of financial assistance while refugee claims were processed.

In their 2021 book The Wolfpack: The Millennial Mobsters Who Brought Chaos and the Cartels to the Canadian Underworld, journalists Peter Edwards and Luis Nájera established that the Sinaloa Cartel had developed solid control of cocaine shipments in and out of Canada, that the Arellano Félix organization held a foothold in western Canada — particularly Vancouver and Alberta — and that the Zetas were present in Canada through networks involving temporary migrant workers.

Asked in 2023 whether Canada’s importance to Mexican organized crime had increased in recent years, Nájera was direct: “I would say it has increased since criminal cells moved up north to settle and expand operations here. It is also strategic to have groups operating north of the U.S. border, close to key places such as Chicago and New York, and without the scrutiny of the DEA and rival groups.”

Don Im, a former senior agent in the DEA’s Special Operations Division, told The Bureau the Montreal seizure fits a pattern his unit began tracking at the end of 2019, when small clusters of nitazene overdose deaths began appearing in northern U.S. states — likely, he said, sourced from Canada but manufactured with Chinese precursor chemicals. The pattern intensified through the COVID years before a gradual decline, which Im attributes to cheaper Mexican-produced fentanyl flooding the market and displacing the Canadian supply.

That displacement, Im argues, may now be reversing.

With Mexican cartels disrupted by a wave of extraditions and leadership deaths, the fentanyl supply from the south is under pressure — and demand in the United States hasn’t gone anywhere. “Non-Mexican drug trafficking organizations in Canada are very likely picking up the slack and fulfilling the demand in the U.S. as addicts and local distributors in the U.S. are looking online,” Im said.

On the Chinese supply chain behind the nitazenes, Im was precise: Chinese companies have been designing and manufacturing synthetic drugs and precursor chemicals for at least 25 years, directed by the Chinese Communist Party to reduce dependency on Western pharmaceutical companies and incentivized by provincial governments to innovate and export. The result, in his assessment, was a perfect storm — Chinese synthetic precursors, Mexican cartel distribution networks, dark web and social media sales channels, and decades of indifferent Western drug policy — that produced what he called “the most deadly form of slow-motion weapon of mass destruction.”

Tyler Durden Fri, 02/27/2026 - 20:05

The Supreme Court in Washington on Feb. 21, 2026. Madalina Kilroy/The Epoch Times

The Supreme Court in Washington on Feb. 21, 2026. Madalina Kilroy/The Epoch Times The entrance to the U.S. Citizenship and Immigration Services location where a New York City Council data analyst and Venezuelan national was detained by Immigration and Customs Enforcement while making an immigration appointment, in the Long Island town of Bethpage, N.Y., on Jan. 14, 2026. Shannon Stapleton/Reuters

The entrance to the U.S. Citizenship and Immigration Services location where a New York City Council data analyst and Venezuelan national was detained by Immigration and Customs Enforcement while making an immigration appointment, in the Long Island town of Bethpage, N.Y., on Jan. 14, 2026. Shannon Stapleton/Reuters Election workers receive drop boxes for hand delivered mail-in ballots for processing at the Clark County Election Department after polls closed in North Las Vegas on Nov. 5, 2024. David Becker/Getty Images

Election workers receive drop boxes for hand delivered mail-in ballots for processing at the Clark County Election Department after polls closed in North Las Vegas on Nov. 5, 2024. David Becker/Getty Images A visitor inspects a gun at the National Rifle Association Annual Meeting & Exhibits at the Kay Bailey Hutchison Convention Center in Dallas on May 17, 2024. Justin Sullivan/Getty Images

A visitor inspects a gun at the National Rifle Association Annual Meeting & Exhibits at the Kay Bailey Hutchison Convention Center in Dallas on May 17, 2024. Justin Sullivan/Getty Images U.S. Border Patrol agents process illegal immigrants from Central America near Roma, Texas, on Aug. 17, 2016. John Moore/Getty Images

U.S. Border Patrol agents process illegal immigrants from Central America near Roma, Texas, on Aug. 17, 2016. John Moore/Getty Images via AFP

via AFP

Source:

Source:

Taliban near the Torkham border, via AFP.

Taliban near the Torkham border, via AFP. via Al Jazeera

via Al Jazeera

Recent comments