House To Vote On Bill To Fund The Government

Authored by Joseph Lord via The Epoch Times,

The U.S. House of Representatives will vote on a multi-bill package to fund the federal government on Thursday.

The legislation includes funding for the departments of Defense, Homeland Security, Labor, Health and Human Services, Education, Transportation, and Housing and Urban Development.

Most portions of the bill are expected to pass easily as members of both parties seek to avoid a repeat of the 43-day government shutdown, the longest in U.S. history, that accompanied the previous government funding fight.

House Minority Leader Hakeem Jeffries (D-N.Y.) and Senate Minority Leader Chuck Schumer (D-N.Y.) are among those, and both leaders have expressed a desire to work with Republicans to pass the 12 annual government funding bills ahead of the Jan. 30 funding deadline.

Though it includes some spending cuts, the package largely holds funding levels at fiscal year 2025 rates.

Republicans are expected to back the legislation largely along party lines.

Rep. Tom Cole (R-Okla.), the lead Republican on the House Appropriations Committee, praised the bill in a statement, saying it “reflects the core tenets of American strength: combat-ready forces, secure communities, effective education and health systems, and modern transportation. At every level, it applies innovation and discipline to deliver results without waste.”

In line with leadership’s desire to avoid a government shutdown, the sections of the bill related to funding for the departments of Defense, Labor, Health and Human Services, Education, Transportation, and Housing and Urban Development are expected to gain Democratic support as well.

However, one segment of the funding has proven divisive.

DHS Funding ControversyAhead of the vote, Democrats came out en masse against the portion of the bill that would fund the Department of Homeland Security (DHS).

Democrats have been increasingly critical of the agency that oversees Immigration and Customs Enforcement (ICE), criticism that has only intensified in the wake of the ICE-involved shooting of Renée Nicole Good in Minneapolis.

In the aftermath of the shooting, Democrats have called for President Donald Trump to back off on the deployment of ICE agents to Democrat-run areas, while the party’s progressive wing has renewed calls to “abolish ICE.”

In Congress, lawmakers have largely urged funding cuts or policy reforms.

While this package includes reforms, several Democrats have indicated that they don’t go far enough and have expressed an intention to oppose the bill.

Despite this opposition, the DHS funding measure is expected to pass with wide GOP support and support from some Democrats.

ICE ReformsThe bill would implement several changes to ICE’s policies and procedures.

One measure in the bill would provide $20 million to ICE for the procurement and deployment of body cameras for ICE and other immigration agents engaged in domestic law enforcement activities. It would similarly require standardization of ICE and immigration agents’ uniforms.

It provides additional funding for civil liberties-related oversight of ICE activities.

The bill would also mandate additional training for immigration agents operating within the U.S. interior, with a focus on de-escalation.

It also instructs DHS Secretary Kristi Noem to ensure that all immigration agents are properly trained on Americans’ First Amendment right to record federal agents during public operations.

It also provides substantially fewer detention beds than were requested by the administration, instead cutting the number. While 50,000 beds were requested, an increase, the bill would cut the total number of detention beds to 41,500, marking a decrease of 5,500 beds.

It also slightly reduces funding for enforcement and removal operations, cutting $115 million.

However, for many Democrats, these reforms don’t go far enough.

Democrats SplitDemocrats are split on the issue, though many have expressed opposition to the bill.

Rep. Lauren Underwood (D-Ill.), a member of the House Appropriations Committee, expressed opposition to the bill in a post on X.

“The 2026 Homeland Security funding bill that the House is voting on this week is an easy NO for me. It’s a blank check with no accountability for DHS’s outrageous abuses,” Underwood wrote.

Several other House Democrats on the Appropriations subcommittee have similarly indicated plans to oppose the bill.

However, others have indicated plans to support the bill or have otherwise said they’re undecided.

Rep. Rosa DeLauro (D-Conn.), the lead Democratic appropriator, has said she'll back the legislation, citing the reforms.

Rep. Henry Cuellar (D-Texas), a moderate in a red-trending district, has also expressed his intention to support the bill.

Tyler Durden Thu, 01/22/2026 - 08:45

An aerial photo shows the Nave Photon crude oil tanker, carrying a shipment of Venezuelan oil, docked in Freeport, Texas, on Jan. 16, 2026. Mark Felix/AFP via Getty Images

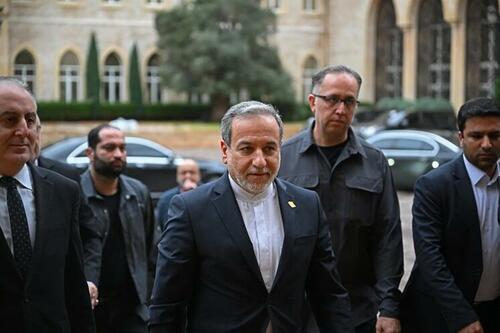

An aerial photo shows the Nave Photon crude oil tanker, carrying a shipment of Venezuelan oil, docked in Freeport, Texas, on Jan. 16, 2026. Mark Felix/AFP via Getty Images AFP/Getty Images: Iran is prepared for war but ready to negotiate, Iran's FM has made clear.

AFP/Getty Images: Iran is prepared for war but ready to negotiate, Iran's FM has made clear.

AFP/Getty Images

AFP/Getty Images

Recent comments